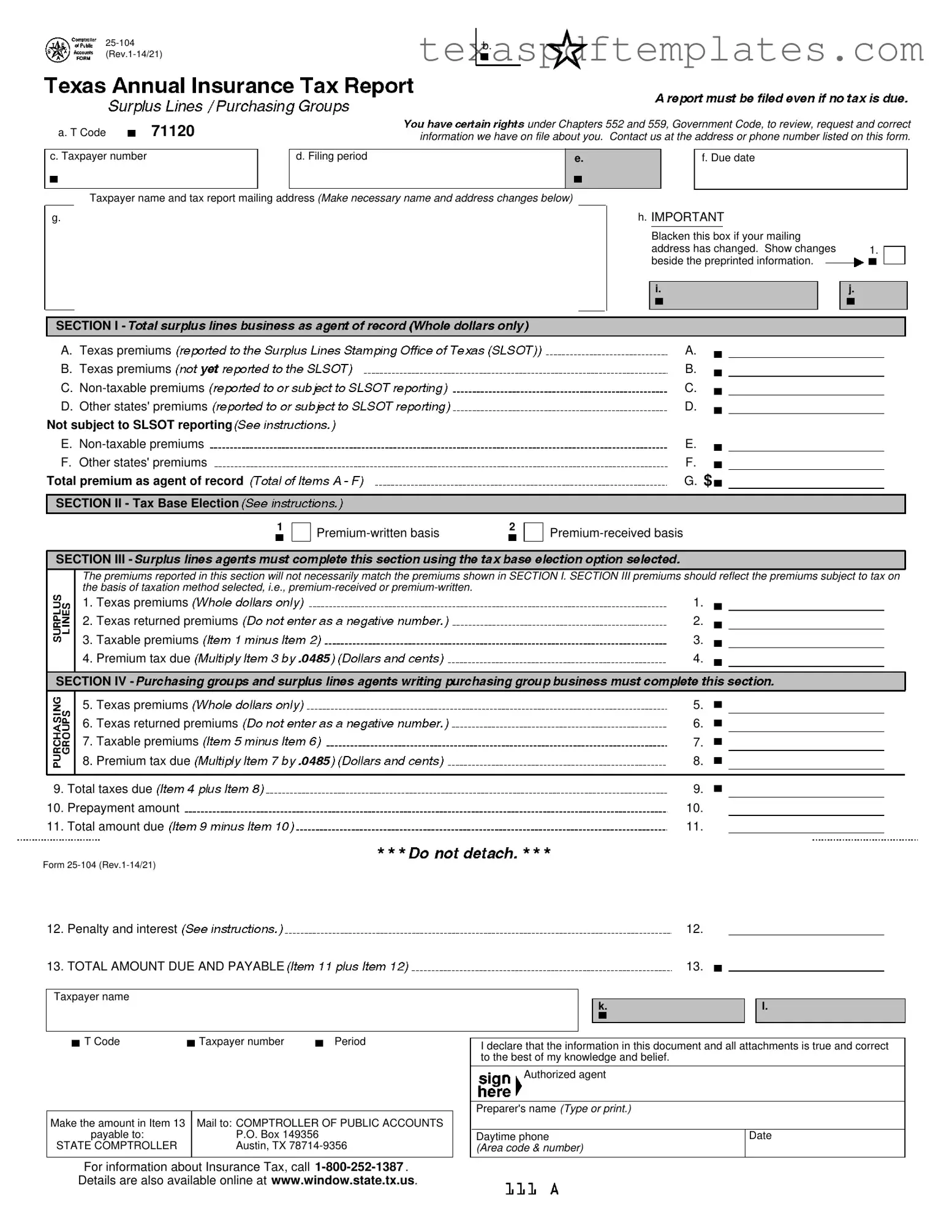

Blank Texas 25 104 PDF Template

Form Example

a. T Code |

71120 |

c. Taxpayer number

b.

under Chapters 552 and 559, Government Code, to review, request and correct inf rmati n we have on file about you. Contact us at the address or phone number listed on this form.

d. Fili peri d |

e. |

|

f. Due date |

|

|

|

|

Taxpayer name and tax |

mailing addr (Make neces ary name and address chang s b low) |

g.

h. IMPORTANT

Blacken this ox if your mailing |

|

|

address has changed. Show changes |

1. |

|

esi e the preprinted information. |

|

|

|

|

|

i.

j.

