Blank Texas Ap 169 PDF Template

Form Example

Texas Application for Motor Vehicle

General Information

Who Must Submit This Application -

You must submit this application if you are a sole owner, partnership, corporation or other organization which intends to finance sales of motor vehicles

Applicants must hold a motor vehicle license issued by the Texas Department of Motor Vehicles.

Applicants should contact the Office of Consumer Credit Commissioner concerning a Motor Vehicle Dealer's Financing license.

For Assistance -

If you have questions about this application or any other

General Instructions -

•Please do not separate pages.

•Write only in white areas.

•Completed and signed application should be mailed to:

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX

Federal Privacy Act -

Disclosure of your Social Security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the address or phone numbers listed on this form.

Texas Application for Motor Vehicle

|

• |

Please read instructions. |

|

|

|

|

|

• Type or print. |

|

|

|

|

|

|

• Do NOT write in shaded areas. |

|

|

|

|

|

Page 1 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

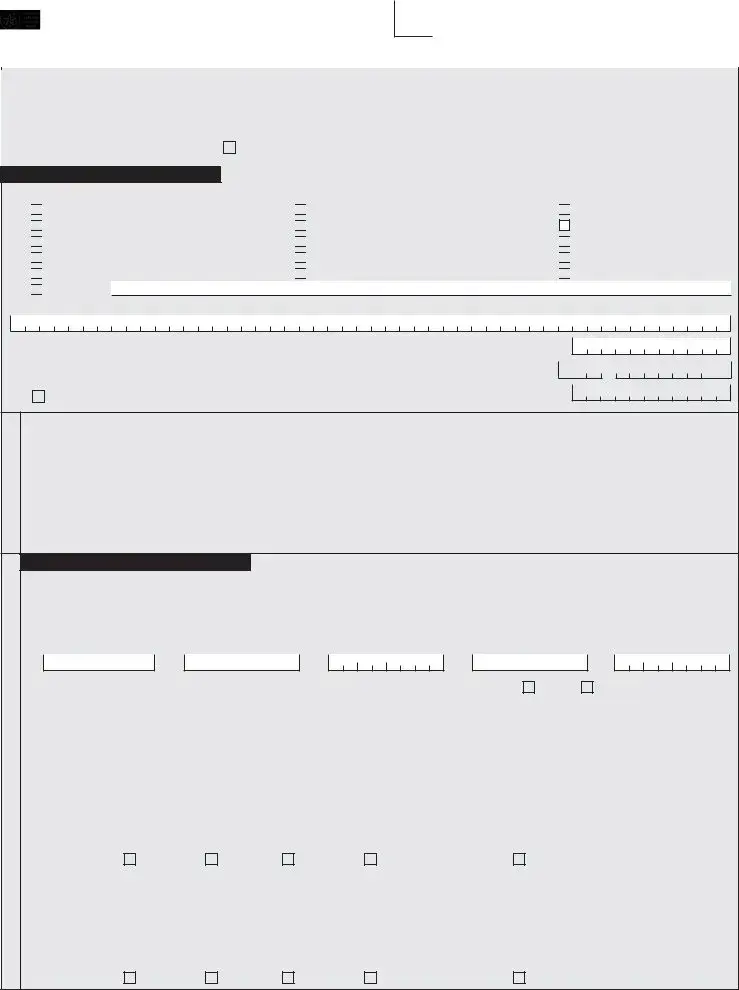

SOLE OWNER IDENTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

1. |

|

Name of sole owner (first name, middle initial and last name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

Social Security number (SSN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Taxpayer number for reporting any Texas tax OR Texas Identification |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check here if you DO NOT |

|

|

Number if you now have or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

have a SSN. |

|

|

have ever had one. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.Business organization type

Profit Corporation (CT, CF)

Profit Corporation (CT, CF)

Nonprofit Corporation (CN, CM)

Nonprofit Corporation (CN, CM)

Limited Liability Company (CL, CI)

Limited Liability Company (CL, CI)

Limited Partnership (PL, PF)

Limited Partnership (PL, PF)

Professional Corporation (CP, CU)

Professional Corporation (CP, CU)

Other (explain)

Other (explain)

General Partnership (PB, PI)

General Partnership (PB, PI)

Professional Corporation (AP,AF)

Professional Corporation (AP,AF)

Business Association (AB, AC)

Business Association (AB, AC)

Joint Venture (PV, PW)

Joint Venture (PV, PW)

Holding Company (HF)

Holding Company (HF)

Business Trust (TF)

Business Trust (TF)

Trust (TR) Please submit a copy of the trust agreement with this application.

