Blank Texas 33 06 PDF Template

Form Example

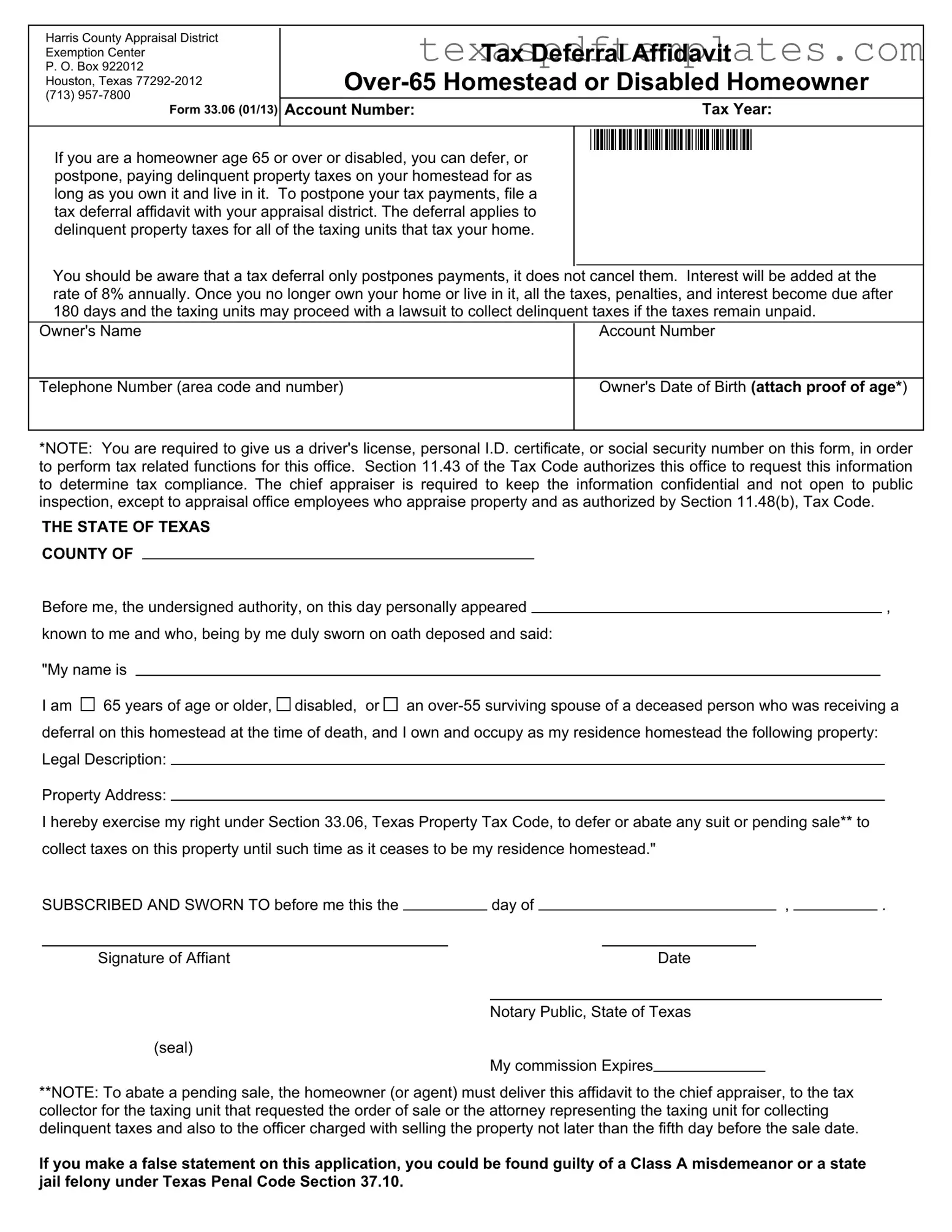

Harris County Appraisal District Exemption Center

P. O. Box 922012

Houston, Texas

Form 33.06 (01/13)

Tax Deferral Affidavit

Account Number: |

Tax Year: |

If you are a homeowner age 65 or over or disabled, you can defer, or postpone, paying delinquent property taxes on your homestead for as long as you own it and live in it. To postpone your tax payments, file a tax deferral affidavit with your appraisal district. The deferral applies to delinquent property taxes for all of the taxing units that tax your home.

*NEWHS124*

You should be aware that a tax deferral only postpones payments, it does not cancel them. Interest will be added at the rate of 8% annually. Once you no longer own your home or live in it, all the taxes, penalties, and interest become due after 180 days and the taxing units may proceed with a lawsuit to collect delinquent taxes if the taxes remain unpaid.

