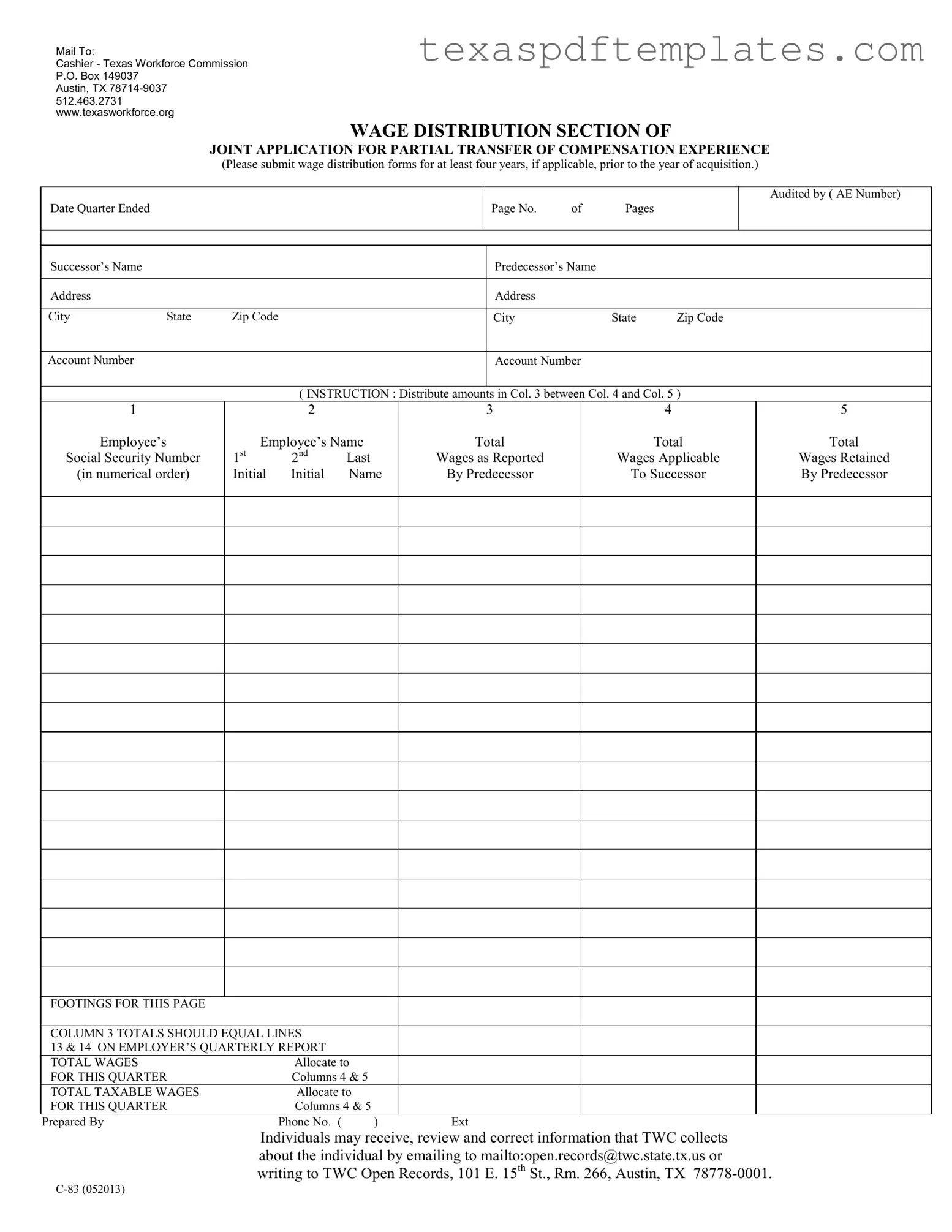

Blank Texas C 83 PDF Template

Form Example

Mail To:

Cashier - Texas Workforce Commission P.O. Box 149037

Austin, TX

WAGE DISTRIBUTION SECTION OF

JOINT APPLICATION FOR PARTIAL TRANSFER OF COMPENSATION EXPERIENCE

(Please submit wage distribution forms for at least four years, if applicable, prior to the year of acquisition.)

