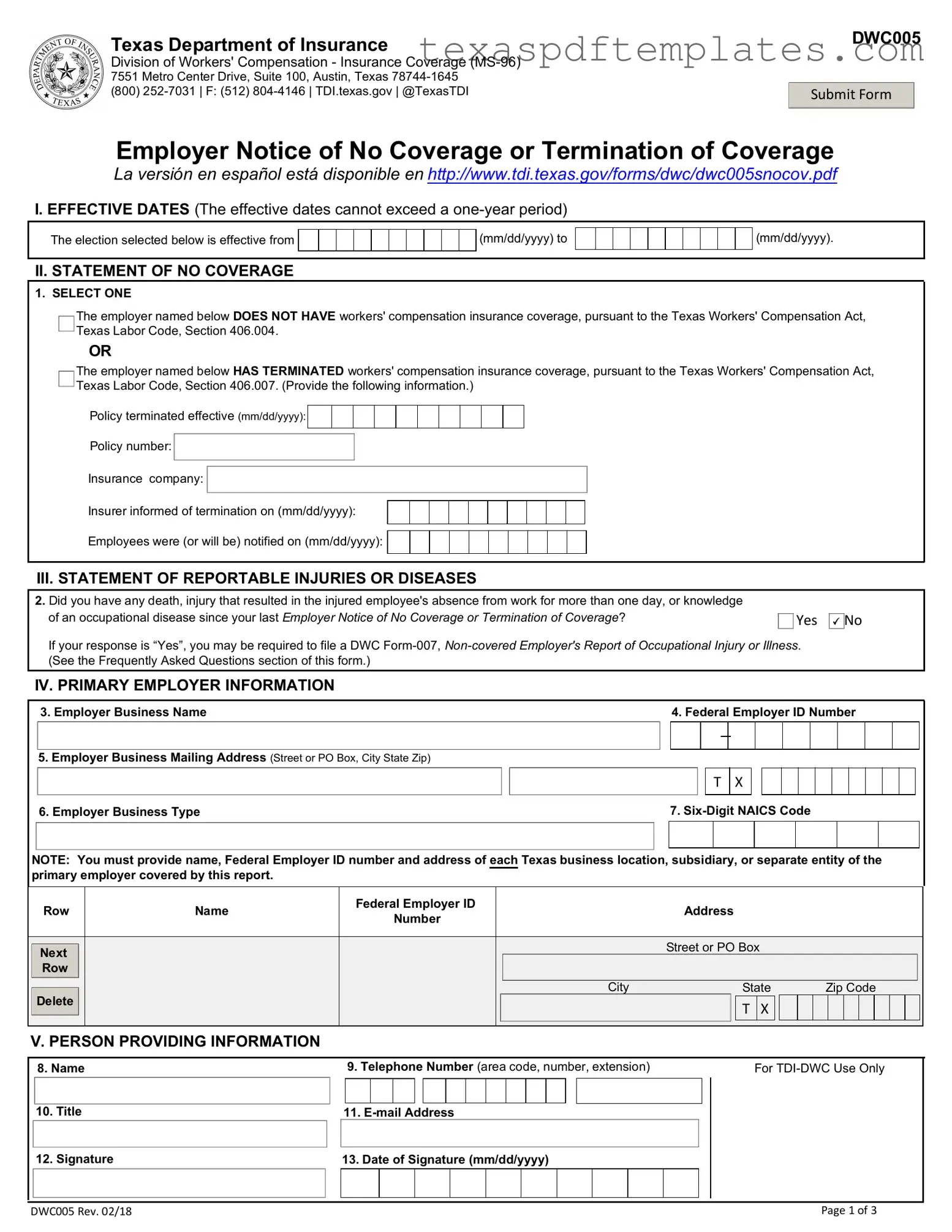

Blank Texas Notice PDF Template

Form Example

Texas Department of Insurance |

DWC005 |

Division of Workers' Compensation - Insurance Coverage |

|

7551 Metro Center Drive, Suite 100, Austin, Texas |

|

(800) |

Submit Form |

Employer Notice of No Coverage or Termination of Coverage

La versión en español está disponible en http://www.tdi.texas.gov/forms/dwc/dwc005snocov.pdf

I. EFFECTIVE DATES (The effective dates cannot exceed a

The election selected below is effective from

(mm/dd/yyyy) to

(mm/dd/yyyy).

II. STATEMENT OF NO COVERAGE

1. SELECT ONE

The employer named below DOES NOT HAVE workers' compensation insurance coverage, pursuant to the Texas Workers' Compensation Act, Texas Labor Code, Section 406.004.

