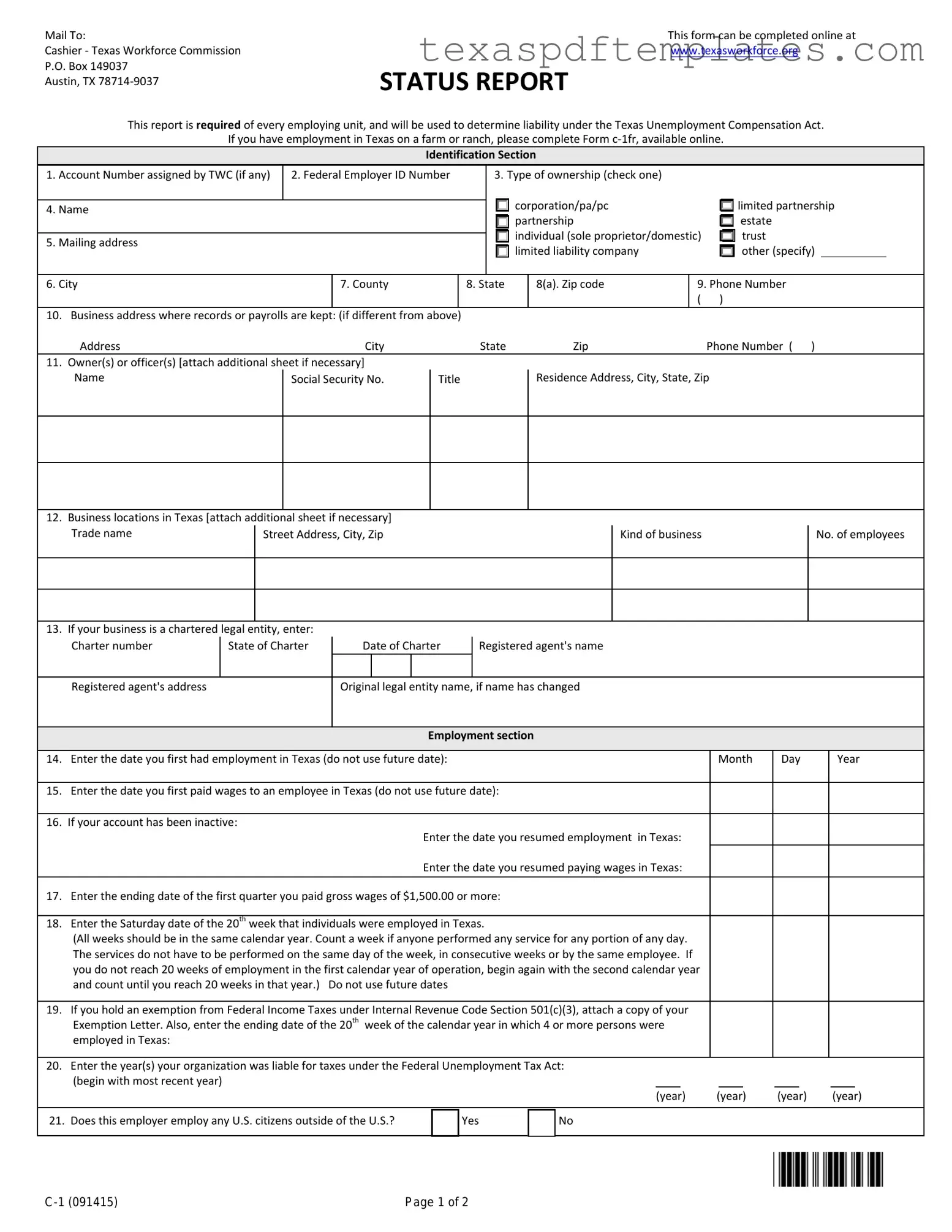

Blank Texas Workforce Commission Report PDF Template

Form Example

Mail To:

Cashier - Texas Workforce Commission

P.O. Box 149037

Austin, TX

This form can be completed online at

www.texasworkforce.org

STATUS REPORT

This report is required of every employing unit, and will be used to determine liability under the Texas Unemployment Compensation Act.

