Blank Texas Vtr 262 PDF Template

Form Example

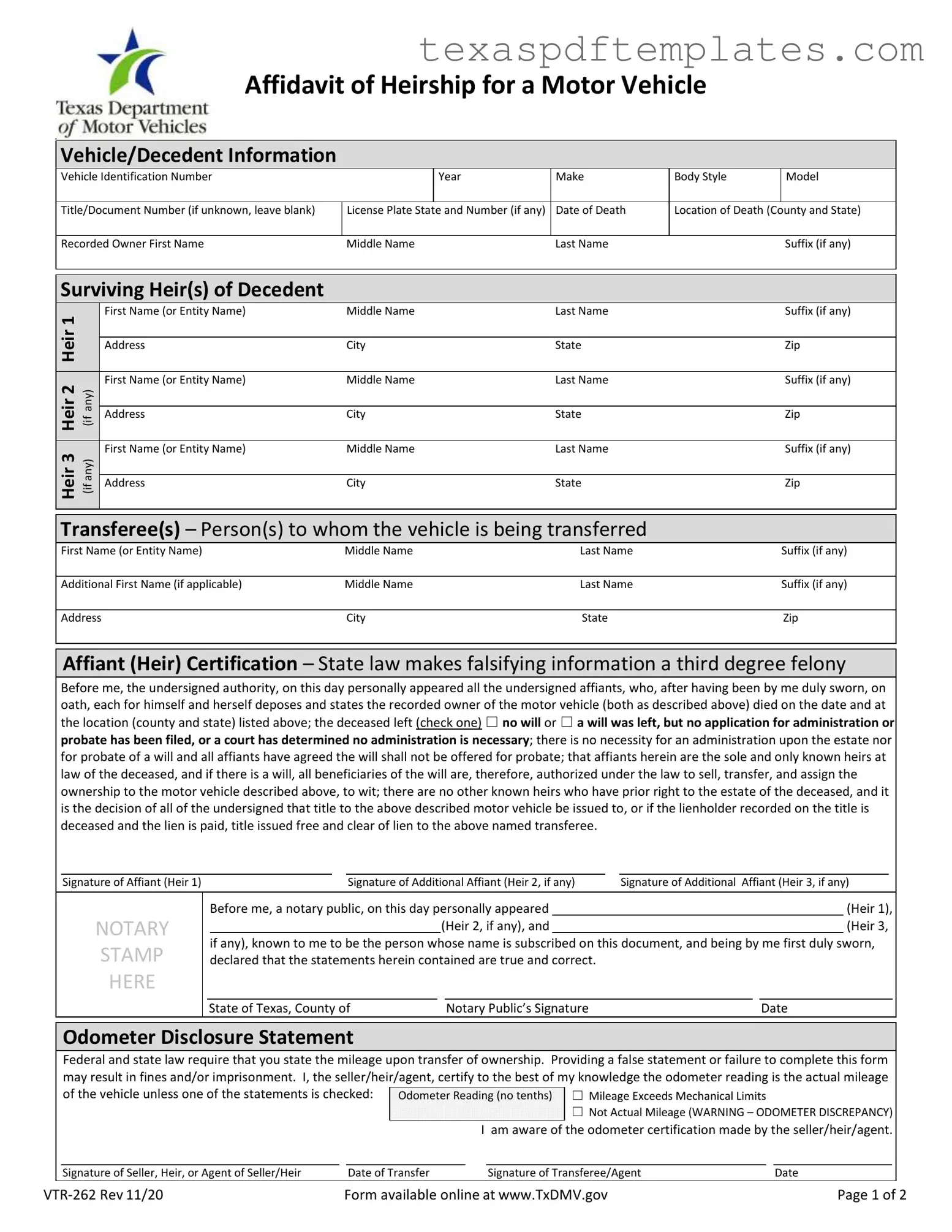

Affidavit of Heirship for a Motor Vehicle

Vehicle/Decedent Information

Vehicle Identification Number |

|

Year |

Make |

|

|

|

|

Title/Document Number (if unknown, leave blank) |

License Plate State and Number (if any) |

Date of Death |

|

|

|

|

|

Recorded Owner First Name |

Middle Name |

Last Name |

|

Surviving Heir(s) of Decedent

1 |

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

|

|

|

|

||

Heir |

|

Address |

City |

State |

|

|

|

||||

|

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

Heir2 |

(ifany) |

||||

Address |

City |

State |

|||

|

|

||||

|

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

Heir3 |

(ifany) |

||||

Address |

City |

State |

|||

|

|

||||

|

|

|

|

|

Transferee(s) – Person(s) to whom the vehicle is being transferred

First Name (or Entity Name) |

Middle Name |

Last Name |

Additional First Name (if applicable) |

Middle Name |

Last Name |

Address |

City |

State |

Body Style |

Model |

|

|

Location of Death (County and State)

