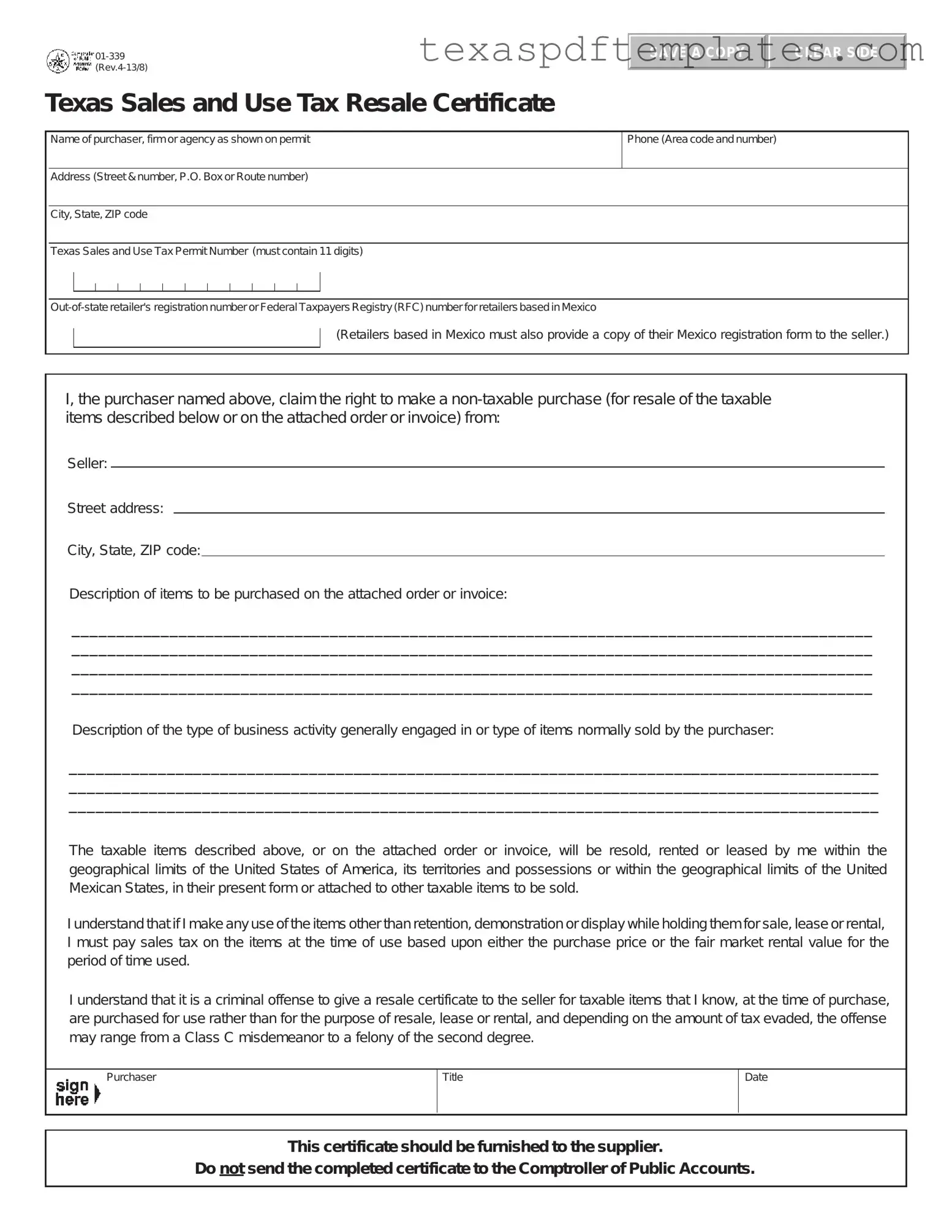

Blank Texas Resale Certificate 01 339 PDF Template

Form Example

SAVE A COPY

CLEAR SIDE

Texas Sales and Use Tax Resale Certificate

Name of purchaser, firm or agency as shown on permit

Phone (Area code and number)

Address (Street & number, P.O. Box or Route number)

City, State, ZIP code

Texas Sales and Use Tax Permit Number (must contain 11 digits)

(Retailers based in Mexico must also provide a copy of their Mexico registration form to the seller.)

I, the purchaser named above, claim the right to make a

Seller:

Street address:

City, State, ZIP code:

Description of items to be purchased on the attached order or invoice:

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

Description of the type of business activity generally engaged in or type of items normally sold by the purchaser:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

The taxable items described above, or on the attached order or invoice, will be resold, rented or leased by me within the geographical limits of the United States of America, its territories and possessions or within the geographical limits of the United Mexican States, in their present form or attached to other taxable items to be sold.

I understand that if I make any use of the items other than retention, demonstration or display while holding them for sale, lease or rental, I must pay sales tax on the items at the time of use based upon either the purchase price or the fair market rental value for the period of time used.

I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that I know, at the time of purchase, are purchased for use rather than for the purpose of resale, lease or rental, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

Texas Sales and Use Tax Exemption Certification

This certificate does not require a number to be valid.

