Blank Texas Ap 146 PDF Template

Form Example

Texas Original Application for

Registration Certificate and Tax Permit(s)

Instructions

General Instructions –

•Do not write in shaded areas.

•Do not separate pages.

•Enter actual location address when requested. Do not enter P.O. Box or rural route (Item 13).

•The registration certificate fee and the occupation tax due for your machine tax permits must be submitted with this application. Permits must be securely affixed to the machine and in a manner that can be clearly seen by the public. Payment must be made payable to the State Comptroller.

•Do not send cash.

Specific Instructions –

•Complete the Texas

•A computer printout of your machine inventory, or the completed supplement, Form

•Each machine listed for the location shown in this application must be registered with the Comptroller by:

a.serial number/inventory I.D. number

b.make or manufacturer

c.type

•If you purchase additional machines during the year, you must file the Application For Additional

•Each time a machine is moved to a different location, within 10 days of the move, the holder of the Registration Certificate must notify the Comptroller in writing or file the Machine Location Amendment for Registration Certificate Holders, Form

•Current calendar year tax permits can be transferred with the sale of a machine by filing a

•Registration Certificates and permits expire December 31 of each year, and renewals are due November 30 of each year. If the due date falls on a Saturday, Sunday or legal holiday, the next business day will be the due date.

•If you purchase a machine from an

•A registration certificate holder may make one or two sales of

•Disclosure of information concerning date of birth and Social Security number is required.

Registration Certificate Fee – $150.00 – Annually

•This fee cannot be prorated.

•This application must be submitted by any person (sole owner, partnership, corporation or other group) that intends to engage in business to own or operate

•If you regularly sell machines as a part of your business, you are not qualified to hold a Registration Certificate and you must apply for a General Business License or an Import License, using Form

•A registration certificate cannot be issued to anyone indebted to the State of Texas for any fees, costs or penalties, or to anyone currently delinquent in the payment of any tax collected by the Comptroller.

Completed application and payment should be mailed to: Comptroller of Public Accounts 111 E. 17th St.

Austin, TX

For Assistance – If you have any questions about this application, contact your nearest Texas State Comptroller’s field office or call us at (800)

Federal Privacy Act – Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the address or phone numbers listed on this form.

Below is a listing of taxes and fees collected by the Comptroller of Public Accounts. If you are responsible for reporting or paying one of the listed taxes or fees, and you do not have a permit or an account with us for this purpose, please obtain the proper application by calling (800)

TAX TYPE(S)

Automotive Oil Sales Fee - If you manufacture and sell automotive oil in Texas; or you import or cause automotive oil to be imported into Texas for sale, use or consumption; or you sell more than 25,000 gallons of automotive oil annually and you own a warehouse or distri- bution center located in Texas, you must complete Form

Battery Sales Fee - If you sell or offer to sell new or used lead acid batteries, you must complete Form

Cement Production Tax - If you manufacture or produce cement in Texas, or you import cement into Texas and you distribute or sell cement in intrastate commerce or use the cement in Texas, you must complete Form

Cigarette, Cigar and/or Tobacco Products Tax - If you wholesale, distribute, store or make retail sales of cigarettes, cigars and/or tobacco products, you must complete Form

Coastal Protection Fee - If you transfer crude oil and condensate from or to vessels at a marine terminal located in Texas, you must complete Form

Crude Oil and Natural Gas Production Taxes - If you produce and/ or purchase crude oil and/or natural gas, you must complete Form

Direct Payment Permit - If you annually purchase at least $800,000 worth of taxable items for your own use and not for resale, you must complete Form

Fireworks Tax - If you collect tax on the retail sale of fireworks, you must complete Form

Franchise Tax - If you are a general partnership or a

Fuels Tax - If you are required to be licensed under Texas Fuels Tax Law for the type and class permit required, you must complete Form

