Blank Texas Sales Tax Exemption Certificate PDF Template

Form Example

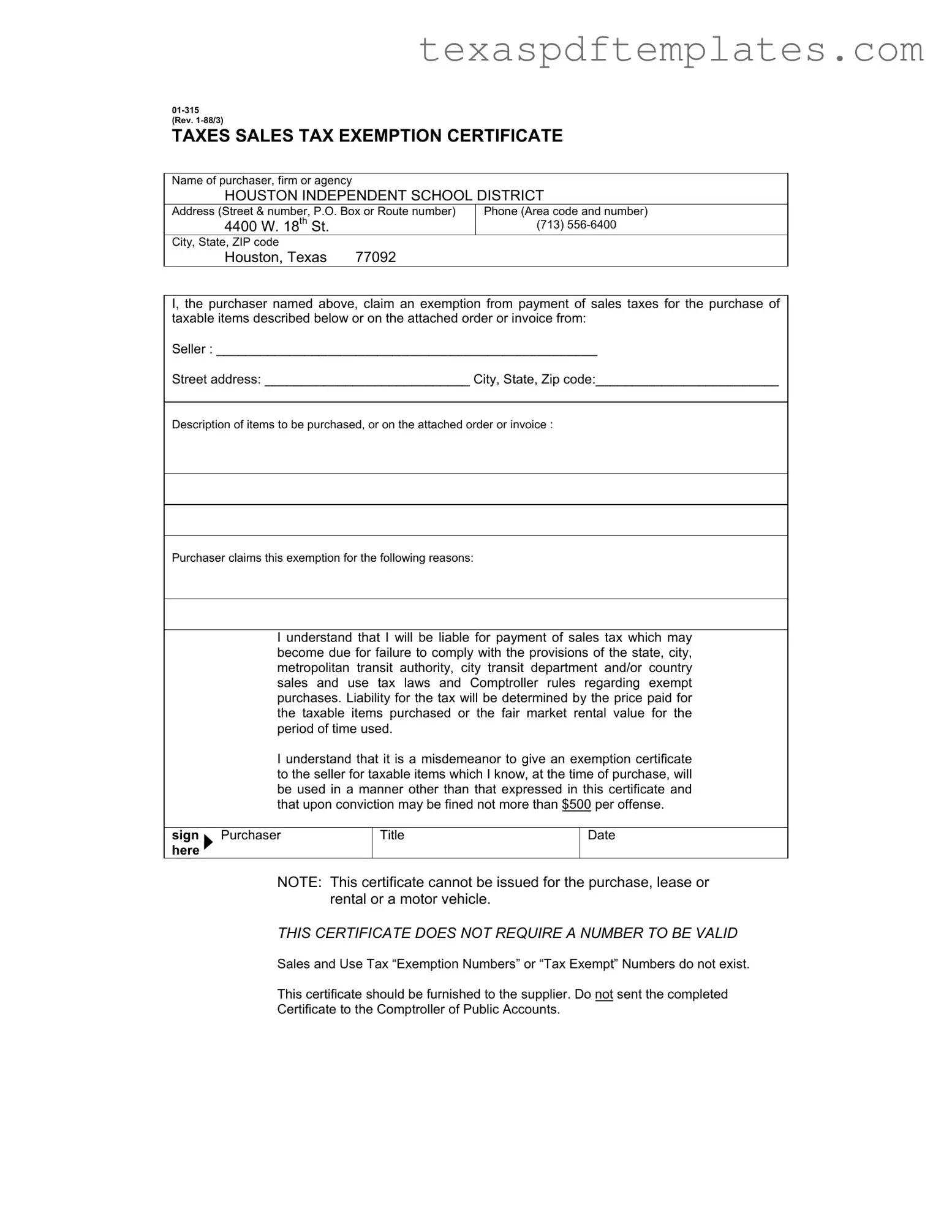

TAXES SALES TAX EXEMPTION CERTIFICATE

Name of purchaser, firm or agency

HOUSTON INDEPENDENT SCHOOL DISTRICT

Address (Street & number, P.O. Box or Route number) |

Phone (Area code and number) |

|

4400 W. 18th St. |

|

(713) |

City, State, ZIP code |

|

|

Houston, Texas |

77092 |

|

I, the purchaser named above, claim an exemption from payment of sales taxes for the purchase of taxable items described below or on the attached order or invoice from:

Seller : ____________________________________________________

Street address: ____________________________ City, State, Zip code:_________________________

Description of items to be purchased, or on the attached order or invoice :

Purchaser claims this exemption for the following reasons:

I understand that I will be liable for payment of sales tax which may become due for failure to comply with the provisions of the state, city, metropolitan transit authority, city transit department and/or country sales and use tax laws and Comptroller rules regarding exempt purchases. Liability for the tax will be determined by the price paid for the taxable items purchased or the fair market rental value for the period of time used.