SECTION I -

A. Texas premiums |

A. |

|

|

B. Texas premiums |

B. |

|

|

C. |

C. |

|

|

D. Other states' premiums |

D. |

||

Not subject to LSOT repor ing |

|

|

|

E. |

E. |

|

|

F. Other states' premiums |

F. |

|

|

Total premium as ag nt of record |

G. $ |

||

|

|

|

|

SECTION II - Tax Ba Elect on |

|

|

|

|

|

|

|

Pr |

2 |

|

SECTION III - |

|

|

|

|

|

|

||

|

The premiums eported |

his se |

will |

ot nece rily m ch the premiums shown SECTION I. SECTION III premiums should refl the premiums subject to tax on |

||||

|

the basis of taxation method |

d, .e., |

||||||

|

1. |

Texas premiu |

s |

|

|

1. |

|

|

|

2. |

Texas return |

d pr |

m s |

|

2. |

|

|

|

3. |

Taxable p emiums |

|

|

3. |

|

|

|

|

4. |

Premium tax due |

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

SECTION IV - |

|

|

|

|

|

|

||

|

5. |

Texas premiu |

s |

|

|

5. |

|

|

|

6. |

Texas return |

d pr |

|

|

6. |

|

|

|

7. |

Taxable premiums |

|

|

7. |

|

|

|

|

8. |

Premium tax due |

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

9. Total taxes due |

|

|

|

9. |

|

|

||

10. Prepayment amount |

|

|

10. |

|

|

|||

11. Total amount due |

|

|

|

11. |

|

|

||

Form

12.Penalty and interest

13.TOTAL AMOUNT DUE AND PAYABLE

Taxpayer name

12.

13.

k.

l.

T Code |

Taxpayer number |

Period |

Make the amount in Item 13 |

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS |

payable to: |

P.O. Box 149356 |

STATE COMPTROLLER |

Austin, TX |

|

|

I declare that the information in this document and all attachments is true and correct to the best of my knowledge and belief.

Authorized agent

Preparer's name (Type or print.)

Daytime phone |

Date |

(Area code & number) |

|

|

|

For information about Insurance Tax, call

Form

Inst uctio |

f r Completing the Texas Annual Insurance T x Report |

Who Must File |

|

All surpl lines ag ts licen ed Texas and a |

purchasi gr ups registered in Texas must file this report, even if no tax is due. |

When to File

he report and payment are d on March 1 of the year following the tax year.

Section I

he

Item A - Texas Pr miums - Enter the total Texas premiums for policies that were effective prior to July 21, 2011 (net of return premiums) that were reported to the SLSOT during the tax year. Enter the total amount of premiums for policies that were effective on or after July 21, 2011 (net of return premiums) that have been reported to the SLSOT where Texas is the home tate of the insured.

Item - Texas Pr miums - Enter the total Texas premiums for policies that were effective prior to July 21, 2011 (net of return premiums) that have NOT YET been reported to the SLSOT during the tax year. Ent r he total amount of premiums for policies that were effective on or after July 21, 2011 (net of return premiums) that have NOT YET been reported to the SLSOT where Texas is the home state of the insured.

Item C -

entirely Texas and the

the premiums are exem t from taxation or are preempted from taxation.

Item D - Oth r States' Premi ms - Enter the total premiums for policies that were effective prior to July 21, 2011 (net of return premiums) allocated to all other states from a

100% of the policy premium, but also allows the monitoring of the amount of

enter the premiums (net of return premium ) that are 100% exempt or

Item F - Oth r States' Premi ms - This category does not apply to policies that are effective on or after July 21, 2011. For policies that are effective prior to July 21, 2011, enter the to al taxable premiums (net of return premiums) allocated to other states for policies that exclusively cover states other than Texas.

Section II

lines agents who received a license during the reporting year must elect one of the tax base options shown.

Rle 34 TAC, Sec. 3.822, provides specific information on the requirements for reporting surplus lines tax. Agents have the option of reporting tax using a

Section III

These premiums will not necessarily match the premiums shown in Section I, because they are based on the reporting method chosen. The term "premium" includes all

premiums, premi m deposits, membership fees, registration fees, assessments, dues and any other consideration for surplus lines insurance. Texas premiums include: premiums written or received for policies that are effective prior to July 21, 2011 that cover risks in this state;

premiums written or received for new or renewal Texas or

Exempt premiums are premiums for a surplus lines policy that covers risks or exposures that are properly allocated to federal waters, international waters, or risks or exposures that are under the jurisdiction of a foreign government. Effective Jan. 1, 2014, premiums on risks or exposures under ocean marine insurance coverage of sto ed or

Feder l preemptions to state taxation for surplus lines insurance include premiums for policies that are issued to the following entities:

the Federal Deposit Insurance Corporation (FDIC), when it acts as the receiver of a failed financial institution that holds the property being insured; the National Credit Union Administration;

a federally chartered credit union; and

Indian Tribal Nations (see Publication

Texas returned premiums - Report the unearned portion of the premium that is credited or refunded to a policyholder as a result of cancellation or premium adjustment prior to the policy expiration. An age t reporting on the premium received basis will not have returned premiums.