Gross Receipts Tax - If you provide certain services on oil and gas wells OR are a utility company located in an incorporated city or town having a population of more than 1,000 according to the most recent federal census and intend to do business in Texas, you must complete Form

Hotel Occupancy Tax - If you provide sleeping accommodations to the public for a cost of $15 or more per day, you must complete Form

International Fuel Tax Agreement (IFTA) - If you operate qualified motor vehicles which require you to be licensed under the International Fuel Tax Agreement, you must com- plete Form

Manufactured Housing Sales Tax - If you are a manufacturer of manufactured homes or industrialized housing engaged in business in Texas, you must complete Form

Maquiladora Export Permit - If you are a maquiladora enterprise and wish to make

Motor Vehicle

Motor Vehicle Gross Rental Tax - If you rent motor vehicles in Texas, you must complete Form

Petroleum Products Delivery Fee - If you are required to be licensed under Texas Water Code, sec. 26.3574, you must complete Form

Sales and Use Tax - If you engage in business in Texas, AND you sell or lease tangible personal property or provide taxable services in Texas to customers in Texas, and/or you acquire tangible personal property or taxable services from

Sulphur Production Tax - If you own, control, manage, lease or operate a sulphur mine, well or shaft or produce sulphur by any method, system or manner, you must complete Form

Telecommunications Infrastructure Fund - If you are a tele- communications utility company or a mobile service provider who collects and pays taxes on telecommunications receipts under Texas Tax Code, Chapter 151, you must complete Form

Texas Customs Broker License - If you have been licensed by the United States Customs Service AND want to issue export certifications, you must complete Form

|

Texas Original Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Registration Certificate and Tax Permit(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

• Please read instructions. |

• Type or print. |

• Do NOT write in shaded areas. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Answer these questions before completing the application. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

I. Do you operate or exhibit your machines exclusively in your own place of business which may be owned, leased or rented? |

|

|

YES |

|

|

|

NO |

||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||

If “NO,” stop here. You must apply for a General Business License (Use Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

II. Do you own and operate any |

|

|

|

YES |

|

|

|

NO |

|||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||||

III. Do you have any financial interest, direct or indirect, in the |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

(For example: manufacture, own, buy, sell, rent, lease, trade, repair, maintain, service, import, transport or exhibit coin- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

.............operated machines within the state, other than the machine(s) owned and operated by you in your place of business.) |

|

|

YES |

|

|

NO |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

If you answered “YES” to Items II or III above, stop here. You must apply for a General Business License. |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

(Use Form |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

This application is for calendar year |

_______________________ |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. Texas Comptroller’s taxpayer number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

........................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2.Legal name of owner (sole owner, partnership, corporation or other name)

3.Mailing address (street number and name, P.O. Box or rural route and box number)

|

|

City |

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

INFORMATION |

6. Enter your Federal Employer Identification Number (FEIN), if any |

........................................................... |

|

|

|

|

|

|

|

|

|

... |

( |

|

|

|

|

|

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

4. Enter the daytime phone number of the person primarily responsible for filing tax returns. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

TAXPAYER |

. ...............................................................5. Enter your Social Security number if you are a sole owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

.....7. If you are incorporating an existing business, enter the taxpayer number of the existing business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

8. Enter your taxpayer number for reporting any Texas tax OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

your Texas Vendor Identification Number if you now have or have ever had one |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

9. Indicate how your business is owned. |

|

|

|

1 - Sole owner |

|

|

|

|

|

|

|

|

|

|

2 - Partnership |

|

|

|

|

|

|

3 - Texas corporation |

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 - Limited partnership |

|

Foreign corporation |

|

|

|

|

|

|

|

|

Other (explain) |

___________________________________ |

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charter, file or COA date |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

State |

|

|

Texas Secretary of State file number or COA number |

month |

day |

year |

|

|||||||||||||||||||||||||||

|

10. If this business is a corporation, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home state |

Identification number |

|

|

|

|

|

||||||||||||

|

11. If your business is a limited partnership, enter the home state and identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

