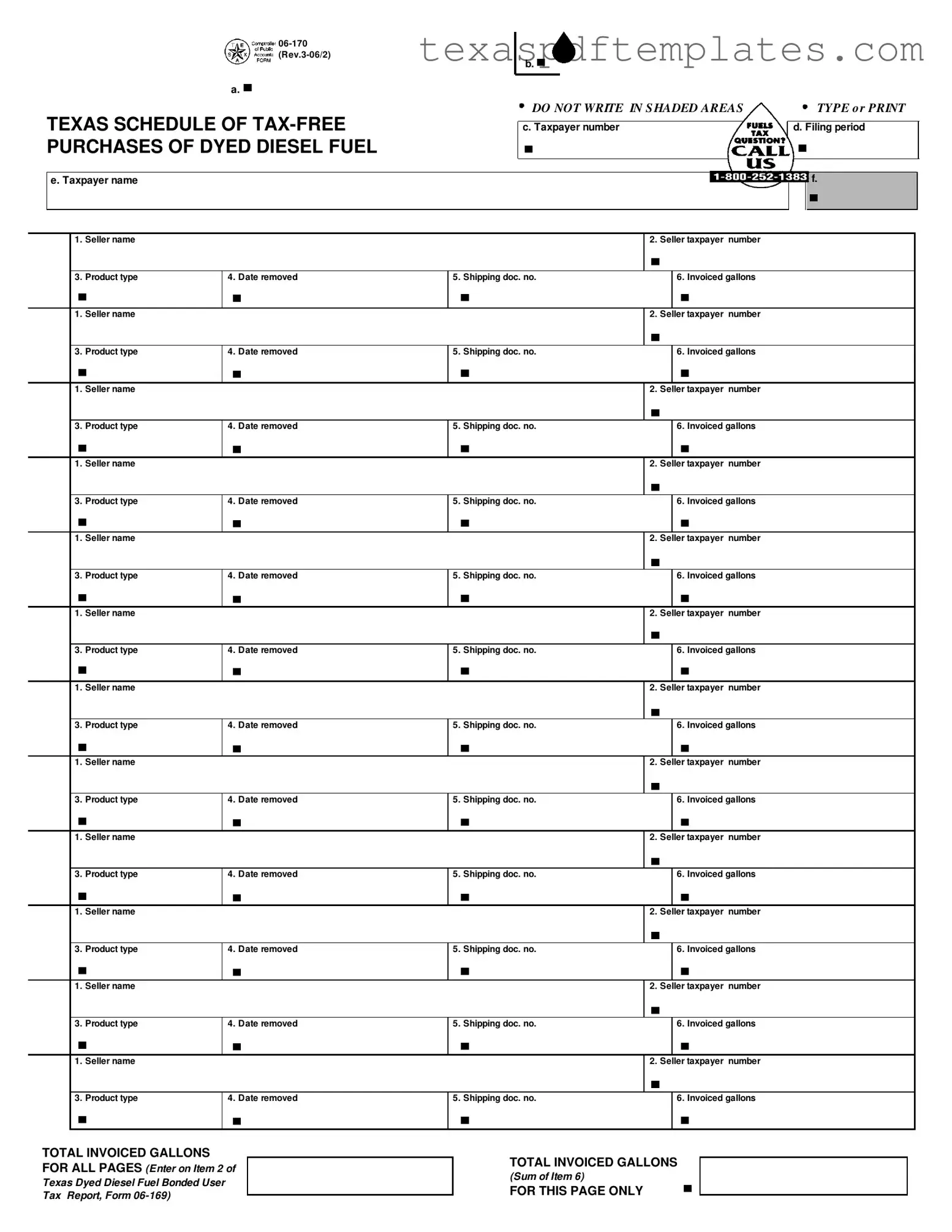

Blank Texas 06 170 PDF Template

Form Example

a.

b.

|

DO NOT WRITE IN S HADED AREAS |

||

TEXAS SCHEDULE OF |

|

|

|

c. Taxpayer number |

|||

PURCHASES OF DYED DIESEL FUEL |

|

|

|

|

|

|

|

e. Taxpayer name |

|

|

|

|

|

|

|

TYPE o r PRINT

d. Filing period

f.

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

|

1. |

Seller name |

|

|

2. Seller taxpayer number |

|

|

|

|

|

|

|

|

|

3. |

Product type |

4. Date removed |

5. Shipping doc. no. |

|

6. Invoiced gallons |

|

|

|

|

|

|

|

TOTAL INVOICED GALLONS FOR ALL PAGES (Enter on Item 2 of

Texas Dyed Diesel Fuel Bonded User Tax Report, Form

TOTAL INVOICED GALLONS

(Sum of Item 6)

FOR THIS PAGE ONLY

Form

TEXAS SCHEDULE OF

PURCHASES OF DYED DIESEL FUEL

Yo u hav e c e rtain rig hts under Ch. 559, Government Code, to review, request, and correct information

we have on file about you. Contact us at the address or

WHO MUST FILE

Every dyed diesel fuel bonded user must file this schedule if they purchase dyed diesel fuel

FOR ASSISTANCE

For assistance with any Texas Fuels tax questions, please contact the Texas State Comptroller's Office at

GENERAL INSTRUCTIONS

Please write only in white areas.