OR

The employer named below HAS TERMINATED workers' compensation insurance coverage, pursuant to the Texas Workers' Compensation Act, Texas Labor Code, Section 406.007. (Provide the following information.)

Policy terminated effective (mm/dd/yyyy):

Policy number:

Insurance company:

Insurer informed of termination on (mm/dd/yyyy):

Employees were (or will be) notified on (mm/dd/yyyy):

III. STATEMENT OF REPORTABLE INJURIES OR DISEASES

2.Did you have any death, injury that resulted in the injured employee's absence from work for more than one day, or knowledge of an occupational disease since your last Employer Notice of No Coverage or Termination of Coverage?

Yes

Yes  No

No

If your response is “Yes”, you may be required to file a DWC

IV. PRIMARY EMPLOYER INFORMATION

3. Employer Business Name |

4. Federal Employer ID Number |

|||||||||||||||||||||

5. Employer Business Mailing Address (Street or PO Box, City State Zip) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

6. Employer Business Type |

7. |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NOTE: You must provide name, Federal Employer ID number and address of each Texas business location, subsidiary, or separate entity of the primary employer covered by this report.

Row |

|

Name |

|

Federal Employer ID |

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Next |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Street or PO Box |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Row |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delete |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

State |

|

|

|

Zip Code |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T |

X |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. PERSON PROVIDING INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

8. Name |

|

|

9. Telephone Number (area code, number, extension) |

|

|

|

|

For |

|||||||||||||||||||||||||||||||

10. Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

12. Signature |

|

13. Date of Signature (mm/dd/yyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DWC005 Rev. 02/18 |

Page 1 of 3 |

DWC005

Frequently Asked Questions

Employer Notice of No Coverage or Termination of Coverage

Who must file the DWC

You must file the DWC

·do not have workers' compensation insurance, or

·you have terminated your workers' compensation insurance coverage

However, if your only employees are exempt from coverage under the Texas Workers' Compensation Act (for example, certain domestic workers, and certain farm and ranch workers) you do not have to file.

Failure to file the form when required may subject the employer to administrative penalties.

How do I file the DWC

Employers can submit the DWC

·filing electronically on the TDI website at: https://txcomp.tdi.state.tx.us/TXCOMPWeb/common/home.jsp:

·faxing the form to (512)

·mailing the form to the address listed at the top of the form.

When do I file the DWC

You must file a separate DWC

·Annually between February 1st and April 30th of each calendar year;

·Within 30 Days of hiring your first employee, unless this due date falls between February 1st and April 30th and you submit the form within this time period;

·Within 10 Days of receiving a request (to file the DWC

·Within 10 Days after notifying your workers' compensation insurance carrier that you are terminating coverage unless you purchasea new policy or become a certified

How do I determine my filing start date?

Use May 1, unless:

1.You have never filed a DWC

2.You terminated workers' compensation insurance coverage, then the start date is the first date you did not have coverage.

3.You hired your first employee, then the start date is the first day the employee started working.

How do I determine my filing period end date?

Use April 30, unless:

·You purchased, or plan to purchase a workers' compensation insurance policy, then the End Date is the last date you did not, or will not, have coverage.

What is a NAICS code?

NAICS (pronounced "nakes") is the

1.Block 5 of your Unemployment Quarterly Report (Form

2.If you have multiple NAICS codes, they may appear in the left margin of the Multiple Worksite Report - BLS 3020 from the U.S. Bureau of Labor Statistics; or

3.For more help with NAICS codes, visit the NAICS web page at:

www.naics.com

Select "Find Your NAICS Code" from the top menu and use the "NAICS Keyword Search" to enter one or more words that generally describe your business. For example, if you are in the restaurant business, enter "restaurant" and get a complete listing of NAICS codes for the restaurant industry.

DWC005 Rev. 02/18 |

Page 2 of 3 |

Are any fields on the DWC |

DWC005 |

All applicable fields must be completed each time the DWC

Section I

·The effective dates are always required.

Section II

·When reporting cancellation or termination of workers' compensation insurance in Statement of No Coverage, the policy and insurer information, and the notification dates must be provided.

Section III

·A selection from Statement of Reportable Injuries or Diseases is always required.

Section IV

·All primary employer fields (boxes 3 through 7) are required.

·Additional business location information is required when applicable.

Section V

·The signature field is not required when filing online.

How/when must a

You must post the Notice to Employees Concerning Workers' Compensation in Texas in the workplace in English, Spanish and any other language common to the employer's employee population in the print type specified by DWC rules whenever you:

1.elect to not have workers' compensation insurance;

2.cancel or terminate workers' compensation insurance;

3.withdraw from certified

4.have workers' compensation coverage cancelled by the insurance company.

