Blank Texas Ap 209 PDF Template

Form Example

APPLICATION FOR EXEMPTION

RELIGIOUS AND RELIGION BASED ORGANIZATION

CAROLE KEETON STRAYHORN • TEXAS COMPTROLLER OF PUBLIC ACCOUNTS

Nonprofit religious organizations should use this application to request exemption from Texas sales tax, hotel occupancy tax, and franchise tax, if applicable. To receive a state tax exemption as a religious organization, a nonprofit religious organization must be an organized group of people regularly meeting at a particular location with an established congregation for the primary purpose of holding, conducting and sponsoring religious worship services according to the rites of their sect. Exemption from federal tax is not required to qualify for exemption from state tax as a religious organization.

The exemption for religious organizations is provided for in Sections 151.310, 156.102, and 171.058 of the Texas Tax Code, and more detailed information can be found in Comptroller’s Rules 3.322, 3.161, and 3.541.

Some organizations will not qualify for exemption as a religious organization as that term is defined in Texas' law and rules, even though their activities may be religious in nature. Evangelistic associations do not qualify for exemption as religious organizations. Organizations that simply support and encourage religion as an incidental purpose, or that further religious work or teach their membership religious understanding, such as Bible study groups, prayer groups, and revivals do not qualify for exempt status under this category. Such an organization might still qualify for exemption from Texas sales taxes, and franchise tax, if applicable, based on their exemption under certain sections of the Internal Revenue Code (IRC).

Texas tax law provides an exemption from sales taxes on goods and services purchased for use by organizations exempt under IRC Section 501(c)(3), (4), (8), (10), or (19). However, exempt organizations are required to collect tax on most of their sales of taxable items. See Exempt

If your organization has been granted federal tax exemption under one of the qualifying sections listed above, your organization will be granted an exemption from Texas sales tax, or sales and franchise tax, on the basis of the IRS exemption, as required by state law. Organizations that qualify for exemption based on a federal exemption are not exempt from hotel occupancy tax because the hotel tax law does not recognize any federal exemptions.

The laws, rules and other information about exemptions are online at:

http://www.window.state.tx.us/taxinfo/exempt

Send the completed application along with all required documentation to:

COMPTROLLER OF PUBLIC ACCOUNTS

Exempt Organizations Section

P.O. Box 13528

Austin, Texas

We will contact you within 10 working days after receipt of your application to let you know the status of your applica- tion. We may require an organization to furnish additional information to establish the claimed exemption. After a review of the material, we will inform the organization in writing if it qualifies for exemption. The comptroller or an authorized representative of the comptroller may audit the records of an organization at any time during regular busi- ness hours to verify the validity of the organization’s exempt status.

If you have questions or need more information, contact our Tax Assistance staff at

You have certain rights under Ch. 559, Government Code, to review, request, and correct information we have on file about you. Contact us at the address or

