Blank Texas Ap 114 PDF Template

Form Example

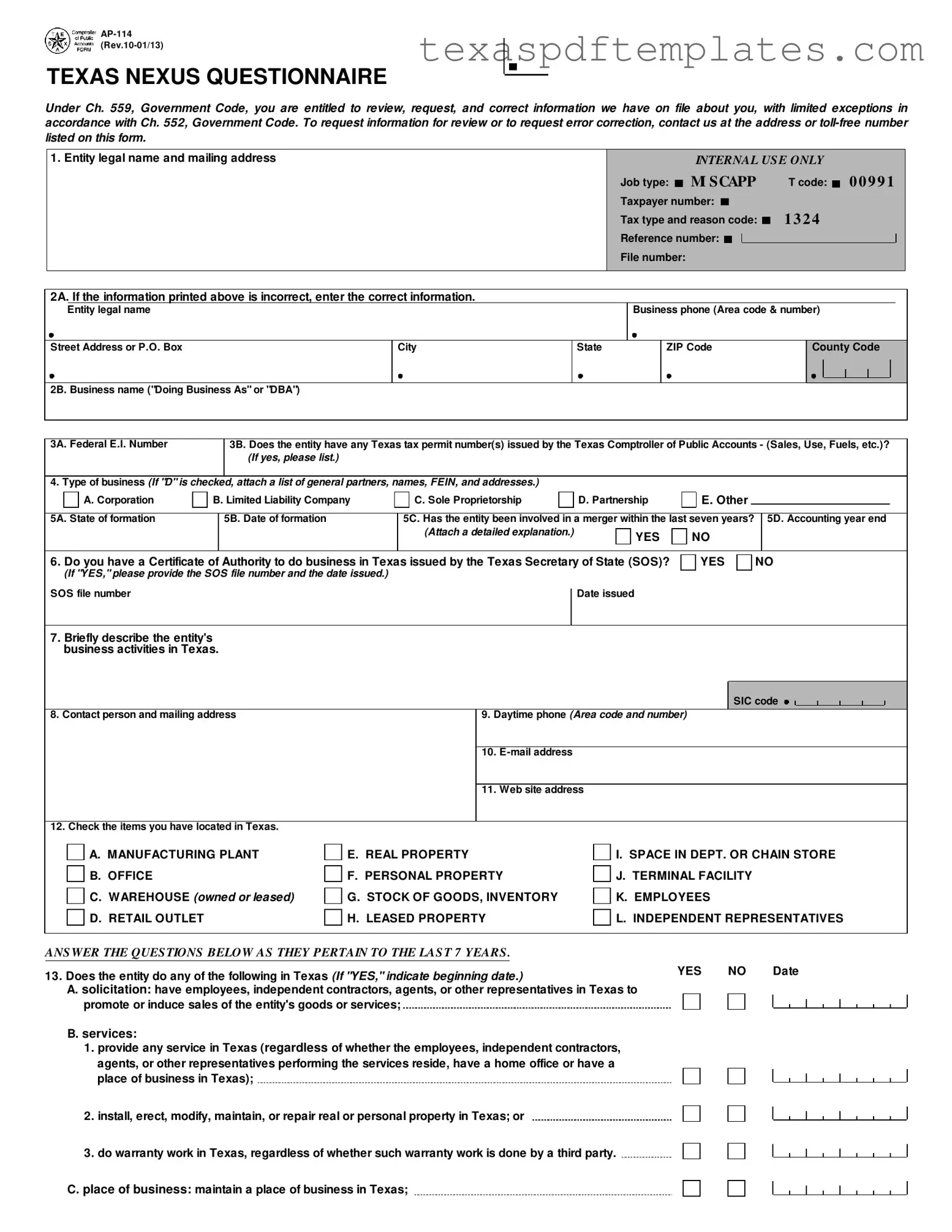

TEXAS NEXUS QUESTIONNAIRE

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or

|

1. Entity legal name and mailing address |

|

INTERNAL US E ONLY |

|||

|

|

Job type: |

MI SCAPP |

T code: 0 0 9 9 1 |

||

|

|

Taxpayer number: |

|

|

||

|

|

Tax type and reason code: |

1 3 2 4 |

|

||

|

|

|

|

|

||

|

|

Reference number: |

|

|

|

|

|

|

File number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2A. If the information printed above is incorrect, enter the correct information. |

|

|

|

|

|

Entity legal name

Business phone (Area code & number)

