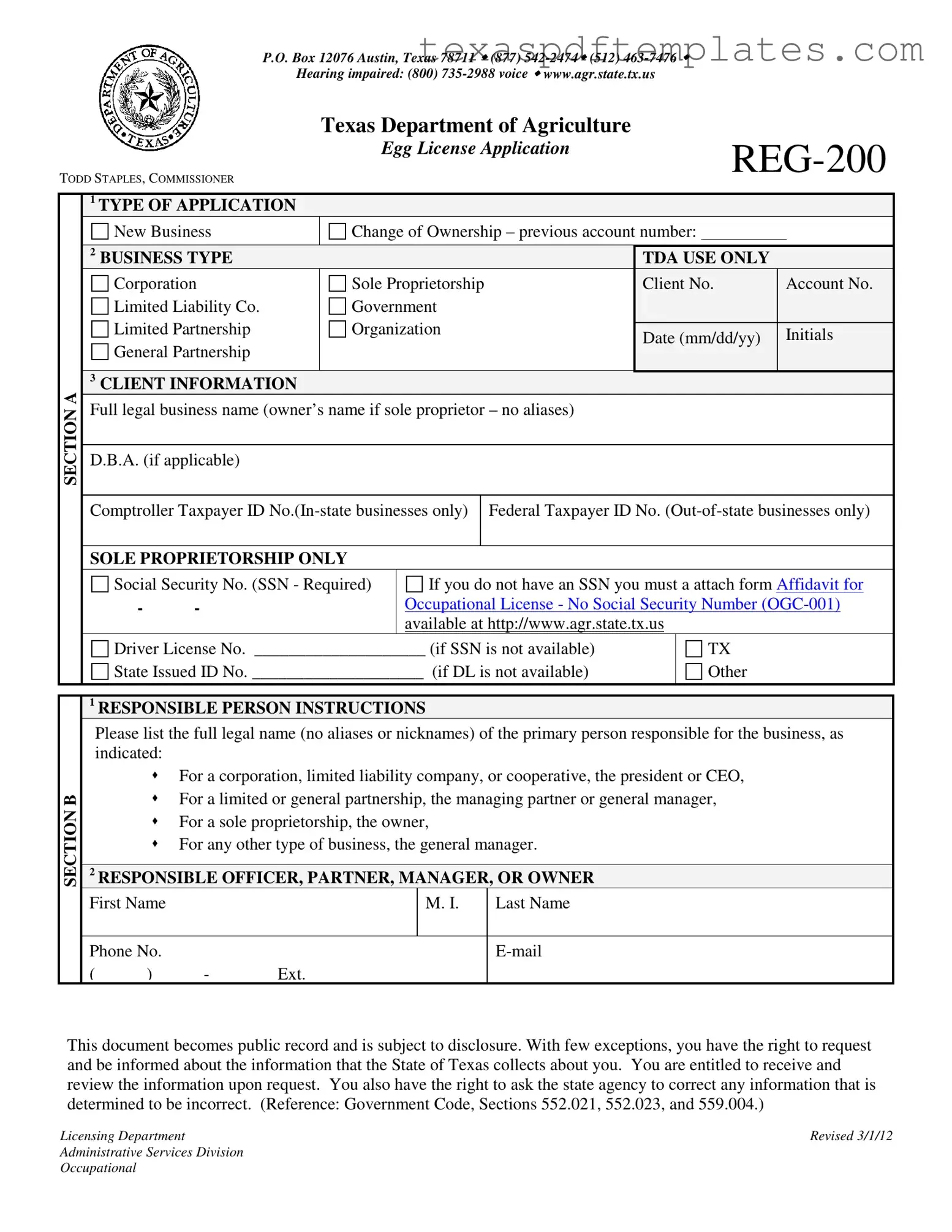

Blank Texas Reg 200 PDF Template

Form Example

P.O. Box 12076 Austin, Texas 78711 (877)

Hearing impaired: (800)

Texas Department of Agriculture

Egg License Application |

|

|

TODD STAPLES, COMMISSIONER

1TYPE OF APPLICATION

SECTION A

SECTION B

|

New Business |

Change of Ownership – previous account number: |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 BUSINESS TYPE |

|

|

|

TDA USE ONLY |

|

|

|

|

||

|

Corporation |

Sole Proprietorship |

|

|

Client No. |

|

|

Account No. |

|

|

|

|

Limited Liability Co. |

Government |

|

|

|

|

|

|

|

|

|

|

Limited Partnership |

Organization |

|

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yy) |

|

|

Initials |

|

|

|||

|

General Partnership |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3CLIENT INFORMATION

