Blank Texas 05 169 PDF Template

Form Example

|

|

|

|

|

|

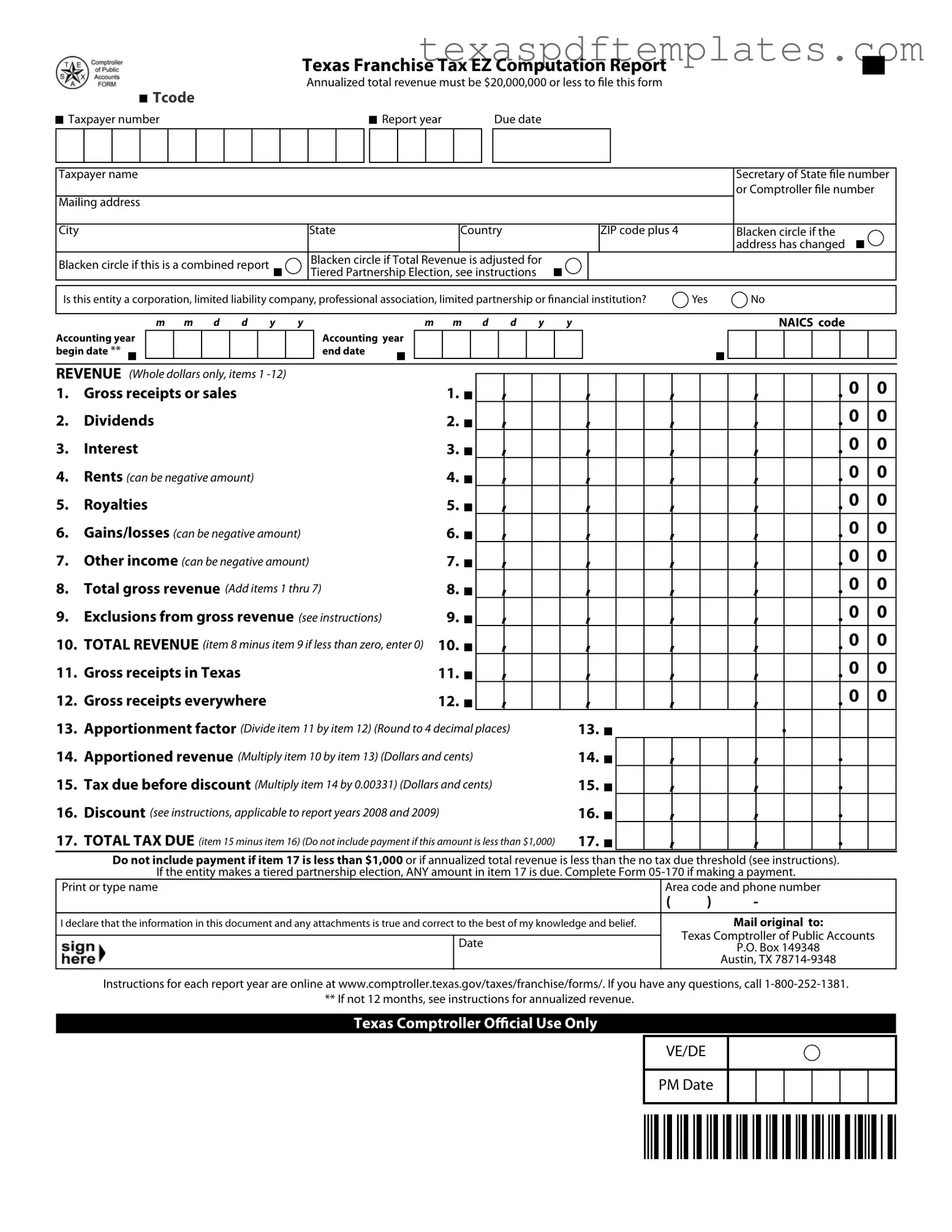

Texas Franchise Tax EZ Computation Report |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

Annualized total revenue must be $20,000,000 or less to file this form |

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

Tcode 13252 |

Annual |

|

|

|

|

|

|

|

|

|

|

|

Due date |

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Taxpayer number |

|

|

|

|

|

|

|

|

Report year |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Taxpayer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State file number |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Comptroller file number |

|||

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

City |

|

|

|

|

State |

|

Country |

ZIP code plus 4 |

|

Blacken circle if the |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

address has changed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Blacken circle if this is a combined report |

|

|

|

Blacken circle if Total Revenue is adjusted for |

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Tiered Partnership Election, see instructions |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

Is this entity a corporation, limited liability company, professional association, limited partnership or financial institution? |

Yes |

No |

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

m m d d y

Accounting year begin date **

y |

m m d d y y |

NAICS code |

Accounting year end date

REVENUE (Whole dollars only, items 1 |

|

|

|

1. |

Gross receipts or sales |

1. |

|

|

|||

2. |

Dividends |

2. |

|

|

|||

3. |

Interest |

3. |

|

|

|||

4. |

Rents (can be negative amount) |

4. |

|

|

|||

5. |

Royalties |

5. |

|

|

|||

6. |

Gains/losses (can be negative amount) |

6. |

|

|

|||

7. |

Other income (can be negative amount) |

7. |

|

|

|||

8. |

Total gross revenue (Add items 1 thru 7) |

8. |

|

|

|||

9. |

Exclusions from gross revenue (see instructions) |

9. |

|

|

|||

|

|||

10. |

TOTAL REVENUE (item 8 minus item 9 if less than zero, enter 0) |

10. |

|

|

|||

11. |

Gross receipts in Texas |

11. |

|

|

|||

12. |

Gross receipts everywhere |

12. |

|

|

|||

13.Apportionment factor (Divide item 11 by item 12) (Round to 4 decimal places)

14.Apportioned revenue (Multiply item 10 by item 13) (Dollars and cents)

15.Tax due before discount (Multiply item 14 by 0.00331) (Dollars and cents)

16.Discount (see instructions, applicable to report years 2008 and 2009)

17.TOTAL TAX DUE (item 15 minus item 16) (Do not include payment if this amount is less than $1,000)

13.

