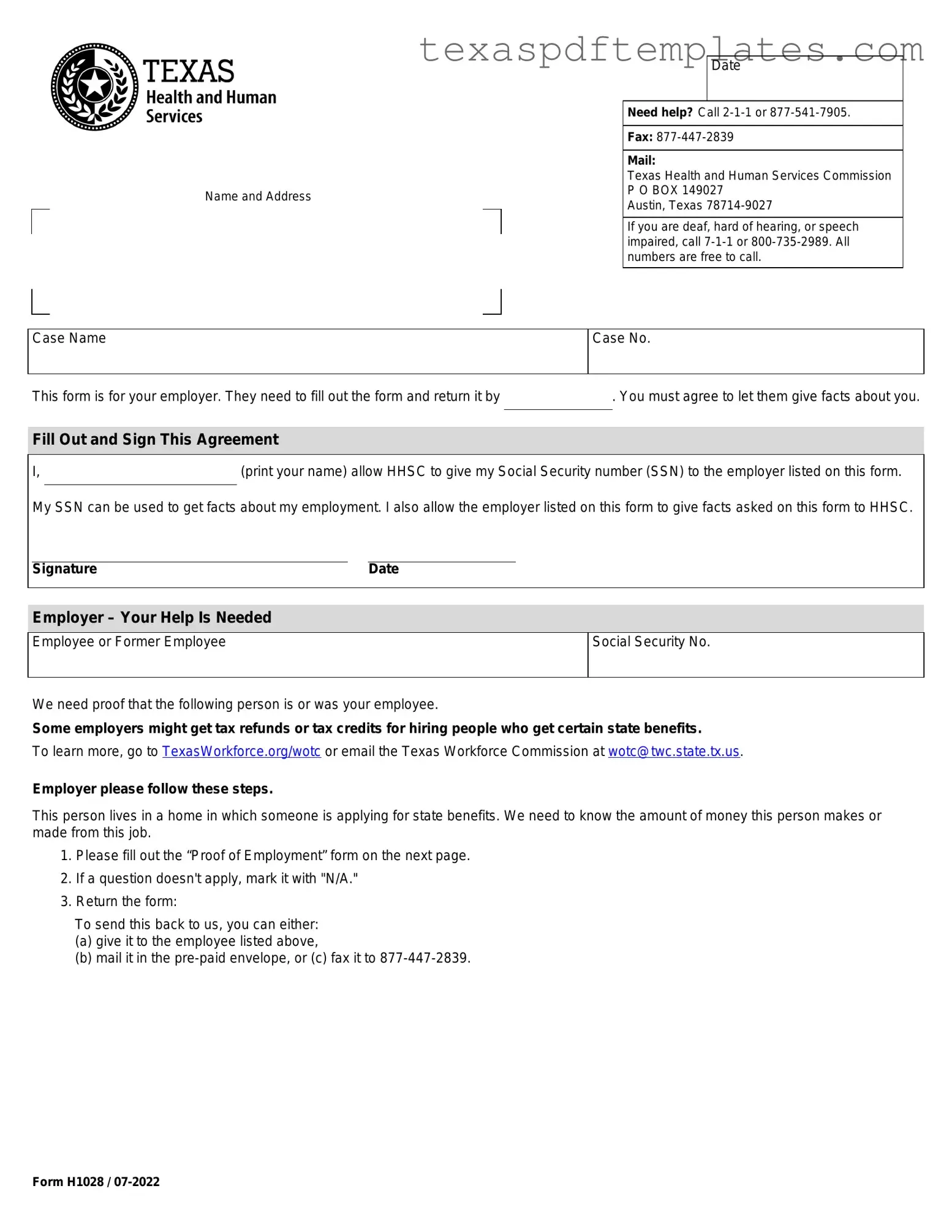

Blank Texas Employment Verification PDF Template

Form Example

Name and Address

Date

Need help? Call

Fax:

Mail:

Texas Health and Human Services Commission

P O BOX 149027

Austin, Texas

If you are deaf, hard of hearing, or speech impaired, call

Case Name

Case No.

This form is for your employer. They need to fill out the form and return it by. You must agree to let them give facts about you.

Fill Out and Sign This Agreement

I, |

|

(print your name) allow HHSC to give my Social Security number (SSN) to the employer listed on this form. |

|

|

|

My SSN can be used to get facts about my employment. I also allow the employer listed on this form to give facts asked on this form to HHSC.

