Blank Texas 50 141 PDF Template

Form Example

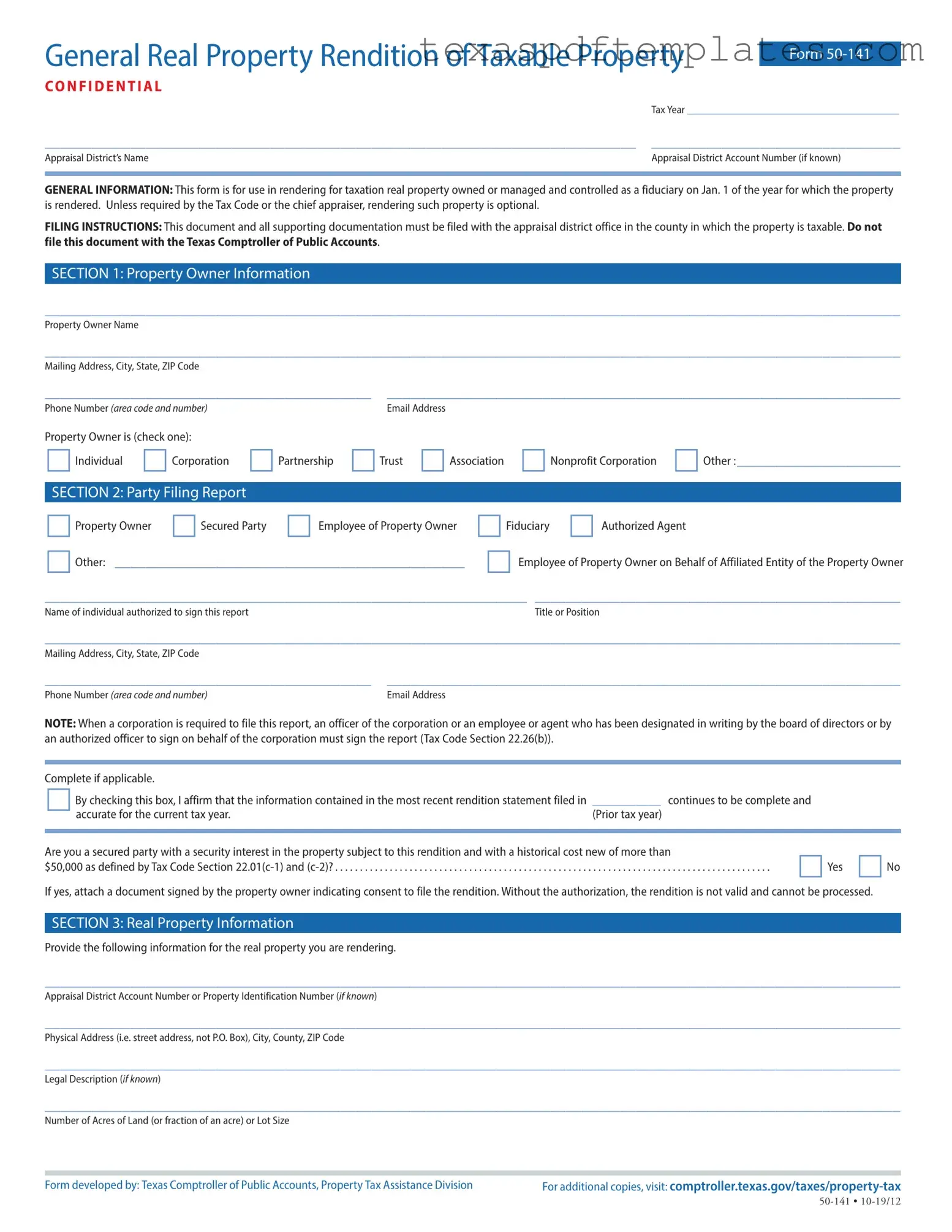

General Real Property Rendition of Taxable Property

Form

C O N F I D E N T I A L

|

Tax Year _______________________________________ |

____________________________________________________________________________ |

________________________________ |

Appraisal District’s Name |

Appraisal District Account Number (if known) |

|

|

GENERAL INFORMATION: This form is for use in rendering for taxation real property owned or managed and controlled as a fiduciary on Jan. 1 of the year for which the property is rendered. Unless required by the Tax Code or the chief appraiser, rendering such property is optional.

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable. Do not file this document with the Texas Comptroller of Public Accounts.

