Blank Texas Dec 1 PDF Template

Form Example

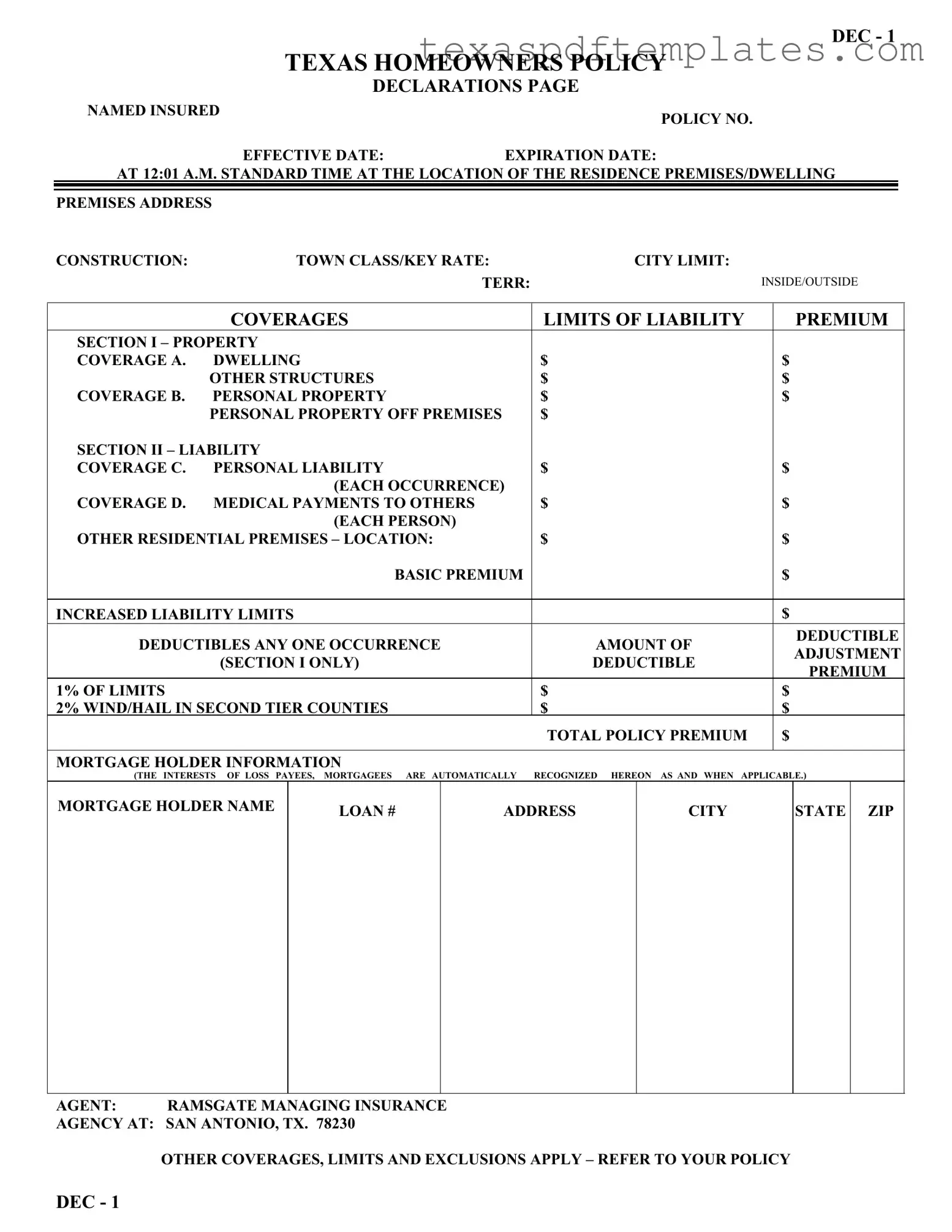

DEC - 1

TEXAS HOMEOWNERS POLICY

DECLARATIONS PAGE

NAMED INSURED |

|

POLICY NO. |

|

|

|

|

EFFECTIVE DATE: |

EXPIRATION DATE: |

AT 12:01 A.M. STANDARD TIME AT THE LOCATION OF THE RESIDENCE PREMISES/DWELLING |

||

|

|

|

|

|

|

PREMISES ADDRESS |

|

|

CONSTRUCTION: |

TOWN CLASS/KEY RATE: |

CITY LIMIT: |

TERR:INSIDE/OUTSIDE

COVERAGES

LIMITS OF LIABILITY

PREMIUM

SECTION I – PROPERTY |

|

|

|

|

||

COVERAGE A. |

DWELLING |

$ |

|

|

$ |

|

|

OTHER STRUCTURES |

$ |

|

|

$ |

|

COVERAGE B. |

PERSONAL PROPERTY |

$ |

|

|

$ |

|

|

PERSONAL PROPERTY OFF PREMISES |

$ |

|

|

|

|

SECTION II – LIABILITY |

|

|

|

|

||

COVERAGE C. |

PERSONAL LIABILITY |

$ |

|

|

$ |

|

|

(EACH OCCURRENCE) |

|

|

|

|

|

COVERAGE D. MEDICAL PAYMENTS TO OTHERS |

$ |

|

|

$ |

||

|

(EACH PERSON) |

|

|

|

|

|

OTHER RESIDENTIAL PREMISES – LOCATION: |

$ |

|

|

$ |

||

|

BASIC PREMIUM |

|

|

|

$ |

|

|

|

|

|

|

|

|

INCREASED LIABILITY LIMITS |

|

|

|

$ |

||

DEDUCTIBLES ANY ONE OCCURRENCE |

AMOUNT OF |

|

DEDUCTIBLE |

|||

|

ADJUSTMENT |

|||||

|

(SECTION I ONLY) |

DEDUCTIBLE |

|

|||

|

|

PREMIUM |

||||

|

|

|

|

|

|

|

1% OF LIMITS |

|

|

$ |

|

|

$ |

2% WIND/HAIL IN SECOND TIER COUNTIES |

$ |

|

|

$ |

||

|

|

|

TOTAL POLICY PREMIUM |

|

$ |

|

|

|

|

|

|

|

|

MORTGAGE HOLDER INFORMATION |

|

|

|

|

||

(THE INTERESTS OF LOSS PAYEES, MORTGAGEES ARE AUTOMATICALLY |

RECOGNIZED HEREON AS AND WHEN APPLICABLE.) |

|||||

|

|

|

|

|

|

|

MORTGAGE HOLDER NAME

LOAN #

ADDRESS

CITY

STATE ZIP

AGENT: RAMSGATE MANAGING INSURANCE

AGENCY AT: SAN ANTONIO, TX. 78230

OTHER COVERAGES, LIMITS AND EXCLUSIONS APPLY – REFER TO YOUR POLICY

DEC - 1

More PDF Templates

Stap Application 2023 - Detailed instructions are provided to guide applicants in completing the form correctly.

Ut Forms - Give the exact name of your college/university to avoid confusion.

Common mistakes

-

Failing to include the correct names of all insured parties. Ensure that all individuals listed on the policy are accurately named to avoid issues with coverage.

-

Not specifying the effective and expiration dates clearly. These dates are crucial for determining the coverage period and should be filled out precisely.

-

Omitting the correct address of the residence premises. This can lead to complications in claim processing and coverage validation.

-

Incorrectly stating the construction type of the dwelling. This detail affects premiums and coverage options.

-

Forgetting to list all other structures on the property. Any additional buildings, like sheds or garages, should be included to ensure full coverage.

-

Miscalculating limits of liability for personal liability coverage. Make sure these limits meet your needs to protect against potential claims.

-

