Blank Texas 74 221 PDF Template

Form Example

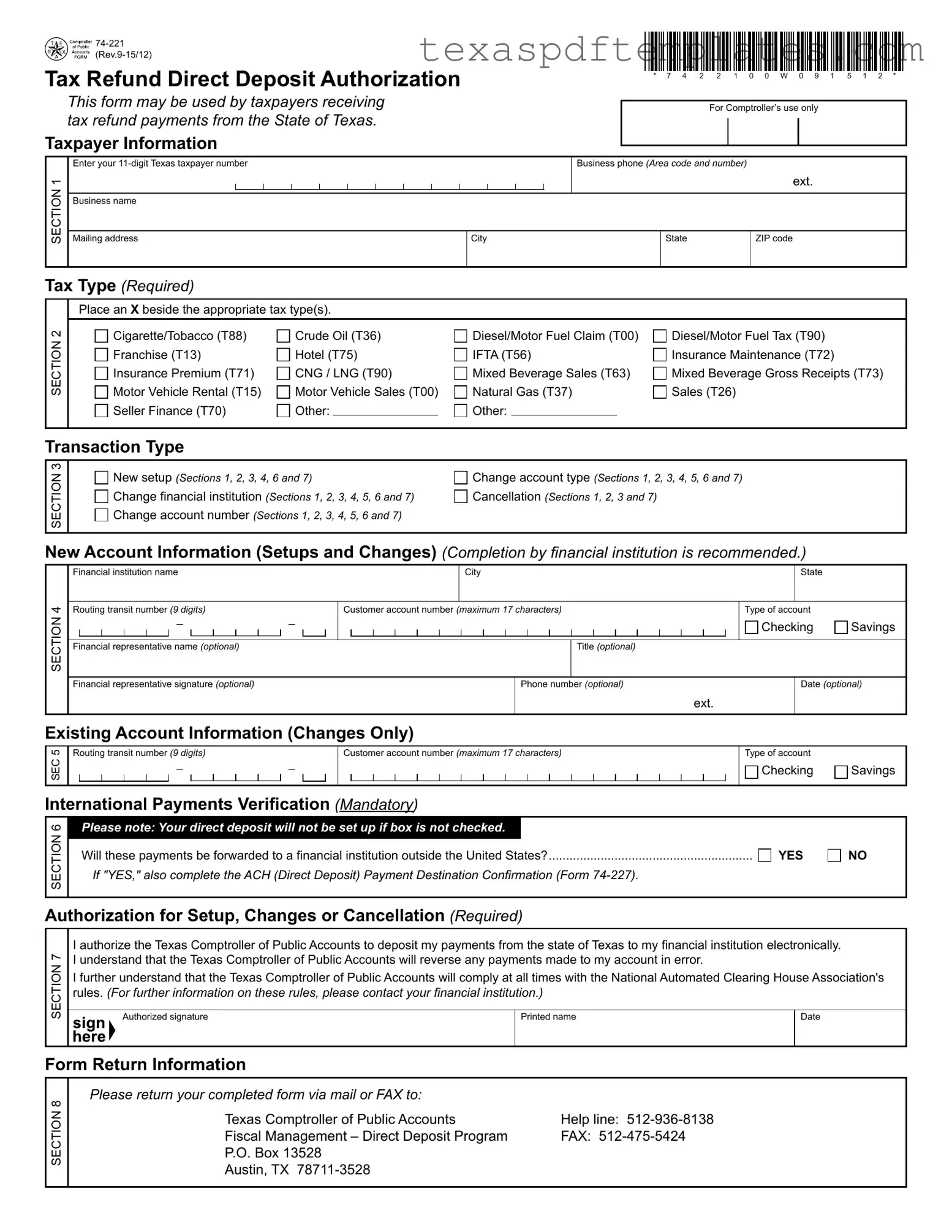

Tax Refund Direct Deposit Authorization

This form may be used by taxpayers receiving tax refund payments from the State of Texas.

Taxpayer Information

Enter your

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION |

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|||||

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*7422100W091512*

*7422100W091512*

* 7 4 2 2 1 0 0 W 0 9 1 5 1 2 *

For Comptroller’s use only

Business phone (Area code and number)

ext.