You must also provide this notice to each employee:

1.at the time of hire;

2.when the employer elects to not have workers' compensation insurance;

3.within 15 days of notification to the insurance carrier that the employer is terminating coverage unless the employermaintains continuous coverage under a new policy or becomes a certified

4.within 15 days of cancellation by the insurance company.

The required notice may be found on the TDI website at:

http://www.tdi.texas.gov/forms/dwc/notice5.pdf (English) and

http://www.tdi.texas.gov/forms/dwc/notice5s.pdf (Spanish)

Are

You must report

1.You have five or more employees and do not have workers' compensation insurance; or

2.you have employee(s) that have waived workers' compensation insurance coverage, whether or not you have workers' compensation insurance.

You must file the form not later than the 7th day of the month following any month in which:

·a

·an employee was absent from work for more than one day* as a result of a

·you acquired knowledge of an occupational disease.

*Do not count the day of the injury or the day the injured employee returned to work when calculating the number of days absent from work.

The DWC

NOTE: With few exceptions, upon your request, you are entitled to be informed about information

DWC005 Rev. 02/18 |

Page 3 of 3 |

More PDF Templates

Texas Certificate of Insurance - Accuracy in the completion of Form 1560 can prevent delays in job assignments.

Texas Cdl - This affidavit helps determine if a medical certificate is needed based on driving categories.

Dwc 69 Form - This form is designed for certifying doctors to report on an injured employee's medical status and improvement.

Common mistakes

-

Failing to provide accurate effective dates. The effective dates must not exceed a one-year period and must be clearly stated.

-

Not selecting the appropriate statement regarding coverage. Employers must choose between stating they do not have coverage or that they have terminated coverage.

-

Omitting required policy information. When terminating coverage, the policy number, insurance company, and termination date must be included.

-

Neglecting to notify employees. Employees must be informed of the lack of coverage within the specified timeframe.

-

Incorrectly reporting injuries or diseases. If there have been reportable injuries or diseases, the employer must accurately respond to the related question.

-

Leaving out the Federal Employer ID Number. This number is essential for identifying the employer correctly.

-

Failing to include all business locations. If the employer has multiple locations, each must be reported with the corresponding information.

-

Not signing the form when required. While online submissions do not require a signature, paper submissions must be signed.

-

Submitting the form after the deadline. Employers must adhere to the specified filing periods to avoid penalties.

Key takeaways

When filling out and using the Texas Notice form (DWC Form-005), it's essential to follow certain guidelines to ensure compliance with state regulations. Here are some key takeaways:

- Understand the Purpose: The form is used to notify the Texas Department of Insurance about the lack of workers' compensation insurance or the termination of existing coverage.

- Filing Requirements: Employers must file the form annually between February 1st and April 30th, within 30 days of hiring the first employee, or within 10 days of termination of coverage.

- Complete All Fields: Every section of the form must be filled out accurately. Missing information can lead to administrative penalties.

- Notification of Employees: Employers must inform employees about the lack of coverage by posting a notice in the workplace and providing it to employees at specific times.

- Additional Reporting Obligations: If there are work-related injuries or diseases, employers may need to file a separate form (DWC Form-007) in addition to the DWC Form-005.

By adhering to these guidelines, employers can ensure they remain compliant with Texas workers' compensation regulations.

Steps to Using Texas Notice

Once you have gathered the necessary information, you can begin filling out the Texas Notice form. This form is essential for notifying the Texas Department of Insurance about your workers' compensation insurance status. Follow these steps to complete the form accurately.

- Start with Section I. Enter the effective dates for the notice. Make sure these dates do not exceed one year.

- In Section II, select one of the two options: either that the employer does not have workers' compensation insurance or that the employer has terminated their coverage. If you select the termination option, provide the policy termination date, policy number, insurance company name, the date the insurer was informed, and the date employees were notified.

- Move to Section III. Answer the question regarding reportable injuries or diseases. Indicate "Yes" or "No." If you answer "Yes," note that you may need to file an additional form.

- In Section IV, fill in the employer's business name and federal employer ID number. Include the business mailing address, business type, and six-digit NAICS code. If there are multiple business locations, provide the required information for each location.

- Complete Section V by entering the name of the person providing the information, their telephone number, title, email address, and signature. Note that the signature is not required if filing online.

- Finally, write the date of the signature in the specified format (mm/dd/yyyy).

After completing the form, submit it to the Texas Department of Insurance, Division of Workers' Compensation. You can file electronically, fax it, or mail it to the address provided at the top of the form. Ensure you keep a copy for your records.