SECTION 1: Property Owner Information

______________________________________________________________________________________________________________

Property Owner Name

______________________________________________________________________________________________________________

Mailing Address, City, State, ZIP Code

__________________________________________ __________________________________________________________________

Phone Number (AREA CODE AND NUMBER) |

Email Address |

|

|

Property Owner is (check one): |

|

|

|

Individual Corporation Partnership Trust Association Nonprofit Corporation Other :_____________________ |

|||

|

|

|

|

SECTION 2: Party Filing Report |

|

|

|

Property Owner Secured Party |

Employee of Property Owner |

Fiduciary Authorized Agent |

|

Other: _____________________________________________ |

Employee of Property Owner on Behalf of Affiliated Entity of the Property Owner |

||

______________________________________________________________ _______________________________________________

Name of individual authorized to sign this reportTitle or Position

______________________________________________________________________________________________________________

Mailing Address, City, State, ZIP Code

__________________________________________ |

__________________________________________________________________ |

Phone Number (AREA CODE AND NUMBER) |

Email Address |

NOTE: When a corporation is required to file this report, an officer of the corporation or an employee or agent who has been designated in writing by the board of directors or by an authorized officer to sign on behalf of the corporation must sign the report (Tax Code Section 22.26(b)).

Complete if applicable.

By checking this box, I affirm that the information contained in the most recent rendition statement filed in accurate for the current tax year.

___________ continues to be complete and

(Prior tax year)

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than |

Yes No |

$50,000 as defined by Tax Code Section |

If yes, attach a document signed by the property owner indicating consent to file the rendition. Without the authorization, the rendition is not valid and cannot be processed.

SECTION 3: Real Property Information

Provide the following information for the real property you are rendering.

______________________________________________________________________________________________________________

Appraisal District Account Number or Property Identification Number (IF KNOWN)

______________________________________________________________________________________________________________

Physical Address (i.e. street address, not P.O. Box), City, County, ZIP Code

______________________________________________________________________________________________________________

Legal Description (IF KNOWN)

______________________________________________________________________________________________________________

Number of Acres of Land (or fraction of an acre) or Lot Size

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division |

For additional copies, visit: |

General Real Property Rendition of Taxable Property |

Form |

SECTION 3: Real Property Information (continued)

List and describe all buildings and other improvements on the land:

$_______________________________________

Property Owner’s Estimate of Total Market Value

for All the Property Described in this Rendition (Optional)**

**Although rendering a value is not required, such action entitles the property owner to be notified if an appraised value greater than the rendered value is to be submitted to the appraisal review board (Tax Code Section 25.19).

SECTION 4: Affirmation and Signature

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or a state jail felony under Section 37.10, Penal Code.

I, __________________________________________________________________________,

Printed Name of Authorized Individual

swear or affirm that the information provided in this report is true and accurate to the best of my knowledge and belief.

NOTE: If the person filing and signing this report is not the property owner, an employee of the property owner, an employee of a property owner signing on behalf of an affiliated entity of the property owner or a secured party as defined by Tax Code Section 22.01, the signature below must be notarized.

____________________________________________________________ |

________________________________________ |

Signature of Authorized Individual |

Date |

Subscribed and sworn before me this _________ day of ______________________________, 20_______.

_____________________________________ Notary Public, State of Texas

Important Information

GENERAL INFORMATION: This form is for use in rendering for taxation real property owned or managed and controlled as a fiduciary on Jan. 1 of the year for which the property is rendered. Unless required by the Tax Code or the chief appraiser, rendering such property is optional. This report is confidential and not open to public inspection; disclosure is permitted pursuant to the terms of Tax Code Section 22.27.

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office in the county in which the property is taxable. Do not file this document with the Texas Comptroller of Public Accounts. Contact information for appraisal district offices may be found on the Comptroller’s website.

DEADLINES: Rendition statements and property report deadlines depend on property type. The statements and reports must be delivered to the chief appraiser after Jan. 1 and no later than the deadlines indicated below.

Rendition Statements and Reports |

Deadlines |

Allowed Extension(s) |

|

|

|

• May 15 upon written |

|

Property generally |

April 15 |

request |

|

• Additional 15 days for good |

|||

|

|

||

|

|

cause shown |

|

|

|

|

|

Property regulated by the |

|

|

|

Public Utility Commission of |

|

• May 15 upon written |

|

Texas, the Railroad Commission |

|

||

|

request |

||

of Texas, the federal Surface |

April 30 |

||

• Additional 15 days for good |

|||

Transportation Board or the |

|

||

|

cause shown |

||

Federal Energy Regulatory |

|

||

|

|

||

Commission. Tax Code 22.23(d). |

|

|

|

|

|

|

For additional copies, visit: |

Page 2 |

More PDF Templates

How to Upload Pay Stubs for Food Stamps - The H1869 form also inquires about the ownership of vehicles valued over $10,000 each.