Neglecting to include deductibles for various occurrences. Clearly outline these amounts to avoid surprises during a claim.

-

Not providing accurate mortgage holder information. This is essential for ensuring that the lender's interests are protected in case of a loss.

-

Leaving out agent information. Including your insurance agent's details can facilitate communication and assistance when needed.

-

Failing to read the fine print regarding coverages and exclusions. Understanding your policy's terms can help prevent misunderstandings later.

Key takeaways

When filling out and using the Texas Dec 1 form, keep these key takeaways in mind:

- Accurate Information: Ensure that all personal and property details are filled out correctly. This includes the named insured, policy number, and the address of the residence.

- Coverage Limits: Review the coverage limits for property and liability sections carefully. Understand the amounts for dwelling, personal property, and medical payments.

- Deductibles: Be aware of the deductibles applicable to your policy. This includes standard amounts and any adjustments based on specific occurrences.

- Mortgage Holder Details: If applicable, provide accurate information about the mortgage holder. This ensures that their interests are recognized in the event of a claim.

Steps to Using Texas Dec 1

Filling out the Texas Dec 1 form is a straightforward process. This form is essential for homeowners to provide necessary information regarding their insurance policy. After completing the form, you will submit it to your insurance provider to ensure your coverage is accurate and up to date.

- Start with your personal information: Fill in the "NAMED INSURED" section with your full name.

- Enter your policy number: Write your existing policy number in the designated field.

- Provide effective and expiration dates: Specify the dates when your policy goes into effect and when it will expire.

- Fill out the address: Enter the complete address of your residence, including city and zip code.

- Describe the construction: Indicate the type of construction of your home (e.g., brick, wood, etc.).

- Class/Key rate: Identify the town class or key rate applicable to your property.

- Coverage limits: For each coverage section (A and B), input the limits of liability and the corresponding premiums.

- Liability coverage: Fill in the personal liability and medical payments to others sections with the required amounts.

- Other residential premises: If applicable, include information about any additional residential properties.

- Deductibles: Specify the deductible amounts for each occurrence and any adjustments for Section I.

- Mortgage holder information: Provide the name, loan number, and address of your mortgage holder.

- Agent information: Note the name and address of your insurance agent, which is Ramsgate Managing Insurance Agency in San Antonio, TX.

- Review: Double-check all entries for accuracy before submitting the form.