Owner's Name |

Account Number |

Telephone Number (area code and number)

Owner's Date of Birth (attach proof of age*)

*NOTE: You are required to give us a driver's license, personal I.D. certificate, or social security number on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the information confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by Section 11.48(b), Tax Code.

THE STATE OF TEXAS

COUNTY OF

Before me, the undersigned authority, on this day personally appeared |

|

, |

known to me and who, being by me duly sworn on oath deposed and said:

"My name is

I am  65 years of age or older,

65 years of age or older,  disabled, or

disabled, or

an

an

deferral on this homestead at the time of death, and I own and occupy as my residence homestead the following property:

Legal Description:

Property Address:

I hereby exercise my right under Section 33.06, Texas Property Tax Code, to defer or abate any suit or pending sale** to

collect taxes on this property until such time as it ceases to be my residence homestead."

SUBSCRIBED AND SWORN TO before me this the |

|

|

|

day of |

|

|

|

, |

|

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of Affiant |

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Notary Public, State of Texas |

|

|

|

|

|||

(seal)

My commission Expires

**NOTE: To abate a pending sale, the homeowner (or agent) must deliver this affidavit to the chief appraiser, to the tax collector for the taxing unit that requested the order of sale or the attorney representing the taxing unit for collecting delinquent taxes and also to the officer charged with selling the property not later than the fifth day before the sale date.

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or a state jail felony under Texas Penal Code Section 37.10.

More PDF Templates

Dps Change of Address - Any male between 18 and 26 years old must consent to register for the Selective Service through the form.

How Long Is a Notary Stamp Good for in Texas - It is crucial to keep a copy of the completed form for personal records.

How to Get Temporary Plates in Texas - The Texas Temporary Tags help keep the roads safe while managing vehicle registrations efficiently.

Common mistakes

-

Incomplete Personal Information: Failing to provide all required personal details, such as the owner's name and account number, can lead to delays or rejection of the form.

-

Missing Proof of Age: Not attaching the necessary documentation, like a driver's license or Social Security number, to verify age or disability status is a common oversight.

-

Incorrect Property Information: Providing an inaccurate legal description or property address can complicate the processing of the tax deferral.

-

Failure to Sign the Affidavit: Forgetting to sign the form or having an incomplete signature can render the affidavit invalid.

-

Ignoring Submission Deadlines: Not submitting the form within the required time frame can result in losing the opportunity for tax deferral.

-

Misunderstanding the Tax Deferral: Confusing tax deferral with tax cancellation is a frequent mistake. It's crucial to remember that deferral only postpones payments, not eliminates them.

-

Not Consulting with the Appraisal District: Failing to reach out for clarification or assistance from the appraisal district can lead to errors that might have been easily resolved.

Key takeaways

When filling out and using the Texas 33.06 form, there are several important points to keep in mind. Understanding these can help ensure that you successfully defer your property tax payments.

- Eligibility Criteria: You must be either 65 years of age or older, disabled, or an over-55 surviving spouse of a deceased person who was receiving a deferral on the homestead at the time of death.

- Filing Process: To initiate the deferral, you need to submit the tax deferral affidavit to your local appraisal district. This form needs to be completed accurately to avoid any delays.

- Postponement, Not Cancellation: Remember that deferring your taxes only postpones the payments. You will still owe the taxes, and interest at an annual rate of 8% will accrue until the taxes are paid.

- Consequences of Non-compliance: If you stop living in your home or sell it, all deferred taxes, penalties, and interest become due within 180 days. Taxing units may then take legal action to collect any unpaid amounts.

By keeping these key points in mind, you can navigate the tax deferral process with greater confidence and clarity.

Steps to Using Texas 33 06

After gathering the necessary information, you can begin filling out the Texas 33 06 form. Ensure that all details are accurate to avoid delays in processing. Follow these steps to complete the form correctly.

- Obtain the Texas 33 06 form from the Harris County Appraisal District or download it from their website.

- Fill in the Owner's Name at the top of the form.

- Enter your Account Number and Telephone Number (including area code).

- Provide your Date of Birth and attach proof of age, such as a driver's license or personal I.D. certificate.

- In the section labeled "THE STATE OF TEXAS COUNTY OF," write the county where you reside.

- In the blank space, write your name again.

- Indicate whether you are 65 years of age or older, disabled, or an over-55 surviving spouse of a deceased person who was receiving a deferral.

- Fill in the Legal Description and Property Address of your homestead.

- Sign and date the form where indicated.

- Have the form notarized by a Notary Public in Texas.

Once you have completed the form, submit it to the appropriate appraisal district office. Retain a copy for your records. Make sure to meet any deadlines to ensure your tax deferral is processed without issues.