Suffix (if any)

Suffix (if any)

Zip

Suffix (if any)

Zip

Suffix (if any)

Zip

Suffix (if any)

Suffix (if any)

Zip

Affiant (Heir) Certification – State law makes falsifying information a third degree felony

Before me, the undersigned authority, on this day personally appeared all the undersigned affiants, who, after having been by me duly sworn, on oath, each for himself and herself deposes and states the recorded owner of the motor vehicle (both as described above) died on the date and at the location (county and state) listed above; the deceased left (check one) ☐ no will or ☐ a will was left, but no application for administration or probate has been filed, or a court has determined no administration is necessary; there is no necessity for an administration upon the estate nor for probate of a will and all affiants have agreed the will shall not be offered for probate; that affiants herein are the sole and only known heirs at law of the deceased, and if there is a will, all beneficiaries of the will are, therefore, authorized under the law to sell, transfer, and assign the ownership to the motor vehicle described above, to wit; there are no other known heirs who have prior right to the estate of the deceased, and it is the decision of all of the undersigned that title to the above described motor vehicle be issued to, or if the lienholder recorded on the title is deceased and the lien is paid, title issued free and clear of lien to the above named transferee.

Signature of Affiant (Heir 1) |

|

Signature of Additional Affiant (Heir 2, if any) |

|

Signature of Additional Affiant (Heir 3, if any) |

NOTARY

STAMP

HERE

|

Before me, a notary public, on this day personally appeared |

|

|

|

(Heir |

1), |

||||

|

|

|

(Heir 2, if any), and |

|

|

|

(Heir 3, |

|||

|

if any), known to me to be the person whose name is subscribed on this document, and being by me first duly sworn, |

|

||||||||

declared that the statements herein contained are true and correct. |

|

|

|

|

||||||

|

|

|

|

|

|

|

||||

State of Texas, County of |

|

Notary Public’s Signature |

|

Date |

|

|||||

|

Odometer Disclosure Statement |

|

|

|

|

|

|

|

||

|

Federal and state law require that you state the mileage upon transfer of ownership. Providing a false statement or failure to complete this form |

|

||||||||

|

may result in fines and/or imprisonment. I, the seller/heir/agent, certify to the best of my knowledge the odometer reading is the actual mileage |