Street Address or P.O. Box

City

State

ZIP Code

County Code

2B. Business name ("Doing Business As" or "DBA")

3A. Federal E.I. Number

3B. Does the entity have any Texas tax permit number(s) issued by the Texas Comptroller of Public Accounts - (Sales, Use, Fuels, etc.)? (If yes, please list.)

4. Type of business (If "D" is checked, attach a list of general partners, names, FEIN, and addresses.)

|

|

A. Corporation |

|

B. Limited Liability Company |

|

C. Sole Proprietorship |

|

D. Partnership |

|

|

|

E. Other |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

5A. State of formation |

|

|

5B. Date of formation |

5C. Has the entity been involved in a merger within the last seven years? |

5D. Accounting year end |

|||||||||||||

|

|

|

|

|

|

|

(Attach a detailed explanation.) |

|

|

YES |

|

|

NO |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.Do you have a Certificate of Authority to do business in Texas issued by the Texas Secretary of State (SOS)?

(If "YES," please provide the SOS file number and the date issued.)

SOS file number |

Date issued |

|

|

YES

NO

7. Briefly describe the entity's business activities in Texas.

SIC code

8. Contact person and mailing address |

9. Daytime phone (Area code and number) |

|

|

|

|

|

10. |

|

|

|

|

|

11. |

Web site address |

|

|

|

12. Check the items you have located in Texas. |

|

|

A.MANUFACTURING PLANT

B.OFFICE

C.WAREHOUSE (owned or leased)

D.RETAIL OUTLET

E.REAL PROPERTY

F.PERSONAL PROPERTY

G.STOCK OF GOODS, INVENTORY

H.LEASED PROPERTY

I.SPACE IN DEPT. OR CHAIN STORE

J.TERMINAL FACILITY

K.EMPLOYEES

L.INDEPENDENT REPRESENTATIVES

ANS WER THE QUES TIONS BELOW AS THEY PERTAIN TO THE LAS T 7 YEARS .

13. Does the entity do any of the following in Texas (If "YES," indicate beginning date.) |

YES |

NO |

Date |

|||||

|

|

|

|

|

|

|

|

|

A. solicitation: have employees, independent contractors, agents, or other representatives in Texas to |

|

|

|

|

|

|

|

|

promote or induce sales of the entity's goods or services; |

|

|

|

|

|

|

|

|

B.services:

1.provide any service in Texas (regardless of whether the employees, independent contractors,

agents, or other representatives performing the services reside, have a home office or have a place of business in Texas);

2. install, erect, modify, maintain, or repair real or personal property in Texas; or

3. do warranty work in Texas, regardless of whether such warranty work is done by a third party.

