Blank Texas Ap 175 PDF Template

Form Example

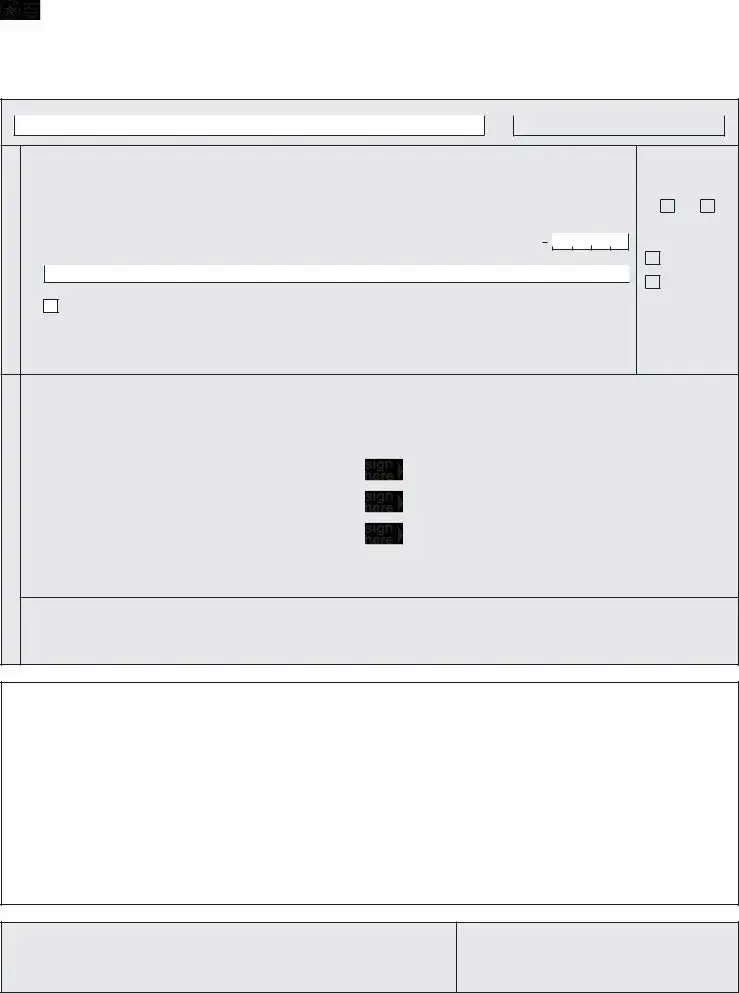

Texas Application for

Cigar and/or Tobacco Products Permit

Who Must Submit This Application – You must submit this application if:

•you are a sole owner, partnership, corporation or other organization that intends to do business in Texas;

•you intend to manufacture, import, wholesale, distribute or store any cigarette, cigar and/or tobacco products; AND

•you intend to make a delivery sale or ship cigarettes in conjunction with a delivery sale.

Definition of

Bonded Agent – any person in this state who is an agent of a person outside this state and receives cigarettes or cigars/tobacco products in interstate commerce and stores the cigarettes or cigars/tobacco products for distribution or delivery to distributors under orders from the person outside this state.

Cigarette distributor – any person who:

(a)is authorized to purchase for the purpose of making a first sale in this state cigarettes in unstamped packages from manufacturers who distribute cigarettes in this state and to stamp cigarette packages;

(b)ships, transports, imports into this state, acquires or possesses cigarettes and makes a first sale of the cigarettes in this state;

(c)manufactures or produces cigarettes; or

(d)is an importer or import broker.

Tobacco products distributor – any person who:

(a)receives tobacco products for the purpose of making a first sale in this state from a manufacturer either outside or within the state, or brings or causes to be brought into this state, tobacco products for sale, use or consumption;

(b)manufactures or produces tobacco products; or

(c)is an importer or import broker.

