Blank Texas Ps 1040R PDF Template

Form Example

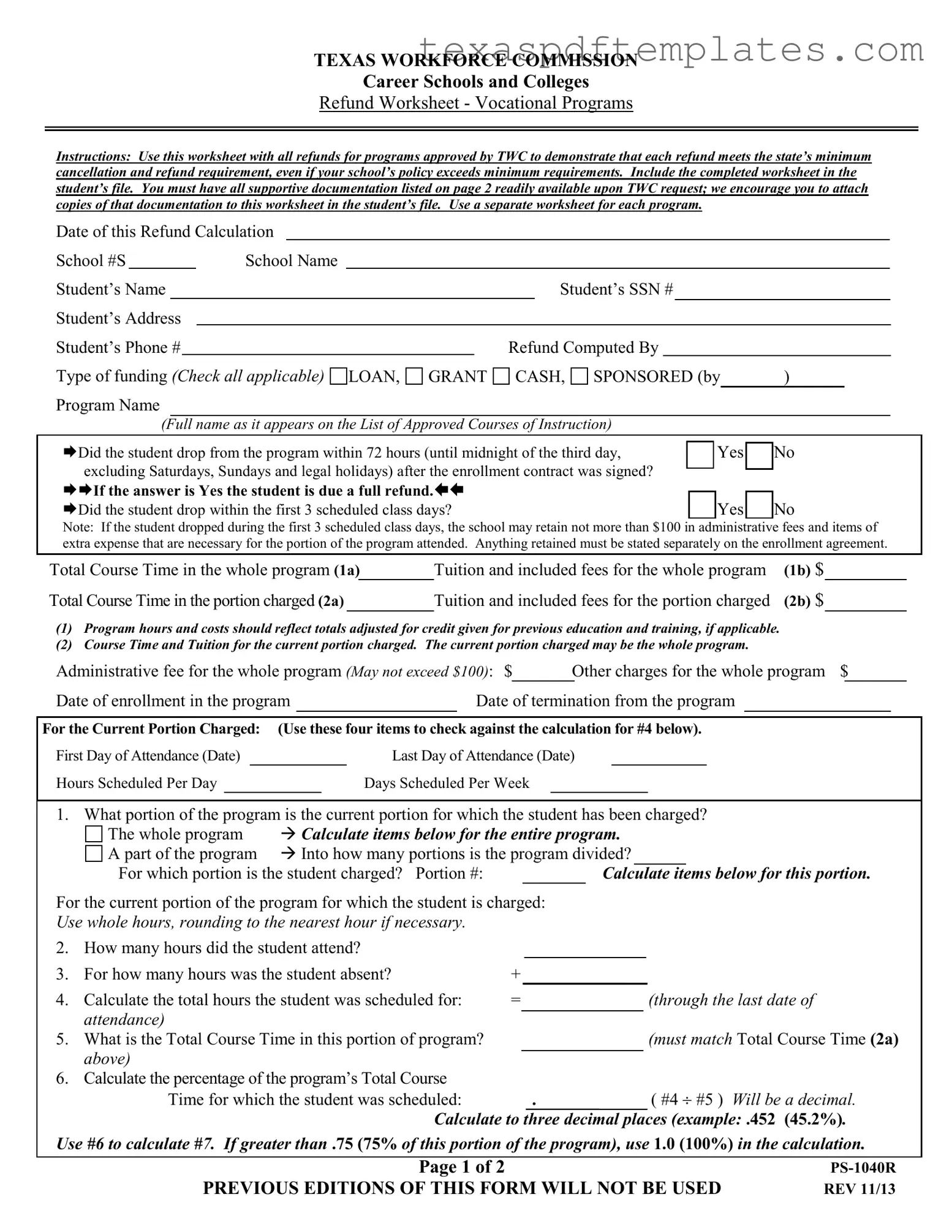

TEXAS WORKFORCE COMMISSION

Career Schools and Colleges

Refund Worksheet - Vocational Programs

Instructions: Use this worksheet with all refunds for programs approved by TWC to demonstrate that each refund meets the state’s minimum cancellation and refund requirement, even if your school’s policy exceeds minimum requirements. Include the completed worksheet in the student’s file. You must have all supportive documentation listed on page 2 readily available upon TWC request; we encourage you to attach copies of that documentation to this worksheet in the student’s file. Use a separate worksheet for each program.

