Blank Texas 802 PDF Template

Form Example

Form

(Periodic Report – Nonprofit Corporation)

The attached form is drafted to meet minimal statutory filing requirements pursuant to the relevant code provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

Commentary

A nonprofit corporation is required by Section 22.357 of the Texas Business Organizations Code (BOC) to file a periodic report that lists the names and addresses of all directors and officers of the corporation. The Office of the Secretary of State may require a domestic nonprofit corporation or a foreign nonprofit corporation registered to transact business in this state to file a report not more than once every four years. The failure to file the report when due will result, after notice, in the involuntary termination of the domestic corporation or the revocation of the registration of the foreign corporation.

Please note that a document on file with the Secretary of State is a public record that is subject to public access and disclosure. When providing address information for a director or officer, use a business or post office box address rather than a residence address if privacy concerns are an issue.

Instructions for Form

File Number: It is recommended that the file number assigned by the Secretary of State be provided to facilitate processing of the document.

Consent: A person designated as the registered agent of an entity must have consented, either in a written or electronic form, to serve as the registered agent of the entity. Although consent is required, a copy of the person’s written or electronic consent need not be submitted with the periodic report. The liabilities and penalties imposed by Sections 4.007 and 4.008 of the BOC apply with respect to a false statement in a filing instrument that names a person as the registered agent of an entity without that person’s consent. (BOC § 5.207)

Form 802 ─ Page 1 of 5

Execution: Pursuant to Section 4.001 of the BOC, the periodic report must be signed by a person authorized by the BOC to act on behalf of the entity in regard to the filing instrument. Generally, a governing person or managerial official of the entity signs a filing instrument. The periodic report need not be notarized; however, before signing, please read the statements on this form carefully. The designation or appointment of a person as registered agent by an organizer or managerial official is an affirmation by the organizer or managerial official that the person named in the instrument as registered agent has consented to serve in that capacity. (BOC § 5.2011)

A person commits an offense under Section 4.008 of the BOC if the person signs or directs the filing of a filing instrument the person knows is materially false with the intent that the instrument be delivered to the Secretary of State for filing. The offense is a Class A misdemeanor unless the person’s intent is to harm or defraud another, in which case the offense is a state jail felony.

Filing Fees: The filing fee for a periodic report for a nonprofit corporation is $5. If the corporation has forfeited its right to conduct affairs for failure to file the periodic report within thirty (30) days of the first notification, the fee is the original $5 plus a late fee of $1 per month or part of a month for one hundred twenty (120) days following the forfeiture, but not less than $5 nor more than $25.

Additional Documentation:

Name Change (optional): To change the name of the corporation at the same time of filing the required periodic report, an amendment (Form 424 or 412, as appropriate) and filing fee of $25 and Form 802 and filing fee (as stated in Filing Fees), must be submitted at the same time to the Reports Unit for filing.

Reinstatement: If the report is not filed within the one hundred twenty (120) day period from the date of the second notification, the domestic corporation will be involuntarily terminated or the registration of the foreign corporation will be revoked. The corporation may be relieved of the involuntary termination or revocation and reinstated by filing the required periodic report (Form 802) and filing fee of $25.

Tax Clearance from Comptroller of Public Accounts: If the corporation is not tax exempt, a tax clearance letter from the Texas Comptroller of Public Accounts stating that the filing entity has satisfied all franchise tax liabilities and may be reinstated is required to be filed with Form 802 and filing fee of $25. Form 811 is not required when reinstating. Contact the Comptroller for assistance in complying with franchise tax filing requirements and obtaining the necessary tax clearance letter by email at: tax.help@cpa.state.tx.us or by calling (800)

Form 802 ─ Page 2 of 5

Amendment to Certificate of Formation or Registration: The name of the corporation must be available at the time of reinstatement. The administrative rules adopted for determining entity name availability (Texas Administrative Code, Title 1, Part 4, Chapter 79, subchapter C) may be viewed at: http://www.sos.state.tx.us/tac/index.shtml A preliminary determination on “name availability” may be obtained by calling (512)

At the time of reinstating, if the corporation name is no longer available, or if written consent is required but cannot be obtained for the use of the name, simultaneously submit: (A) a certificate of amendment to the certificate of formation to change the name of the domestic entity as a condition of reinstatement; or (B) an amended registration to state the assumed name under which the foreign entity shall transact business. The amendment (Form 424 or 412, as appropriate) and filing fee of $25 and Form 802 and filing fee of $25, and the tax clearance letter, must be submitted at the same time to the Reports Unit for filing. Forms 424 and 412 are available at: http://www.sos.state.tx.us/corp/forms_boc.shtml

Upon completing the reinstatement process of submitting all required forms, paying all applicable filing fees, and meeting all filing requirements, the status of the nonprofit corporation will be changed to in existence.