– All applicants |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Complete the Texas |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

|

(If business location address is a rural route and box number, provide directions or use |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

12. Trade name of business/machine location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business phone (area code and number) |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

13. Location of business/machine location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas Original Application |

|

|

|

|

|

||

for |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

Registration Certificate and Tax Permit(s) |

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|||||

• Please read instructions. |

• Type or print. |

|

|

|

• Do NOT write in shaded areas. |

Page 2 |

||

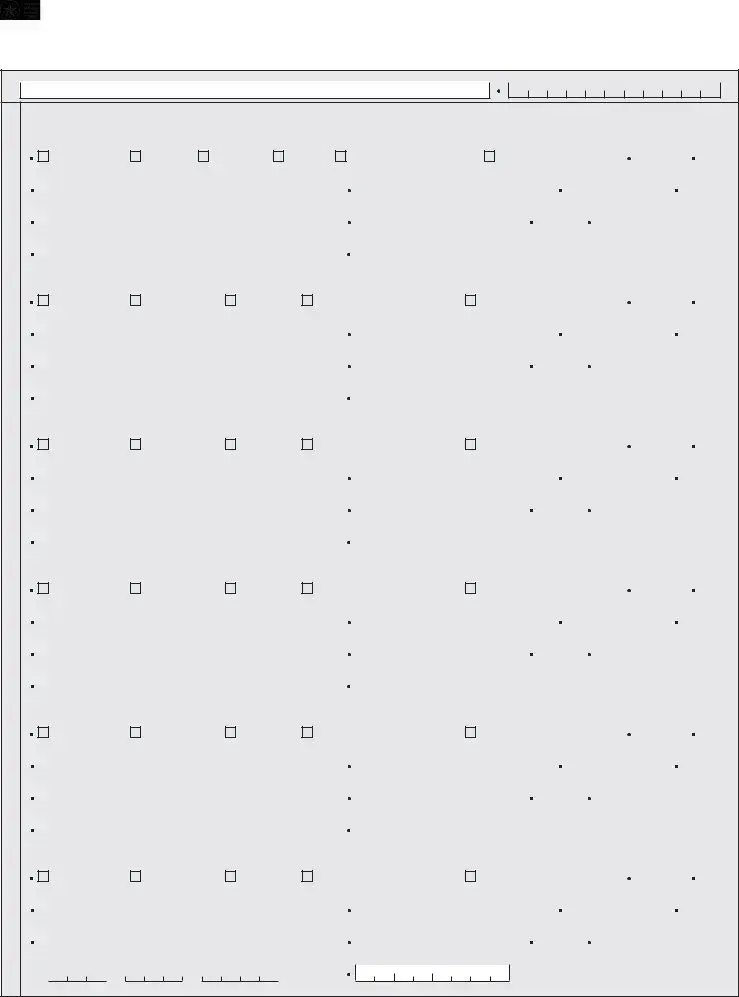

Legal name (same as Item 2)

APPLICANT INFORMATION

14. Check the applicable boxes and complete the information below:

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

|||

|

Sole owner |

|

|

Partner |

|

|

|

|

Director |

|

|

Officer |

|

Corporate stockholder |

|

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|

|

|

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

||

|

Partner |

|

|

Director |

|

|

|

|

|

|

|

|

|

Officer |

|

|

Corporate stockholder |

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

||

|

Partner |

|

|

Director |

|

|

|

|

|

|

|

|

|

Officer |

|

|

Corporate stockholder |

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

||

|

Partner |

|

|

Director |

|

|

|

|

|

|

|

|

|

Officer |

|

|

Corporate stockholder |

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

||

|

Partner |

|

|

Director |

|

|

|

|

|

|

|

|

|

Officer |

|

|

Corporate stockholder |

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

( |

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Position |

(Check all applicable boxes.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage of ownership or |