C. place of business: maintain a place of business in Texas;

Form

YES NO Date

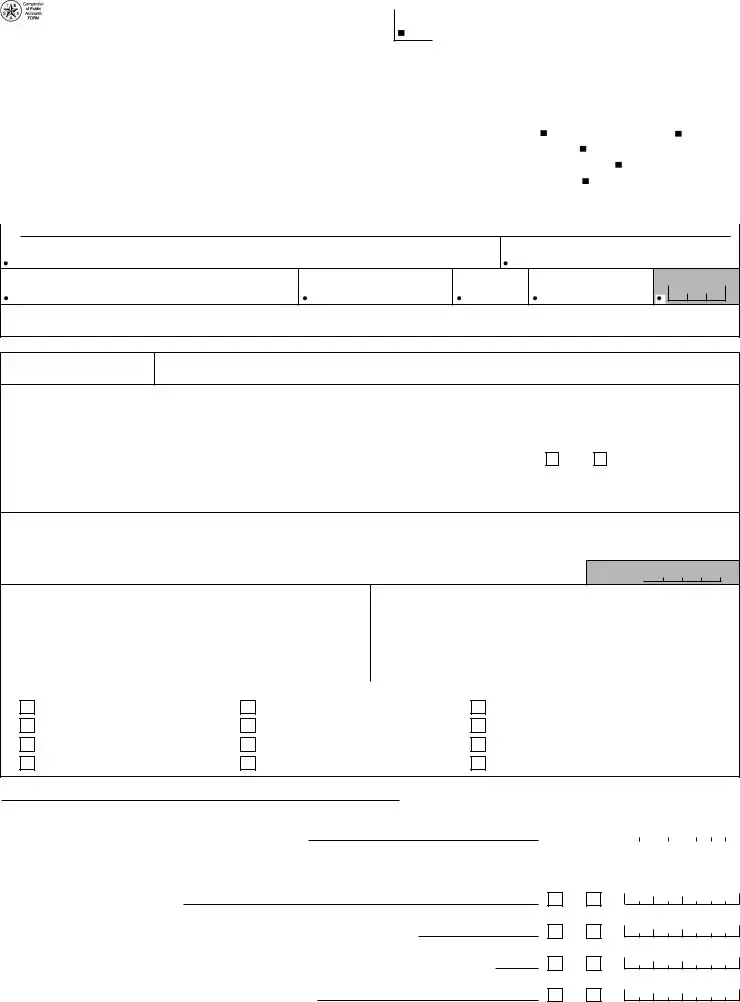

13.(Continued)

D. partners: act as a general partner in a general or limited partnership which is doing business in Texas;

E. contracting: perform a contract in Texas regardless of whether the entity brings its own employees into the state, hires local labor, or subcontracts with another;

F. inventory: have inventory in Texas;

G. real estate: hold, acquire, lease, or dispose of any property located in Texas;

H. shows: the staging of shows or other events in Texas;

I.transportation:

1. carry passengers or property in Texas if both pickup and delivery occur within Texas; or

2.have facilities and/or employees, independent contractors, agents, or other representatives in Texas for storage, delivery, or shipment of goods; for servicing, maintaining, or repairing of vehicles or other

equipment; for coordinating and directing the transportation of passengers or property; or for doing other business of the corporation/LLC;

J. franchisers: enter into one or more contracts with persons or other business entities located in Texas, by which:

1. the franchisee is granted the right to engage in the business of offering, selling, or distributing goods or services under a marketing plan or system prescribed in substantial part by the franchiser; and

2.the operation of a franchisee's business pursuant to such plan is substantially associated with the franchiser's trademark, service mark, trade name, logotype, advertising, or other commercial symbol

designating the franchiser or its affiliate;

K. processing: assemble, process, manufacture, or store goods in Texas;

L. advertising: enter Texas to purchase, place, or display advertising when the advertising is for the benefit of another;

M. processing and shipment: send materials to a Texas manufacturer, processor, repairer, or printer to be processed and stored in completed form awaiting orders for their shipment;

N. loan production activities: solicit sales contracts or loans, gather financial data, make credit checks, or perform other financial activities in Texas through employees, independent contractors, agents, or other representatives;

O. holding companies: maintain a place of business in Texas or manage direct, and/or perform services in Texas for subsidiaries or investee corporations/LLCs;

P. federal enclaves: do business in any area within Texas, even if the area is leased by, owned by, ceded to, or under the control of the federal government;

Q. consignments: have consigned goods in Texas;

R. delivering: deliver into Texas items it has sold, in company vehicles;

S. leasing: lease tangible personal property that is used in Texas.

Remarks:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Authorized signature (Officer, director, authorized agent)

Date

Type or print name

Title

PROVIDING COMPLETE AND ACCURATE BUSINESS INFORMATION WILL EXPEDITE

THE PROCESSING OF YOUR QUESTIONNAIRE.

Please return the questionnaire to: Texas Comptroller of Public Accounts 111 E. 17th Street

Austin, TX

For assistance, call

(TDD), the toll free number is

More PDF Templates

Texas De Brazil Delivery - Consider your decision regarding the Jury Waiver Agreement seriously.