I understand that it is a misdemeanor to give an exemption certificate to the seller for taxable items which I know, at the time of purchase, will be used in a manner other than that expressed in this certificate and that upon conviction may be fined not more than $500 per offense.

sign Purchaser here

Title

Date

NOTE: This certificate cannot be issued for the purchase, lease or rental or a motor vehicle.

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID

Sales and Use Tax “Exemption Numbers” or “Tax Exempt” Numbers do not exist.

This certificate should be furnished to the supplier. Do not sent the completed Certificate to the Comptroller of Public Accounts.

More PDF Templates

How to Get a Lost Title for a Mobile Home in Texas - Applicants must indicate whether the home was sold as part of the transaction.

Sales Tax Exemption Form Texas - For retailers in Mexico, additional documentation is necessary to validate claims made on the resale certificate.

Certificate of Good Standing Texas - The PS 1040R is an essential tool for schools to follow along the detailed refund procedures.

Common mistakes

-

Incomplete Information: One common mistake is not filling out all required fields. The purchaser's name, address, and contact information must be complete. Leaving out any details can lead to delays or rejection of the exemption claim.

-

Incorrect Seller Information: Another frequent error is providing incorrect details about the seller. It's essential to accurately list the seller's name, address, and city. Mistakes here can cause complications during the transaction.

-

Failure to Specify Items: Some individuals forget to clearly describe the items being purchased. It's important to specify what items are exempt. Vague descriptions can lead to misunderstandings or disputes later on.

-

Misunderstanding Exemption Reasons: Lastly, many people do not fully understand the reasons for claiming an exemption. It's crucial to select the correct exemption reason and ensure it aligns with the intended use of the items. Misrepresenting this can result in legal issues.

Key takeaways

Filling out and using the Texas Sales Tax Exemption Certificate form requires careful attention to detail. Here are key takeaways to ensure compliance and proper use of the certificate:

- Identify the Purchaser: Clearly state the name of the purchaser, firm, or agency at the top of the form. This information is essential for validating the exemption.

- Provide Accurate Contact Information: Include the complete address and phone number of the purchaser. This helps in any necessary follow-up regarding the exemption.

- Specify the Seller: Fill in the seller's name and address accurately. This identifies who the exemption applies to and ensures that the seller is aware of the tax-exempt status.

- Detail the Items Purchased: Describe the items being purchased or attach an order or invoice. This specificity is crucial for the exemption to be valid.

- Understand the Liability: Acknowledge that the purchaser is responsible for any sales tax due if the exemption is misused. This includes understanding the legal implications of misrepresenting the intended use of the items.

- Do Not Submit to Comptroller: Remember that the completed certificate should be given to the seller and not sent to the Comptroller of Public Accounts. This is a common misconception.

By adhering to these guidelines, individuals and organizations can effectively utilize the Texas Sales Tax Exemption Certificate while remaining compliant with state tax laws.

Steps to Using Texas Sales Tax Exemption Certificate

Completing the Texas Sales Tax Exemption Certificate is a straightforward process that requires specific information to be filled out accurately. This form allows certain purchasers, like educational institutions, to claim exemption from sales tax on qualifying purchases. Below are the steps to guide you through filling out the form correctly.

- Begin by entering the name of the purchaser, firm, or agency in the designated space at the top of the form.

- Next, provide the complete address, including the street address, P.O. Box, or route number.

- Include the phone number in the area provided, ensuring to use the correct area code.

- Fill in the city, state, and ZIP code of the purchaser’s location.

- In the section labeled "Seller," write the name of the seller from whom the items are being purchased.

- Provide the seller's street address, ensuring it is complete and accurate.

- Next, fill in the city, state, and ZIP code for the seller's location.

- Describe the items to be purchased in detail. You may also refer to an attached order or invoice if necessary.

- Indicate the reason for claiming the exemption in the space provided.

- Sign the form where indicated, ensuring that the signature is that of the purchaser named at the top.

- Include the title of the purchaser in the appropriate space.

- Finally, write the date on which the form is being completed.

Once the form is filled out, it should be provided to the supplier. It is important to remember that this certificate does not need to be submitted to the Comptroller of Public Accounts. Ensure that all information is accurate to avoid any potential issues with tax compliance.