Attorney-Approved Texas Transfer-on-Death Deed Template

Form Example

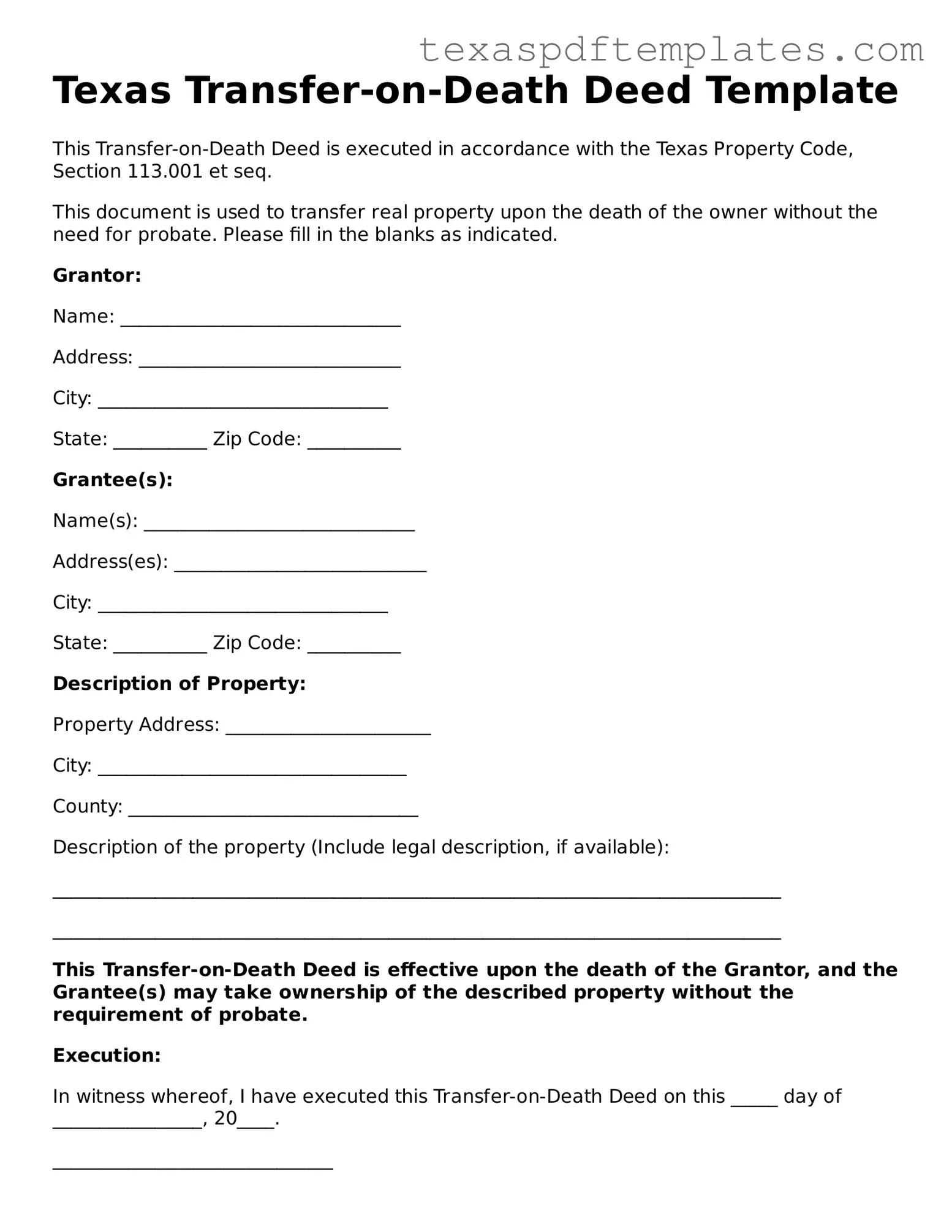

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the Texas Property Code, Section 113.001 et seq.

This document is used to transfer real property upon the death of the owner without the need for probate. Please fill in the blanks as indicated.

