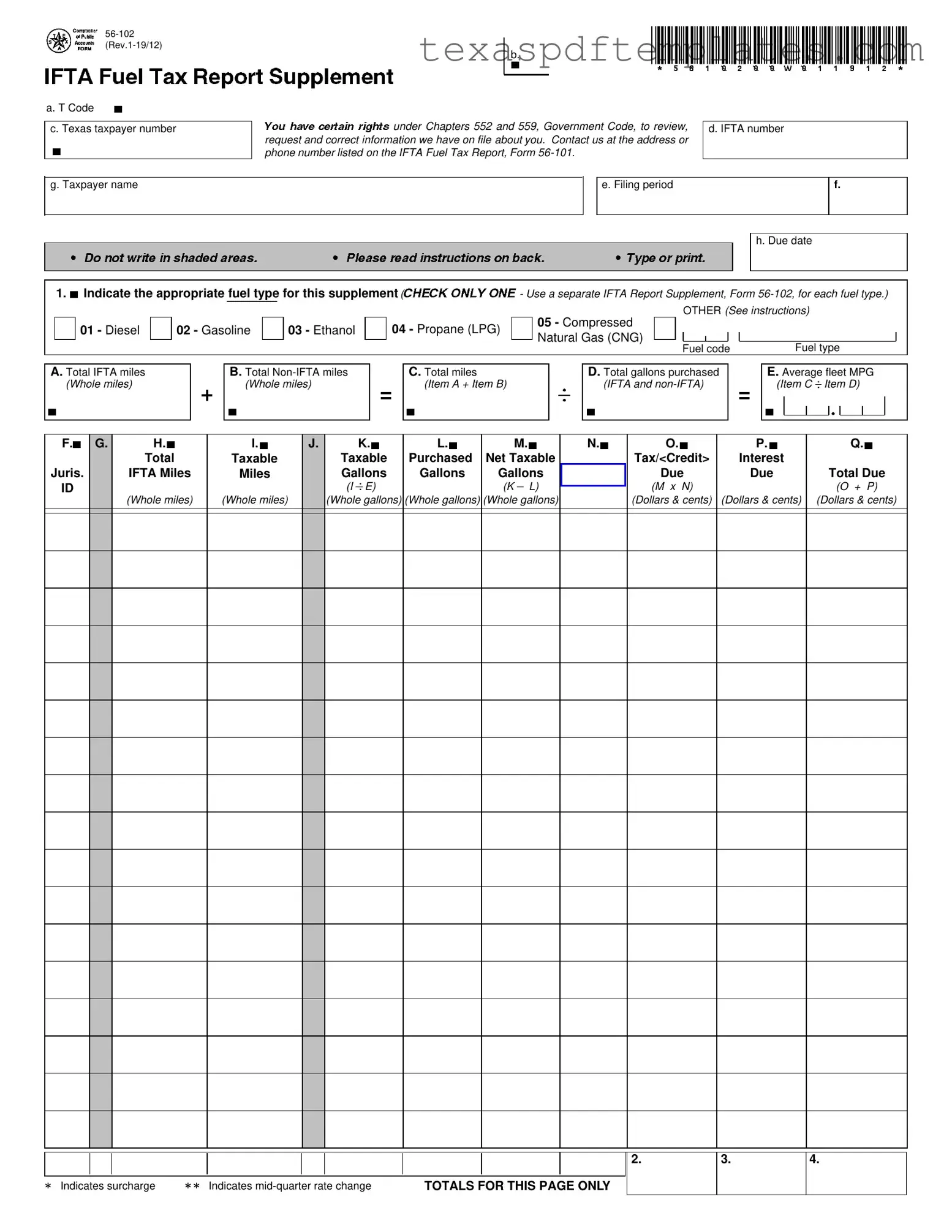

Blank Texas Ifta PDF Template

Form Example

instructions |

ReportSupplement |

|

back. |

|

|

|

|

||||

a. T Code b56100 |

|

Youhavecertainrights |

|

|

|

|

|

|

|

|

b |

|

|

|

|

|

|

|

|||

c. Texas taxpayer number |

|

under Chapters 552 a d 559, Government Code, to review, |

|

d. IFTA num er |

||||||

IDonotwriteinshadedareas. |

request and correct information we have |

file about you Contact us at the address or |

|

|

|

|||||

phone numberIlistedPleaseon thereadIFTA Fuel Tax Report,onForm |

ITypeorprint. |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

g. Taxpayer name |

|

|

|

|

|

|

e. Filing ri d |

|

f. |

|

|

|

|

|

|

|

|

|

|

|

|

h. Due date

1.bIndicate the appropriate fuel type for this supplement (CHECKONLYONE- Use a separate IFTA Report Supplement, Form