Full legal business name (owner’s name if sole proprietor – no aliases)

D.B.A. (if applicable)

Comptroller Taxpayer ID

SOLE PROPRIETORSHIP ONLY

Social Security No. (SSN - Required) |

If you do not have an SSN you must a attach form Affidavit for |

|||

- |

- |

Occupational License - No Social Security Number |

||

|

|

available at http://www.agr.state.tx.us |

|

|

Driver License No. ____________________ (if SSN is not available) |

|

TX |

||

|

||||

State Issued ID No. ____________________ (if DL is not available) |

|

Other |

||

|

|

|

|

|

1RESPONSIBLE PERSON INSTRUCTIONS

Please list the full legal name (no aliases or nicknames) of the primary person responsible for the business, as indicated:

For a corporation, limited liability company, or cooperative, the president or CEO,

For a limited or general partnership, the managing partner or general manager,

For a sole proprietorship, the owner,

For any other type of business, the general manager.

2RESPONSIBLE OFFICER, PARTNER, MANAGER, OR OWNER

First Name |

|

|

M. I. |

Last Name |

|

Phone No. |

|

|

|

||

|

|

|

|||

( |

) |

- |

Ext. |

|

|

This document becomes public record and is subject to disclosure. With few exceptions, you have the right to request and be informed about the information that the State of Texas collects about you. You are entitled to receive and review the information upon request. You also have the right to ask the state agency to correct any information that is determined to be incorrect. (Reference: Government Code, Sections 552.021, 552.023, and 559.004.)

Licensing Department |

Revised 3/1/12 |

Administrative Services Division |

|

Occupational |

|

|

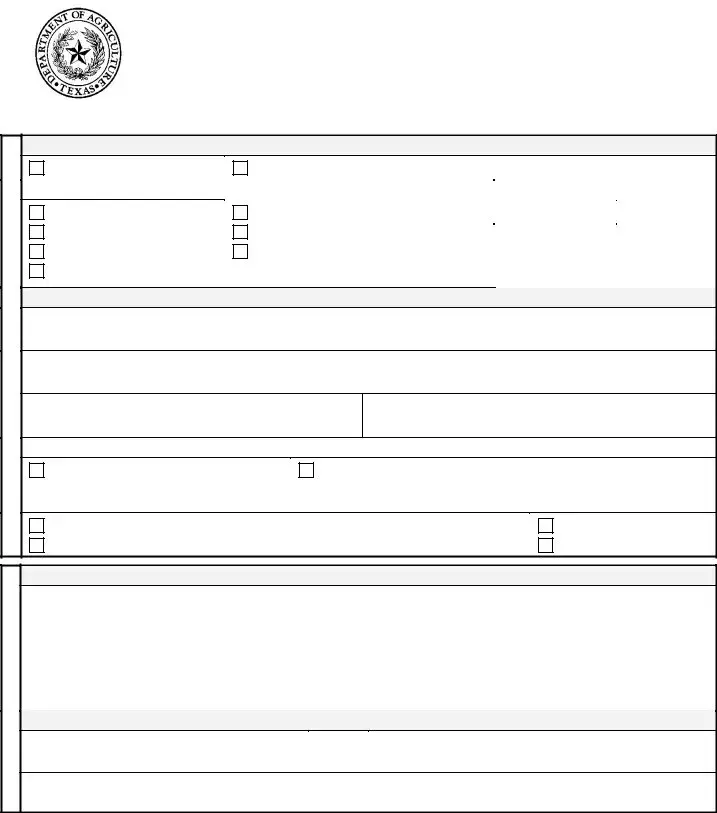

Page 2 of 4 |

|||

Legal Business Name ______________________________ |

|

|

||

|

|

|

|

|

|

|

3 RESPONSIBLE PERSON MAILING ADDRESS |

|

|

(CONT’D.)B |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip |

SEC. |

|

|

|

|

|

Web Address of Business (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1PERSON TO CONTACT FOR

