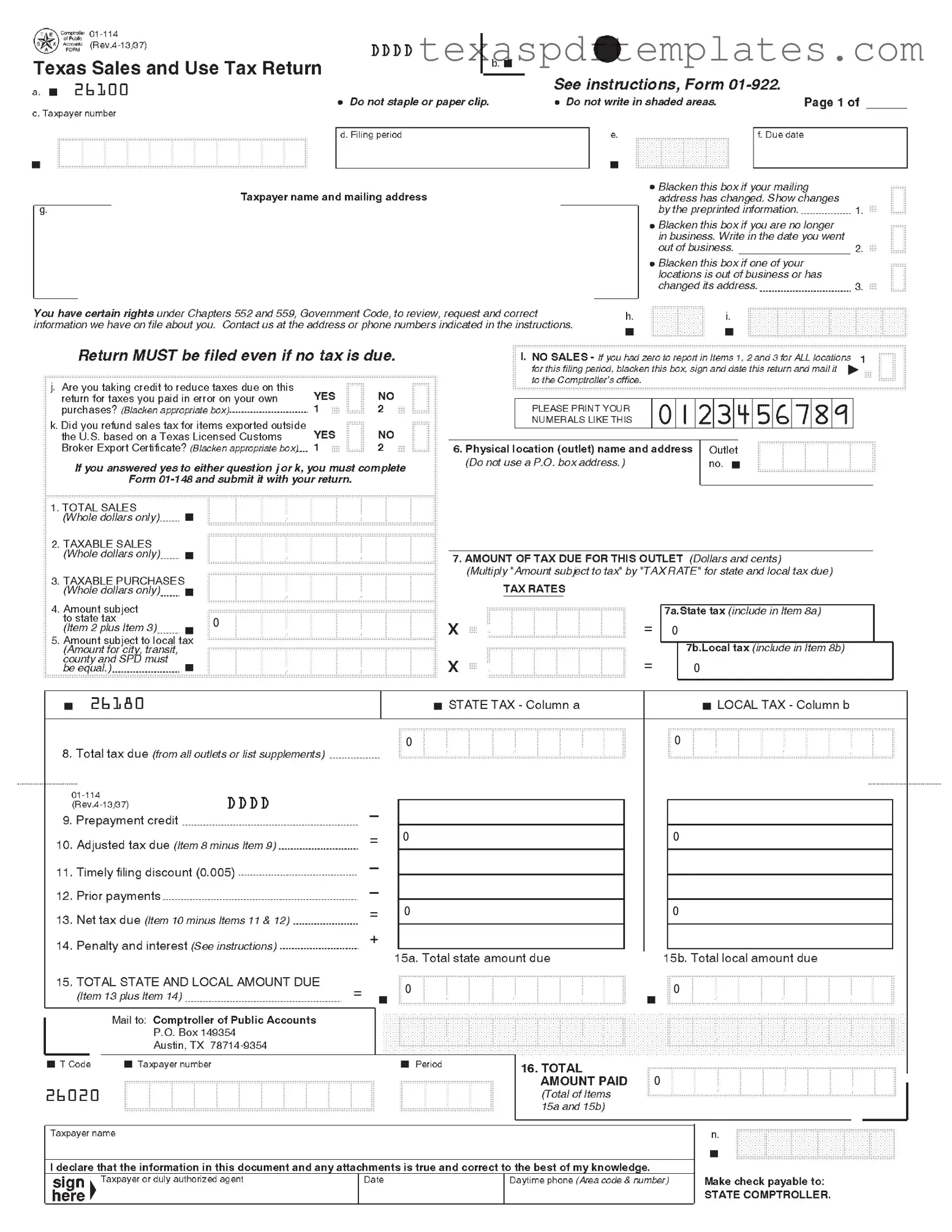

Blank Texas Sales 01 922 PDF Template

Form Example

0

0

0

0

0

0

0

0

0

0 |

0 |

0

More PDF Templates

Texas Department of Licensing and Regulation Form - Detailed records of the company’s financial standing must be maintained and submitted.