14.

15.

16.

17.

00

00

00

00

00

00

00

00

00

00

00

00

Do not include payment if item 17 is less than $1,000 or if annualized total revenue is less than the no tax due threshold (see instructions).

If the entity makes a tiered partnership election, ANY amount in item 17 is due. Complete Form

Print or type name |

Area code and phone number |

|||

|

|

( |

) |

- |

|

|

|

|

|

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

|

Mail original to: |

|

|

|

|

Texas Comptroller of Public Accounts |

|

|

Date |

|

||

|

|

|

P.O. Box 149348 |

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|

|

Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. If you have any questions, call

** If not 12 months, see instructions for annualized revenue.

VE/DE

PM Date

More PDF Templates

Tax Exempt Form Texas - The form requires details about the organization’s worship services and attendance.

Texas Divorce Forms - The original divorce decree becomes part of your official legal record post-filing.

Common mistakes

-

Incorrect Reporting of Revenue: Many individuals mistakenly report their total revenue as less than or greater than $20,000,000, which disqualifies them from using this form.

-

Omitting Required Information: Failing to include essential details such as the taxpayer number or report year can lead to processing delays.

-

Address Errors: Providing an incorrect mailing address or failing to update it can result in important documents being sent to the wrong location.

-

Misunderstanding Apportionment: Some filers do not correctly calculate the apportionment factor, which can affect the tax due.

-

Neglecting to Blacken Circles: Not marking the appropriate circles for changes in address or combined reporting can lead to confusion and errors in processing.

-

Incorrectly Reporting Negative Amounts: Some filers struggle with reporting negative amounts for rents, gains/losses, or other income, leading to incorrect total revenue calculations.

-

Missing Signatures: Failing to sign the form can result in it being considered incomplete, delaying any processing or potential refunds.

-

Not Following Instructions: Ignoring specific instructions for the report year can lead to errors in calculations, particularly regarding discounts and exclusions.

Key takeaways

When filling out the Texas 05-169 form, there are several important points to consider:

- Eligibility Criteria: To use this form, the annualized total revenue must be $20,000,000 or less. Ensure that your business meets this threshold before proceeding.

- Required Information: Complete all sections accurately, including your taxpayer number, report year, and entity type. Any missing information may delay processing.

- Revenue Reporting: Report gross receipts and other income in whole dollars only. Be mindful of exclusions from gross revenue, as they will affect your total revenue calculation.

- Tax Payment Threshold: Do not include payment if the total tax due is less than $1,000 or if the annualized total revenue is below the no tax due threshold. Review the instructions carefully for exceptions.

For additional guidance, refer to the instructions available online or contact the Texas Comptroller's office for assistance.

Steps to Using Texas 05 169

Filling out the Texas 05-169 form is essential for businesses meeting specific revenue thresholds. Once you have gathered the necessary information, follow these steps to complete the form accurately.

- Enter the Taxpayer number in the designated box.

- Fill in the Report year in the appropriate section.

- Provide the Taxpayer name as registered with the state.

- Input the Secretary of State file number or Comptroller file number.

- Complete the Mailing address, including City, State, Country, and ZIP code plus 4.

- Blacken the circle if the address has changed.

- Mark the circle if this is a combined report.

- Indicate if Total Revenue is adjusted for Tiered Partnership Election by marking the circle.

- Specify whether the entity is a corporation, limited liability company, professional association, limited partnership, or financial institution by selecting Yes or No.

- Enter the Accounting year begin date in the format mm/dd/yyyy.

- Provide the NAICS code.

- Fill in the Accounting year end date in the format mm/dd/yyyy.

- For revenue items, input the amounts in whole dollars for Gross receipts or sales, Dividends, Interest, Rents, Royalties, Gains/losses, and Other income in their respective boxes (items 1-7).

- Add items 1 through 7 to calculate Total gross revenue and enter this amount in item 8.

- List any Exclusions from gross revenue in item 9.

- Calculate TOTAL REVENUE by subtracting item 9 from item 8 and enter the result in item 10. If the result is less than zero, enter 0.

- Input the Gross receipts in Texas in item 11.

- Enter the Gross receipts everywhere in item 12.

- Calculate the Apportionment factor by dividing item 11 by item 12. Round to four decimal places and enter this in item 13.

- Determine the Apportioned revenue by multiplying item 10 by item 13 and enter the result in item 14.

- Calculate Tax due before discount by multiplying item 14 by 0.00331 and enter this in item 15.

- If applicable, enter the Discount in item 16.

- Calculate TOTAL TAX DUE by subtracting item 16 from item 15 and enter the result in item 17. Do not include payment if this amount is less than $1,000.

- Print or type your name and provide your Area code and phone number.

- Sign and date the form, declaring that the information is true and correct.

- Mail the original form to the Texas Comptroller of Public Accounts at the specified address.

After completing the form, ensure all information is accurate before mailing it. If you have questions or need assistance, resources are available online or by calling the provided number.