OTHER (See instructions)

01 - Diesel

02 - Gasoline

03 - Ethanol

04 - Propane (LPG)

05 - Compressed

Natural Gas (CNG)

Fuel code |

Fuel type |

A. Total IFTA miles |

|

B. Total |

|

C. Total miles |

|

|

|

D. Total gallons purchased |

|

E. Average fleet MPG |

|

|||||||

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|||

b(Whole miles) |

+ |

b(Whole miles) |

= |

b(Item A + Item B) |

. |

|

b(IFTA and |

= |

b(Item C |

. |

Item.D) |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F.b

Juris.

ID

G.

H.b

Total

IFTA Miles

(Whole miles)

I.b

Taxable

Miles

(Whole miles)

J.

|

K. |

bbbbbL.M.N. |

O. |

|||||

Taxable |

Purchased |

Net Taxable |

|

Tax/<Credit> |

||||

Gallons |

Gallons |

Gallons |

Tax Rate |

Due |

||||

. |

|

|

|

|

|

|

|

|

(I |

. |

E) |

|

(K |

|

L) |

|

(M x N) |

(Whole gallons) |

(Whole gallons) (Whole gallons) |

|

(Dollars & cents) |

|||||

|

|

|

|

|

|

|

|

|

P.b

Interest

Due

(Dollars & cents)

Q.b

Total Due

(O + P)

(Dollars & cents)

*

Indicates surcharge |

**Indicates |

TOTALS FOR THIS PAGE ONLY |

2.

3.

4.

