Blank Texas 50 160 PDF Template

Form Example

CONFIDENTIAL

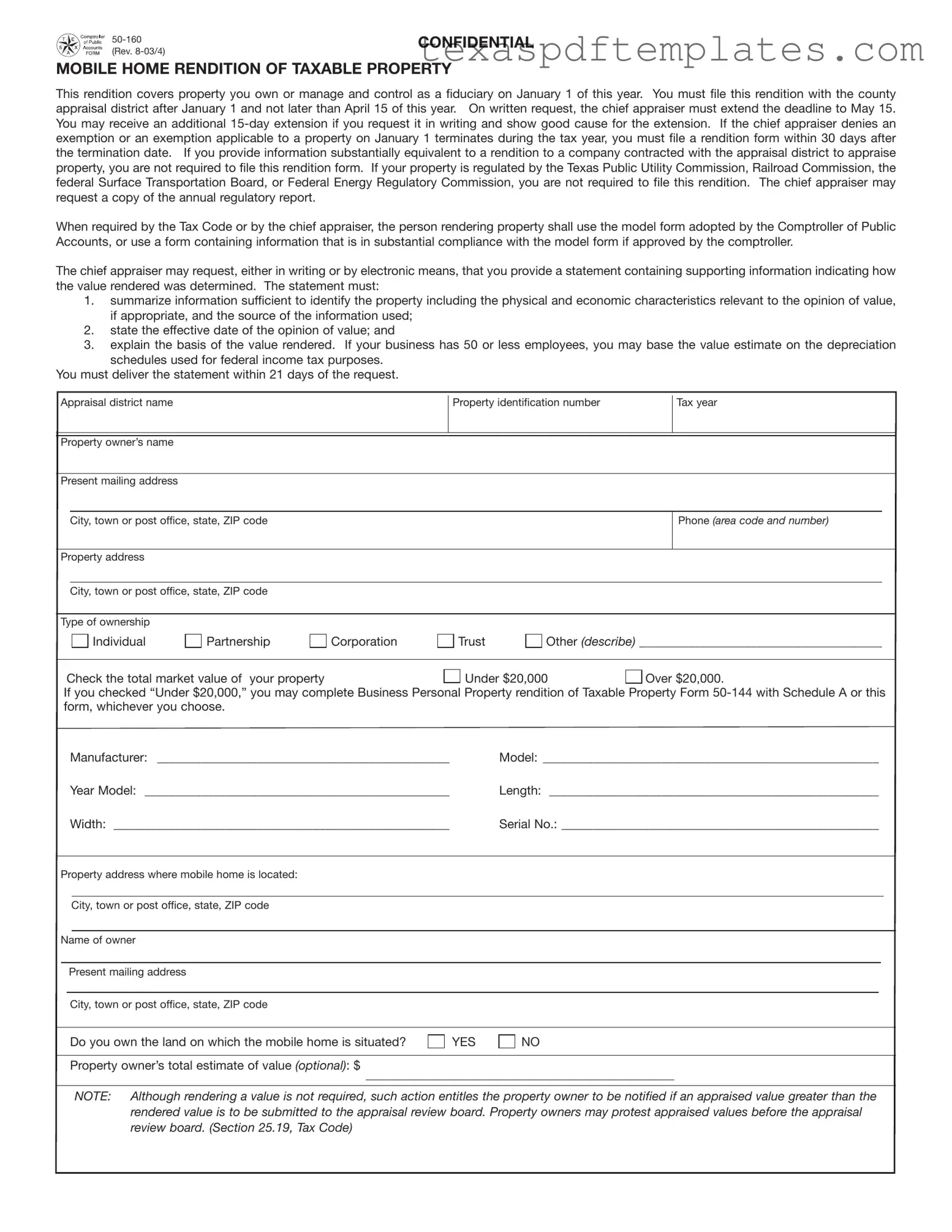

MOBILE HOME RENDITION OF TAXABLE PROPERTY

This rendition covers property you own or manage and control as a fiduciary on January 1 of this year. You must file this rendition with the county appraisal district after January 1 and not later than April 15 of this year. On written request, the chief appraiser must extend the deadline to May 15. You may receive an additional

When required by the Tax Code or by the chief appraiser, the person rendering property shall use the model form adopted by the Comptroller of Public Accounts, or use a form containing information that is in substantial compliance with the model form if approved by the comptroller.