|

First Name |

|

|

M. I. |

Last Name |

|

|

||

|

|

|

|

|

|||||

|

Primary Phone |

|

|

Secondary Phone (optional) |

|||||

|

( |

) |

- |

Ext. |

( |

) |

- |

Ext. |

|

|

|

|

|

|

|

|

|

|

|

|

Fax (optional) |

|

|

|

|

|

|

|

|

C |

( |

) |

- |

Ext. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION |

|

|

|

|

|

|

|||

|

|||||||||

***Important Note*** I understand that my email address is required for the Texas Department of Agriculture to keep me |

|||||||||

informed of critical information, including licensing and regulatory updates; renewal invoices; and other important |

|||||||||

|

communications. Failure to provide an email address may result in my not receiving |

||||||||

|

affect my compliance with state regulations, thereby, resulting in monetary penalties. |

|

|||||||

2MAILING ADDRESS Address

City

State

Zip

1FACILITY INFORMATION

Facility Name

SECTION D

SECTION D

2PHYSICAL ADDRESS OF LOCATION OF LICENSEE, LICENSED ACTIVITIES OR EQUIPMENT

Address (No P.O. Box)

City |

State |

Zip |

County |

|

|

|

|

Directions to Physical Location if address above is difficult to find

Licensing Department |

Revised 3/1/12 |

Administrative Services Division |

|

Occupational |

|

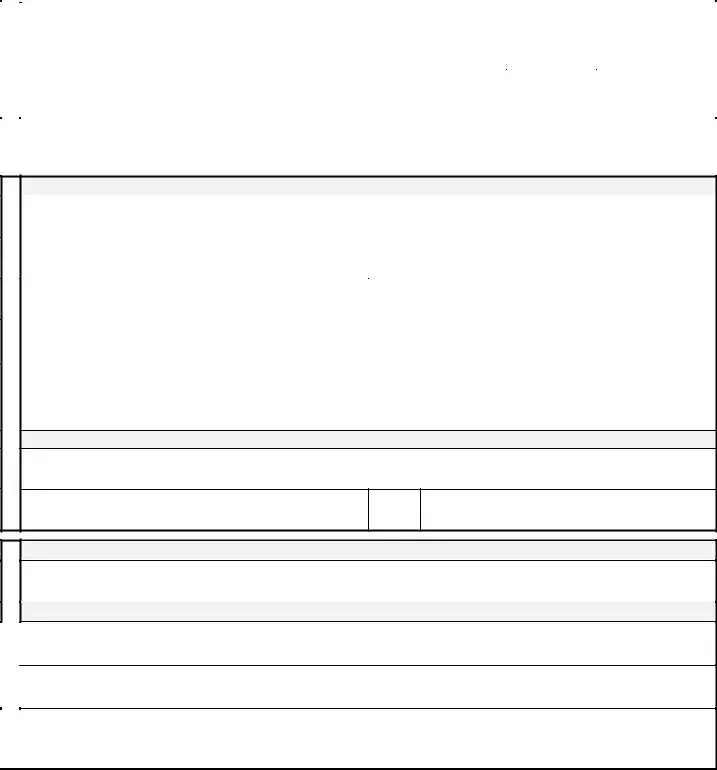

Page 3 of 4 |

|

Legal Business Name ______________________________ |

|

SECTION E

SECTION E

1

An applicant for an Egg license whose principal place of business is situated outside the State of Texas must appoint and designate a resident citizen of Texas as said applicant’s resident agent within Texas. This information is REQUIRED if the address provided in Section C is out of state.

Who do you wish to designate as resident agent?

The Texas Secretary of State

The Texas Secretary of State

Other (list below) Resident Agent Name

Other (list below) Resident Agent Name

Resident Agent Address

City |

Zip |

Business Phone |

||

|

|

( |

) |

- |

|

|

|

|

|

SEC. F

SECTION G

1BUSINESS CLASSIFICATION

Processor – Complete Section G, #2

Broker ($420) – Please skip to Section H

Retailers selling eggs directly to consumers are not required to obtain a license.

1

Are you a packer? |

Yes |

No |

||

If yes, please provide USDA Plant No. (if applicable) ________________________ |

||||

Estimated Average Weekly Volume (check only one) |

||||

Class 1 |

($20) |

– 1 case (30 dozen eggs) or more, but less than 10 cases |

||

Class 2 |

($40) |

– 10 cases or more, but less than 50 cases |

||

Class 3 |

($60) |

– 50 cases or more, but less than 100 cases |

||

Class 4 |

($100) – 100 cases or more, but less than 200 cases |

|||

Class 5 ($180) |

– 200 cases or more, but less than 500 cases |

||

Class 6 ($270) |

– 500 cases or more, but less than 1,000 cases |

||

Class 7 |

($360) – |

1,000 cases or more, but less than 1,500 cases |

|

Class 8 |

($720) – |

1,500 cases or more, but less than 3,000 cases |

|

Class 9 |

($900) – |

3,000 cases or more, but less than 4,500 cases |

|

Class 10 ($1200) |

– 4,500 cases or more, but less than 7,000 cases |

||

Class 11 ($1800) |

– 7,000 cases or more, but less than 10,000 cases |

||

Class 12 ($2400) |

– 10,000 cases or more |

||

2PROCESSOR CLASS

Estimated Average Weekly Volume (check only one)