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

corporate |

|

|

|

|

|

||

|

Partner |

|

|

Director |

|

|

|

|

|

|

|

|

|

Officer |

|

|

Corporate stockholder |

|

|

|

Record keeper |

% |

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

stock held |

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Name (last, first, middle initial) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver license number and state |

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home address (street) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP code |

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Daytime phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date of birth (mmddyyyy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

(

(  )

)  -

-

|

Texas Original Application |

|

|

|

|

|

||

for |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

Registration Certificate and Tax Permit(s) |

|

|

|

|

|

||

|

|

|

|

|

|

|||

|

|

|

|

|

|

|||

|

|

|

|

|||||

• Please read instructions. |

• Type or print. |

|

|

|

• Do NOT write in shaded areas. |

Page 3 |

||

Legal name (same as Item 2)

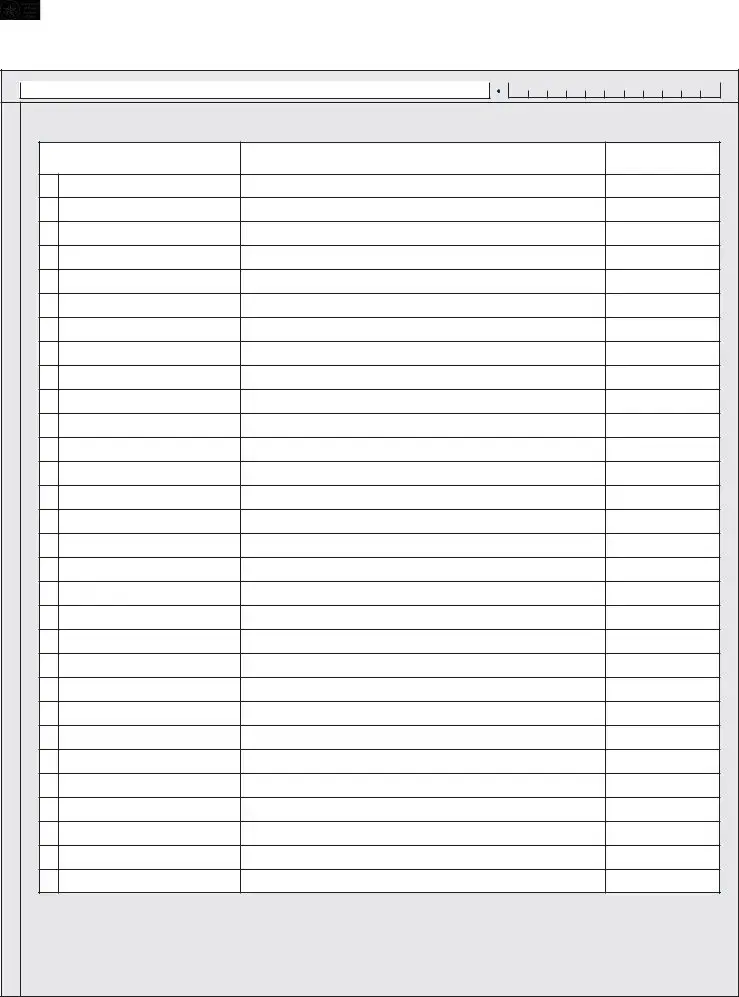

MACHINE INFORMATION

15.For each machine at this location (Item 13) requiring a permit, list the serial number/inventory I.D. number, machine make and machine type. For each additional location, complete a separate Machine Inventory Supplement for Registration Certificate Holder, Form

MACHINE SERIAL |

MACHINE MAKE |

MACHINE TYPE CODE |

|

NUMBER/INVENTORY |

OR |

||

(Use letter codes from Item 16) |

|||

I.D. NUMBER |

MANUFACTURER |

||

|

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

20.

21.

22.

23.

24.

25.

26.

27.

28.

29.

30.