Free Printable Dl-43 Form - Applicants must describe their duties in the security role they are applying for.

Employment Verification Letter Template - Clear instructions on completing the form help avoid common mistakes and omissions.

Common mistakes

-

Incorrect Entity Information: Many individuals fail to verify the entity's legal name and mailing address. This can lead to confusion and delays in processing.

-

Missing Business Name: When a "Doing Business As" (DBA) name is applicable, it is often overlooked. Providing this information is crucial for accurate identification.

-

Omitting Tax Permit Numbers: Some applicants forget to include any Texas tax permit numbers issued by the Texas Comptroller. Listing these is essential for compliance.

-

Incorrect Dates: Entering the wrong date of formation or merger can lead to complications. Double-checking these dates is a simple yet important step.

-

Neglecting Business Activities: Failing to provide a clear description of the entity's business activities in Texas can hinder the review process. This section should be detailed and accurate.

-

Missing Contact Information: Applicants sometimes forget to include a daytime phone number or email address. Providing this information ensures that communication can occur smoothly.

-

Inaccurate Responses to Questions: Responding incorrectly to questions about activities in Texas, such as solicitation or inventory, can lead to misunderstandings. Careful consideration of each question is necessary.

-

Failure to Attach Required Documents: When applicable, not attaching lists of partners or detailed explanations can cause delays. Ensure all necessary documents are included.

-

Not Signing the Form: Some individuals forget to sign the form. An authorized signature is required to validate the information provided.

Key takeaways

Here are some key takeaways about filling out and using the Texas AP-114 form:

- The AP-114 form is known as the Texas Nexus Questionnaire.

- It is important to provide the entity legal name and mailing address accurately at the top of the form.

- If any information is incorrect, make sure to correct it in section 2A.

- List any Texas tax permit numbers you may have in section 3B.

- Indicate the type of business in section 4, selecting from options like corporation, LLC, or partnership.

- Provide the state and date of formation in section 5.

- Section 6 asks if you have a Certificate of Authority to do business in Texas; provide the file number if applicable.

- In section 7, briefly describe your business activities in Texas, including the relevant SIC code.

- Section 12 requires checking off items you have located in Texas, such as offices, warehouses, or employees.

- Complete the declaration at the end of the form, ensuring all information is true and correct.

Be sure to return the completed form to the Texas Comptroller of Public Accounts at the specified address. For assistance, a toll-free number is available for inquiries.

Steps to Using Texas Ap 114

Completing the Texas AP-114 form requires careful attention to detail and accurate information about your business activities in Texas. After filling out the form, you will need to submit it to the Texas Comptroller of Public Accounts, ensuring that all required information is included to avoid delays in processing.

- Begin with the entity's legal name and mailing address in the designated fields at the top of the form.

- If any of the printed information is incorrect, provide the correct details in section 2A.

- List the business name, if applicable, in section 2B.

- Enter the Federal Employer Identification Number (E.I. Number) in section 3A.

- Indicate whether the entity has any Texas tax permit numbers by answering section 3B.

- Choose the type of business from the options provided in section 4.

- Fill out the state of formation and date of formation in sections 5A and 5B, respectively.

- Answer section 5C regarding any mergers within the last seven years.

- Provide the accounting year-end in section 5D, attaching a detailed explanation if necessary.

- Indicate whether you have a Certificate of Authority to do business in Texas in section 6, and provide the SOS file number and date issued if applicable.

- Describe the entity's business activities in Texas in section 7, including the Standard Industrial Classification (SIC) code.

- Provide the contact person's name and mailing address in section 8.

- Enter the daytime phone number in section 9.

- Provide the email address in section 10 and the website address in section 11.

- Check all applicable items located in Texas in section 12.

- Answer the questions in section 13 regarding various business activities conducted in Texas, providing dates where applicable.

- Sign and date the form at the bottom, ensuring that the signature is from an authorized individual.

- Submit the completed form to the Texas Comptroller of Public Accounts at the address provided, ensuring that it is sent to the correct location.