Real Estate Investment Trust (TH, TI)

Real Estate Investment Trust (TH, TI)

Joint Stock Company (ST, SF)

Joint Stock Company (ST, SF)

Estate (ES)

Estate (ES)

5.Legal name of partnership, company, corporation, association, trust or other

6.Taxpayer number for reporting any Texas tax OR Texas Identification Number if you now have or have ever had one.

7. Federal Employer Identification Number (FEIN) assigned by the Internal Revenue Service ................................

1

8. |

|

...............................................................................................................Check here if you do not have an FEIN. |

3

BUSINESS INFORMATION

TAXPAYER INFORMATION

9. |

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Street number, P.O. Box or rural route and box number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State/province |

|

|

ZIP code |

|

County (or country, if outside the U.S.) |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Name of person to contact regarding day to day business operations |

|

|

|

|

|

|

|

|

Daytime phone |

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you are a SOLE OWNER, skip to Item 16.

11. If the business is a Texas profit corporation, nonprofit corporation, professional corporation |

File number |

|

month day |

|

year |

||||||||

or limited liability company, enter the file number issued by the Texas Secretary of State |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|||

and date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12.If the business is a

State/country of inc.Charter numbermonth day year Texas Certificate of Authority number month day year

13. If the business is a corporate entity, have you been involved in a merger within the last seven years? |

|

|

YES |

|

|

|

NO |

If "YES," attach a |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

detailed explanation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

14. If the business is a limited partnership or registered limited liability |

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

partnership, enter the home state and registered identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

15. Enter information for all partners - Attach additional sheets, if necessary. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

*If a general partner is an individual, enter the SSN of the individual. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone (area code and number) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

ZIP code |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

*SSN or FEIN |

|

|

|

|

|

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number |

|

|

|

|

State |

|

|

|

County (or country, if outside the U.S.) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

month |

day |

year |

|

|

|

Percent of |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ownership |

______ |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Position held: |

|

|

Partner |

|

|

Officer |

|

|

|

|

Director |

|

|

Corporate stockholder |

|

|

Record keeper |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone (area code and number) |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Home address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

ZIP code |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

*SSN or FEIN |

|

|

|

|

|

|

Date of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number |

|

|

|

|

State |

|

|

|

County (or country, if outside the U.S.) |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