|

||||||||

|

of the vehicle unless one of the statements is checked: |

|

|

|

|

|

|

|||

|

Odometer Reading (no tenths) |

☐ Mileage Exceeds Mechanical Limits |

|

|

||||||

|

|

|

|

|

|

|

☐ Not Actual Mileage (WARNING – ODOMETER DISCREPANCY) |

|

||

|

|

|

|

|

I am aware of the odometer certification made by the seller/heir/agent. |

|

||||

|

|

|

|

|

|

|

|

|

||

|

Signature of Seller, Heir, or Agent of Seller/Heir |

|

Date of Transfer |

|

Signature of Transferee/Agent |

Date |

|

|||

Form available online at www.TxDMV.gov |

Page 1 of 2 |

|||||||||

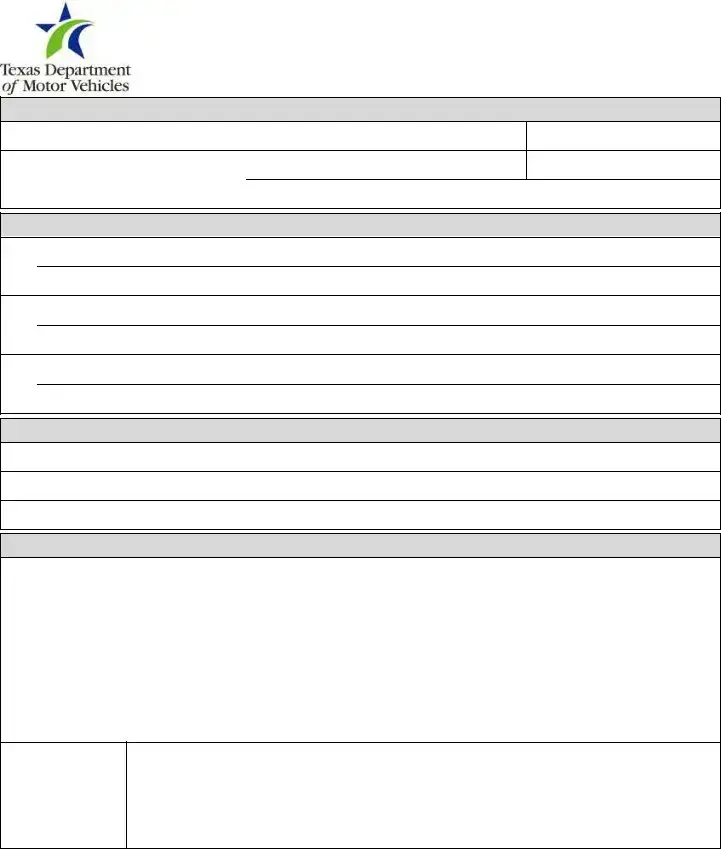

Affidavit of Heirship for a Motor Vehicle

Information

The section is for informational purposes only. Affiant(s) must obtain their own legal advice if required.

If the estate has been probated, the executor or administrator may assign the title provided a certified copy of the probate proceedings, Letters Testamentary, or Letters of Administration is attached. In this situation, this form is not required. Otherwise, the procedures in the “Instructions” section below must be met to transfer ownership.

If there has been no administration on the estate, and no administration is necessary, the heirs may complete this form, and no further documentation is required.

If an heirship affidavit is used when a court has determined no administration is necessary, the affiant(s) must attach the original or certified copy of the court document indicating no administration of the will is necessary and the portions of the will that specify the will is in the deceased owner’s name and indicates the name(s) of the heir(s).

If all heirs cannot appear before one notary public on the same date, or there are more than three heirs, additional copies of this form must be completed. If additional copies of this form are completed, all copies must be submitted by the transferee (or purchaser) with the title application at the time of application to a county tax

If one of the heirs is a surviving spouse, that heir is the only heir needing to complete this form unless there are surviving children of the decedent with a parent who is other than the surviving spouse in which case all surviving children must also complete this form.

If there is no surviving spouse, all children of the decedent (if any) must sign as affiants.

If the decedent left neither a spouse nor children, consult legal counsel as to who are the “heirs at law.”

Children

Children born to or legally adopted by the decedent qualify for this procedure as “children” of the decedent.

A guardian must sign for any surviving minor children of the decedent and attach Letters of Guardianship.

Instructions

1.Complete the “Vehicle/Decedent Information” section on page 1. All fields are required unless indicated otherwise.

2.The heir(s) (up to three) must complete the “Surviving Heir(s) of Decedent” section on page 1. Refer to the “Information” section above for additional information. If there are more than three heirs, additional completed forms are necessary.

3.Complete the “Transferee(s)” section to indicate to whom the vehicle is being transferred. An heir may also be listed as a transferee.

4.Complete the “Affiant (Heir) Certification” section by marking the appropriate selection as to the will. The preceding three sections of the form must be completed prior to completion of this section. Each heir (up to three) must sign this form before a notary. All signatures must be notarized. This section may not be completed by execution of a power of attorney.

5.The “Odometer Disclosure Statement” section must be completed by an heir (or any agent of an heir) and the purchaser of the motor vehicle if the vehicle is subject to odometer disclosure. This section may be completed after the notarization has been completed. Only one seller/heir is required to execute the odometer disclosure statement.

6.The following documentation is required in order for a title transfer to be processed by the county tax assessor- collector’s office in the name of the title applicant(s):

Application for Texas Title and/or Registration (Form

Affidavit of Heirship for a Motor Vehicle (Form

If a court has determined no administration is necessary:

Original or certified copy of the court document indicating no administration of the will is necessary; and

The portions of the will specifying the will is in the decedent’s name and indicating the heir(s);

Title and/or registration verification if the vehicle was last titled out of state;

Release of Lien (if a lien is recorded on the title record); and

A copy of current proof of liability insurance in the applicant’s name (if applying for registration).