TEXAS APPLICATION FOR TAX EXEMPTION

FOR RELIGIOUS AND

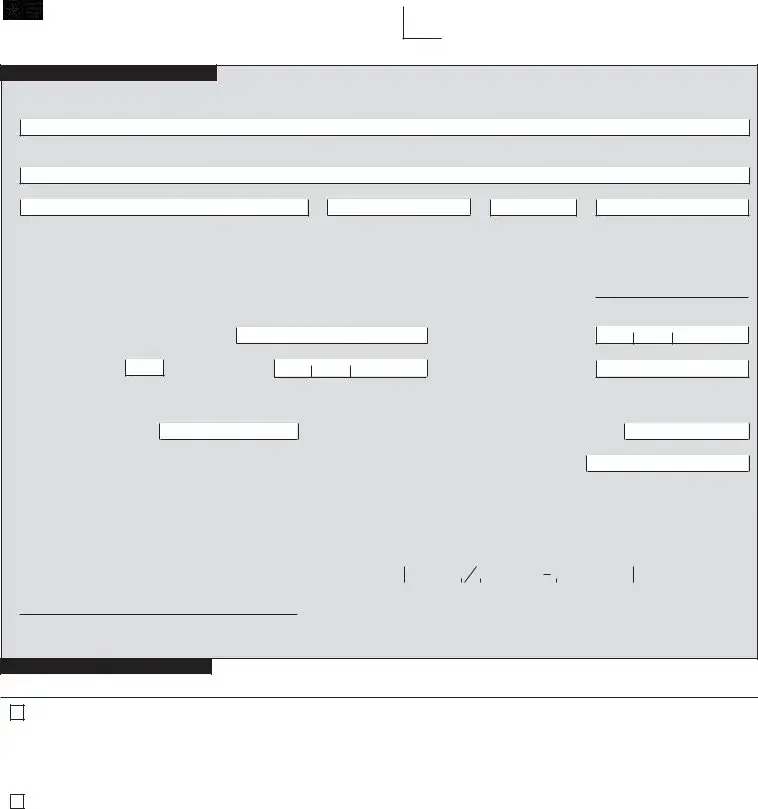

SECTION A

1. ORGANIZATION NAME

• TYPE OR PRINT |

|

• Do NOT write in shaded areas. |

Page 1 |

(Legal name as provided in Articles of Incorporation, or, if unincorporated, the governing document. For

2. ORGANIZATION MAILING ADDRESS

Street number, P.O. Box, or rural route and box number

CityState/provinceZIP codeCounty (or country, if outside the U.S.)

3. Texas Taxpayer number (if applicable) ................................................................................................................

4. For TEXAS corporations ONLY, filing information issued by the Secretary of State:

File Number ..............................................

Month |

Day |

Year |

File Date .......................................

5. For |

Month |

Day |

Year |

|

Certificate of Authority File Number .............

File Date ...............................

Home State

of Incorporation .......

Month |

Day |

Year |

Date of

Incorporation ...

Home State Filing

or Registration Number .......

6. Federal Employer's Identification Number (EIN) (Required if applying for exemption on the basis of a federal exemption) ......

7.Average attendance

at worship service ................

If average attendance is less than 50, indicate the number

of families represented in the average attendance ...................

8. Date of first worship service ................................................................................................................................................

|

|

|

|

|

|

|

Time |

|

|

|

|

|

|

|

|

|

|

|

|

Frequency |

|

|

|

|||||

9. Time and frequency of worship services |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

10. Name, address and daytime phone number of the person submitting this application. |

|

|

|

|||||||||||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

Title |

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organization Name |

Daytime Phone (Area code and number) |

|

|

Extension |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

City |

|

|

|

|

|

|

|

State |

Zip |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If address provided is not the same as the organization's mailing address, indicate to which address our response should be mailed: |

||||||||||||||||||||||||||

|

|

|

|

To organization mailing address |

|

|

|

To mailing address of submitter |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B

Provide the following additional information as it applies to the appropriate option below:

Option A (Member of a common denomination or convention of churches):

If your organization is a church that is a member of a common denomination or convention of churches, and the parent organization either has a 501(c)(3) federal group exemption, or has previously obtained a religious exemption in Texas for the churches under its jurisdiction, your church can obtain exemption based on its affiliation with the parent organization. Attach a letter from the parent organization stating that your church is a recognized subordinate, or provide the web address of the parent organization where your church's affiliation can be verified.

Option B (Independent church or nondenominational church that does not meet the requirements under Option A):

A copy of your organization’s governing document

A copy of your group’s statement of faith.

Documentation such as a bulletin, brochure, Web address (URL) or written statement that indicates the regular order of what takes place during the worship services.

A statement containing the physical address (no P.O. Box) and a description of the facility where worship services are regularly conducted. If available, include pictures of the interior and exterior of the facility. If renting or leasing, include a copy of the rental/lease agreement.

A statement confirming the services are open to the public. The statement must indicate how the services are advertised to the public.

If your church has its own 501(c)(3) federal exemption, provide a copy of the IRS determination letter along with the information in option A or B so that we may update our records.

APPLICATIONS RECEIVED WITHOUT SUPPORTING DOCUMENTATION REQUIRED

UNDER OPTION A OR OPTION B WILL BE RETURNED.