Insurance Cert - The insurance policy must cover all plumbing activities under the RMP's license.

Common mistakes

-

Ignoring the Instructions: Many individuals overlook the detailed instructions provided with the Texas Sales 01 922 form. These instructions contain crucial information on how to fill out the form correctly, including what to include in each section and how to calculate taxes.

-

Incorrect Taxpayer Number: It is essential to enter the correct taxpayer number. Mistakes in this number can lead to processing delays or even rejection of the return.

-

Failing to Blacken Appropriate Boxes: The form includes several boxes that must be blackened to indicate specific circumstances, such as if the business is no longer operational. Neglecting to do this can result in incomplete information being submitted.

-

Providing Incomplete Sales Figures: When reporting total sales, taxable sales, and taxable purchases, ensure that all amounts are accurate and presented in whole dollars. Rounding or omitting figures can lead to errors in tax calculations.

-

Using a P.O. Box for the Physical Location: The form specifically requests a physical address for the outlet. Using a P.O. Box can lead to complications and may result in the return being considered invalid.

-

Neglecting to File When No Taxes Are Due: Even if there are no taxes due, it is still necessary to file the return. Failing to do so can lead to penalties or issues with future filings.

-

Not Signing the Form: A common mistake is submitting the form without a signature. The taxpayer or an authorized agent must sign and date the return to validate it.

Key takeaways

The Texas Sales 01 922 form is essential for reporting sales and use tax in Texas.

Always ensure that you do not staple or paper clip the form, as this could interfere with processing.

Fill in your taxpayer number and the filing period accurately to avoid delays.

Mark the appropriate boxes if your mailing address has changed or if you are no longer in business.

Even if no taxes are due, you must still file the return to remain compliant with state regulations.

When reporting sales, only use whole dollars in the designated fields.

If you had zero sales during the filing period, blacken the box indicating "NO SALES" and submit the form.

For any refunds of sales tax on exported items, you must complete Form 01-148 and submit it alongside your return.

Before submitting, ensure that the information declared is true and correct, as inaccuracies can lead to penalties.

Steps to Using Texas Sales 01 922

Filling out the Texas Sales 01 922 form requires careful attention to detail. This form is essential for reporting sales and use tax, and it must be completed accurately to ensure compliance with state regulations. Below are the steps to fill out the form correctly.

- Obtain the form: Download the Texas Sales 01 922 form from the Texas Comptroller's website or acquire a physical copy.

- Fill in your taxpayer number: Locate the section labeled "Taxpayer number" and enter your unique number.

- Specify the filing period: Indicate the relevant filing period for the report.

- Enter your due date: Write the due date for the tax return.

- Provide your name and address: Fill in your business name and mailing address. If your address has changed, blacken the appropriate box.

- Indicate business status: If you are no longer in business, blacken the box and write the date you ceased operations.

- Report location status: If any of your locations are out of business or have changed addresses, blacken the corresponding box.

- Complete sales information: Fill in the total sales, taxable sales, and taxable purchases in whole dollars only.

- Calculate amounts subject to tax: Add taxable sales and taxable purchases to determine the amount subject to state tax.

- Determine tax due: Multiply the amount subject to tax by the applicable tax rates for state and local taxes.

- Provide outlet information: Enter the physical location name and address of your outlet, ensuring not to use a P.O. box.

- Sign and date the form: The taxpayer or an authorized agent must sign and date the return.

- Include daytime phone number: Provide your daytime phone number for any follow-up communication.

- Make payment: If applicable, make your check payable to the "STATE COMPTROLLER" and include it with your return.

After completing the form, review all entries for accuracy. Ensure that you have not left any sections blank and that your calculations are correct. Once everything is confirmed, mail the form to the appropriate address provided in the instructions.