Please write only in white areas.

TYPE or PRINT all information

TYPE or PRINT all information

Complete all applicable items that are not preprinted.

Complete all applicable items that are not preprinted.

If any preprinted information is not correct, mark out the incorrect item and write in the correct information.

If any preprinted information is not correct, mark out the incorrect item and write in the correct information.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

ROUND ALL GALLONAGE FIGURES TO WHOLE GALLONS.

SPECIFIC INSTRUCTIONS

Item 1 - Enter the name of the seller.

Item 2 - Enter the

Item 3 - Enter the

072 - Dyed Kerosene.

Item 4 - Enter the date, MM/DD/YY, as it appears on the Shipping Document/Bill of Lading. This is the date the fuel was PHYSICALLY REMOVED from a terminal or bulk plant. May be left blank if summarizing transactions. See item #5.

Item 5 - Enter the Shipping Document/Bill of Lading number. This is the identifying number from the document issued at the terminal or bulk plant when the product is removed. You may report the summary of multiple transactions when the seller and product type are the same. Enter the word 'SUM.' You must maintain detailed records of the transactions reported as a summary.

Item 6 - Enter invoiced gallons. You may report the summary of multiple transactions. See item #5.

More PDF Templates

Unemployment Form - The C 83 helps facilitate smooth transitions during business changes.

Letter of Financial Support for Medicaid - Employers can better plan and manage their workforce with this documentation.

Common mistakes

-

Neglecting to use the correct areas: Many individuals mistakenly write in the shaded areas of the form. It is crucial to remember that only the white areas are designated for input. Writing in the wrong sections can lead to confusion and potential rejection of the form.

-

Inaccurate taxpayer information: Providing incorrect taxpayer numbers can cause significant delays. Each seller's 11-digit taxpayer number must be accurate. Double-checking this information helps ensure smooth processing.

-

Missing or incorrect product type: It is essential to enter the correct three-digit product type code. For dyed diesel fuel, the code is 228, while dyed kerosene is 072. Errors here can lead to misunderstandings about the type of fuel purchased.

-

Improper date format: The date must be entered in the MM/DD/YY format as shown on the Shipping Document. Failing to adhere to this format can result in processing issues. Always verify the date before submission.

-

Ignoring shipping document details: The Shipping Document/Bill of Lading number is a critical piece of information. Omitting it or providing an incorrect number can hinder the verification process. Always ensure this number is accurate.

-

Rounding errors in gallonage: When entering the invoiced gallons, rounding to whole gallons is required. Failing to do so may lead to discrepancies and complications in tax calculations.

Key takeaways

Filling out the Texas 06-170 form is essential for those who purchase dyed diesel fuel tax-free. Here are some key takeaways to keep in mind:

- Who Must File: Every dyed diesel fuel bonded user is required to file this schedule if they buy dyed diesel fuel tax-free from licensed fuel sellers. Non-compliance could lead to collection actions.

- Correct Information: Only fill in the white areas of the form. Ensure that all information is typed or printed clearly. If any preprinted details are incorrect, cross them out and write the correct information.

- Gallons Reporting: All gallonage figures must be rounded to whole gallons. This is crucial for accurate reporting and compliance.

- Multiple Transactions: If you have multiple transactions with the same seller and product type, you can summarize them. In such cases, write 'SUM' in the relevant fields, but keep detailed records of each transaction.

- Specific Instructions: Pay close attention to the specific instructions for each item on the form. For instance, item 3 requires the three-digit product type, such as 228 for dyed diesel fuel.

- Assistance: If you have questions about the Texas Fuels tax or need help with the form, reach out to the Texas State Comptroller's Office at their toll-free number for support.

Completing the Texas 06-170 form accurately is vital for maintaining compliance with state regulations. Taking the time to understand each requirement can save you from potential issues down the road.

Steps to Using Texas 06 170

Completing the Texas 06-170 form requires attention to detail and accuracy. This form is essential for reporting tax-free purchases of dyed diesel fuel. Follow the steps below to ensure the form is filled out correctly.

- Locate the Taxpayer number field and enter your unique taxpayer number.

- In the Taxpayer name field, type or print your name clearly.

- Fill in the Filing period with the relevant dates.

- For each transaction, complete the following fields:

- Seller name: Enter the name of the seller.

- Seller taxpayer number: Input the 11-digit taxpayer number of the seller.

- Product type: Specify the three-digit product type (228 for Dyed Diesel Fuel, 072 for Dyed Kerosene).

- Date removed: Enter the date in MM/DD/YY format when the fuel was physically removed.

- Shipping doc. no: Provide the Shipping Document or Bill of Lading number. If summarizing multiple transactions, enter 'SUM.'

- Invoiced gallons: Indicate the total invoiced gallons for the transaction. Round to whole gallons.

- Repeat step 4 for each additional transaction, ensuring all applicable items are completed.

- At the end of the form, calculate the TOTAL INVOICED GALLONS FOR ALL PAGES and enter this figure in Item 2 of the Texas Dyed Diesel Fuel Bonded User Tax Report, Form 06-169.

- Make sure to review the form for any errors before submission.