State |

ZIP code |

|

|

Tax Type (Required)

SECTION 2

Place an X beside the appropriate tax type(s).

Cigarette/Tobacco (T88) |

Crude Oil (T36) |

Diesel/Motor Fuel Claim (T00) |

Diesel/Motor Fuel Tax (T90) |

||||

Franchise (T13) |

Hotel (T75) |

IFTA (T56) |

Insurance Maintenance (T72) |

||||

Insurance Premium (T71) |

CNG / LNG (T90) |

Mixed Beverage Sales (T63) |

Mixed Beverage Gross Receipts (T73) |

||||

Motor Vehicle Rental (T15) |

Motor Vehicle Sales (T00) |

Natural Gas (T37) |

Sales (T26) |

||||

Seller Finance (T70) |

Other: |

|

|

Other: |

|

|

|

Transaction Type

SECTION 3

New setup (Sections.1,.2,.3,.4,.6.and.7)

New setup (Sections.1,.2,.3,.4,.6.and.7)

Change inancial institution (Sections.1,.2,.3,.4,.5,.6.and.7)

Change inancial institution (Sections.1,.2,.3,.4,.5,.6.and.7)

Change account number (Sections.1,.2,.3,.4,.5,.6.and.7)

Change account number (Sections.1,.2,.3,.4,.5,.6.and.7)

Change account type (Sections.1,.2,.3,.4,.5,.6.and.7)

Change account type (Sections.1,.2,.3,.4,.5,.6.and.7)

Cancellation (Sections.1,.2,.3.and.7)

Cancellation (Sections.1,.2,.3.and.7)

New Account Information (Setups and Changes) (Completion.by.inancial.institution.is.recommended.)

SECTION 4

Financial institution name

Routing transit number (9 digits)

Financial representative name (optional)

Financial representative signature (optional)

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Customer account number (maximum.17.characters) |

|

|

|

|

|

|

|

|

|

Type of account |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

Phone number (optional) |

|

|

|

|

|

|

|

|

|

|

Date (optional) |

||||||

ext.

Existing Account Information (Changes Only)

5 |

Routing transit number (9 digits) |

|

|

|

|

|

|

|

Customer account number (maximum.17.characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of account |

|||||||||||||||||||||||||||||||||||||||||||||

SEC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Payments Veriication (Mandatory)

6 |

Please note: Your direct deposit will not be set up if box is not checked. |

|

|

|

SECTION |

|

|

|

|

Will these payments be forwarded to a inancial institution outside the United States? |

YES |

|||

|

||||

|

. |

|

||

|

|

|

|

|

Savings

Savings

NO

Authorization for Setup, Changes or Cancellation (Required)

SECTION 7

I authorize the Texas Comptroller of Public Accounts to deposit my payments from the state of Texas to my inancial institution electronically. I understand that the Texas Comptroller of Public Accounts will reverse any payments made to my account in error.

I further understand that the Texas Comptroller of Public Accounts will comply at all times with the National Automated Clearing House Association's rules. (For.further.information.on.these.rules,.please.contact.your.inancial.institution.)

Authorized signature |

Printed name |

Date |

|

|

|

Form Return Information

SECTION 8

Please return your completed form via mail or FAX to: |

|

Texas Comptroller of Public Accounts |

Help line: |

Fiscal Management – Direct Deposit Program |

FAX: |

P.O. Box 13528 |

|

Austin, TX |

|

Form

Instructions for Tax Refund Direct Deposit Authorization

You have certain rights.under.Chapters.552.and.559,.Government.Code,.to.review,.request.and.correct.information.we.have.on. file.about.you..To.request.information.for.review.or.to.request.error.correction,.use.the.contact.information.on.this.form.

Section 1: Taxpayer Information

Enter Texas taxpayer number, business phone, business/payee name and enter payee contact information.

Section 2: Tax Type

Place an "X" in the appropriate box(s) to indicate type of tax refund.

Section 3: Transaction Type

Select the appropriate type of direct deposit transaction.

Section 4: New Account Information (Needed for setups and changes)

Completion by financial institution is recommended.