If you have employment in Texas on a farm or ranch, please complete Form

Identification Section

1. Account Number assigned by TWC (if any) |

2. Federal Employer ID Number |

|

|

3. Type of ownership (check one) |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

corporation/pa/pc |

|

limited partnership |

|||||

4. Name |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

partnership |

|

estate |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

individual (sole proprietor/domestic) |

trust |

||||||

5. Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

limited liability company |

|

other (specify) |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

6. City |

|

|

|

7. County |

|

|

8. State |

|

8(a). Zip code |

9. Phone Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

10. |

Business address where records or payrolls are kept: |

(if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Address |

|

|

|

City |

|

|

|

State |

|

Zip |

|

Phone Number ( ) |

|||||||

11. |

Owner(s) or officer(s) [attach additional sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Name |

|

|

Social Security No. |

Title |

|

|

|

|

Residence Address, City, State, Zip |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. |

Business locations in Texas [attach additional |

sheet if necessary] |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Trade name |

|

Street Address, City, Zip |

|

|

|

|

|

|

|

Kind of business |

|

No. of employees |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

If your business is a chartered legal |

entity, enter: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Charter number |

State of Charter |

Date of Charter |

|

Registered agent's name |

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Registered agent's address |

|

|

|

Original legal entity name, if name has changed |

|

|

|

|

|

||||||||||

Employment section

14. |

Enter the date you first had employment in Texas (do not use future date): |

|

|

|

|

Month |

Day |

Year |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Enter the date you first paid wages to an employee in Texas (do not use future date): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

If your account has been inactive: |

Enter the date you resumed employment in Texas: |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

|

|

Enter the date you resumed paying wages in Texas: |

|

|

|

|

|

|

|

|||

17. |

Enter the ending date of the first quarter you paid gross wages of $1,500.00 or more: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Enter the Saturday date of the 20th week that individuals were employed in Texas. |

|

|

|

|

|

|

|

|

|

|

|

|

(All weeks should be in the same calendar year. Count a week if anyone performed any service for any portion of any day. |

|

|

|

|

|

|

|

||||

|

The services do not have to be performed on the same day of the week, in consecutive weeks or by the same employee. If |

|

|

|

|

|

|

|

||||

|

you do not reach 20 weeks of employment in the first calendar year of operation, begin again with the second calendar year |

|

|

|

|

|

|

|

||||

|

and count until you reach 20 weeks in that year.) Do not use future dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

19. |

If you hold an exemption from Federal Income Taxes under Internal Revenue Code Section 501(c)(3), attach a copy of your |

|

|

|

|

|

|

|

||||

|

Exemption Letter. Also, enter the ending date of the 20th week of the calendar year in which 4 or more persons were |

|

|

|

|

|

|

|

||||

|

employed in Texas: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

20. |

Enter the year(s) your organization was liable for taxes under the Federal Unemployment Tax Act: |

|

|

|

|

|

|

|

||||

|

(begin with most recent year) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(year) |

(year) |

(year) |

(year) |

|||||

|

|

|

|

|

|

|

|

|

|

|||

21. Does this employer employ any U.S. citizens outside of the U.S.? |

Yes |

No |

|

|

|

|

|

|

|

|||

Page 1 of 2 |

Domestic - Household Employment Section

Complete 22 only if you have domestic or household employees (includes maids, cooks, chauffeurs, gardeners, etc.)

22. Enter the ending date of the first calendar quarter in which you paid gross wages of $1,000 or more to employees |

Month |

Day |

Year |

performing domestic service: |

|

|

|

Nature of Activity Section |

|

|

|

|

|

|

|

23.Describe fully the nature of activity in Texas, and list the principal products or services in order of importance:

_________________________________________________________________________________________________________________________________

_________________________________________________________________________________________________________________________________

24.If the business in Texas was acquired from another legal entity, you must complete items

a) |

Previous owner’s TWC Account Number (if known) |

______________________________________________________________________________ |

|||

b) |

Date of acquisition |

_________________________________________________________________________________________________________ |

|||

c) |

Name of previous owner(s) |

_________________________________________________________________________________________________ |

|||

d) |

Address |

________________________________________________________________________________________________________________ |

|||

e) City |

_______________________ |

What portion of business was acquired? (check one)

State |

__________________________ |

Zip |

_________________________________ |

||

all |

part (specify) |

|

|

|

|

25.On the date of the acquisition, was the previous owner(s), or any partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, also an owner, partner, officer, shareholder, or other owner of a legal or

equitable interest in the successor business? |

Yes |

No |

If “Yes”, check all that apply:

same owner, officer, partner, or shareholder

sole proprietor incorporating

same parent company

other (describe below)

_________________________________________________

If “No,” on the date of the acquisition, did the previous owner(s), partner(s), officer(s), shareholder(s), other owner(s) or a person related by blood or marriage to any of these individuals, holding a legal or equitable interest in the predecessor business, hold an option to purchase such an interest in the successor business?

yes

no

26.After the acquisition, did the predecessor continue to:

•Own or manage the organization that conducts the organization, trade or business?

•Own or manage the assets necessary to conduct the organization, trade or business?

•Control through security or lease arrangement the assets necessary to conduct the organization, trade or business?

•Direct the internal affairs or conduct of the organization, trade or business?

