Blank Texas 05 164 PDF Template

Form Example

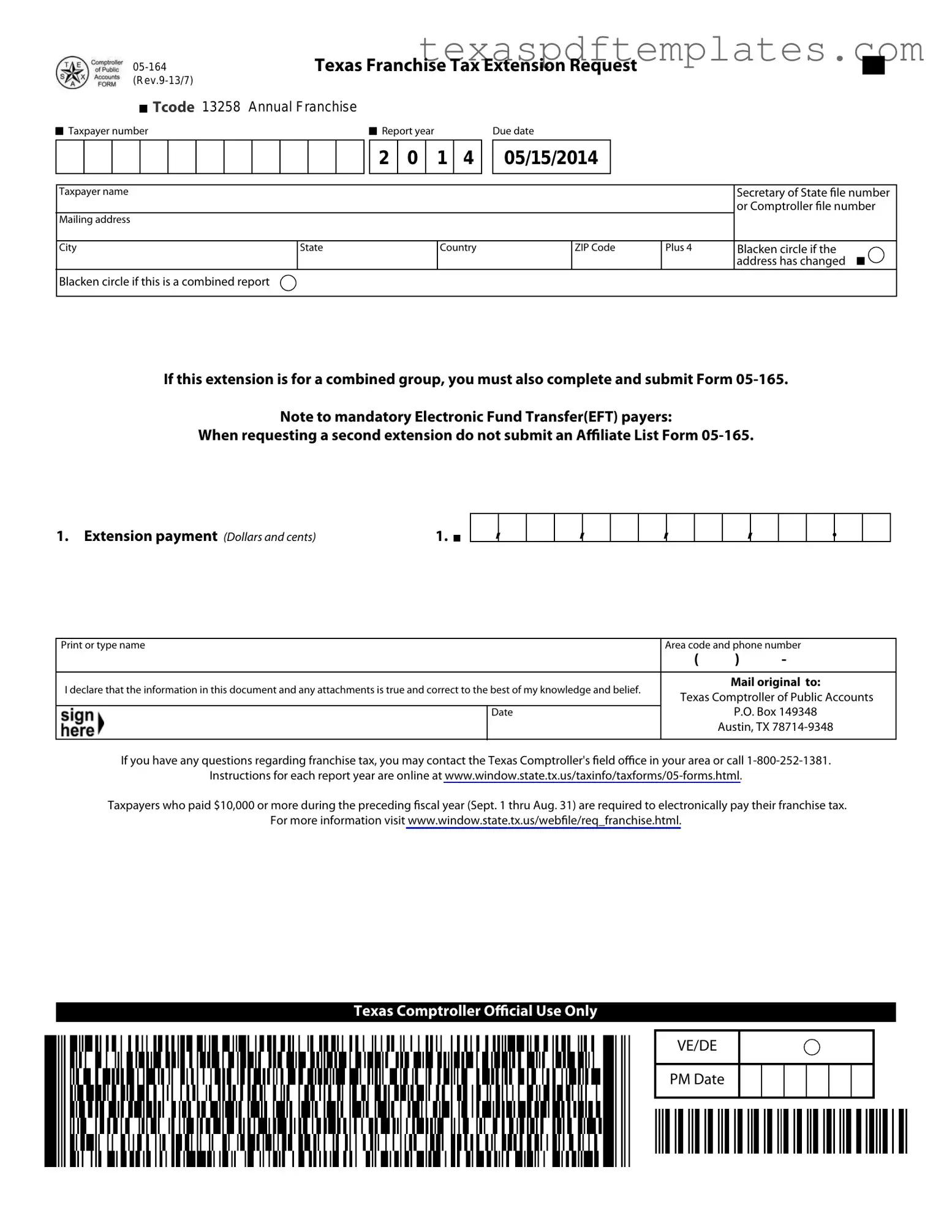

Texas Franchise Tax Extension Request

Tcode 13258 AnnualFranchise

Tcode 13258 AnnualFranchise

Taxpayer number |

|

Report year |

Due date |

|

2 0

1 4

05/15/2014

Taxpayer name |

|

|

|

|

Secretary of State file number |

||

|

|

|

|

|

or Comptroller file number |

||

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

City |

State |

Country |

ZIP Code |

Plus 4 |

Blacken circle if the |

||

|

|

|

|

|

address has changed |

|

|

|

|

|

|

|

|

||

Blacken circle if this is a combined report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If this extension is for a combined group, you must also complete and submit Form

Note to mandatory Electronic Fund Transfer(EFT) payers:

When requesting a second extension do not submit an Affiliate List Form

1. Extension payment (Dollars and cents) |

1. |

|

|

||

|

Print or type name |

Area code and phone number |

||||

|

|

( |

) |

- |

|

|

|

|

|

||

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

Mail original to: |

|||

Texas Comptroller of Public Accounts |

|||||

|

|

||||

|

Date |

|

P.O. Box 149348 |

||

|

|

|

Austin, TX |

||

|

|

|

|

|

|

If you have any questions regarding franchise tax, you may contact the Texas Comptroller's field office in your area or call

Instructions for each report year are online at

Taxpayers who paid $10,000 or more during the preceding fiscal year (Sept. 1 thru Aug. 31) are required to electronically pay their franchise tax.