The chief appraiser may request, either in writing or by electronic means, that you provide a statement containing supporting information indicating how the value rendered was determined. The statement must:

1.summarize information sufficient to identify the property including the physical and economic characteristics relevant to the opinion of value, if appropriate, and the source of the information used;

2.state the effective date of the opinion of value; and

3.explain the basis of the value rendered. If your business has 50 or less employees, you may base the value estimate on the depreciation schedules used for federal income tax purposes.

You must deliver the statement within 21 days of the request.

Appraisal district name

Property owner’s name

Present mailing address

Property identification number

Tax year

|

City, town or post office, state, ZIP code |

|

|

|

|

|

|

|

|

|

Phone (area code and number) |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

City, town or post office, state, ZIP code |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Type of ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Individual |

|

Partnership |

|

Corporation |

|

|

Trust |

|

Other (describe) _______________________________________ |

|||||

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|||||||||

Check the total market value of your property |

|

|

|

|

Under $20,000 |

|

Over $20,000. |

|||||||||

|

|

|

|

|

||||||||||||

If you checked “Under $20,000,” you may complete Business Personal Property rendition of Taxable Property Form

|

|

Manufacturer: _______________________________________________ |

|

Model: ______________________________________________________ |

|||||||

|

|

Year Model: _________________________________________________ |

|

Length: _____________________________________________________ |

|||||||

|

|

Width: ______________________________________________________ |

|

Serial No.: ___________________________________________________ |

|||||||

|

|

|

|

|

|

|

|

|

|||

Property address where mobile home is located: |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

||

|

|

|

City, town or post office, state, ZIP code |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

Name of owner |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Present mailing address |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, town or post office, state, ZIP code |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Do you own the land on which the mobile home is situated? |

|

|

YES |

|

NO |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property owner’s total estimate of value (optional): $ |

|

|

|

|

|

|

|||

NOTE: Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to be submitted to the appraisal review board. Property owners may protest appraised values before the appraisal review board. (Section 25.19, Tax Code)

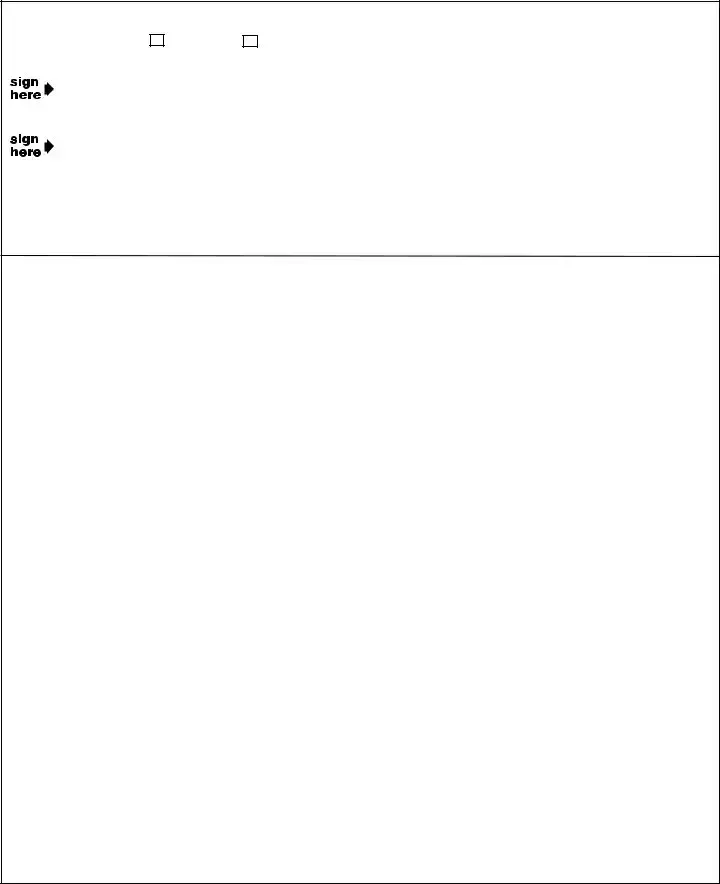

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated entity of the

property owner? |

Yes |

No |

This form must be signed and dated. By signing this document, you attest that the information contained on it is true and correct to the best of |

||

your knowledge and belief. If you checked “Yes” above, sign and date on the first signature line below. No notarization is required. |

||

Signature |

|

|

__________________________________________________________________ Date _________________

If you checked “No” above, you must complete the following:

I swear that the information provided on this form is true and correct to the best of my knowledge and belief.