•Payment Instructions: Accepted methods of payment are: (1) a check or money order payable through a U.S. bank or financial institution made payable to the Secretary of State; (2) a valid American Express, Discover, MasterCard, or Visa credit card (subject to a statutorily authorized convenience fee of 2.7% of the total fees incurred); (3) a funded LegalEase account; or (4) a prefunded Secretary of State client account. Use Form 815 at: http://www.sos.state.tx.us/corp/forms_reports.shtml to pay by credit card, LegalEase, or client account.

•Delivery Instructions: Submit the completed form(s), with the filing fees, in duplicate to the Secretary of

State. Mail to: Secretary of State, Reports Unit, P.O. Box 12028, Austin, Texas

James Earl Rudder Office Building, Reports Unit, 1019 Brazos, Austin, Texas 78701; or fax to: (512)

Revised 08/12

Form 802 ─ Page 3 of 5

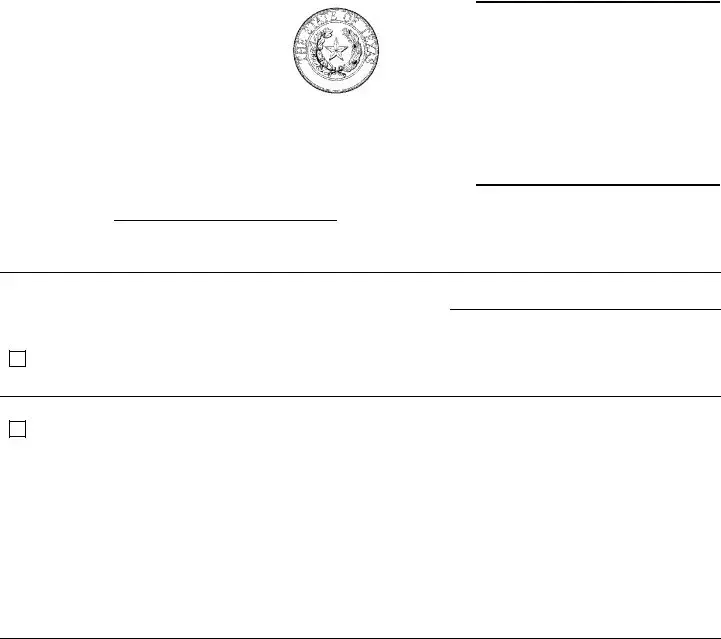

Form 802 |

|

|

This space reserved for filing office use. |

(Revised 08/12) |

|

|

|

Submit in duplicate to: |

|

|

|

Secretary of State |

|

|

|

Reports Unit |

|

|

|

P.O. Box 12028 |

|

|

|

Austin, TX |

Periodic Report |

|

|

Phone: (512) |

|

||

FAX: (512) |

of a |

|

|

Dial: |

Nonprofit Corporation |

|

|

Filing Fee: See Instructions |

|

||

|

|

|

|

File Number:

1.The name of the corporation is: (A name change requires an amendment; see Instructions)

2.It is incorporated under the laws of: (Set forth state or foreign country)

3.The name of the registered agent is:

A. The registered agent is a corporation (cannot be entity named above) by the name of:

OR

B. The registered agent is an individual resident of the state whose name is:

First Name |

MI |

Last Name |

Suffix |

4. The registered office address, which is identical to the business address of the registered agent in Texas, is:

(Only use street or building address; see Instructions)

|

|

TX |

|

Street Address |

City |

State |

Zip Code |

5.If the corporation is a foreign corporation, the address of its principal office in the state or country under the laws of which it is incorporated is:

Street or Mailing Address |

City |

State |

Zip Code |

Country |

6. The names and addresses of all directors of the corporation are: (A minimum of three directors is required.)

(If additional space is needed, include the information as an attachment to this form for item 6.)

