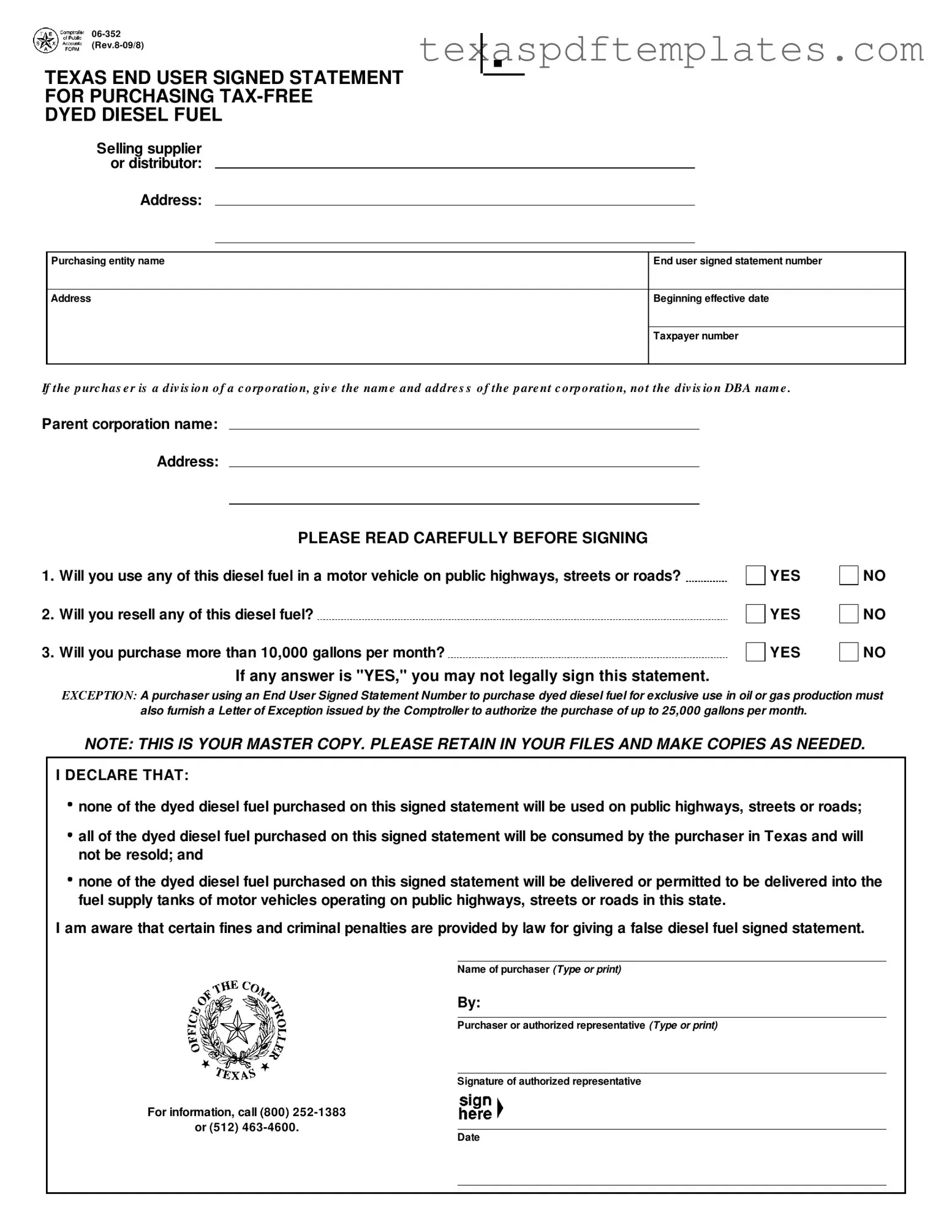

Blank Texas 06 352 PDF Template

Form Example

TEXAS END USER SIGNED STATEMENT FOR PURCHASING

DYED DIESEL FUEL

Selling supplier or distributor:

Address:

Purchasing entity name

End user signed statement number

Address

Beginning effective date

Taxpayer number

If the p urc has e r is a d iv is io n o f a c o rp o ratio n, g iv e the nam e and ad d re s s o f the p are nt c o rp o ratio n, no t the d iv is io n DBA nam e .

Parent corporation name:

Address:

PLEASE READ CAREFULLY BEFORE SIGNING

1. |

Will you use any of this diesel fuel in a motor vehicle on public highways, streets or roads? |

YES |

2. |

Will you resell any of this diesel fuel? |

YES |

3. |

Will you purchase more than 10,000 gallons per month? |

YES |

NO NO NO

If any answer is "YES," you may not legally sign this statement.

EXCEPTION: A purchaser using an End User Signed Statement Number to purchase dyed diesel fuel for exclusive use in oil or gas production must

also furnish a Letter of Exception issued by the Comptroller to authorize the purchase of up to 25,000 gallons per month.