Form

Item 1 - |

Indicate the |

ppropriate fuel type if it is not preprinted. Place an |

|||||||||||||||||||

|

"X" in the applicable box for Diesel, Gasoline, Ethanol, Propane |

||||||||||||||||||||

|

or Compressed Na ural Gas. For OTHER fuel typ s, place an |

||||||||||||||||||||

|

"X" in the last box and ent |

|

the fuel code and fuel type as |

||||||||||||||||||

|

listed below: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

06 |

|

|

|

|

|

|

11 |

|

|

|

|

Methanol |

|

|

|||||

|

|

07 |

|

|

|

|

|

|

12 |

|

|

|

|

Biod esel |

|

|

|||||

|

|

08 |

|

|

|

|

|

|

13 |

|

|

|

|

Electricity |

|

|

|||||

|

|

09 |

|

|

Gasohol |

|

|

14 |

|

|

|

|

Hydrogen |

|

|

||||||

|

|

10 |

|

|

|

LNG |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use a sep rate Form |

r |

ch |

|

fu |

|

type. Go |

to |

|||||||||||||

|

www.co |

ptr |

ll |

r.texas.gov/taxes/fu |

s/docs/biodies |

l.pdf |

|

for |

|||||||||||||

|

additional |

information |

repor ing biodies |

l. |

|

|

|

|

|

|

|

|

|||||||||

Item A - |

T |

tal IFTA |

miles |

- |

E ter |

|

ot |

|

|

|

trave |

d |

n |

IFTA |

|||||||

|

jurisdictions by all qual fi |

d motor vehicles in your fleet using |

|||||||||||||||||||

|

the fuel type |

|

icated. Report all mil |

trave |

d whether the |

||||||||||||||||

|

miles are taxable or nont xable. F |

r IFTA jurisdictions with a |

|||||||||||||||||||

|

surcharge, include miles trav led only once f r that juris- |

||||||||||||||||||||

|

diction. The total in C |

lumn H f r all pages must equal item A. |

|||||||||||||||||||

Item B - |

Total |

||||||||||||||||||||

|

traveled in |

dictions of No |

h |

est Territori s and |

|||||||||||||||||

|

Yukon Territory of Canad |

, M xico, Alaska |

nd the D strict of |

||||||||||||||||||

|

Columbia by all qua ifi d |

tor vehi l |

in |

|

|

fle |

t. Report all |

||||||||||||||

|

mileage |

traveled |

whe her |

the |

mileage |

|

is |

taxable |

or |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Item C - |

Total miles - A |

the am unt in Item A and the amount |

n |

||||||||||||||||||

|

Item B to determine the |

tal mil |

trav led |

by |

|

l qualified |

|||||||||||||||

|

motor vehicles in your fleet. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Item D - |

Total Gallons Purcha ed |

- Ent |

the |

total |

gallons |

of |

fuel |

||||||||||||||

|

purchased in both IFTA and |

||||||||||||||||||||

|

qualified |

|

tor |

vehic |

in |

your |

fleet |

u |

ing the |

fu |

l |

type |

|||||||||

|

indicated. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Note: |

||||

|

Fuel is |

sidered "purchas |

d" when it is pump |

|

into your |

||||||||||||||||

|

qualified vehicle.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Item E - |

Average Fleet MPG - Divide It m C by Item D. R und to 2 |

||||||||||||||||||||

|

decimal places. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column F - |

Jurisdicti n ID - Preprinted are all IFTA member jurisdic- |

||||||||||||||||||||

|

|

ns in which y have indicated oper tions during t |

|

|

|||||||||||||||||

|

|

previ |

us f |

quart rs. If you did not operate in a jurisdic- |

|||||||||||||||||

|

|

listed, make |

o entri |

s for that jurisdiction. If you op |

- |

|

|||||||||||||||

|

|

ated in any ju isdict on other than tho |

|

listed, enter |

e |

||||||||||||||||

|

|

jurisdiction's two |

etter abbreviation from the t |

ble b |

l |

w. |

|

|

|||||||||||||

Column H - |

T tal IFTA Miles - |

En |

|

the |

total mil |

(taxable |

and |

||||||||||||||

|

|

n ntaxable) trav |

d in |

ach IFTA juri |

diction for this fuel |

||||||||||||||||

|

|

ype |

ly. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Column I - |

Taxab e Miles - Enter |

|

IFTA tax ble miles for each |

||||||||||||||||||

|

|

jurisdiction. Trip permit miles are not considered taxable in |

|||||||||||||||||||

|

|

any jurisdiction. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column K - |

Taxab e Gallons |

- Divide the amount in Column I by the |

|||||||||||||||||||

|

|

amount in Item E to d termine the tot |

l taxable gallons of |

||||||||||||||||||

|

|

fuel |

nsumed in each jurisdiction. |

|

|

|

|

|

|

|

|

|

|

||||||||

Column L - |

Pur hased |

Gallons |

- |

Ent |

the |

total |

gallons |

of |

fuel |

||||||||||||

|

|

purchased |

tax paid |

each IFTA jurisdiction. Ke |

|

your |

|||||||||||||||

|

|

receipts for each purchase claimed. When using bulk |

|||||||||||||||||||

|

|

storage, |

report |

|

nly |

gallons removed |

for use in |

your |

|||||||||||||

|

|

qualified motor vehicles. Fuel remaining in sto age cannot |

|||||||||||||||||||

|

|

be claimed until it is used. Column L cannot be greater |

|||||||||||||||||||

|

|

an Item D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Column M - Net Taxable Gallons - Subtract Column L from Column K for each jurisdiction.

-If Column K is greater than Column L, enter the taxable gallons.

-If Column L is greater than Column K, enter the credit gallons. Use brackets < > to indicate credit gallons.

Column N - Tax Rate - The tax rate is listed for each preprinted IFTA jurisdiction on your report. If the tax rate is not preprinted, enter the tax rate for the appropriate fuel type from the enclosed tax rate chart. Refer to the IFTA, Inc. web page (www.iftach.org) for tax rate footnotes and exchange rate.