For more information visit www.window.state.tx.us/webfile/req_franchise.html.

Texas Comptroller Official Use Only

VE/DE

PM Date

More PDF Templates

Harris County Eviction Court - Providing both the street address and unit number, if applicable, enhances clarity regarding the premises involved.

Ut Austin Lsat - The Texas 509 form allows consent for a proposed name similar to an existing name.

How to Start a Farmers Market - It is critical for applicants to keep copies of their submissions.

Common mistakes

-

Incorrect Tax Year: Many individuals mistakenly enter the wrong tax year on the form. Always double-check to ensure you are applying for the correct year.

-

Missing Taxpayer Number: Failing to include the taxpayer number can lead to delays. Ensure this number is filled out accurately.

-

Improper Mailing Address: Providing an incorrect or incomplete mailing address can result in lost correspondence. Verify that the address is up-to-date and complete.

-

Failure to Indicate Address Change: If your address has changed, it is crucial to blacken the circle indicating this change. Neglecting this step may cause issues with future communications.

-

Not Specifying Combined Report: If this extension is for a combined group, you must indicate this on the form. Forgetting to do so can lead to complications.

-

Extension Payment Omitted: Some individuals forget to include the required extension payment. Ensure that the payment amount is clearly stated in dollars and cents.

-

Failure to Sign the Declaration: It is essential to sign and date the declaration at the bottom of the form. An unsigned form will not be processed.

-

Not Using the Correct Form Version: Using an outdated version of the form can lead to rejection. Always use the most recent version available.

-

Ignoring Electronic Payment Requirements: Taxpayers who paid $10,000 or more in the previous year must pay electronically. Not adhering to this rule can result in penalties.

-

Failure to Check for Additional Instructions: Many overlook the additional instructions provided online. Always refer to the official website for the latest guidance and requirements.

Key takeaways

Filling out and using the Texas 05-164 form requires careful attention to detail. Below are key takeaways to ensure a smooth process.

- Understand the Purpose: The Texas 05-164 form is primarily used to request an extension for filing the annual franchise tax report.

- Know the Due Date: For most taxpayers, the due date for submitting this form is May 15 of the year the report is due.

- Provide Accurate Information: Ensure that all details, such as taxpayer name, address, and taxpayer number, are filled out accurately to avoid processing delays.

- Combined Reports: If your extension request is for a combined group, it is essential to complete and submit Form 05-165 as well.

- Extension Payment: Be prepared to include an extension payment, if applicable, by indicating the amount in dollars and cents on the form.

- Electronic Fund Transfer: Taxpayers who are required to pay electronically should note that a second extension does not require the submission of the Affiliate List Form 05-165.

- Mailing Instructions: The original form must be mailed to the Texas Comptroller of Public Accounts at the specified address to ensure it is processed correctly.

- Contact Information: If you have questions, you can reach out to the Texas Comptroller's field office or call their helpline for assistance.

- Stay Informed: For the most current instructions and requirements, refer to the Texas Comptroller’s website, which provides updated information on tax forms and procedures.

By keeping these takeaways in mind, taxpayers can navigate the process of filing the Texas 05-164 form with greater confidence and efficiency.

Steps to Using Texas 05 164

Filling out the Texas 05-164 form is a straightforward process. Follow these steps carefully to ensure that all required information is accurately provided. Once completed, the form must be mailed to the Texas Comptroller of Public Accounts by the due date.

- Obtain the Texas 05-164 form from the Texas Comptroller's website or your local office.

- Fill in the Taxpayer Number in the designated space.

- Enter the Report Year in the appropriate box.

- Provide the Due Date for the report.

- Input the Taxpayer Name as it appears on official documents.

- Enter the Secretary of State File Number or Comptroller File Number.

- Fill in the Mailing Address, including street address, city, state, country, and ZIP code plus 4.

- Blacken the circle if the address has changed.

- Blacken the circle if this is a combined report.

- If applicable, note that a combined group must complete and submit Form 05-165.

- For extension payment, enter the amount in Dollars and Cents.

- Print or type your name in the designated area.

- Provide your Area Code and Phone Number.

- Sign and date the form, declaring that the information is true and correct to the best of your knowledge.

- Mail the original form to:

Texas Comptroller of Public Accounts

P.O. Box 149348

Austin, TX 78714-9348.

After mailing the form, it is advisable to keep a copy for your records. If you have any questions or need assistance, contact the Texas Comptroller's field office or call the provided number for support.