Blank Texas C 5 PDF Template

Form Example

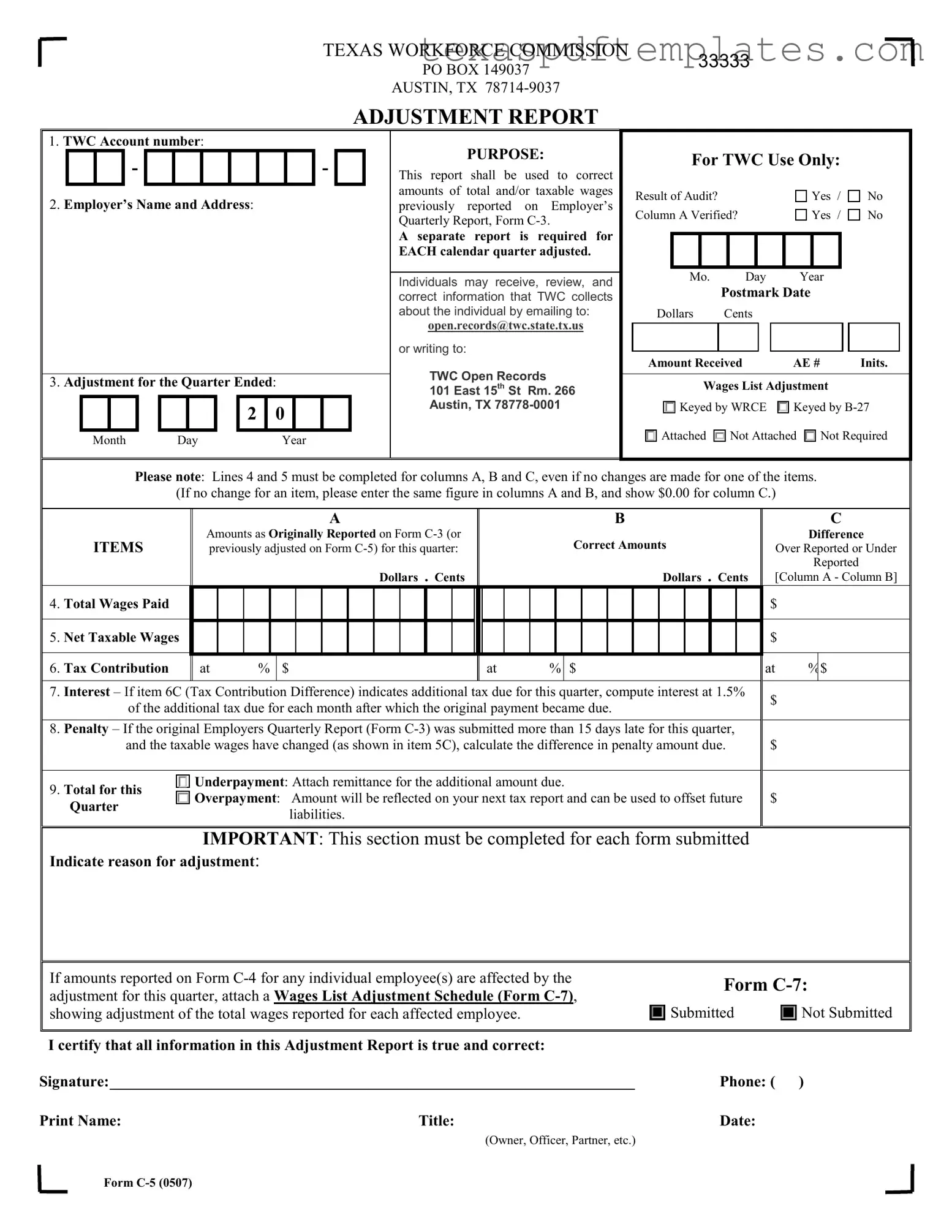

TEXAS WORKFORCE COMMISSION |

33333 |

|

PO BOX 149037 |

||

|

||

AUSTIN, TX |

|

ADJUSTMENT REPORT

1.TWC Account number:

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

2.Employer’s Name and Address:

3.Adjustment for the Quarter Ended:

|

|

|

|

|

|

2 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Day |

Year |

||||||

PURPOSE:

This report shall be used to correct amounts of total and/or taxable wages previously reported on Employer’s Quarterly Report, Form

A separate report is required for EACH calendar quarter adjusted.

Individuals may receive, review, and correct information that TWC collects about the individual by emailing to:

open.records@twc.state.tx.us

or writing to:

TWC Open Records

101 East 15th St Rm. 266

Austin, TX

For TWC Use Only:

Result of Audit? |

|

|

|

|

|

Yes / |

|

No |

||

Column A Verified? |

|

Yes / |

|

No |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mo. |

|

Day |

Year |

|

|

||||

|

|

|

Postmark Date |

|

|

|||||

Dollars |

Cents |

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

Amount Received |

AE # |

|

Inits. |

|||||||

Wages List Adjustment

Keyed by WRCE

Keyed by WRCE  Keyed by

Keyed by

Attached

Attached

Not Attached

Not Attached  Not Required

Not Required

Please note: Lines 4 and 5 must be completed for columns A, B and C, even if no changes are made for one of the items.