Endorsements and audits on surplus lines insurance policies must be reported based on the date of the endorsement or audit, not the date of the original policy. The tax for endorsements and audits that generate return premiums due a policyholder must be calculated using the tax rate that was originally charged.

Section IV

Purchasing groups obtaining coverage from insurers licensed in Texas or surplus lines agents licensed in Texas do NOT owe tax on this report, but must a zero report. Purchasing groups obtaining coverage independently through negotiations and procurement occurring outside Texas are subject to tax on the premiums paid for coverage of their members located in Texas.

Check this box if insurance was obtained from a licensed insurance company or a licensed or registered risk retention group.

Check this box if insurance was obtained from a surplus lines agent licensed in Texas.

Specific Instructions

Item 12 - Penalty and interest

If tax is paid

If tax is paid

If tax is paid over 60 days late: Enter penalty of 10% (.10) of Item 11 plus interest. Calculate interest at the rate published online at www.window.state.tx.us or call the Comptroller at

Electronic reporting nd payment options are available 24 hours day, 7 days a week. Have this form available when you log on.

More PDF Templates

Dissolve Llc in Texas - Timely filings are crucial for reinstating your entity’s legal operations.

How to Subpoena - Every detail on the subpoena must be carefully checked for accuracy and completeness.

Common mistakes

-

Incorrectly Filling Out Personal Information: Many individuals fail to accurately complete their personal information, such as the taxpayer name and taxpayer number. This can lead to processing delays or issues with the submission.

-

Missing Required Signatures: Some people neglect to sign the form or have the authorized agent sign it. This omission can result in the form being rejected or considered invalid.

-

Not Reporting All Premiums: A common mistake is not including all applicable premiums in the correct sections. This can lead to discrepancies and potential penalties.

-

Failing to Update Address Changes: If a taxpayer’s mailing address has changed, they must indicate this on the form. Failing to do so can cause important correspondence to be sent to the wrong address.

-

Ignoring Deadlines: Many individuals overlook the due date for filing the report and payment. Submitting after the deadline can result in penalties and interest charges.

Key takeaways

1. Filing Requirement: All surplus lines agents licensed in Texas must submit the Texas 25-104 form, even if no tax is owed. This ensures compliance with state regulations.

2. Due Date: The report and any payment are due on March 1 of the year following the tax year. Timely submission is crucial to avoid penalties.

3. Understanding Sections: The form is divided into several sections, each addressing different types of premiums. Familiarize yourself with these to accurately report your figures.

4. Premium Types: Report Texas premiums for policies effective before and after July 21, 2011. This distinction is vital for accurate tax calculations.

5. Non-Taxable Premiums: Identify and report non-taxable premiums correctly. This includes those covering risks located entirely in Texas or exempt policies.

6. Tax Base Election: Agents can choose between a premium-written or premium-received basis for tax reporting. This decision can be changed every four years, impacting future tax liabilities.

7. Penalties for Late Payment: If the tax payment is late, penalties apply. A 5% penalty is charged for payments 1-30 days late, escalating to 10% for 31-60 days late, plus interest for payments over 60 days late.

8. Electronic Options: Electronic reporting and payment options are available 24/7. This provides flexibility and convenience for filing the Texas 25-104 form.

Steps to Using Texas 25 104

Completing the Texas 25-104 form is a straightforward process. Follow these steps to ensure accurate submission. After filling out the form, you'll be ready to mail it to the appropriate address along with any payment due.

- Begin with the preprinted information at the top of the form. Verify that your taxpayer name and tax mailing address are correct. If there are changes, make them in the designated area.

- If your mailing address has changed, blacken the box provided to indicate this change.

- In Section I, enter the total Texas premiums for policies effective prior to July 21, 2011, and those effective on or after that date, net of return premiums. Fill out the corresponding fields for non-taxable premiums and other states' premiums as instructed.

- Proceed to Section II. Choose your tax base option (premium-written or premium-received basis) based on your reporting preference.

- In Section III, report the premiums based on your chosen method. Ensure these figures align with the premiums reported in Section I.

- Move to Section IV. If applicable, check the boxes indicating whether insurance was obtained from licensed companies or surplus lines agents.

- For Item 12, calculate any penalties and interest if your payment is late. Follow the guidelines provided for calculating these amounts.

- Finally, in Item 13, total the amount due and ensure all calculations are accurate.

- Sign and date the form, providing your name and daytime phone number if applicable.

- Mail the completed form along with payment to the address listed on the form: COMPTROLLER OF PUBLIC ACCOUNTS, P.O. Box 149356, Austin, TX 78714-9356.