NOTE: THIS IS YOUR MASTER COPY. PLEASE RETAIN IN YOUR FILES AND MAKE COPIES AS NEEDED.

I DECLARE THAT:

none of the dyed diesel fuel purchased on this signed statement will be used on public highways, streets or roads;

none of the dyed diesel fuel purchased on this signed statement will be used on public highways, streets or roads;

all of the dyed diesel fuel purchased on this signed statement will be consumed by the purchaser in Texas and will not be resold; and

all of the dyed diesel fuel purchased on this signed statement will be consumed by the purchaser in Texas and will not be resold; and

none of the dyed diesel fuel purchased on this signed statement will be delivered or permitted to be delivered into the fuel supply tanks of motor vehicles operating on public highways, streets or roads in this state.

none of the dyed diesel fuel purchased on this signed statement will be delivered or permitted to be delivered into the fuel supply tanks of motor vehicles operating on public highways, streets or roads in this state.

I am aware that certain fines and criminal penalties are provided by law for giving a false diesel fuel signed statement.

Name of purchaser (Type or print)

By:

Purchaser or authorized representative (Type or print)

Signature of authorized representative

For information, call (800)

or (512)

Date

More PDF Templates

Texas Lhl005 - Contact numbers provided on the form facilitate communication with the Department.

Txdmv Forms - It is important to review the form for completeness before submission.

Business Property Tax Texas - Corporations must have designated officers file the rendition as per legal requirements.

Common mistakes

-

Incorrectly identifying the purchasing entity: Ensure that the name of the purchasing entity matches the legal name as registered. This includes any divisions or subsidiaries; the parent corporation's name should be provided if applicable.

-

Omitting the taxpayer number: The taxpayer number is crucial for identification. Failing to include it can lead to delays or rejection of the form.

-

Not answering the usage questions accurately: The form asks specific questions about usage. Answering "YES" to any of these questions disqualifies the signer from using the form.

-

Failing to provide a Letter of Exception when needed: If you plan to purchase more than 25,000 gallons per month for oil or gas production, a Letter of Exception from the Comptroller is required.

-

Ignoring the retention requirement: The form states that it is a master copy. It is essential to keep this document in your files and make copies as needed.

-

Not signing the form: The form must be signed by the purchaser or an authorized representative. A missing signature invalidates the statement.

-

Neglecting to include the effective date: The beginning effective date must be clearly stated. Omitting this information can cause confusion regarding the validity of the purchase.

-

Providing false information: Any false statements can lead to significant fines and penalties. It is vital to ensure that all information is accurate and truthful.

Key takeaways

The Texas 06-352 form is essential for individuals or entities wishing to purchase dyed diesel fuel tax-free. Below are key takeaways regarding its use and completion:

- The form is officially titled "Texas End User Signed Statement for Purchasing Tax-Free Dyed Diesel Fuel."

- It requires the name and address of the selling supplier or distributor.

- The purchasing entity must provide its name, address, and taxpayer number.

- If the purchaser is a division of a corporation, the parent corporation's name and address must be included.

- Before signing, the purchaser must answer specific questions regarding the use of the diesel fuel.

- If any question is answered "YES," the purchaser cannot legally sign the statement.

- An exception exists for those using the fuel exclusively for oil or gas production, requiring a Letter of Exception.

- The form serves as the master copy; it is crucial to retain it and make copies as needed.

- False statements on the form can lead to significant fines and criminal penalties.

- For further assistance, the Texas Comptroller's office can be contacted at the provided phone numbers.

Steps to Using Texas 06 352

Completing the Texas 06 352 form is a necessary step for individuals or entities purchasing dyed diesel fuel tax-free. It is important to ensure that all information is accurate and complete, as this form serves as a declaration regarding the intended use of the fuel. Below are the steps to fill out the form correctly.

- Identify the selling supplier or distributor and enter their name and address in the designated fields.

- Provide the name of the purchasing entity in the specified area.

- Enter the end user signed statement number assigned to your purchase.

- Fill in the address of the purchasing entity.

- Specify the beginning effective date for this purchase.

- Input the taxpayer number associated with the purchasing entity.

- If the purchaser is a division of a corporation, provide the name and address of the parent corporation, rather than the division name.

- Answer the three questions regarding the use of the diesel fuel by marking "YES" or "NO" as applicable:

- Will you use any of this diesel fuel in a motor vehicle on public highways, streets, or roads?

- Will you resell any of this diesel fuel?

- Will you purchase more than 10,000 gallons per month?

- Review the declaration statement carefully. Confirm that you understand the implications of signing the form.

- Type or print the name of the purchaser in the designated area.

- Type or print the name of the authorized representative, if applicable.

- Sign the form in the space provided for the authorized representative.

- Include the date of signing at the bottom of the form.

After completing the form, retain the master copy for your records and make copies as needed for future transactions. Ensure that you comply with all regulations to avoid any legal repercussions.