Class 1 |

($60) – Less than 250 cases per week |

|

Class 2 |

($120) |

– 250 cases or more, but less than 600 cases |

Class 3 |

($210) |

– 600 cases or more, but less than 1,500 cases |

Class 4 |

($420) |

– 1,500 cases or more |

Licensing Department |

Revised 3/1/12 |

Administrative Services Division |

|

Occupational |

|

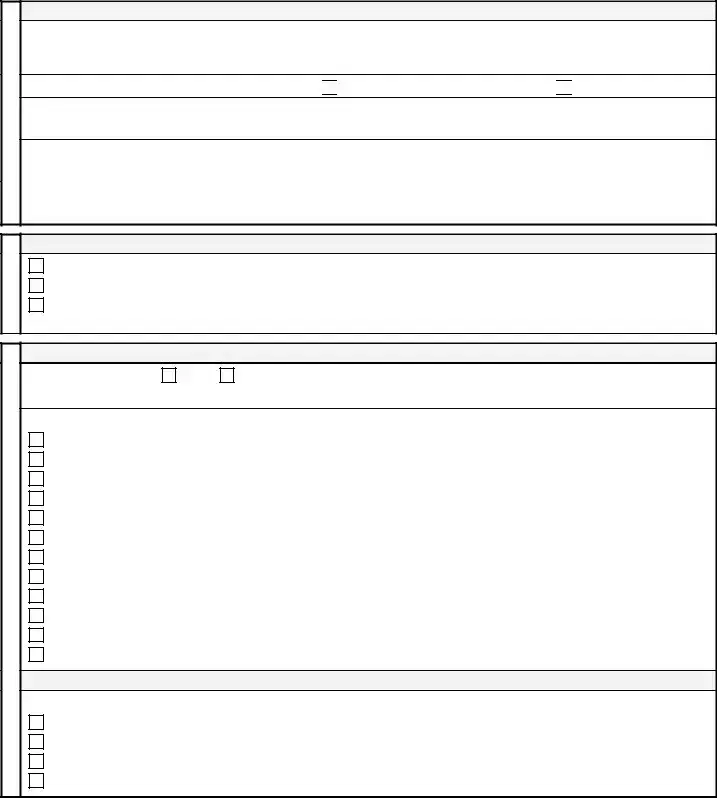

Page 4 of 4 |

|

Legal Business Name ______________________________ |

|

SECTION H

SECTION H

SECTION I

SECTION J

SECTION J

1PAYMENT

Please see instructions for applicable fees.

|

|

|

REGISTRATION IS NOT VALID UNTIL APPROVED BY TDA. |

|

|

|||||||

|

Method of Payment |

(payable to Texas Department of Agriculture) |

|

|

||||||||

|

Check # |

|

|

Cashier’s Check # |

|

|

|

Money Order # |

|

|

|

|

|

Amount remitted |

|

|

|

|

Mail to: Texas Department of Agriculture |

|

|

||||

|

|

|

|

|

|

|

||||||

|

$ |

|

|

|

|

|

|

P.O. Box 12076, Austin, TX |

|

|

||

|

|

|

|

|

|

|

|

|

||||

|

TDA USE ONLY |

|

Receipt No. |

|

|

Date Receipt Issued |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

1SIGNATURE

The applicant, by and through their personal or agent's signature below (1) certifies that all information provided in connection with this application at any time is true and correct to the best of the applicant's knowledge; (2) acknowledges that any misrepresentation or false statement made by the applicant, or an authorized agent of the applicant, in connection with this application, whether intentional or not, will constitute grounds for denial, revocation, or

Applicant Name |

Title |

|

|

Applicant Signature |

Date |

/ |

/ |

|

month |

day |

year |

|

|

|

|

1CHECKLIST

Please use this checklist to ensure you are sending all of the necessary information and documents.

