Attorney-Approved Texas Tractor Bill of Sale Template

Form Example

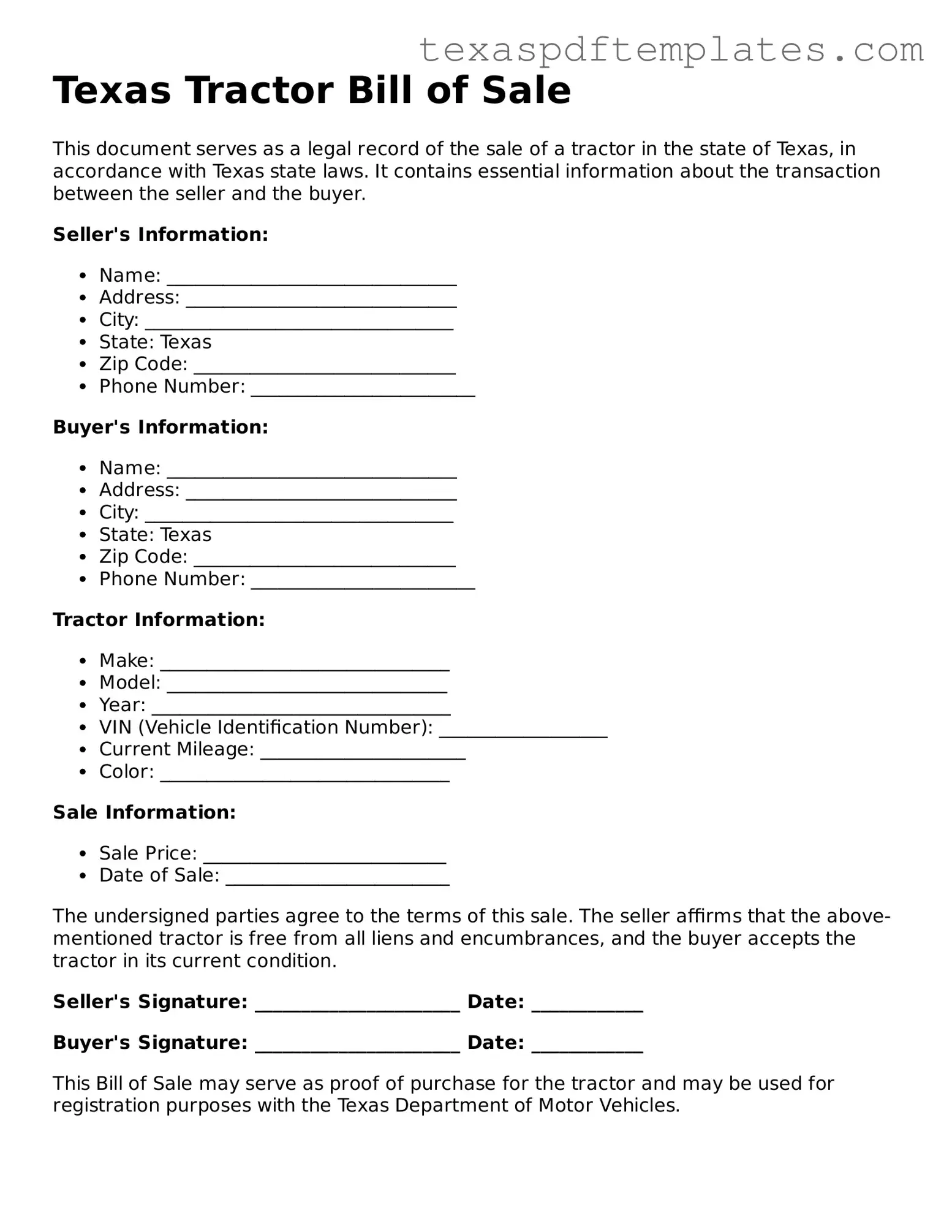

Texas Tractor Bill of Sale

This document serves as a legal record of the sale of a tractor in the state of Texas, in accordance with Texas state laws. It contains essential information about the transaction between the seller and the buyer.

Seller's Information:

- Name: _______________________________

- Address: _____________________________

- City: _________________________________

- State: Texas

- Zip Code: ____________________________

- Phone Number: ________________________

Buyer's Information:

- Name: _______________________________

- Address: _____________________________

- City: _________________________________

- State: Texas

- Zip Code: ____________________________

- Phone Number: ________________________

Tractor Information:

- Make: _______________________________

- Model: ______________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): __________________

- Current Mileage: ______________________

- Color: _______________________________

Sale Information:

- Sale Price: __________________________

- Date of Sale: ________________________

The undersigned parties agree to the terms of this sale. The seller affirms that the above-mentioned tractor is free from all liens and encumbrances, and the buyer accepts the tractor in its current condition.