Importer – any person who ships, transports or imports into this state cigarettes or tobacco products manufactured or produced outside the United States for the purpose of making a first sale in this state. (An importer must obtain an annual permit from the Comptroller's office for each place of business owned or operated in Texas. There is no fee required to obtain an importer permit.)

Manufacturer – any person who manufactures or produces and sells cigarettes or tobacco products to a distributor.

Manufacturer’s Representative – any person who is employed by a manufacturer to sell or distribute the manufacturer's stamped cigarette packages or tax- paid cigars/tobacco products.

Wholesaler – Any person, including a manufacturer's representative, who sells or distributes stamped cigarette packages or

General Definitions –

Customs bonded warehouse – a business location under the jurisdiction of the Federal Government.

Engaged in Business – You are engaged in business in Texas if you or independent salespersons make sales, leases or rentals, or take orders for tangible personal property, or deliver tangible personal property, or perform taxable services, or have lease (personal) property, a warehouse or other location in Texas; or benefit from a location in Texas of authorized installation, servicing or repair facilities; or allow a franchisee or licensee to operate under your trade name if they are required to collect Texas tax.

First Sale – means (a) the first transfer of possession in connection with a purchase, sale or exchange for value of cigarettes or cigars/tobacco products in intrastate commerce; (b) the first use or consumption of cigarettes or cigars/tobacco products in this state; or (c) the loss of cigarettes or cigars/tobacco products in this state whether through negligence, theft or other loss.

Penalty and late fee – If you are a distributor, and you have been selling without a permit, you will need to file returns and pay tax, plus applicable penalty and interest, for the period of time that you have been in business. A $50 late fee will be assessed on each existing location that is not in compliance with permit requirements. Operating without a valid permit is punishable by a fine of not more than $2,000 per day.

Place of Business – means a commercial business location where cigarettes or cigars/tobacco products are sold, kept for sale or consumption or are otherwise stored, or a vehicle from which cigarettes or cigars/tobacco products are sold. The commercial business location where cigarettes are stored or kept cannot be a residence or a unit in a public storage facility (except for cigars and tobacco products Manufacturer's Representatives).

Delivery Sale – means a sale of cigarettes to a consumer in this state in which the purchaser submits the order for the sale by means of telephone or other method of voice transmission, by using the mail or any other delivery service, or through the Internet or another

Delivery Service – means a person, including the United States Postal Service, that is engaged in the commercial delivery of letters, packages or other containers.

Shipping Container – means a container in which cigarettes are shipped in connection with a delivery sale.

Shipping Documents – means a bill of lading, air bill, United States Postal Service form or any other document used to evidence the undertaking by a delivery service to deliver letters, packages or other containers.

For Assistance –

If you have any questions or need more information regarding this application, the cigarette tax, or the cigars and tobacco products tax, visit the Comptroller’s website at www.window.state.tx.us or call

Specific Instructions

Item 1 – Sole owner - Enter first name, middle initial and last name. Partnership - Enter the legal names of the partners. Corporation/Entity - Enter the legal name exactly as it is registered with the Secretary of State.

Other organization - Enter the title of the organization.

Item 2 – Enter the complete mailing address where you want to receive mail from the Comptroller of Public Accounts.

NOTE: If you want to receive mail for other taxes at a different address, attach a letter with the other address(es).

Item 6 – If you have both a Texas taxpayer number and a Texas vendor identification number, enter only the first eleven digits of the vendor identification number.

Item 7 – If you check "Other," identify the type of organization. Example: social club, independent school district, family trust.

Item 11 – Enter all information relevant to sole ownership. For partnerships, enter the information for ALL partners. For corporations or other organizations, enter the information for the principal officers (presi- dent,

Item 13 – Enter the physical location address (not P.O. Box number or rural route and box number) for the commercial business location where cigarettes or cigars/tobacco products are sold, kept for sale or consumption or are otherwise stored. A lease agreement may be requested.