Grantor:

Name: ______________________________

Address: ____________________________

City: _______________________________

State: __________ Zip Code: __________

Grantee(s):

Name(s): _____________________________

Address(es): ___________________________

City: _______________________________

State: __________ Zip Code: __________

Description of Property:

Property Address: ______________________

City: _________________________________

County: _______________________________

Description of the property (Include legal description, if available):

______________________________________________________________________________

______________________________________________________________________________

This Transfer-on-Death Deed is effective upon the death of the Grantor, and the Grantee(s) may take ownership of the described property without the requirement of probate.

Execution:

In witness whereof, I have executed this Transfer-on-Death Deed on this _____ day of ________________, 20____.

______________________________

Signature of Grantor

Witnesses:

- Name: _________________________ Signature: ________________________ Date: _______________

- Name: _________________________ Signature: ________________________ Date: _______________

Notary Public:

State of Texas

County of ______________________

Subscribed and sworn to before me this _____ day of ________________, 20____.

______________________________

Notary Public’s Signature

______________________________

Notary Public’s Name

My commission expires: ____________

Other Popular Texas Templates

Physicians Directive - A Living Will helps communicate your values and priorities concerning end-of-life care to healthcare professionals.

Texas Holographic Will Statute - Preparation of a Self-Proving Affidavit is a proactive step in effective estate planning.

Texas Department of Motor Vehicle - Enable a representative to perform actions concerning your vehicle's taxes.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details on the form. This includes not listing the full names of both the property owner and the beneficiary. Omitting any required information can lead to the deed being invalidated.

-

Incorrect Property Description: A common mistake is inaccurately describing the property. The deed must include a precise legal description, not just a street address. Errors in this section can create significant issues in transferring ownership.

-

Not Following Signature Requirements: The form must be signed by the property owner in the presence of a notary. Some people neglect this requirement, thinking a simple signature will suffice. Without notarization, the deed is not legally enforceable.

-

Failing to Record the Deed: After completing the form, it must be filed with the county clerk's office where the property is located. Many individuals forget this crucial step, which can result in the deed not being recognized upon the owner’s death.

-

Not Updating the Deed: Life changes such as marriage, divorce, or the death of a beneficiary can necessitate updates to the deed. Failing to amend the document accordingly can lead to complications and unintended consequences for property distribution.

Key takeaways

When considering a Transfer-on-Death (TOD) Deed in Texas, it's crucial to understand the process and its implications. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Transfer-on-Death Deed allows you to designate a beneficiary who will receive your property upon your death, bypassing the probate process.

- Eligibility Requirements: The property must be real estate located in Texas, and you must be the sole owner or a co-owner with rights of survivorship.

- Filling Out the Form: Ensure that all required fields are completed accurately. Include the legal description of the property and the full name of the beneficiary.

- Sign and Notarize: The deed must be signed by you in the presence of a notary public to be legally valid. This step is essential to ensure that your intentions are honored.

- Record the Deed: After signing, promptly file the TOD Deed with the county clerk in the county where the property is located. This action is necessary for the transfer to take effect.

By following these steps, you can ensure that your property is transferred according to your wishes without the complications of probate. Act swiftly to secure your plans for the future.

Steps to Using Texas Transfer-on-Death Deed

After obtaining the Texas Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that the transfer of property occurs as intended. Follow these steps to complete the form properly.

- Begin by writing the name of the property owner in the designated section. This should be the person who currently holds the title to the property.

- Provide the address of the property. Include the street address, city, state, and zip code to ensure clarity.

- Identify the legal description of the property. This can typically be found on the property deed or tax records. It is essential for accurately identifying the property.

- List the name of the beneficiary or beneficiaries. This is the person or people who will receive the property upon the owner's death.

- Include the address of each beneficiary. This helps to confirm their identity and ensures proper notification in the future.

- Sign the form. The property owner must sign in the presence of a notary public to validate the document.

- Have the form notarized. The notary will confirm the identity of the signer and add their seal to the document.

- File the completed deed with the county clerk’s office in the county where the property is located. This step is necessary to make the deed effective.

Once the form is completed and filed, it will be part of the public record. This means that it can be accessed by anyone who wishes to verify the ownership and transfer of the property in the future.