More PDF Templates

Texas Corporation Commission - Disclaimer components may be needed for descriptive or generic elements.

How Many Acres Do You Need for Ag Exemption in Texas - This form provides specific examples of items that qualify for exemption for clearer understanding.

Common mistakes

-

Incomplete Information: Many applicants fail to fill out all required sections of the Texas AP 209 form. This can lead to delays or outright rejection of the application. Ensure that every relevant field is filled out, including organization name, mailing address, and federal employer identification number (EIN) if applicable.

-

Incorrect Legal Name: Using a name that does not match the official name as provided in the Articles of Incorporation can be a significant mistake. The name must align with the documentation filed in the home state of the organization.

-

Missing Supporting Documents: Failing to attach necessary documents, such as the governing document or a letter from a parent organization, can result in the application being returned. Always double-check that all required documentation is included before submission.

-

Incorrect Taxpayer Number: Some applicants mistakenly enter an incorrect Texas taxpayer number or fail to provide one when required. This can create complications in processing the application.

-

Neglecting to Specify Service Details: It’s crucial to provide accurate information about the frequency and timing of worship services. Incomplete or vague details can lead to questions about the organization’s legitimacy.

-

Ignoring Submission Guidelines: Not following the instructions for submission, such as mailing to the correct address or using the appropriate format, can cause delays. Always refer to the provided guidelines to ensure compliance.

Key takeaways

Filling out the Texas AP 209 form is an important step for nonprofit religious organizations seeking tax exemptions. Here are some key takeaways to consider:

- Eligibility Criteria: Only organized groups that regularly meet for worship at a specific location qualify for exemption as a religious organization.

- Federal Exemption Not Required: Organizations do not need a federal tax exemption to qualify for state tax exemption.

- Exemption Sections: The exemption is outlined in Sections 151.310, 156.102, and 171.058 of the Texas Tax Code.

- Exclusions: Evangelistic associations and groups that support religion incidentally do not qualify for exemption.

- Tax Exemptions: Organizations may qualify for sales tax exemption under certain sections of the Internal Revenue Code, even if they do not meet the criteria for religious exemption.

- Documentation Required: Complete supporting documents must accompany the application, or it will be returned.

- Review Timeline: The Comptroller’s office will contact applicants within 10 working days regarding the status of their application.

- Audit Rights: The Comptroller may audit the organization’s records at any time during business hours to verify exempt status.

- Contact Information: For questions, organizations can reach the Tax Assistance staff at 1-800-252-5555 or (512)463-4600 in Austin.

Understanding these points can help streamline the application process and ensure compliance with Texas tax laws.

Steps to Using Texas Ap 209

After gathering all necessary information and documentation, the next step involves filling out the Texas AP 209 form to apply for tax exemption as a religious organization. This process requires careful attention to detail to ensure all information is accurate and complete. Once the form is completed, it should be submitted to the appropriate office for review.

- Begin by entering the organization name in the first field. This should match the legal name as stated in the Articles of Incorporation or the governing document.

- In the second field, provide the organization mailing address. Include the street number, city, state, ZIP code, and county.

- If applicable, enter the Texas taxpayer number in the designated area.

- For Texas corporations, fill in the file number and file date as issued by the Secretary of State.

- If the organization is a non-Texas corporation, provide the certificate of authority file number, file date, home state of incorporation, and date of incorporation.

- Enter the Federal Employer's Identification Number (EIN) if applying for exemption based on a federal exemption.

- Indicate the average attendance at worship services. If the average attendance is less than 50, specify the number of families represented.

- Provide the date of the first worship service.

- Fill in the time and frequency of worship services.

- Complete the section with the name, address, and daytime phone number of the person submitting the application.

- Specify whether the response should be mailed to the organization mailing address or the submitter's mailing address if different.

Next, provide additional information as required in Section B based on the organization's affiliation. This may involve attaching supporting documents to demonstrate eligibility for exemption. After completing all sections, review the application for accuracy and completeness before submission.