16. Enter the number of each type of music, skill or pleasure

– A – |

– B – |

– C – |

– D – |

– E – |

– F – |

PHONOGRAPHS |

POOL TABLES |

PINBALL GAMES |

VIDEO GAMES |

DARTS |

OTHER |

|

|

|

|

|

|

....................................................................17. Total number of machines in all locations that require tax permits. (Total of Item 16 A - F) |

_______________________ |

|

Texas Original Application |

|

|

|

|

|

||

for |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||

|

Registration Certificate and Tax Permit(s) |

|

|

|

|

Page 4 |

||

|

|

|

|

|

||||

|

|

|

|

|

||||

• Please read instructions. |

• Type or print. |

|

|

|

• Do NOT write in shaded areas. |

|||

Legal name (same as Item 2)

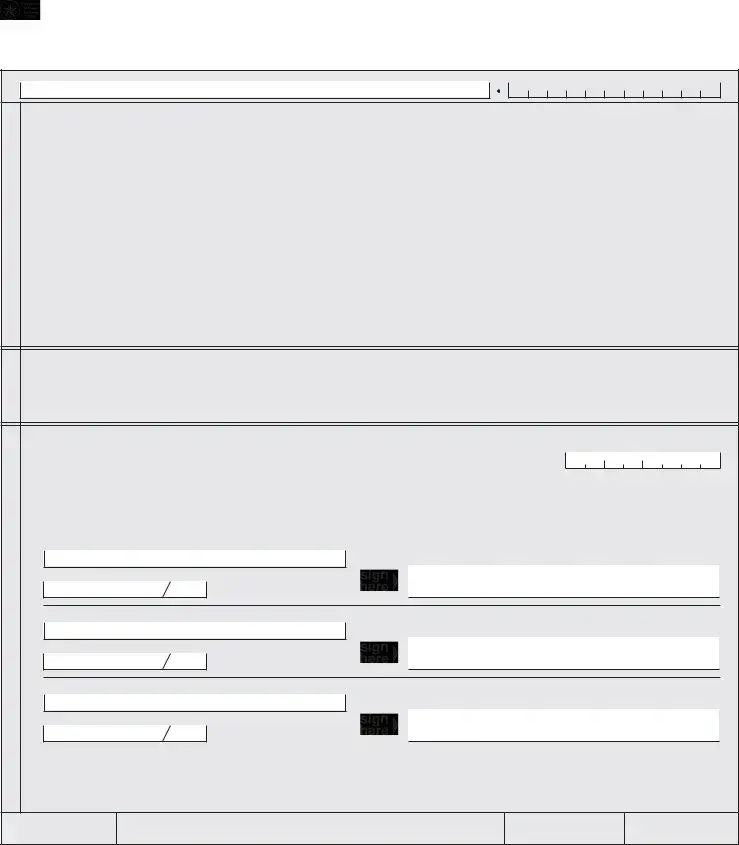

INFORMATIONPAYMENTOCCUPATION TAX CALCULATION

STATEMENT

When you calculate the occupation tax due on your

Occupation Tax Permits

Tax Rate Schedule for Each

1st quarter (January - March) |

$60.00 |

3rd quarter (July - September) |

$30.00 |

2nd quarter (April - June) |

$45.00 |

4th quarter (October - December) |

$15.00 |

18.Calculate the occupation tax due for all machines placed on location during this application year. Multiply the total number of machines placed on location for the first time in the appropriate calendar quarter by the rate for that quarter.

a. |

1st quarter: |

_______________ |

machines at $60.00 each = $ |

________________ |

b. |

2nd quarter: |

_______________ |

machines at $45.00 each = $ |

________________ |

c. |

3rd quarter: |

_______________ |

machines at $30.00 each = $ |

________________ |

d. |

4th quarter: |

_______________ |

machines at $15.00 each = $ |

________________ |

...........................................................................................19. TOTAL OCCUPATION TAX DUE (total Items 18a, b, c and d) |

$ |

_________________ |

|

|

|

20. Amount due for Registration Certificate Fee |

$ |

150.00 |

|

|

|

21. Amount due for Occupation Tax Permits (from Item 19) |

$ |

_________________ |

|

|

|

22. TOTAL AMOUNT DUE (total Item 20 and Item 21) |

$ |

_________________ |

23. The sole owner, all general partners, corporation or organization president, |

Date of signature |

|

|

treasurer, managing director or an authorized representative must sign. A representative must submit a |

month |

day |

year |

|

|

|

|

written power of attorney.