Important: Your direct deposit account information may be different from what is printed on your checks. It is recommended that you contact your financial institution to confirm your direct deposit account information.

Prenote Test:

A prenote test will be sent to your financial institution for the account information provided. The prenote test is for a period of six banking days, and it is to verify your account information. If no further action is required by your financial institution, your direct deposit information will become effective when the six banking day prenote time frame has expired.

Section 5: Existing Account Information (Needed for changes to existing account information)

When requesting a change to your existing direct deposit account information, you must complete Section 5 with the existing account information for verification purposes. This measure will help the paying state agency verify accuracy of the requested change.

Any change to banking information begins a prenote test period. See explanation in Section 4, above.

Section 6: International Payments Veriication

Check "YES" or "NO" to indicate if direct deposit payments to the account information designated in

Section 3 of this form will be forwarded to a financial institution outside the United States.

If "YES," also complete the ACH (Direct Deposit) Payment Destination Confirmation (Form

Section 7: Authorization for Setup, Changes or Cancellation

Must be completed in its entirety, and no alterations to the authorization language will be accepted.

More PDF Templates

Sellers Permit Texas - The application includes questions about the company's ownership and management structure.

Texas Ap 152 - It encourages applicants to consult the Comptroller's office for assistance if needed.

What Is Gf No on T-47 - It corroborates property details for title companies and lenders.

Common mistakes

-

Incorrect Taxpayer Number: Many individuals mistakenly enter an incorrect 11-digit Texas taxpayer number. This number is essential for processing your refund, and any errors can delay your payment.

-

Omitting Required Tax Type: Failing to place an "X" beside the appropriate tax type can lead to confusion. Ensure that you select all applicable tax types to avoid processing issues.

-

Inaccurate Account Information: Some people provide incorrect financial institution details. Double-check the routing transit number and account number to ensure they match your bank's records. Errors here can result in failed deposit attempts.

-

Neglecting International Payments Verification: If your payments will go to a bank outside the United States, you must check "YES" in Section 6. Skipping this step can lead to complications in receiving your funds.

Key takeaways

When filling out the Texas 74-221 form for tax refund direct deposit authorization, it is essential to keep several key points in mind:

- Accurate Information is Crucial: Ensure that your Texas taxpayer number, business name, and contact details are entered correctly. Any discrepancies could delay your refund.

- Select the Correct Tax Type: It is important to mark an "X" next to the appropriate tax type(s) in Section 2. This step helps the Texas Comptroller identify the source of your refund.

- Understand the Prenote Test: A prenote test will be conducted to verify your account information. This process takes six banking days. Your direct deposit will only become effective after this verification is completed.

- Authorization is Required: Complete Section 7 to authorize the Texas Comptroller to deposit your payments electronically. This section must be filled out entirely, as any alterations will not be accepted.

Steps to Using Texas 74 221

Completing the Texas 74-221 form is a straightforward process that allows you to authorize direct deposit for your tax refunds. Follow these steps carefully to ensure that your information is accurate and complete.

- Begin by entering your 11-digit Texas taxpayer number in Section 1.

- Fill in your mailing address, including city, state, and ZIP code.

- Provide your business name and business phone number, including the area code.

- In Section 2, place an "X" next to the appropriate tax type(s) for which you are requesting a refund.

- In Section 3, select the type of transaction you are requesting: new setup, change of financial institution, change of account number, change of account type, or cancellation.

- For new accounts or changes, complete Section 4 with your financial institution's name, routing transit number, and customer account number.

- Indicate the type of account (checking or savings) and provide optional details such as the financial representative's name and phone number.

- If you are changing existing account information, complete Section 5 with the current routing transit number and account number.

- In Section 6, indicate whether your payments will be forwarded to a financial institution outside the United States by checking "YES" or "NO." If "YES," complete the additional form as required.

- Finally, in Section 7, sign and print your name, and include the date to authorize the setup, changes, or cancellation.

Once you have completed the form, return it via mail or fax to the Texas Comptroller of Public Accounts. Make sure to keep a copy for your records. Your direct deposit will be set up after a verification process, ensuring that your information is accurate and secure.