Item 22 – If you are an importer, enter the permit number(s) issued by the Department of Treasury, Alcohol & Tobacco Tax & Trade Bureau under 26 U.S.C. Chapter 52, to engage in the business of importing tobacco products.

TAXPAYER INFORMATION

OWNERSHIP INFORMATION

Texas Application for

Cigarette, Cigar and/or |

• Type or print. |

• Do NOT write in shaded areas. |

Tobacco Products Permit |

|

|

Page 1

1.Legal name of owner (sole owner or partners, first name, middle initial and last name; corporation or other name)

•

2.Mailing address (street and number, P.O. Box or rural route and box number)

•

|

City |

|

State |

|

ZIP code |

|

|

|

County |

|||||||||||||||||||||||||||

• |

|

• |

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

Enter the daytime phone number of the person |

|

|

|

|

|

Area code |

|

|

|

|

|

|

Number |

||||||||||||||||||||||

|

|

|

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

primarily responsible for filing tax returns |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

4. |

Enter your Federal Employer Identification (FEI) Number, if any, |

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

assigned by the United States Internal Revenue Service |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5.If you are incorporating an existing business,

enter the taxpayer number of the existing business. .........................................................................

6.Enter your taxpayer number for reporting any Texas tax OR your Texas vendor

identification number if you now have or have ever had one. ...........................................................

7. |

Indicate how your business is owned. |

|

1 - Sole owner |

|

|

|

2 - Partnership |

|

3 - Texas corporation/LLC |

|||||||||||||||||||

|

|

|

7 - Limited partnership |

|

6 - Foreign corporation/LLC |

|

4 - Other (explain) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

8. |

If your business is a Texas entity, |

|

|

|

|

|

File number |

|

|

File date (month, day, year) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

. ...................................................................enter the file number and date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

9. If your business is not a Texas entity, enter home state, file number, Texas registration number and date.

|

Home state |

File number |

Texas registration number |

|

|

|

|

|

|

|

|

Registration date (month, day, year) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. If your business is a limited partnership, |

|

|

Home state |

Identification number |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

.......................................................enter the home state and identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

11. Complete for sole owners, general partners or principal officers of your business. (Attach additional sheets, if necessary.)

Name (first, middle initial, last)

•

Social Security or individual taxpayer identification number |

Driver license number |

State |

Phone (area code and number) |

•

Home address (street and number, city, state, ZIP code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sex |

|

|

|

|

M |

|

|

|

F |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Date of birth (month, day, year) |

|

|

Race |

|

|

|

Percent of ownership or |

|

|

|

|

|

Has this person ever been convicted |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate stock held ... |

% |

of a felony in any state? |

|

|

|

|

|

YES |

|

|

NO |

|||||||||||||||||||||||||||||

|

Position (Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

Sole owner |

|

|

Partner |

|

|

|

Director |

|

|

|

Officer |

|

Corporate stockholder |

|

|

Other (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Name (first, middle initial, last) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

Social Security or individual taxpayer identification number |

Driver license number |

|

|

|

|

State |

|

Phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

• |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street and number, city, state, ZIP code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sex |

|

|

M |

|

|

|

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Date of birth (month, day, year) |

|

|

Race |

|

|

Percent of ownership or |

|

Has this person ever been convicted |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate stock held ... |

% |

of a felony in any state? |

|

|

YES |

|

|

NO |

|||||||

Position (Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Sole owner |

|

|

|

|

|

Partner |

|

|

|

Director |

|

|

Officer |

|

Corporate stockholder |

|

|

Other (specify) |

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Privacy Act

Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone number listed on this form.

Texas Application for

Cigarette, Cigar and/or

Tobacco Products Permit

|

|

|

|

• Type or print. |

• Do NOT write in shaded areas. |

||

Page 2

12. Legal name of owner (same as Item 1)

BUSINESS LOCATION

13. Business location name

•

Business location address where cigarettes or cigars/tobacco products are sold, kept for sale or consumption or are otherwise stored. Address must be a commercial location. Public storage units, rural routes or P.O. Boxes are not allowed.