Date of this Refund Calculation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

School #S |

|

School Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Student’s Name |

|

|

|

|

|

|

|

Student’s SSN # |

|

|

|

|

|

|

|

|

||||

Student’s Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Student’s Phone # |

|

|

|

|

|

|

Refund Computed By |

|

|

|

|

|

|

|

|

|

||||

Type of funding (Check all applicable) LOAN, |

GRANT |

CASH, |

SPONSORED (by |

) |

|

|

||||||||||||||

Program Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(Full name as it appears on the List of Approved Courses of Instruction) |

|

|

|

|

|

|

|

|

|||||||||||

Did the student drop from the program within 72 hours (until midnight of the third day, |

|

|

Yes |

|

No |

|

||||||||||||||

|

|

|

|

|||||||||||||||||

excluding Saturdays, Sundays and legal holidays) after the enrollment contract was signed? |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||

If the answer is Yes the student is due a full refund. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Did the student drop within the first 3 scheduled class days? |

|

|

|

|

|

|

Yes |

|

No |

|

||||||||||

Note: If the student dropped during the first 3 scheduled class days, the school may retain not more than $100 in administrative fees and items of extra expense that are necessary for the portion of the program attended. Anything retained must be stated separately on the enrollment agreement.

Total Course Time in the whole program (1a) |

Tuition and included fees for the whole program |

(1b) |

$ |

||

Total Course Time in the portion charged (2a) |

|

|

Tuition and included fees for the portion charged |

(2b) |

$ |

(1)Program hours and costs should reflect totals adjusted for credit given for previous education and training, if applicable.

(2)Course Time and Tuition for the current portion charged. The current portion charged may be the whole program.

Administrative fee for the whole program (May not exceed $100): $ |

Other charges for the whole program $ |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Date of enrollment in the program |

|

|

Date of termination from the program |

|

|

|

|||||||||||||||||||

|

|

|

|||||||||||||||||||||||

For the Current Portion Charged: |

(Use these four items to check against the calculation for #4 below). |

|

|||||||||||||||||||||||

First Day of Attendance (Date) |

|

|

|

|

Last Day of Attendance (Date) |

|

|

|

|||||||||||||||||

Hours Scheduled Per Day |

|

|

|

|

Days Scheduled Per Week |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|||||||||||||||||||||||

1. |

What portion of the program is the current portion for which the student has been charged? |

|

|||||||||||||||||||||||

|

The whole program |

Calculate items below for the entire program. |

|

||||||||||||||||||||||

|

A part of the program Into how many portions is the program divided? |

|

|

|

|||||||||||||||||||||

|

For which portion is the student charged? Portion #: |

|

|

|

Calculate items below for this portion. |

|

|||||||||||||||||||

For the current portion of the program for which the student is charged: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Use whole hours, rounding to the nearest hour if necessary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2. |

How many hours did the student attend? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

3. |

For how many hours was the student absent? |

+ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

4. |

Calculate the total hours the student was scheduled for: |

= |

|

|

|

|

|

|

|

|

(through the last date of |

|

|||||||||||||

|

attendance) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

5. |

What is the Total Course Time in this portion of program? |

|

|

|

|

|

|

(must match Total Course Time (2a) |

|

||||||||||||||||

|

above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6. |

Calculate the percentage of the program’s Total Course |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Time for which the student was scheduled: |

. |

( #4 ÷ #5 ) Will be a decimal. |

Calculate to three decimal places (example: .452 (45.2%). |

||

Use #6 to calculate #7. If greater than .75 (75% of this portion of the program), use 1.0 (100%) in the calculation.