Date Quarter Ended

Page No. |

of |

Pages |

Audited by ( AE Number)

Successor’s Name |

|

|

|

|

|

Predecessor’s Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

Zip Code |

|

|

|

City |

State |

Zip Code |

|

|

|

|

|

|

|

|

|

|

|

Account Number |

|

|

|

|

|

Account Number |

|

|

|

|

|

|

|

|

|

||||

|

|

|

( INSTRUCTION : Distribute amounts |

in Col. 3 between Col. 4 and Col. 5 ) |

|

||||

1 |

|

|

2 |

|

3 |

|

4 |

5 |

|

Employee’s |

|

Employee’s Name |

Total |

|

Total |

Total |

|||

Social Security Number |

1st |

2nd |

Last |

Wages as Reported |

Wages Applicable |

Wages Retained |

|||

(in numerical order) |

Initial |

Initial |

Name |

By Predecessor |

To Successor |

By Predecessor |

|||

FOOTINGS FOR THIS PAGE |

|

|

|

|

|

|

|

COLUMN 3 TOTALS SHOULD EQUAL LINES |

|

|

|

13 & 14 ON EMPLOYER’S QUARTERLY REPORT |

|

|

|

TOTAL WAGES |

Allocate to |

|

|

FOR THIS QUARTER |

Columns 4 & 5 |

|

|

TOTAL TAXABLE WAGES |

Allocate to |

|

|

FOR THIS QUARTER |

Columns 4 & 5 |

|

|

Prepared By |

Phone No. ( |

) |

Ext |

Individuals may receive, review and correct information that TWC collects about the individual by emailing to mailto:open.records@twc.state.tx.us or writing to TWC Open Records, 101 E. 15th St., Rm. 266, Austin, TX

More PDF Templates

Texas Franchise Tax Threshold 2023 - Each applicant must provide their social security number as required by law.

Notice of Nonsuit - Notice indicating no further pursuit of claims.

Common mistakes

-

Failing to include the correct address for both the successor and predecessor. It's essential that these addresses are complete and accurate to avoid any processing delays.

-

Not providing the correct account numbers. Both the successor's and predecessor's account numbers must be filled in accurately to ensure proper identification.

-

Omitting the employee's social security numbers. Each employee listed must have their social security number included to avoid complications in wage distribution.

-

Incorrectly calculating the wage totals. The totals in columns 3, 4, and 5 must be accurate and correspond to the figures reported in the employer’s quarterly report.

-

Not submitting wage distribution forms for the required four years prior to the acquisition. This is necessary for a complete application.

-

Using incorrect dates for the quarter ended. It is vital to ensure that the date reflects the correct quarter to avoid confusion.

-

Forgetting to sign the form. The form must be signed by the appropriate parties to validate the information provided.

-

Neglecting to include contact information for the preparer. A phone number and extension should be provided to facilitate communication if needed.

-

Failing to review the form for accuracy before submission. A thorough review can catch mistakes that could delay processing.

-

Not keeping a copy of the submitted form for personal records. Retaining a copy can be useful for future reference or in case of any disputes.

Key takeaways

When filling out and using the Texas C 83 form, consider these key takeaways:

- Purpose of the Form: The Texas C 83 form is used for the partial transfer of compensation experience between a predecessor and successor employer.

- Wage Distribution Requirement: It is important to submit wage distribution forms for at least four years prior to the year of acquisition, if applicable.

- Accurate Information: Ensure that all names, addresses, and account numbers are filled out correctly to avoid processing delays.

- Allocation of Wages: Distribute amounts in Column 3 between Columns 4 and 5 as instructed on the form. This is crucial for accurate tax reporting.

- Verification of Totals: Double-check that the totals in Column 3 match the totals on the employer’s quarterly report to ensure consistency.

- Contact Information: If you need to correct any information collected by the Texas Workforce Commission, you can reach out via email or mail as provided in the form.

Steps to Using Texas C 83

Completing the Texas C 83 form is a straightforward process that requires careful attention to detail. This form is essential for the transfer of compensation experience between employers. After filling out the form, you will need to submit it to the Texas Workforce Commission for processing. Below are the steps to accurately complete the Texas C 83 form.

- Begin by writing the Date and Quarter Ended at the top of the form.

- Indicate the Page No. and the number of Pages you are submitting.

- Fill in the Audited by (AE Number) section.

- Provide the Successor’s Name and Address, including City, State, and Zip Code.

- Enter the Account Number for the successor.

- Next, fill in the Predecessor’s Name and Address, along with City, State, and Zip Code.

- Input the Account Number for the predecessor.

- In the wage distribution section, list each employee’s Name and Social Security Number in numerical order.

- For each employee, fill in the Total Wages as Reported by Predecessor in Column 3.

- Allocate the amounts in Column 3 between Total Applicable Wages Retained in Column 4 and Total Taxable Wages in Column 5.

- Complete the Footings for this Page section, ensuring that Column 3 totals equal lines 13 & 14 on the Employer’s Quarterly Report.

- Finally, indicate who Prepared By and provide a Phone No. with extension, if applicable.