The law provides that a person who knowingly secures or attempts to secure a license by fraud, misrepresentation or subterfuge is guilty of a second degree felony and upon conviction is punishable by confinement for two (2) to twenty (20) years and a fine up to $10,000. (Occupations Code §2153.357; Penal Code §12.33)

I (We) declare that the information in this document and any attachments is true and correct to the best of my (our) knowledge and belief.

Type or print name and title of sole owner, partner or officer

Sole owner, partner or officer

Driver license number / state

Type or print name and title of partner or officer

Partner or officer

Driver license number / state

Type or print name and title of partner or officer

Partner or officer

Driver license number / state

WARNING. You may be required to obtain an additional permit or license from the State of Texas or from a local governmental entity to conduct business. A listing of links relating to acquiring licenses, permits, and registrations from the State of Texas is available online at http://www.Texas.gov. You may also want to contact the municipality and county in which you will conduct business to determine any local governmental requirements.

Field office number

E.O. name

User ID

Date

More PDF Templates

Texas Boat Transfer Form - Understanding the contents of the form is key to responsible ownership of marine equipment.

How to Get a Driver's License in Texas - An applicant’s sponsoring attorney or business name must be provided.

Ifta Paperwork - Make checks payable to the Texas Comptroller of Public Accounts to ensure proper processing of your payment.

Common mistakes

-

Incorrect Address Entry: One common mistake is entering a P.O. Box or rural route instead of the actual physical location address in Item 13. This can lead to delays or rejection of the application, as the Texas Comptroller requires a valid street address.

-

Payment Errors: Applicants often fail to submit the correct payment along with their application. The registration certificate fee is $150.00, and it must be paid via check or money order made out to the State Comptroller. Sending cash is not allowed, which can result in processing issues.

-

Incomplete Machine Inventory: Some individuals neglect to provide a complete inventory list of their machines. Each machine must be listed with its serial number, make, and type. Omitting any of this information can lead to complications in the registration process.

-

Failure to Update Ownership Information: If there are changes in ownership or corporate structure, applicants often forget to file the necessary updates. This includes submitting the Texas Coin-Operated Machine Ownership Statement, Form AP-138, to reflect any new owners or partners. Not doing so can affect the validity of the registration certificate.

Key takeaways

The Texas AP-146 form is essential for individuals or businesses that wish to register coin-operated machines in Texas.

Do not write in shaded areas of the form, as these sections are reserved for official use.

Provide the actual location address of your business when prompted. Avoid using P.O. Box or rural route addresses.

Include the registration certificate fee of $150 and any applicable occupation taxes when submitting the application. Payments should be made out to the State Comptroller and cash should not be sent.

Complete the Texas Coin-Operated Machine Ownership Statement, Form AP-138, as part of your application process.

Each machine must be registered with specific details, including serial number, make, and type.

If additional machines are acquired during the year, submit Form AP-141 to request additional tax permits.

Notify the Comptroller within 10 days if a registered machine is relocated, using Form AP-142.

Registration certificates and permits expire on December 31 each year, with renewals due by November 30.

Steps to Using Texas Ap 146

Filling out the Texas AP-146 form is an essential step for individuals or businesses looking to register coin-operated machines. The following steps will guide you through the process to ensure that you complete the application accurately and efficiently.

- Begin by reading all instructions carefully, ensuring you understand the requirements.

- Do not write in shaded areas on the form.