Page 1 of 2 |

|

PREVIOUS EDITIONS OF THIS FORM WILL NOT BE USED |

REV 11/13 |

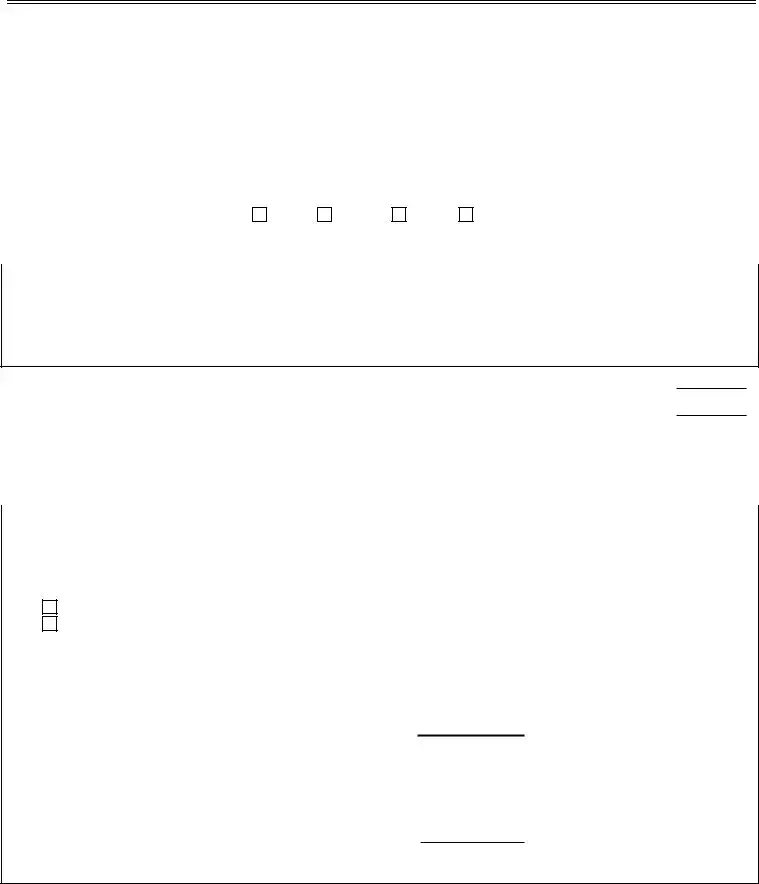

7.Calculate tuition and included fees earned by the school for the current portion charged:

Tuition and included fees for current portion charged |

$ |

|

(2b from previous page) |

|||||

|

|

|

|

|

|

|

||

#6 (From previous page) |

× . |

|

= |

$ |

|

|||

|

|

|

|

|

|

|

|

|

8. Total of tuition and fees earned from prior (How many? |

|

) portions charged |

|

$ |

|

|||

|

|

|

|

|

|

|

|

|

Earned fees and supplies for the whole program:

9. |

Administrative fees earned, but not included in tuition (not to exceed $100.00) |

$ |

|

|

||

10. |

Chargeable* books not included in tuition (receipts required): |

$ |

|

|

||

11. |

Chargeable* supplies and other fees not included in tuition (receipts required): |

+ $ |

|

|

||

|

*Must be necessary for portion of program attended & separately stated in enrollment agreement |

|

|

|

|

|

12. |

Total earned by school for the whole program |

(items 7 + 8 + 9 + 10 + 11) = $ |

||||

|

|

|

|

|

|

|

13. |

Total amount paid towards #12 on behalf of student (Fees, Tuition, Books, Supplies) $ |

|||||

|

|

|

|

|

|

|

14. |

Refund due (if #13 is greater than Item #12) = |

|

$ |

|

|

|

15. |

Balance due school (if #13 is less than Item #12) |

|

$ |

|

|

|

Documentation:

The following documents must be readily available, preferably attached to this Refund Worksheet in the Student’s file:

1.Enrollment Agreement

2.Record of Previous Education & Training

3.Complete attendance record

4.Complete progress record w/status changes

5.

6.Ledger

7.Book & supply receipts (if applicable)

8.Proof of consummation of refund

For questions concerning Texas Workforce Commission Career Schools and Colleges Cancellation and Refund Policy, please consult the form series

___________________________________________________________________________________________________________________________

Completed forms, inquiries, or corrections to the individual information contained in this form shall be sent to the TWC Career Schools and Colleges, 101 East 15th Street, Room 226T, Austin, Texas

___________________________________________________________________________________________________________________________

Page 2 of 2 |

|

PREVIOUS EDITIONS OF THIS FORM WILL NOT BE USED |

REV 11/13 |

More PDF Templates

How to Start a Farmers Market - There is a clear section dedicated to payment methods and fee details.

How to Know If I Have Medicaid - Some families may incur a monthly fee as part of the program’s requirements.

Common mistakes

-

Incorrectly identifying the type of funding. Make sure to check all applicable funding sources like loans, grants, or cash sponsorships. Missing this can affect the refund calculation.

-

Failing to provide accurate dates. Ensure that the enrollment and termination dates are correct. Errors here can lead to incorrect refund amounts.

-

Not calculating attendance correctly. Clearly document the first and last days of attendance, along with hours scheduled per day. This information is crucial for determining the refund.