•

|

City |

|

|

State |

|

|

|

ZIP code |

|

|

|

|

||||||

• |

|

|

• |

|

|

• |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

14. Enter the daytime phone |

Area code |

|

|

Number |

|

|

|

|

||||||||

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

||||||||||||||

|

|

number of the person primarily • |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

responsible for the business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15. |

Is this location inside the city limits? |

|

|

|

|

|

|

|

|

|

|

|

YES |

|

NO |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

16. |

Is this location a customs bonded warehouse? |

|

|

|

|

|

|

|

|

|

|

|

YES |

|

NO |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

If "YES," please explain.

For Comptroller Use Only

Job name

MISCAPP

00991

00991

8 8

Reference No.

TAX RESPONSIBILITY

17. Describe the nature of your business at this location. (Use additional sheets, if necessary.)

18. |

What is the first business date that this business location will |

month |

|

day |

|

|

|

|

year |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

conduct sales of cigarettes, cigars and/or tobacco products? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19. |

Are you planning to sell cigarettes over the Internet/mail order? |

|

|

|

|

|

|

|

|

|

|

YES |

|

NO |

||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

If "YES," please provide your email or Web page address:

NOTE: State law requires all Internet and mail order cigarette sellers planning to deliver cigarettes to a purchaser in Texas to register their business with the state and collect all applicable state taxes and remit them to the Comptroller's office.

20. |

Indicate the permit type needed for cigarettes: |

|

Manufacturer |

|

|

Wholesaler |

|

Distributor |

|

|

Bonded agent |

|

|

|

Importer |

|

|

||||||||

21. |

Indicate the permit type needed for other tobacco products: |

|

Manufacturer |

|

Wholesaler |

|

|

Distributor |

|

Bonded agent |

|

Importer |

|||||||||||||

|

|

|

|

|

|

||||||||||||||||||||

22. |

Provide your current Dept. of Treasury, Alcohol & Tobacco Tax & Trade Bureau (T.T.B.) permit number(s) for cigarette and/or tobacco products: |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

Will you store unstamped cigarettes and/or |

|

|

|

|

YES |

|

|

|

NO |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

If "YES," for whom will you store unstamped cigarettes and/or

24. |

Indicate how your company will handle sample complimentary products: |

|

|

|

|

||||||

|

|

Manufacturer will stamp all complimentary cigarettes. |

|

Manufacturer will ship to a licensed distributor who will stamp or pay the tax. |

|||||||

|

|

|

|||||||||

|

|

Manufacturer will pay the tax directly to the State of Texas |

|

|

Not applicable: Federal military/Native American Reservation sales |

||||||

|

|

|

|

||||||||

|

|

for complimentary tobacco products. |

|

|

|

|

|

|

|

||

25. |

Will you stamp cigarettes in Texas with another state's stamp? |

|

YES |

|

NO |

||||||

|

|

||||||||||

|

If "YES," please list the other states: |

|

|

|

|

|

|

|

|

||

26. |

Will you sell cigarettes, cigars and/or tobacco products from a motor vehicle? |

|

YES |

|

NO |

||||||

|

|

||||||||||

If "YES," please complete the following (Use additional sheets or complete Form

YEAR |

MAKE |

MODEL |

LICENSE PLATE NO. |

STATE |

MOTOR VEHICLE ID NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27.If your place of business is a vehicle, where will business records for the vehicle(s) listed above be maintained? (Use street address or directions, city, state and ZIP code - NOT P.O. Box, rural route or public storage.) — Must be a commercial location.

28.Will you sell or store cigarettes, cigars and/or tobacco products at the location

where the records will be kept? |

|

YES |

|

NO |

Texas Application for

Cigarette, Cigar and/or

Tobacco Products Permit

• Type or print. |

• Do NOT write in shaded areas. |

Page 3

29. Legal name of owner (same as Item 1)

•

SUCCESSOR INFORMATION

If you purchased an existing business or business assets, complete Items

Trade name |

|

Taxpayer number of former owner |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. Enter the former owner's legal name. If known, enter the former owner's telephone number.