Note: Errors that have been lined through and corrected require a statement of fact. Erasures and significant alterations may require a new form to be completed.

Form available online at www.TxDMV.gov |

Page 2 of 2 |

More PDF Templates

Texas Corporation Commission - Distinct specimens are needed for different classes of goods or services.

Do You Have to Register a Jon Boat - The Texas Parks and Wildlife Department is the governing body overseeing this form.

Delivery Log - The Texas Department of Aging provides resources to assist in understanding form requirements.

Common mistakes

-

Incomplete Vehicle/Decedent Information: Many individuals fail to fill out all required fields in the "Vehicle/Decedent Information" section. This includes crucial details such as the Vehicle Identification Number (VIN), year, and make of the vehicle. Missing any of this information can delay the title transfer process.

-

Improper Heir Information: It is common for people to overlook the need to list all surviving heirs accurately. If there are more than three heirs, additional forms must be completed. Failing to include all heirs can lead to disputes and complications later on.

-

Notary Oversight: Some applicants neglect to ensure that all signatures are notarized correctly. Each heir must sign the form in the presence of a notary public. If any signature is missing or improperly notarized, the form may be rejected.

-

Odometer Disclosure Errors: Many individuals either forget to complete the Odometer Disclosure Statement or provide inaccurate mileage readings. This section is legally required, and inaccuracies can result in fines or legal issues.

Key takeaways

Filling out the Texas VTR-262 form can seem daunting, but understanding the key elements can make the process smoother. Here are some essential takeaways:

- Complete All Required Fields: Ensure that every section of the "Vehicle/Decedent Information" is filled out accurately. Missing information can delay the transfer process.

- Identify Surviving Heirs: List all surviving heirs in the designated section. If there are more than three heirs, additional forms will be necessary.

- Affiant Certification: Each heir must sign the form in front of a notary public. This step is crucial for validating the document.

- Odometer Disclosure: It is mandatory to complete the odometer disclosure statement. This ensures compliance with federal and state laws regarding mileage disclosure.

- Documentation Requirements: When submitting the form, include all necessary documents, such as proof of no administration being necessary, and any relevant court documents.

- Consult Legal Counsel: If there are uncertainties about who qualifies as heirs or the need for additional legal documentation, seeking legal advice is recommended.

- Surviving Spouse Considerations: If there is a surviving spouse, they are typically the only heir required to complete the form, unless there are children from a different relationship.

- Errors and Corrections: If you make an error on the form, simply crossing it out may not be sufficient. Significant changes may require a new form to be filled out.

By keeping these points in mind, you can navigate the process of completing the Texas VTR-262 form with confidence and clarity.

Steps to Using Texas Vtr 262

Once you have gathered all necessary information, you can begin filling out the Texas VTR-262 form. This form is essential for transferring ownership of a motor vehicle when the recorded owner has passed away. Careful attention to detail is important to ensure that all information is accurate and complete.

- Start by filling out the “Vehicle/Decedent Information” section. Include the Vehicle Identification Number, year, make, title/document number, license plate state and number, date of death, and the recorded owner's full name.

- In the “Surviving Heir(s) of Decedent” section, provide the names and addresses of up to three heirs. Make sure to fill in the first name, middle name, last name, and address for each heir.

- Next, complete the “Transferee(s)” section. Indicate the person or entity to whom the vehicle is being transferred. Include their full name and address.

- In the “Affiant (Heir) Certification” section, mark the appropriate box regarding the existence of a will. Ensure that all previous sections are completed before signing this section. Each heir must sign in front of a notary public, and all signatures need to be notarized.

- Complete the “Odometer Disclosure Statement” section. This must be filled out by an heir or their agent, certifying the vehicle's mileage. This can be done after notarization.

- Gather the required documentation for the title transfer. This includes the completed VTR-262 form, an Application for Texas Title and/or Registration (Form 130-U), and any necessary court documents if applicable.

After completing these steps, ensure that all forms and documents are submitted to the county tax assessor-collector’s office. It’s important to double-check for any errors or missing information to avoid delays in processing your application.