month |

day |

year |

|

|

|

Percent of |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ownership |

______ |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Position held: |

|

|

Partner |

|

|

Officer |

|

|

|

|

Director |

|

|

Corporate stockholder |

|

|

Record keeper |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||

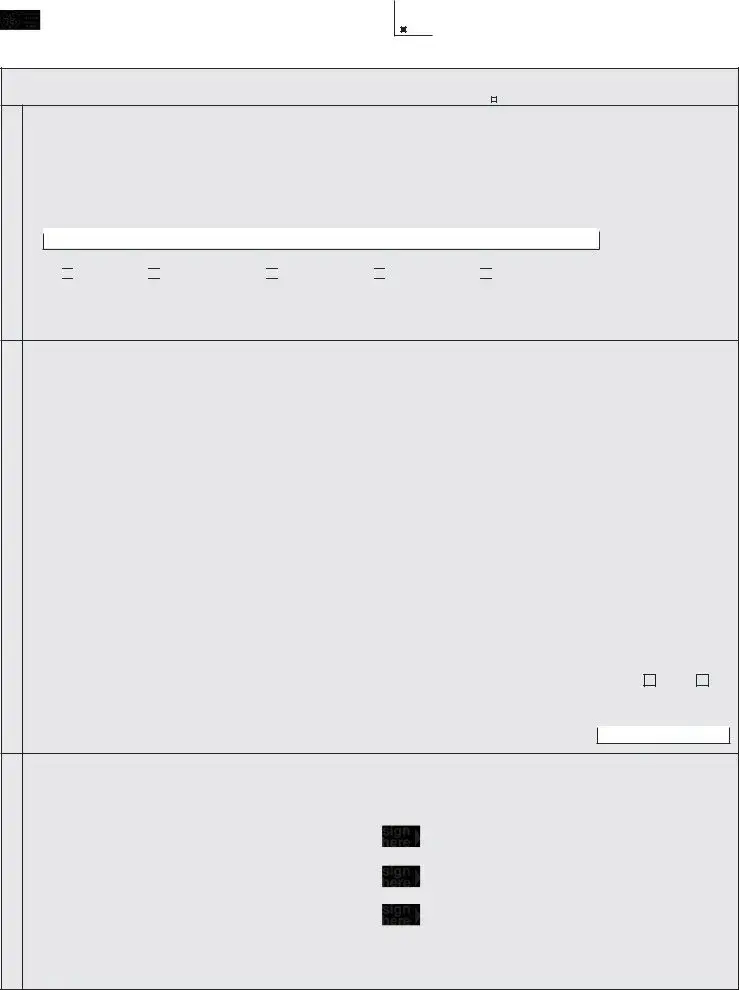

Texas Application for Motor Vehicle

• Please read instructions. |

• Type or print. |

• Do NOT write in shaded areas. |

Page 2 |

16. Legal name of owner (same as Item 1)

PREVIOUS OWNER INFORMATION

BUSINESS LOCATION AND INFORMATION

SIGNATURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

17. |

Enter the former owner's name. If known, enter the former owner's Texas taxpayer number. |

|

||||||||||||||||||||

|

Trade name |

|

|

|

|

|

|

Taxpayer number of former owner |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

Enter the former owner's legal name. If known, enter the former owner's address and telephone number. |

|

||||||||||||||||||||

|

Legal name of former owner |

Phone (area code and number) |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of former owner (street and number, city, state, ZIP code)

19. Check each of the following items you purchased.

Inventory

Inventory

Corporate stock

Corporate stock

Equipment

Equipment

Real estate

Real estate

Other assets 20. Enter the purchase price of the business or assets purchased and the date of purchase.

Other assets 20. Enter the purchase price of the business or assets purchased and the date of purchase.

|

Purchase price |

|

Date of purchase |

|

|

|

|

|

|

|

|

|

|

|

|

21. Enter the trade name, location and dealer number for all your places of business. (Attach additional sheets, if necessary.)

|

Trade name of your business |

|

|

|

|

|

|

|

|

|

|

|

Business phone (area code and number) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of your business (Use street and number or directions - NOT P.O. Box or rural route number.) |

|

|

Dealer number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

ZIP code |

County |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name of your business |

|

|

|

|

|

|

|

|

|

|

|

Business phone (area code and number) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Location of your business (Use street and number or directions - NOT P.O. Box or rural route number.) |

|

|

Dealer number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

ZIP code |

County |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trade name of your business |

|

|

|

|

|

|

|

|

|

|

|

Business phone (area code and number) |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Location of your business (Use street and number or directions - NOT P.O. Box or rural route number.) |

|

|

Dealer number |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

City |

State |

|

ZIP code |

County |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

22. Do you sell |

|

|

YES |

|

NO |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. Enter the dealer number for your primary location as assigned by the Texas Department of Motor Vehicles |

|

|

|

|

|

|

|

|

||||||||||||||

24.Enter the date of the first business operation in Texas subject to the

The sole owner, all general partners, corporation president, |

Date of application |

|

|

authorized representative must sign this application. Representative must submit a power of attorney with |

|

|

|

|

|

|

|

the application. (Attach additional sheets if necessary.) |

|

|

|

|

|

|

|

25. I (We) declare that the information in this document and any attachments is true and correct to the best of my (our) knowledge and belief.

Type or print name and title of sole owner, partner or officer |

|

Sole owner, partner or officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Type or print name and title of partner or officer |

|

Partner or officer |

|

|

|

|

|

|

|

|

|

Type or print name and title of partner or officer |

|

Partner or officer |

|

|

|

|

|

|

|

|

|

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online at http://www.Texas.gov. You may also want to contact the municipality and county in which you will conduct business to determine any local governmental requirements.

More PDF Templates

What Happens When a Deed of Trust Is Paid Off - The transfer of rights in the property is an important aspect of this form.

Texas Franchise Tax Threshold 2023 - The applicant must affirm that all answers are complete and truthful.

Common mistakes

-

Neglecting to Read Instructions: Many applicants overlook the importance of thoroughly reading the instructions provided with the Texas AP 169 form. This can lead to misunderstandings about what information is required and how to properly complete the form.

-

Writing in Shaded Areas: Some individuals mistakenly write in the shaded areas of the form, which are specifically designated as off-limits. This can result in the application being rejected or delayed.

-

Incorrectly Filling Out Identification Sections: Errors often occur in the identification sections, such as providing the wrong Social Security Number or failing to check the box indicating if one does not have an SSN. These mistakes can complicate the processing of the application.

-

Omitting Required Signatures: Failing to include the necessary signatures from all required parties, such as the sole owner or corporate officers, can lead to the application being incomplete. This oversight can significantly delay the approval process.

-

Providing Incomplete Business Information: Incomplete entries for business information, such as mailing address or contact details, are common mistakes. These omissions can hinder communication and the processing of the application.