Legal name of former owner |

|

Phone (area code and number) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of former owner (street and number, city, state, ZIP code)

32.Check each of the following items you purchased. (This includes the value of stock exchanged for assets.)

Inventory |

|

Corporate stock |

|

Equipment |

|

Real estate |

|

Other assets |

33. Enter the purchase price of the business or assets purchased and the date of purchase.

Purchase price |

|

Date of purchase (month, day, year) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OF NR

Former owner is

Active

OOB

SIGNATURES

The sole owner, all general partners, corporation president, |

Date of application (month, day, year) |

|||||||

authorized representative must sign this application. Representative must submit a written power of attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with application. (Attach additional sheets, if necessary.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. I (We) declare that the information in this document and any attachments is true and correct to the best of my (our) knowledge and belief.

Type or print name and title of sole owner, partner or officer |

|

Sole owner, partner or officer |

|

|

|

Type or print name and title of partner or officer |

|

Partner or officer |

|

|

|

Type or print name and title of partner or officer |

|

Partner or officer |

|

|

|

Your permit must be prominently displayed in your place of business.

All information provided on this form may be disclosed to the public, upon request, under the

Texas Public Information Act, Government Code, Chapter 552.

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online at http://www.Texas.gov. You may also want to contact the municipality and county in which you will conduct business to determine any local governmental requirements.

(Cigarette and/or Tobacco Products Permits expire the last day of February each year.)

PERMIT TYPE |

ANN. FEE |

MAR. |

APR. |

MAY |

JUNE |

JULY |

AUG. |

SEPT. |

OCT. |

NOV. |

DEC.* |

JAN.* |

FEB.* |

Bonded agent |

$300.00 |

$300.00 |

$275.00 |

$250.00 |

$225.00 |

$200.00 |

$175.00 |

$150.00 |

$125.00 |

$100.00 |

$75.00 |

$50.00 |

$25.00 |

Distributor |

300.00 |

300.00 |

275.00 |

250.00 |

225.00 |

200.00 |

175.00 |

150.00 |

125.00 |

100.00 |

75.00 |

50.00 |

25.00 |

Manufacturer |

300.00 |

300.00 |

275.00 |

250.00 |

225.00 |

200.00 |

175.00 |

150.00 |

125.00 |

100.00 |

75.00 |

50.00 |

25.00 |

Wholesaler |

200.00 |

200.00 |

183.33 |

166.67 |

150.00 |

133.33 |

116.67 |

100.00 |

83.33 |

66.67 |

50.00 |

33.33 |

16.67 |

Vehicle |

15.00 |

15.00 |

13.75 |

12.50 |

11.25 |

10.00 |

8.75 |

7.50 |

6.25 |

5.00 |

3.75 |

2.50 |

1.25 |

Importer |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

NO FEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A vehicle permit can only be purchased in addition to a Distributor, Manufacturer or Wholesaler permit. The vehicle permit fees listed above reflect the amount due per vehicle.

*During the last three months of the permit period, the Comptroller may collect the prorated fee for the current period and the fee for the next period. Add the amount in the "Annual Fee" column to the prorated amount for the applicable month. (i.e., January fee is $50.00 + annual fee of $300.00 = $350.00.)

A $50 late fee will be assessed on each existing location that is not in compliance with permit requirements. Tex. Tax Code Ann. Ch. 154 and/or Ch. 155.

Mail your completed application with the required permit fee to:

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX

Make check payable to:

State Comptroller

More PDF Templates

Texas 74 221 - Providing accurate financial institution details is vital for successful deposits.

Ltc Application Texas - This certification is recognized statewide across Texas.

Common mistakes

-

Incorrect Business Type Selection: Applicants often fail to accurately indicate the type of business ownership. This can lead to delays or rejections. Ensure that you select the correct category, such as sole owner, partnership, or corporation.