FUEL TAX SURCHARGES - Some jurisdictions impose an additional charge on each taxable gallon of fuel used in that jurisdiction. This surcharge is not paid at the pump or upon withdrawal from bulk storage facilities; the surcharge is collected on the quarterly IFTA report. If you have traveled in any of the jurisdictions that impose a surcharge, you must calculate and pay the surcharge on this report. To calculate the amount due for the surcharge, multiply the number of taxable gallons (K) used in that jurisdiction by the surcharge rate. Fuel tax surcharges need to be reported on separate lines of the report supplements.

RATE CHANGES WITHIN A QUARTER - Sometimes jurisdictions change their tax rate during a quarter. When this occurs, it is necessary to separate the miles traveled during each rate period and report them on separate lines of the report supplement. If you traveled in a jurisdiction that had a

Column O - Tax <Credit> Due - Multiply the amount in Column M by the tax rate for that jurisdiction in Column N to determine the tax or credit. Enter credit amount in brackets < >.

Column P - Interest Due - If you file late, compute interest on the tax due for each jurisdiction for each fuel type. Interest is com- puted on tax due from the due date of the report until the date the payment is postmarked. For current interest rate, refer to www.comptroller.texas.gov/taxes/fuels/ifta.php. Reports must be postmarked no later than the last day of the month following the end of the quarter to be timely. If the last day of the month falls on a Saturday, Sunday or national holiday, the due date will be the next business day.

Column Q - Total Due - For each jurisdiction add the amounts in Column O and Column P, and enter the total dollar amount due or credit amount. Enter credit amount in brackets < >.

Item 2 - Enter the total of amounts in Column O for all jurisdictions listed on this page for the fuel type indicated.

Item 3 - Enter the total of amounts in Column P for all jurisdictions listed on this page for the fuel type indicated.

Item 4 - Enter the total of amounts in Column Q for all jurisdictions listed on this page for the fuel type indicated. This total is necessary to calculate the fuel type totals reported on the corresponding line of the International Fuel Tax Agreement (IFTA) Quarterly Fuel Tax Report, Form

JURISDICTION ABBREVIATIONS

AL |

Alabama |

KY |

Kentucky |

NC |

North Carolina |

WI |

Wisconsin |

AK |

Alaska |

LA |

Louisiana |

ND |

North Dakota |

WY |

Wyoming |

AZ |

Arizona |

ME |

Maine |

OH |

Ohio |

CANADIAN PROVINCES |

|

AR |

Arkansas |

MD |

Maryland |

OK |

Oklahoma |

||

CA |

California |

MA |

Massachusetts |

OR |

Oregon |

AB |

Alberta |

CO |

Colorado |

MI |

Michigan |

PA |

Pennsylvania |

BC |

British Columbia |

CT |

Connecticut |

MN |

Minnesota |

RI |

Rhode Island |

MB |

Manitoba |

DE |

Delaware |

MS |

Mississippi |

SC |

South Carolina |

NB |

New Brunswick |

DC |

Dist. of Columbia |

MO |

Missouri |

SD |

South Dakota |

NL |

Newfoundland |

FL |

Florida |

MT |

Montana |

TN |

Tennessee |

NT |

Northwest Territories |

GA |

Georgia |

NE |

Nebraska |

TX |

Texas |

NS |

Nova Scotia |

ID |

Idaho |

NV |

Nevada |

UT |

Utah |

ON |

Ontario |

IL |

Illinois |

NH |

New Hampshire |

VT |

Vermont |

PE |

Prince Edward Island |

IN |

Indiana |

NJ |

New Jersey |

VA |

Virgina |

QC |

Quebec |

IA |

Iowa |

NM |

New Mexico |

WA |

Washington |

SK |

Saskatchewan |

KS |

Kansas |

NY |

New York |

WV |

West Virginia |

YT |

Yukon |

More PDF Templates

Texas Vehicle Registration Lookup - Accuracy in the submission ensures a smoother processing of the request.

Texas Lis Pendens - Potential impact on property title is communicated through the Lis Pendens notice.

How to Report Non Payment of Child Support in Texas - Your complaint will be reviewed by a designated Field Ombudsman, ensuring a personalized approach.