(If no change for an item, please enter the same figure in columns A and B, and show $0.00 for column C.)

|

|

|

|

A |

|

|

B |

|

|

C |

|

|

Amounts as Originally Reported on Form |

|

|

|

|

|

Difference |

||

|

ITEMS |

previously adjusted on Form |

|

|

Correct Amounts |

|

Over Reported or Under |

|||

|

|

|

|

|

|

|

|

|

|

Reported |

|

|

|

|

Dollars . Cents__ |

|

|

Dollars . |

Cents__ |

[Column A - Column B] |

|

4. |

Total Wages Paid |

|

|

|

|

|

|

|

$ |

|

5. |

Net Taxable Wages |

|

|

|

|

|

|

|

$ |

|

6. |

Tax Contribution |

at |

% |

$ |

at |

% |

$ |

|

at |

% $ |

7. |

Interest – If item 6C (Tax Contribution Difference) indicates additional tax due for this quarter, compute interest at 1.5% |

$ |

|||

|

|

of the additional tax due for each month after which the original payment became due. |

|||

|

|

|

|||

8. |

Penalty – If the original Employers Quarterly Report (Form |

|

|||

|

|

and the taxable wages have changed (as shown in item 5C), calculate the difference in penalty amount due. |

$ |

||

|

|

|

|

|

|

9. |

Total for this |

Underpayment: Attach remittance for the additional amount due. |

$ |

||

Overpayment: Amount will be reflected on your next tax report and can be used to offset future |

|||||

|

Quarter |

|

|||

|

|

liabilities. |

|

||

|

|

|

|

||

IMPORTANT: This section must be completed for each form submitted

Indicate reason for adjustment:

If amounts reported on Form |

|

Form |

||

adjustment for this quarter, attach a Wages List Adjustment Schedule (Form |

|

|||

|

Submitted |

|

Not Submitted |

|

showing adjustment of the total wages reported for each affected employee. |

|

|

||

|

|

|

|

|

I certify that all information in this Adjustment Report is true and correct:

Signature:___________________________________________________________________ |

Phone: ( ) |

|

Print Name: |

Title: |

Date: |

|

(Owner, Officer, Partner, etc.) |

|

Form

More PDF Templates

Texas Department of Insurance Forms - Your personal data must be handled according to privacy regulations.

Texas Private Security Bureau - Reviewing the form guidelines can clarify expectations for both the applicant and the psychologist.

Common mistakes

-

Failing to include the TWC Account number at the top of the form. This number is essential for identifying the employer's account.

-

Not providing the Employer’s Name and Address accurately. Ensure that this information matches what is on file with the Texas Workforce Commission.

-

Leaving the Adjustment for the Quarter Ended section incomplete. It is crucial to specify the correct quarter being adjusted.

-

Neglecting to fill out lines 4 and 5. These lines must be completed even if no changes are made to the reported amounts.

-

Incorrectly calculating the Tax Contribution amounts. Double-check the percentages and ensure that the calculations are accurate.

-

Forgetting to attach the Wages List Adjustment Schedule (Form C-7) when required. This is necessary if individual employee wages are affected.

-

Not signing the form. The certification of truthfulness requires a signature from an authorized individual.

-

Omitting the Phone Number of the signer. This information is important for any follow-up communication.

-

Submitting the form without ensuring all required fields are completed. Review the form thoroughly before submission to avoid delays.

Key takeaways

Filling out the Texas C-5 form can seem daunting, but understanding its key components will make the process smoother. Here are some essential takeaways to keep in mind:

- Purpose of the Form: The Texas C-5 form is specifically designed to correct any discrepancies in total and/or taxable wages previously reported on the Employer’s Quarterly Report (Form C-3). Each calendar quarter that requires adjustments must be submitted with a separate report.

- Accurate Information: Ensure that all information is accurate and complete. Lines 4 and 5 must be filled out for columns A, B, and C, even if there are no changes. If there are no changes, simply enter the same figure in columns A and B, and show $0.00 for column C.

- Timeliness Matters: If the original Employer’s Quarterly Report (Form C-3) was submitted more than 15 days late and taxable wages have changed, a penalty will be assessed. It’s crucial to submit the C-5 form promptly to avoid additional charges.

- Adjustment Documentation: If the adjustment affects the amounts reported for individual employees on Form C-4, you will need to attach a Wages List Adjustment Schedule (Form C-7). This ensures that all affected employees are accurately accounted for.

By keeping these points in mind, you can navigate the Texas C-5 form with confidence. Remember, accuracy and timeliness are your best allies in ensuring compliance and avoiding penalties.

Steps to Using Texas C 5

Completing the Texas C 5 form requires careful attention to detail. This report is essential for making corrections to previously reported wage amounts. Follow the steps outlined below to ensure accurate submission.

- Obtain the Texas C 5 form from the Texas Workforce Commission website or your local office.

- Enter your TWC Account number in the designated field.

- Fill in your employer's name and address in the appropriate sections.

- Specify the adjustment quarter by entering the month, day, and year for the quarter ended.

- Complete lines 4 and 5, which require the total wages paid and net taxable wages, respectively.

- In Column A, list the amounts as originally reported on Form C-3 or previously adjusted amounts.

- In Column B, enter the correct amounts for the same items.

- In Column C, calculate the difference between Column A and Column B.

- Complete items 6 through 8, including tax contributions, interest, and penalties, if applicable.

- Indicate the reason for the adjustment in the designated section.

- Attach any necessary documentation, such as the Wages List Adjustment Schedule (Form C-7), if required.

- Sign the form, providing your printed name, title, and date of signing.

- Submit the completed form to the Texas Workforce Commission at the address provided on the form.

Ensure that all fields are filled out completely and accurately. Review the form for any errors before submission to avoid delays or complications in processing your adjustment report.