Egg License Application

Fee (see instructions for assistance with calculating the correct fee.)

Please note that an incomplete application may result in processing delays.

Licensing Department |

Revised 3/1/12 |

Administrative Services Division |

|

Occupational |

|

More PDF Templates

Texas Dmv Bill of Sale - Timely and accurate submission can expedite the licensing process.

Voucy Act - The court emphasizes the immediate need for a restraining order to protect the children.

Common mistakes

-

Inaccurate Business Information: Many applicants mistakenly provide incorrect or incomplete information about their business type or legal name. This can lead to confusion and delays in processing.

-

Missing Required Identifications: Failing to include necessary identification numbers, such as the Social Security Number for sole proprietors or the Federal Taxpayer ID for out-of-state businesses, is a common oversight. This omission can hinder the application process.

-

Neglecting the Email Requirement: Some individuals overlook the importance of providing a valid email address. Without it, applicants may miss critical updates or renewal notices that could impact their compliance with state regulations.

-

Improper Designation of Responsible Person: It is essential to accurately list the primary responsible person for the business. Errors in this section can lead to miscommunication and issues with the license.

-

Incomplete Payment Information: Applicants often fail to include the correct payment method or amount. Incomplete payment details can result in the application being considered invalid.

Key takeaways

Filling out the Texas Reg 200 form for an Egg License can seem daunting at first, but understanding its components can simplify the process significantly. Here are some key takeaways to keep in mind:

- Application Types: You can apply for a new business license or report a change of ownership. Be sure to indicate your choice clearly in Section A.

- Business Structure: Specify your business type accurately. Options include corporation, sole proprietorship, limited liability company, and others.

- Client Information: Provide the full legal name of the business. If you are a sole proprietor, use your name without any aliases.

- Tax Identification: Include your Comptroller Taxpayer ID number if you are based in Texas. Out-of-state businesses must provide a Federal Taxpayer ID number.

- Responsible Person: Clearly list the primary person responsible for the business. This could be the owner, president, or managing partner, depending on your business structure.

- Public Record: Remember that the information you provide will become public record. You have the right to request and review this information.

- Facility Information: Provide the physical address of your business location. This should not be a P.O. Box.

- Out-of-State Applicants: If your business is located outside Texas, you must designate a resident agent within Texas. This is a legal requirement.

- Business Classification: Depending on your operations, indicate whether you are a dealer-wholesaler or processor. Each classification has specific requirements.

- Payment Instructions: Ensure you include the correct fee with your application. Registration is not valid until approved by the Texas Department of Agriculture.

By following these guidelines, you can navigate the Texas Reg 200 form more effectively. Remember, attention to detail is crucial to avoid delays in processing your application.

Steps to Using Texas Reg 200

Filling out the Texas Reg 200 form is a straightforward process. This form is essential for those looking to apply for an egg license in Texas. To ensure that your application is complete and accurate, follow these steps carefully.

- Begin by indicating the type of application you are submitting in Section A. Choose either "New Business" or "Change of Ownership" and provide the previous account number if applicable.

- In Section B, specify your business type. Options include Corporation, Sole Proprietorship, Limited Liability Company, and others. Make sure to provide the organization date.

- Fill out your client information in Section C. Include the full legal business name, DBA (if applicable), and the appropriate taxpayer ID numbers.

- For sole proprietorships, provide your Social Security Number or attach the required affidavit if you do not have one. If you do not have an SSN, include your driver's license number or Texas state-issued ID number.

- In Section D, provide the responsible person's information. This includes their full legal name, phone number, and email address. Make sure this person is the primary contact for the business.

- Also in Section D, complete the mailing address for the responsible person and the facility information, including the physical address where the licensed activities will occur.

- If you are an out-of-state applicant, designate a resident agent in Section E. Provide their name and address.

- In Section G, choose your business classification. If you are a dealer-wholesaler or processor, complete the relevant sections and provide your estimated average weekly volume.

- Proceed to Section H to provide your payment information. Include the method of payment and the amount you are remitting.

- Finally, in Section I, sign and date the application. Ensure that you certify the truthfulness of the information provided.

- Use the checklist at the end to confirm that all necessary documents and fees are included before submitting your application.

After completing the form, review it to ensure all information is accurate. Submit your application along with any required fees to the Texas Department of Agriculture at the address provided. It's important to keep a copy for your records. Processing times may vary, so stay informed about your application's status.