Yes

No

If “Yes” to any of above, describe: |

_____________________________________________________________________________________________ |

Voluntary Election Section

27.A

Yes, effective Jan. 1, |

|

|

I wish to cover all employees (except those performing service(s) which are specifically exempt in the Texas Unemployment |

Compensation Act). |

|

||

|

|

|

|

|

|

|

Signature Section |

|

|

|

|

I hereby certify that the preceding information is true and correct, and that I am authorized to execute this Status Report on behalf of the employing unit named herein. (this report must be signed by the owner, officer, partner or individual with a valid Written Authorization on file with the Texas Workforce Commission)

Date of signature:

Month ___ Day |

___ Year ___ |

Sign here ________________________________________ |

Title |

_______________ |

|||||

|

|

||||||||

|

|

|

|

|

|

|

|

||

Driver's license number |

__________________ State |

__________ |

______________________________________________ |

||||||

|

|

|

|

|

|

|

|

|

|

Individuals may receive, review and correct information that TWC collects about the individual by emailing to open.records@twc.state.tx.us or writing to: TWC Open

Records, 101 E. 15th St., Rm. 266, Austin, TX

Page 2 of 2 |

More PDF Templates

Texas Severance Tax - This form is submitted by mail to the Texas Comptroller of Public Accounts.

Ifta Texas - Only the white areas of the form should be filled out as instructed.

Texas Cdl - The Texas CDL 7 form is critical for commercial drivers to certify their operation type.

Common mistakes

-

Missing Information: One common mistake is leaving out important details. For example, not providing the Account Number or Federal Employer ID Number can delay processing.

-

Incorrect Dates: People often enter future dates for employment or wage payments. This can lead to confusion and potential penalties. Always ensure the dates are in the past.

-

Improper Ownership Type: Selecting the wrong type of ownership can cause issues. Make sure to accurately check the box that corresponds to your business structure, whether it’s a corporation, partnership, or sole proprietorship.

-

Neglecting Additional Sheets: If there are multiple owners or business locations, failing to attach additional sheets is a frequent error. Ensure you provide all necessary information to avoid delays.

-

Signature Issues: Not signing the report or having the wrong person sign it is another common mistake. The report must be signed by an authorized individual, such as an owner or officer of the business.

Key takeaways

Filling out the Texas Workforce Commission Report form is essential for compliance with state regulations. Here are key takeaways to consider:

- This report is mandatory for every employing unit in Texas.

- It helps determine liability under the Texas Unemployment Compensation Act.

- Online completion is available at www.texasworkforce.org.

- Accurate identification information is crucial. Include your TWC account number and Federal Employer ID Number.

- Specify the type of ownership accurately. Options include corporation, partnership, and sole proprietor.

- Provide a detailed description of your business activities and the principal products or services offered.

- If applicable, attach necessary documents, such as the Exemption Letter for tax exemptions under Section 501(c)(3).

- Employers must report the date they first had employment and the date they first paid wages in Texas.

- Signature by an authorized individual is required to certify the information provided is accurate.

Steps to Using Texas Workforce Commission Report

Completing the Texas Workforce Commission Report form is a straightforward process. It is essential to provide accurate information to ensure compliance with state regulations. Follow the steps below to fill out the form correctly.

- Gather necessary information, including your Account Number (if any) and Federal Employer ID Number.

- Indicate the type of ownership by checking the appropriate box (corporation, partnership, individual, etc.).

- Fill in your business name and mailing address, including city, county, state, and zip code.

- Provide a contact phone number for your business.

- If your business address differs from the mailing address, include the business address, city, state, zip code, and phone number.

- List the owner(s) or officer(s) of the business, including their names, Social Security numbers, titles, and residence addresses.

- Document business locations in Texas, including trade names, street addresses, and the number of employees.

- If applicable, enter details about your chartered legal entity, including charter number, state of charter, and registered agent's information.

- Record the date you first had employment in Texas and the date you first paid wages to an employee.

- If your account has been inactive, provide the dates you resumed employment and paying wages in Texas.

- Enter the ending date of the first quarter in which you paid gross wages of $1,500 or more.

- Identify the Saturday date of the 20th week that individuals were employed in Texas.

- If applicable, attach a copy of your Exemption Letter and enter the ending date of the 20th week of the calendar year in which four or more persons were employed in Texas.

- List the years your organization was liable for taxes under the Federal Unemployment Tax Act.

- Indicate whether your employer employs any U.S. citizens outside of the U.S.

- If you have domestic or household employees, complete the relevant section regarding wages paid.

- Describe the nature of your business activity in Texas and list principal products or services.

- If you acquired the business from another entity, provide the previous owner's information and details about the acquisition.

- Answer questions regarding ownership interests in both the predecessor and successor businesses.

- If applicable, indicate your voluntary election to pay state unemployment tax and provide the effective date.

- Sign and date the report, ensuring it is signed by an authorized individual.

Once you have completed the form, it is crucial to review all entries for accuracy. After verifying the information, submit the report to the Texas Workforce Commission at the address provided on the form. Ensure you keep a copy for your records.