-

Incomplete Mailing Address: Providing an incomplete or incorrect mailing address can result in important communications being missed. Always double-check that the address is complete, including street number, city, state, and ZIP code.

-

Missing Social Security Number: Applicants sometimes neglect to include the Social Security number or the individual taxpayer identification number when required. This information is crucial for tax identification purposes.

-

Using a P.O. Box for Business Location: Many applicants mistakenly list a P.O. Box as their business location. The form requires a physical address where business activities occur, which cannot be a residence or public storage unit.

-

Failure to Provide All Required Information: Omitting information about partners or corporate officers can lead to processing issues. It is essential to fill out all relevant sections completely and accurately.

-

Incorrect Taxpayer Number Entry: Entering the wrong taxpayer number or vendor identification number can cause significant delays. Ensure that you enter the correct numbers as assigned by the Texas Comptroller's office.

-

Not Identifying the Nature of the Business: Some applicants fail to describe their business activities adequately. Providing a clear description helps in assessing the application accurately.

-

Ignoring Additional Permit Requirements: Applicants sometimes overlook the need for additional permits or licenses required by local or state authorities. Research local regulations to ensure compliance.

-

Neglecting to Sign the Application: Failing to sign the application is a common mistake. The application must be signed by the appropriate individual, such as the sole owner or an authorized representative.

Key takeaways

When filling out the Texas Application for Non-Retailer Cigarette, Cigar and/or Tobacco Products Permit (Form AP-175), keep the following key takeaways in mind:

- Eligibility Requirements: Ensure that you meet the eligibility criteria. You must be a sole owner, partnership, corporation, or other organization intending to manufacture, import, wholesale, distribute, or store tobacco products in Texas.

- Correct Information: Provide accurate details, especially in the ownership and business location sections. Errors can lead to delays or denials in your application.

- Understand Definitions: Familiarize yourself with terms like "distributor," "importer," and "delivery sale." This understanding will help you correctly identify your business type and responsibilities.

- Timely Submission: Submit your application promptly to avoid penalties. Operating without a valid permit can result in fines up to $2,000 per day.

- Required Documentation: Be prepared to provide additional documentation, such as a lease agreement for your business location or proof of previous permits if applicable.

- Contact Information: If you have questions, reach out to the Comptroller’s office for assistance. Their website and hotline can provide valuable guidance.

Steps to Using Texas Ap 175

Completing the Texas Application for Non-Retailer Cigarette, Cigar and/or Tobacco Products Permit (Form AP-175) is essential for businesses intending to operate in this sector. Follow these steps carefully to ensure accurate submission and compliance with state regulations.

- Item 1: Enter the legal name of the owner. If you are a sole owner, provide your first name, middle initial, and last name. For partnerships, list the names of all partners. If a corporation, use the name registered with the Secretary of State.

- Item 2: Provide your complete mailing address. This is where you will receive correspondence from the Comptroller of Public Accounts.

- Item 6: If applicable, enter your Texas vendor identification number. Include only the first eleven digits.

- Item 7: Indicate the type of business ownership by checking the appropriate box (sole owner, partnership, corporation, etc.). If "Other," specify the type of organization.

- Item 11: Fill out information for sole owners, all partners, or principal officers. Include Social Security numbers or taxpayer identification numbers where applicable.

- Item 13: Enter the physical address of your business location. Ensure it is a commercial address; P.O. Boxes are not acceptable.

- Item 22: If you are an importer, provide your permit number(s) issued by the Department of Treasury for importing tobacco products.

- Item 34: All required signatures must be provided by the sole owner, partners, or officers. Ensure that the application is dated appropriately.

Once you have completed the form, review it for accuracy. Submit your application along with the required permit fee to the Comptroller of Public Accounts. This step is crucial to ensure you can legally operate your business and avoid penalties. Be proactive—address any questions or concerns before submission to facilitate a smooth approval process.