Form 2982 - It is vital to include complete address and contact information for family members listed.

E-file Login - Ensure all sections are filled out completely to avoid delays.

Common mistakes

-

Failing to include the correct tax year at the top of the form. This can lead to confusion and processing delays.

-

Not providing the appraisal district account number if known. This information helps to identify the property more efficiently.

-

Forgetting to check the box that indicates the type of property owner. This is essential for proper classification.

-

Leaving out the mailing address or providing an incomplete address. Accurate contact information is vital for communication.

-

Neglecting to indicate whether the property owner is an individual or entity. This information is necessary for legal clarity.

-

Not signing the form in the affirmation and signature section. A missing signature can render the submission invalid.

-

Failing to provide a physical address for the property. Using a P.O. Box instead of a street address can complicate the process.

-

Omitting the legal description of the property if known. This detail helps to accurately identify the property in question.

-

Not attaching necessary documentation when claiming to be a secured party. Without proper authorization, the rendition cannot be processed.

-

Missing the filing deadline. Submitting the form late can result in penalties or the inability to render the property for taxation.

Key takeaways

When filling out and using the Texas 50-141 form, there are several important points to keep in mind. This form is essential for rendering real property for taxation purposes in Texas.

- Purpose of the Form: The Texas 50-141 form is used to report real property owned or managed as a fiduciary as of January 1 of the tax year.

- Optional Filing: Rendering property is generally optional unless mandated by the Tax Code or the chief appraiser.

- Filing Location: Submit the completed form and any supporting documents to the appraisal district office in the county where the property is located, not to the Texas Comptroller.

- Property Owner Information: Clearly provide the property owner’s name, mailing address, and contact details in the designated sections.

- Filing Party: Indicate who is filing the report—options include the property owner, an authorized agent, or a fiduciary.

- Consent Requirement: If filing as a secured party, include a signed document from the property owner granting permission; otherwise, the rendition cannot be processed.

- Property Description: Accurately describe the real property, including the physical address and legal description if known.

- Market Value Estimate: While it’s optional to provide a market value estimate, doing so allows the property owner to receive notifications about appraised values that exceed their rendered value.

- Signature and Notarization: The form must be signed by an authorized individual, and if the signer is not the property owner, notarization is required.

By following these guidelines, you can ensure that the Texas 50-141 form is filled out correctly and submitted on time, helping to avoid potential issues with property taxation.

Steps to Using Texas 50 141

Filling out the Texas 50-141 form requires careful attention to detail. This form must be submitted to the appropriate appraisal district office in the county where the property is located. After completing the form, ensure that all necessary supporting documentation is included before submission.

- Obtain the form: Download the Texas 50-141 form from the Texas Comptroller's website or request a copy from your local appraisal district office.

- Enter the tax year: Fill in the tax year for which you are rendering the property at the top of the form.

- Appraisal district information: Write the name of the appraisal district and the account number, if known.

- Property owner information: Complete the section with the property owner's name, mailing address, phone number, and email address.

- Select property owner type: Check the appropriate box to indicate whether the property owner is an individual, corporation, partnership, trust, association, nonprofit corporation, or other.

- Party filing the report: Indicate who is filing the report by checking the appropriate box (e.g., property owner, secured party, fiduciary).

- Authorized individual: Provide the name, title or position, mailing address, phone number, and email address of the individual authorized to sign the report.

- Affirmation of previous rendition: If applicable, check the box affirming that the information in the most recent rendition statement is accurate for the current tax year.

- Secured party question: Answer whether you are a secured party with a security interest in the property, and attach the necessary consent document if the answer is yes.

- Real property information: Fill in the appraisal district account number or property identification number, physical address, legal description, and number of acres or lot size.

- Improvements description: List and describe all buildings and other improvements on the property.

- Market value estimate: Optionally, provide your estimate of the total market value for all property described in the rendition.

- Signature and date: The authorized individual must sign and date the form. If the signer is not the property owner or an authorized employee, notarization is required.

After completing these steps, review the form for accuracy. Ensure all required fields are filled out and that any necessary documents are attached. Finally, submit the form to the appraisal district office by the specified deadline.