-

Omitting supportive documentation. Attach all necessary documents such as the enrollment agreement and attendance records. Missing documentation can delay processing.

-

Misunderstanding the refund policy. Familiarize yourself with the school’s refund policy and the state’s minimum requirements. Not knowing these can lead to mistakes in calculations.

-

Incorrectly calculating the percentage of program time. Ensure that the percentage of the program’s total course time is calculated accurately. This affects how much tuition is earned by the school.

-

Not using a separate worksheet for each program. Each program requires its own worksheet. Combining them can cause confusion and errors in calculations.

-

Failing to account for administrative fees. Remember that the school may retain up to $100 in administrative fees. This must be clearly stated in the enrollment agreement.

-

Ignoring the need for precision in calculations. Round hours to the nearest whole number and ensure all calculations are accurate. Errors can lead to incorrect refund amounts.

Key takeaways

When filling out and using the Texas PS 1040R form, there are several important points to keep in mind:

- Purpose: This form is used to calculate refunds for students enrolled in vocational programs approved by the Texas Workforce Commission.

- Documentation: Ensure that all supporting documents, such as enrollment agreements and attendance records, are readily available and preferably attached to the worksheet.

- Separate Worksheets: Use a separate worksheet for each program the student is enrolled in to maintain clarity and accuracy.

- Refund Eligibility: If a student drops the program within 72 hours of signing the enrollment contract, they are entitled to a full refund.

- Administrative Fees: If a student drops within the first three scheduled class days, the school may retain up to $100 for administrative fees.

- Calculating Attendance: Carefully track the student’s attendance, including scheduled hours and days, to ensure accurate refund calculations.

- Refund Calculation: Calculate the total amount due to the student by comparing the total amount paid against the total earned by the school.

- Refund Process: If the amount paid exceeds the total earned, a refund is due. Conversely, if the total earned exceeds the amount paid, a balance is owed to the school.

- Contact Information: For questions or corrections, contact the Texas Workforce Commission directly at the provided address and phone number.

By following these guidelines, individuals can navigate the refund process effectively and ensure compliance with state regulations.

Steps to Using Texas Ps 1040R

Filling out the Texas PS 1040R form is an important step for schools to process refunds for students in vocational programs. This form ensures that all necessary calculations and documentation are in order, meeting state requirements. Follow these steps carefully to complete the form accurately.

- Begin by entering the Date of this Refund Calculation at the top of the form.

- Fill in the School #S and School Name.

- Provide the Student’s Name, SSN #, Address, and Phone #.

- Indicate who Refund Computed By is.

- Check all applicable types of funding: LOAN, GRANT, CASH, or SPONSORED.

- Enter the Program Name as it appears on the List of Approved Courses of Instruction.

- Answer the question: Did the student drop from the program within 72 hours after the enrollment contract was signed? If yes, the student is due a full refund.

- Answer the next question: Did the student drop within the first 3 scheduled class days? If yes, note that the school may retain not more than $100 in administrative fees.

- Fill in the Total Course Time in the whole program (1a) and the Tuition and included fees for the whole program (1b).

- Complete the Total Course Time in the portion charged (2a) and the Tuition and included fees for the portion charged (2b).

- Enter the Administrative fee for the whole program (not to exceed $100) and any Other charges for the whole program.

- Provide the Date of enrollment in the program and the Date of termination from the program.

- Record the First Day of Attendance and Last Day of Attendance.

- Enter the Hours Scheduled Per Day and Days Scheduled Per Week.

- Determine if the current portion is the whole program or a part of it, and specify the portion number if applicable.

- Calculate the number of hours the student attended and the hours they were absent.

- Calculate the total hours the student was scheduled for and the Total Course Time for the current portion.

- Calculate the percentage of the program’s Total Course Time for which the student was scheduled.

- Use this percentage to calculate the tuition and included fees earned by the school for the current portion charged.

- Sum up the total of tuition and fees earned from prior portions charged.

- Calculate the administrative fees earned, chargeable books, supplies, and other fees not included in tuition.

- Calculate the total earned by the school for the whole program.

- Enter the total amount paid towards the total earned by the school.

- Finally, calculate the Refund due and the Balance due school based on the amounts entered.

Make sure to keep all supporting documentation, such as the enrollment agreement and attendance records, ready and preferably attached to this worksheet. Completing the form accurately will help ensure that all parties understand the refund process clearly.