Signature |

Date |

Employer – Your Help Is Needed

Employee or Former Employee

Social Security No.

We need proof that the following person is or was your employee.

Some employers might get tax refunds or tax credits for hiring people who get certain state benefits.

To learn more, go to TexasWorkforce.org/wotc or email the Texas Workforce Commission at wotc@twc.state.tx.us.

Employer please follow these steps.

This person lives in a home in which someone is applying for state benefits. We need to know the amount of money this person makes or made from this job.

1.Please fill out the “Proof of Employment” form on the next page.

2.If a question doesn't apply, mark it with "N/A."

3.Return the form:

To send this back to us, you can either:

(a)give it to the employee listed above,

(b)mail it in the

Form H1028 /

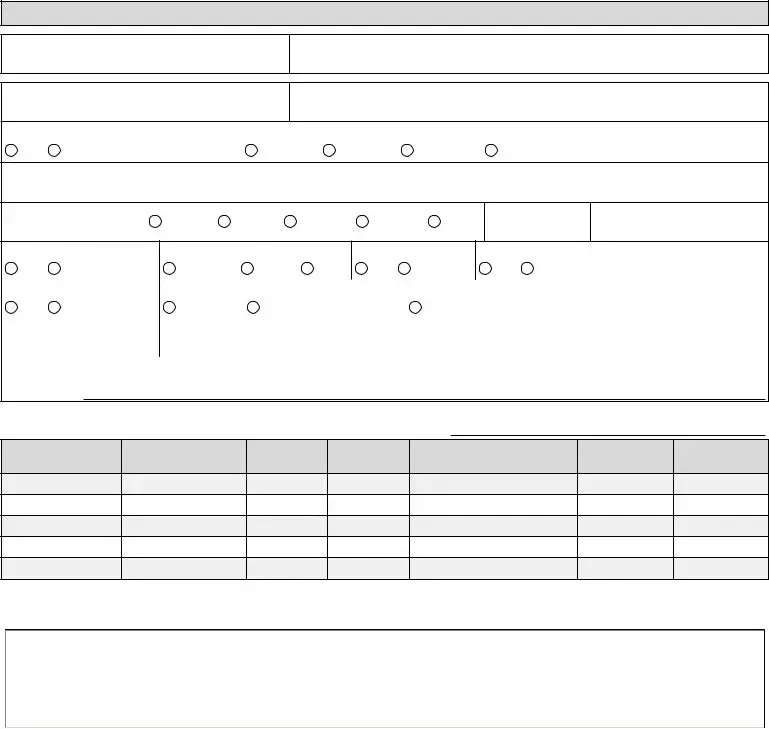

Employment Verification

Form H1028

Page 2 /

Proof of employment to be filled out by the employer.

Company or Employer

Address (Street, City, State, ZIP code)

Employee Name (as shown on your records)

Employee Address (Street, City, State, ZIP Code – as shown on your records)

Is (or was) this person employed by you? |

If yes, what type of job? |

|

|

||

Yes |

No |

Full Time |

Part Time |

Permanent |

Temporary |

If no: Stop here – sign and date the bottom of this form and return it.

If yes: Answer all the questions below. If a question doesn’t apply, write “N/A".

Rate of Pay |

Per Day |

Per Week |

Per Month |

Per Job |

Per Hour |

How Often Paid?

Average Hours Per Pay Period

Commissions Tips Bonuses |

Overtime Pay |

|

|

FICA or FIT Withheld |

Profit Sharing or Pension Plan |

|||

Yes |

No |

Frequently |

Rarely |

Never |

Yes |

No |

Yes |

No If yes, current value? |

Health insurance available? |

If yes, employee is: |

|

|

|

Name of Insurance Company |

|||

Yes |

No |

Not Enrolled |

Enrolled with Family Member |

Enrolled for Self Only |

|

|

||

|

|

|

|

|

|

|||

Date Hired |

|

Date First Check Received |

Average Hours Per Week |

If Employee |

is or was on Leave Without Pay: |

|||

|

|

|

|

|

|

Start Date: |

End Date: |

|

|

|

|

|

|

|

|

|

|

Do you expect any changes to the above information within the next few months?  Yes

Yes  No

No

If yes, explain:

On the chart below, list all wages received by this employee during the month(s) of:

Date Pay

Period Ended

Date Employee

Received Paycheck

Actual Hours

Gross

Pay

Other Pay*

(tips, commissions, bonuses)

EITC

Advance

Total Pretax

Contributions

*Please explain (in comments section below) when and how often tips, commissions, or bonuses are received. Comments

If this person is no longer in your employ.

|

Date Separated |

Reason for Separation |

|

|

|

|

Date Final Check Received |

|

|

Gross Amount of Final Check |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer – Read, Sign and Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

I confirm that this information is true and correct to the best of my knowledge: |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Signature |

|

Date |

Title |

Area Code and Phone No. |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

More PDF Templates

Original Petition for Divorce - The form facilitates the official start of the dissolution of marriage.

How to Reduce Property Taxes in Texas - This form must be filled out by the driver involved in an accident.

Common mistakes

-

Incomplete Information: Failing to provide all required details, such as the employee's full name, Social Security number, or case number, can delay processing. Each section must be filled out accurately to ensure the form is valid.

-

Incorrect Employment Status: Employers may mistakenly mark the wrong employment status. It is crucial to indicate whether the employee is full-time, part-time, permanent, or temporary. This information impacts eligibility for state benefits.

-

Omitting Pay Details: Not including accurate pay information, such as the rate of pay or how often the employee is paid, can lead to complications. Providing this data is essential for verifying employment and benefits eligibility.

-

Failing to Sign and Date: Some employers forget to sign and date the form. This step is necessary for the form to be considered complete and valid. Without a signature, the information may not be accepted.

-

Improper Submission: Submitting the form incorrectly, whether by failing to use the pre-paid envelope, not faxing it to the correct number, or giving it back to the wrong person, can result in delays. Adhering to submission guidelines is vital for timely processing.

Key takeaways

Filling out and using the Texas Employment Verification form is a crucial process for both employees and employers. Here are some key takeaways to keep in mind:

- Employer Responsibility: The employer must complete the form accurately and return it promptly. This ensures that the employee can receive the necessary state benefits.

- Employee Consent: The employee must agree to allow the employer to share their employment details. This consent is essential for the verification process.

- Clear Communication: If any questions on the form do not apply, the employer should mark them as "N/A." This helps avoid confusion and ensures clarity.

- Multiple Submission Options: Employers can return the completed form in various ways: by giving it directly to the employee, mailing it in the pre-paid envelope, or faxing it to the designated number.

- Accurate Information: It is vital for employers to provide truthful and complete information regarding the employee's wages and employment status. This includes any bonuses, commissions, or changes in employment.

Steps to Using Texas Employment Verification

After you have received the Texas Employment Verification form, it is important to fill it out accurately and completely. This form is essential for your employer to provide necessary information about your employment status. Follow these steps to ensure the form is filled out correctly.

- Print your name clearly in the designated area.

- Agree to allow the Texas Health and Human Services Commission (HHSC) to share your Social Security number with your employer.

- Sign and date the agreement section at the bottom of the form.

- Have your employer fill out the “Proof of Employment” section on the next page.

- Provide your employer’s name and address, including street, city, state, and ZIP code.

- Include your name and address as shown in their records.

- Your employer must confirm if you are or were employed by them. If yes, they should specify the type of job (full-time, part-time, etc.).

- If the answer is no, your employer should sign and date the form, then return it.

- If yes, your employer needs to answer all subsequent questions, marking “N/A” for any that do not apply.

- Your employer should indicate your rate of pay and how often you are paid.

- They must provide details on average hours worked per pay period and any additional compensation such as commissions or bonuses.

- Your employer should confirm if health insurance is available and provide the name of the insurance company if applicable.

- They need to fill in your hire date, the date you received your first paycheck, and average hours worked per week.

- If you were on leave without pay, your employer must specify the start and end dates of that leave.

- Your employer should indicate if they expect any changes to the information provided within the next few months.

- For the wage chart, your employer must list all wages received during the specified month(s), including dates, hours worked, gross pay, and any other pay.

- If you are no longer employed, your employer needs to provide the date you separated, the reason for separation, and the date of your final check.

- Your employer must sign, date, and provide their title along with their contact number at the end of the form.

Once the form is completed, your employer should return it to the Texas Health and Human Services Commission. They can do this by mailing it, faxing it, or giving it back to you to send. Make sure all information is accurate to avoid delays in processing.