Common mistakes

-

Incorrect Fuel Type Selection: Failing to check the appropriate box for the fuel type used can lead to inaccuracies. Make sure to select only one fuel type for each report supplement.

-

Missing Jurisdiction Information: Not entering the jurisdiction IDs for the areas where fuel was purchased can result in incomplete data. Ensure all jurisdictions are accurately listed.

-

Incorrect Mileage Reporting: Reporting total miles traveled without distinguishing between IFTA and non-IFTA miles can cause discrepancies. Always separate and accurately report both types of mileage.

-

Fuel Gallons Miscalculation: Entering incorrect total gallons purchased can lead to tax miscalculations. Ensure that the gallons reported reflect actual purchases.

-

Omitting Surcharges: Failing to account for surcharges in jurisdictions that impose them can lead to underreporting. Make sure to calculate and include any applicable surcharges.

-

Not Keeping Receipts: Not retaining receipts for fuel purchases can hinder the ability to substantiate claims. Always keep records for verification purposes.

-

Late Filing Penalties: Submitting the report after the due date can incur interest penalties. Be aware of the deadlines and file timely to avoid additional charges.

Key takeaways

When filling out the Texas IFTA form, it is essential to keep the following key points in mind:

- Use the Correct Form: Always use Form 56-102 for reporting fuel types. Each fuel type requires a separate form.

- Identify Fuel Type: Clearly indicate the fuel type by checking the appropriate box. If using an "Other" fuel type, provide the specific code and name.

- Report All Miles: Include all miles traveled in both IFTA and non-IFTA jurisdictions. This includes taxable and non-taxable miles.

- Track Fuel Purchases: Enter the total gallons of fuel purchased in both IFTA and non-IFTA areas. Keep receipts as proof of purchase.

- Calculate Average MPG: Divide the total miles by the total gallons purchased to find the average miles per gallon for your fleet.

- Understand Taxable Miles: Only report taxable miles for IFTA jurisdictions. Trip permit miles do not count as taxable.

- Account for Surcharges: If any jurisdiction has a surcharge, calculate it separately and report it on the form.

- Be Aware of Rate Changes: If a jurisdiction changes its tax rate during the quarter, report the miles traveled under each rate separately.

- File on Time: Ensure the report is postmarked by the last day of the month following the end of the quarter to avoid late fees.

By following these guidelines, you can ensure that your Texas IFTA form is completed accurately and efficiently.

Steps to Using Texas Ifta

Completing the Texas IFTA form requires careful attention to detail and accurate reporting of your fuel usage and mileage. This process is essential for ensuring compliance with tax regulations. Below are the steps to guide you through filling out the form correctly.

- Type or print your taxpayer name in the designated field.

- Fill in your Texas taxpayer number.

- Enter your IFTA number and do not write in the shaded areas.

- Indicate the fuel type by placing an "X" in the appropriate box. Use a separate form for each fuel type.

- Report the Total IFTA miles traveled by all qualified motor vehicles using the indicated fuel type.

- Enter the Total Non-IFTA miles traveled in non-IFTA jurisdictions.

- Calculate the Total miles by adding the Total IFTA miles and Total Non-IFTA miles.

- Provide the Total gallons purchased in both IFTA and non-IFTA jurisdictions.

- Calculate the Average fleet MPG by dividing Total miles by Total gallons purchased, rounding to two decimal places.

- Enter the Jurisdiction ID for each IFTA member jurisdiction where you operated.

- Report the Total IFTA Miles and Taxable Miles for each jurisdiction.

- Calculate Taxable Gallons by dividing Taxable Miles by Average fleet MPG.

- Enter the Purchased Gallons for each jurisdiction, ensuring it does not exceed Total gallons purchased.

- Calculate Net Taxable Gallons by subtracting Purchased Gallons from Taxable Gallons.

- Fill in the Tax Rate for each jurisdiction as listed on your report.

- Determine the Tax/Credit Due by multiplying Net Taxable Gallons by the Tax Rate.

- If applicable, compute Interest Due for late filings based on the current interest rate.

- Sum the amounts in the appropriate columns to calculate the Total Due for each jurisdiction.

- Complete the totals for all jurisdictions listed on the page for the indicated fuel type.