Name of purchaser, firm or agency

SAVE A COPY

CLEAR SIDE

Address (Street & number, P.O. Box or Route number)

Phone (Area code and number)

City, State, ZIP code

I, the purchaser named above, claim an exemption from payment of sales and use taxes (for the purchase of taxable items described below or on the attached order or invoice) from:

Seller:

Street address: |

|

City, State, ZIP code: |

|

Description of items to be purchased or on the attached order or invoice:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

Purchaser claims this exemption for the following reason:

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

___________________________________________________________________________________________

I understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the provisions of the Tax Code and/or all applicable law.

I understand that it is a criminal offense to give an exemption certificate to the seller for taxable items that I know, at the time of purchase, will be used in a manner other than that expressed in this certificate, and depending on the amount of tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Purchaser

Title

Date

NOTE: This certificate cannot be issued for the purchase, lease, or rental of a motor vehicle.

THIS CERTIFICATE DOES NOT REQUIRE A NUMBER TO BE VALID.

Sales and Use Tax "Exemption Numbers" or "Tax Exempt" Numbers do not exist.

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

More PDF Templates

30 Day Notice - A forwarding address is required for the return of the security deposit.

Texas Tobacco License - Once approved, the permit must be prominently displayed at the business location.

Texas Cdl - Part of compliance involves reviewing FAQs related to DOT medical certification requirements.

Common mistakes

-

Incorrect or Missing Texas Sales and Use Tax Permit Number: Ensure the permit number contains exactly 11 digits. An incorrect number can invalidate the certificate.

-

Failure to Provide Seller Information: Always include the seller’s name, address, city, state, and ZIP code. Omitting this information can lead to confusion and potential tax liabilities.

-

Incomplete Description of Items: Clearly describe the items being purchased. An unclear or vague description can lead to disputes regarding tax obligations.

-

Not Specifying Business Activity: Provide a detailed description of the type of business activity or items normally sold. This helps establish the legitimacy of the resale claim.

-

Using the Certificate for Non-Eligible Purchases: Ensure the items purchased are intended for resale, rental, or lease. Using the certificate for personal use can result in legal penalties.

-

Failing to Sign and Date the Certificate: The certificate must be signed and dated by the purchaser. A missing signature or date renders the document invalid.

-

Not Keeping a Copy: Always save a copy of the completed certificate for your records. This can serve as proof if questions arise later.

-

Submitting the Certificate to the Comptroller: Do not send the completed certificate to the Comptroller of Public Accounts. It should be given directly to the supplier.

Key takeaways

Understanding the Texas Resale Certificate 01 339 form is essential for both buyers and sellers engaged in taxable transactions. Here are key takeaways to keep in mind:

- Purpose: The Texas Resale Certificate allows purchasers to buy items tax-free for resale, rental, or lease.

- Eligibility: Only businesses with a valid Texas Sales and Use Tax Permit can use this certificate.

- Information Required: Complete the form with accurate details, including the purchaser's name, address, and permit number.

- Item Description: Clearly describe the items being purchased to ensure compliance and clarity.

- Geographical Limits: The resale of items must occur within the United States or Mexico.

- Consequences of Misuse: Misusing the certificate can lead to serious legal repercussions, including criminal charges.

- Do Not Send: Do not submit the completed certificate to the Comptroller of Public Accounts; it should be given directly to the seller.

- Keep a Copy: Always retain a copy of the completed certificate for your records.

By following these guidelines, businesses can navigate the resale process more effectively and stay compliant with tax regulations.

Steps to Using Texas Resale Certificate 01 339

Completing the Texas Resale Certificate 01 339 form is essential for those looking to make tax-exempt purchases for resale. This process involves providing specific information about the purchaser and the items being purchased. Follow the steps outlined below to accurately fill out the form.

- Enter the Purchaser's Information: Fill in the name of the purchaser, firm, or agency as it appears on the sales tax permit. Include the phone number with area code, street address, city, state, and ZIP code.

- Provide the Texas Sales and Use Tax Permit Number: Ensure this number contains 11 digits. If applicable, include the out-of-state retailer's registration number or the Federal Taxpayers Registry number for retailers based in Mexico.

- Claim Non-Taxable Purchase: State that you, the purchaser, claim the right to make a non-taxable purchase for resale. Include the seller's name, street address, city, state, and ZIP code.

- Describe the Items: Provide a detailed description of the items to be purchased as listed on the attached order or invoice. Use clear and concise language.

- Business Activity Description: Describe the type of business activity generally engaged in or the type of items normally sold by the purchaser. This helps establish the context of the resale.

- Understand Tax Responsibilities: Acknowledge that the taxable items will be resold, rented, or leased within the geographical limits of the United States or Mexico. Note the implications of using items for purposes other than resale.

- Sign and Date: The purchaser must sign and date the form, confirming the accuracy of the information provided and understanding the legal implications of misuse.

- Submit the Certificate: Furnish the completed certificate to the supplier. Do not send it to the Comptroller of Public Accounts.