Signature

__________________________________________________________________ Date _________________

Subscribed and sworn before me this ____________day of ____________________________, 20______.

__________________________________________________________

Notary Public, State of Texas

Section 22.26 of the Tax Code states:

(a)Each rendition statement or property report required or authorized by this chapter must be signed by an individual who is required to file the statement or report.

(b)When a corporation is required to file a statement or report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by an authorized officer to sign in behalf of the corporation must sign the statement or report.

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

If you fail to timely file a rendition or property report required by Texas law, the chief appraiser must impose a penalty in an amount equal to 10 percent of the total taxes due on the property for the current year. If the court determines that you filed a false rendition or report with the intent to commit fraud or to evade the tax or you alter, destroy, or conceal any record, document, or thing or present to the chief appraiser any altered or fraudulent record, document, or thing, or otherwise engage in fraudulent conduct for the purpose of affecting the outcome of an inspection, investigation determination, or other proceeding before the appraisal district, the chief appraiser must impose an additional penalty equal to 50 percent of the total taxes due on the property for the current year.

More PDF Templates

Texas Drivers License Application Form - All fees are non-refundable once the application is submitted.

Texas Private Security Bureau - The PSB 13 highlights the interdependent relationship between mental health and public security.

Common mistakes

-

Incorrect Deadline Submission: Many individuals fail to submit the Texas 50 160 form by the required deadline of April 15. Extensions can be requested, but they must be made in writing and show good cause.

-

Failure to Provide Accurate Information: Some people do not include complete and accurate information about the property, such as the physical and economic characteristics. This can lead to complications or delays in the appraisal process.

-

Omitting Required Signatures: It is crucial that the form is signed and dated. Without the proper signature, the submission may be considered invalid, leading to potential penalties.

-

Not Understanding Ownership Status: Misunderstandings about ownership can result in incorrect answers on the form. Individuals must clearly identify if they are the property owner, an employee of the owner, or acting on behalf of an affiliated entity.

Key takeaways

Filling out the Texas 50 160 form is an important process for property owners. Here are key takeaways to consider:

- The form is due between January 1 and April 15 of the tax year.

- Extensions can be requested in writing, allowing a deadline extension to May 15.

- A further 15-day extension may be available if good cause is shown.

- If an exemption is denied or terminates, a new form must be filed within 30 days.

- Property regulated by certain commissions is exempt from filing this form.

- Information provided to a contracted appraisal company may substitute the need to file.

- Supporting information may be required by the chief appraiser upon request.

- Property owners with 50 or fewer employees can use federal depreciation schedules for value estimates.

- Not filing on time can result in a penalty of 10% of the total taxes due.

- Filing a false rendition may lead to serious legal consequences, including fines.

Understanding these points can help ensure compliance and avoid penalties related to property taxation in Texas.

Steps to Using Texas 50 160

Filling out the Texas 50-160 form requires careful attention to detail. This form must be submitted to the county appraisal district by April 15, unless an extension is granted. Below are the steps to complete the form accurately.

- Begin by entering the name of the appraisal district.

- Provide your property owner's name.

- Fill in your present mailing address, including city, state, and ZIP code.

- Input the property identification number and the tax year.

- List your phone number with area code.

- Enter the property address where the mobile home is located, along with the city, state, and ZIP code.

- Indicate the type of ownership by selecting from the options provided (Individual, Partnership, Corporation, Trust, or Other).

- Check the box for the total market value of your property: Under $20,000 or Over $20,000.

- If your property is under $20,000, decide whether to complete Form 50-144 or this form.

- Provide details about the mobile home, including manufacturer, model, year model, length, width, and serial number.

- Fill in the property address where the mobile home is located again, including city, state, and ZIP code.

- State whether you own the land on which the mobile home is situated by checking YES or NO.

- Optionally, provide the property owner's total estimate of value.

- Answer whether you are the property owner or an employee of the property owner by checking YES or NO.

- If you checked "YES," sign and date the form on the first signature line.

- If you checked "NO," complete the sworn statement section, sign, and date it.

- If applicable, have a notary public sign and date the form in the designated area.

Once completed, ensure that all sections are filled out correctly before submitting the form to avoid any penalties. Keep a copy for your records and be aware of the deadlines for filing and any potential extensions.