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

|

|

|

|

|

|

|

First Name |

MI |

Last Name |

|

|

Suffix |

|

|

|

|

|

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

Form 802 ─ Page 4 of 5

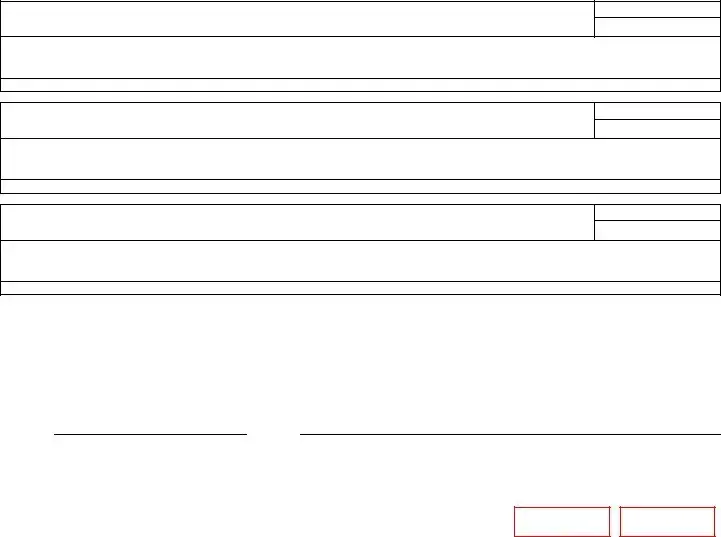

7. The names, addresses, and titles of all officers of the corporation are: (The offices of president and secretary

must be filled, but both may not be held by the same officer.)

(If additional space is needed, include the information as an attachment to this form for item 7.)

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

President |

|

|

||||

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

Secretary |

|

|

||||

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

|

|

|

|

|

Officer Title |

First Name |

MI |

Last Name |

|

Suffix |

|

Street or Mailing Address |

|

City |

State |

Zip Code |

Country |

Execution:

The undersigned affirms that the person designated as registered agent has consented to the appointment. The undersigned signs this document subject to the penalties imposed by law for the submission of a materially false or fraudulent instrument and certifies under penalty of perjury that the undersigned is authorized under the provisions of law governing the entity to execute the filing instrument.

Date:

Signature of authorized officer

Reset

Form 802 ─ Page 5 of 5

More PDF Templates

How Much Is a Divorce in Texas - The petitioner must provide some personal identification information, like a driver’s license or social security number.

Texas Workmans Comp - Information collected by TDI-DWC is subject to transparency laws, allowing for review by the requester.

Common mistakes

-

Omitting the File Number: Failing to include the file number assigned by the Secretary of State can slow down processing. Always provide this number to ensure efficiency.

-

Incorrect Corporation Name: Entering an incorrect legal name for the corporation can lead to significant issues. Ensure that the name matches exactly as registered.

-

Improper Registered Agent Information: Listing the corporation itself as the registered agent is a common mistake. Remember, the registered agent must be an individual or another entity registered in Texas.

-

Invalid Registered Office Address: Providing a P.O. Box or mailbox service instead of a physical street address can cause rejection of the form. The registered office must be a location where service of process can be delivered.

-

Insufficient Director Information: Not listing at least three directors is a frequent oversight. A minimum of three is required, so double-check this section before submission.

-

Missing Officer Titles: Failing to include titles for all officers can lead to confusion. Make sure to list the president and secretary, as both positions are mandatory.

-

Neglecting to Sign the Form: Forgetting to sign the report is a simple yet critical mistake. Ensure that the authorized person signs the document to validate it.

-

Ignoring Filing Fees: Not including the correct filing fee can delay processing. Always verify the fee amount and payment method before sending the form.

Key takeaways

The Texas 802 form is essential for nonprofit corporations to comply with state regulations regarding periodic reporting.

It must be filed at least once every four years, or risk termination of the corporation's status.

Ensure that the corporation's legal name is accurately provided, as any changes require a separate amendment.

Include the file number assigned by the Secretary of State to streamline processing.

List all directors and officers with their names and addresses; a minimum of three directors is mandatory.

Use a registered agent who has consented to serve in that role; this person must not be the corporation itself.

Provide a registered office address where legal documents can be served during business hours.

Filing fees are relatively low, at $5, but can increase if the report is late.

To change the corporation's name during this filing, submit an amendment form and pay the associated fee.

Failure to file within the designated timeframe can lead to revocation of the corporation's registration.

Make sure to submit the form in duplicate to the Secretary of State for proper processing.

Steps to Using Texas 802

To complete the Texas 802 form, follow these steps carefully. Ensure all required information is accurate and complete before submitting the form to avoid delays or penalties.

- File Number: Enter the file number assigned by the Secretary of State.

- Corporation Name: Provide the legal name of the corporation.

- Jurisdictional Information: Indicate the state or jurisdiction where the corporation is formed.

- Registered Agent: Choose either a domestic or foreign entity registered in Texas or an individual resident as the registered agent. Ensure the agent has consented to serve.

- Registered Office Address: Enter the street address of the registered office where the registered agent can be served.

- Principal Office Address: If applicable, provide the street or mailing address of the principal office of the corporation.

- Directors: List the names and addresses of all directors. A minimum of three directors is required. Attach additional information if necessary.

- Officers: List the names, addresses, and titles of all officers, including a president and a secretary. Attach additional information if necessary.

- Execution: The authorized person must sign the document, affirming that the registered agent has consented to the appointment.

After completing the form, submit it in duplicate to the Secretary of State along with the required filing fee. Ensure all information is correct to prevent any issues with processing your report.