-

Not Attaching Necessary Documentation: Applicants sometimes forget to include required documentation, such as a copy of the trust agreement if applicable. Missing documents can result in the application being returned or denied.

-

Failing to Include Previous Owner Information: When applicable, neglecting to provide information about a previous owner can lead to complications, especially if the business was purchased. This information is critical for the application’s accuracy.

-

Ignoring Contact Information: Many applicants do not provide a contact name or daytime phone number, making it difficult for the Texas State Comptroller's office to reach them for any clarifications or additional information needed.

Key takeaways

When filling out the Texas Application for Motor Vehicle Seller-Financed Sales Tax Permit (Form AP-169), it is essential to understand the key components and requirements. Here are ten important takeaways:

- Who Needs to Apply: This application is necessary for sole owners, partnerships, corporations, or any organizations intending to finance motor vehicle sales.

- Motor Vehicle License Requirement: Applicants must possess a motor vehicle license issued by the Texas Department of Motor Vehicles.

- Contact Information: For questions, reach out to the nearest Texas State Comptroller's office or call (800) 252-1382 or (512) 463-4600. Email assistance is also available at tax.help@cpa.state.tx.us.

- Mailing Instructions: Do not separate the pages of the application. Send the completed form to the Comptroller of Public Accounts at 111 E. 17th St., Austin, TX 78774-0100.

- Privacy Notice: Your Social Security number is required for tax administration purposes. This information is protected under federal and state privacy laws.

- Filling Out the Form: Write only in the white areas of the form. Avoid using shaded areas.

- Business Structure: Indicate the type of business organization you represent, such as a corporation, partnership, or limited liability company.

- Previous Ownership: If applicable, provide information about any previous owners and the assets purchased from them.

- Business Location: Clearly state the trade name, location, and dealer number for all business locations. Do not use P.O. Boxes for addresses.

- Signature Requirement: The application must be signed by the sole owner, general partners, or authorized representatives. A power of attorney is required if someone else is signing on behalf of the applicant.

By following these guidelines, applicants can ensure that their submission is complete and compliant with Texas regulations.

Steps to Using Texas Ap 169

Filling out the Texas Application for Motor Vehicle Seller-Financed Sales Tax Permit (Form AP-169) is essential for those intending to finance motor vehicle sales in Texas. Ensure you have all necessary information ready, as accuracy is crucial for a smooth application process. Follow the steps below to complete the form correctly.

- Begin with the SOLE OWNER IDENTIFICATION section:

- Enter the name of the sole owner, including first name, middle initial, and last name.

- Provide the Social Security number (SSN).

- If applicable, include the taxpayer number for Texas tax reporting or check the box if you do not have an SSN.

- For NON-SOLE OWNER IDENTIFICATION, complete the following:

- Select the type of business organization from the options provided.

- Input the legal name of the business entity.

- Provide the taxpayer number for Texas tax reporting or check the box if you do not have one.

- Enter the Federal Employer Identification Number (FEIN) if applicable, or check the box if you do not have one.

- In the BUSINESS INFORMATION section:

- List the mailing address, including street number, city, state, ZIP code, and county.

- Provide the name and daytime phone number of the contact person for day-to-day operations.

- If applicable, enter the file number and date for Texas corporations or LLCs.

- If the business is not based in Texas, provide the state or country of incorporation, charter number, and dates.

- Indicate if the business has been involved in a merger in the last seven years and attach an explanation if "YES."

- For limited partnerships, provide the home state and registered identification number.

- List information for all partners, including names, titles, contact information, SSN or FEIN, date of birth, and ownership percentages.

- In the PREVIOUS OWNER INFORMATION section:

- If applicable, enter the former owner's name and taxpayer number.

- Provide the legal name and contact details of the former owner.

- Check all items purchased from the previous owner.

- Enter the purchase price and date of purchase.

- For BUSINESS LOCATION AND INFORMATION:

- List the trade name, business phone number, location, and dealer number for each business location.

- Indicate if you sell diesel-powered motor vehicles exceeding 14,000 pounds.

- Provide the dealer number assigned by the Texas Department of Motor Vehicles.

- Enter the date of first business operation in Texas subject to the Seller-Financed Motor Vehicle Receipts Tax.

- Finally, in the SIGNATURES section:

- Ensure the application is signed by the sole owner, all general partners, or corporate officers.

- Type or print the names and titles of all signers.

After completing the form, review all entries for accuracy. Mail the signed application to the Comptroller of Public Accounts at the address provided in the instructions. Ensure you retain a copy for your records. If you have any questions, contact the Texas State Comptroller's office for assistance.