Seller's Signature: ______________________ Date: ____________

Buyer's Signature: ______________________ Date: ____________

This Bill of Sale may serve as proof of purchase for the tractor and may be used for registration purposes with the Texas Department of Motor Vehicles.

Other Popular Texas Templates

Transferring Car Title in Texas - Aids in ensuring compliance with local regulations regarding trailer sales.

Texas Notary Acknowledgement Pdf - The form must be completed in the presence of a notary.

Buying a Boat Without a Title in Texas - Legal proof of ownership transfer for watercraft.

Common mistakes

-

Incorrect Information: Buyers and sellers often make mistakes by providing inaccurate details about the tractor, such as the model, year, or VIN (Vehicle Identification Number). This can lead to confusion and legal issues later.

-

Missing Signatures: Both the buyer and the seller must sign the form. Failing to obtain the necessary signatures can invalidate the sale.

-

Omitting Date of Sale: Not including the date when the sale takes place can create problems for record-keeping and future references.

-

Not Including Payment Details: It’s important to specify the payment method and amount. Leaving this out can lead to disputes over payment.

-

Failure to Provide Bill of Sale Copies: Both parties should keep a copy of the completed bill of sale. Not doing so can complicate future transactions or disputes.

-

Ignoring State Requirements: Texas may have specific requirements for the bill of sale. Not adhering to these can make the document legally unenforceable.

-

Not Notarizing When Necessary: While notarization is not always required, certain situations may call for it. Notary services can add an extra layer of security to the transaction.

Key takeaways

When engaging in the sale or purchase of a tractor in Texas, understanding the importance of the Tractor Bill of Sale form is essential. This document serves as a formal record of the transaction, providing protection for both the buyer and the seller. Here are some key takeaways to consider:

- Purpose of the Form: The Texas Tractor Bill of Sale is designed to document the transfer of ownership from the seller to the buyer. It serves as proof of the transaction and can be useful for future reference.

- Essential Information: The form should include critical details such as the names and addresses of both parties, the tractor's make, model, year, and Vehicle Identification Number (VIN). Accurate information is vital to avoid disputes.

- Purchase Price: Clearly stating the purchase price in the form is important. This amount should reflect the agreed-upon price for the tractor, ensuring transparency in the transaction.

- Signatures Required: Both the seller and the buyer must sign the document. This signature requirement indicates mutual agreement to the terms outlined in the bill of sale.

- Notarization: While not mandatory, having the bill of sale notarized can add an extra layer of authenticity and may be beneficial if any disputes arise in the future.

- Retention of Copies: After completing the form, both parties should retain a copy for their records. This practice helps ensure that each party has proof of the transaction should any issues arise later.

- State Requirements: Familiarize yourself with any specific state requirements regarding the sale of agricultural equipment. Different states may have varying regulations, and compliance is crucial.

By carefully completing the Texas Tractor Bill of Sale form, both buyers and sellers can facilitate a smooth transaction, minimizing the potential for misunderstandings and ensuring a clear transfer of ownership.

Steps to Using Texas Tractor Bill of Sale

Filling out the Texas Tractor Bill of Sale form is an important step in the process of transferring ownership of a tractor. Once completed, this document serves as proof of the transaction and can be used for registration and title purposes. Follow these steps to ensure the form is filled out correctly.

- Obtain the Form: Download the Texas Tractor Bill of Sale form from a reliable source or obtain a physical copy.

- Seller Information: Fill in the seller's name, address, and contact information at the top of the form.

- Buyer Information: Enter the buyer's name, address, and contact information in the designated section.

- Tractor Details: Provide specific details about the tractor, including the make, model, year, VIN (Vehicle Identification Number), and any other relevant information.

- Sale Price: Clearly state the sale price of the tractor in the appropriate section of the form.

- Date of Sale: Write the date when the sale is taking place.

- Signatures: Both the seller and the buyer must sign and date the form to validate the transaction.

- Witness or Notary: If required, have the form witnessed or notarized to add an extra layer of authenticity.

After completing the form, make copies for both the seller and buyer. Keep these copies for your records. The original form should be retained by the buyer for registration purposes. This document will help ensure a smooth transfer of ownership.