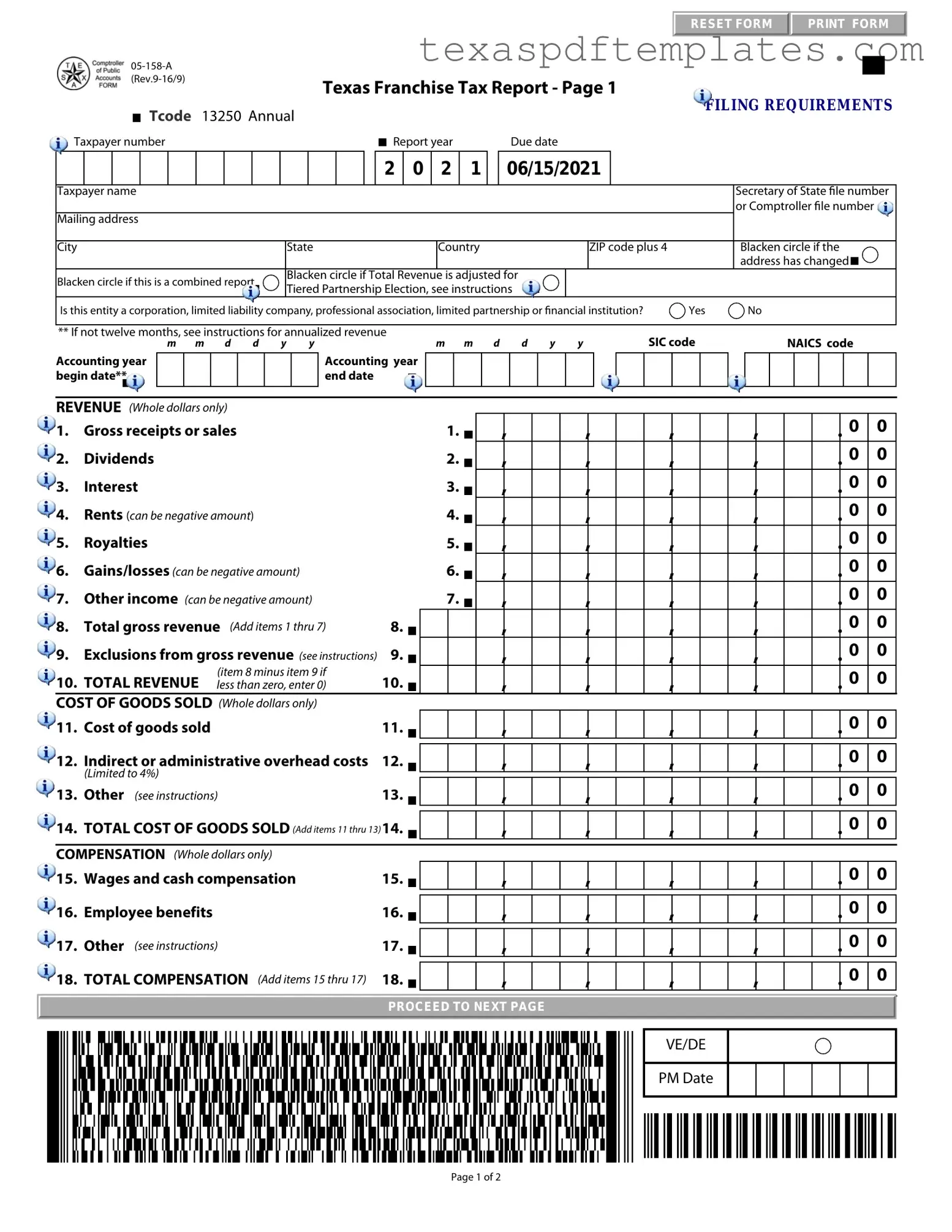

Blank Texas 05 158 A PDF Template

Form Example

RESET FORM |

PRINT FORM |

|

|

Texas Franchise Tax Report - Page 1

Tcode |

13250 Annual |

FILING REQUIREMENTS |

|

Taxpayer number

Report year |

Due date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

0 |

|

2 |

|

1 |

|

|

|

06/15/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secretary of State le number |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Comptroller le number |

|||||||||

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

City |

|

|

|

|

|

|

State |

|

|

|

|

|

Country |

|

|

|

|

|

|

|

ZIP code plus 4 |

Blacken circle if the |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

address has changed |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Blacken circle if this is a combined report |

|

|

|

|

Blacken circle if Total Revenue |

is adjusted for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

Tiered Partnership Election, see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

Is this entity a corporation, limited liability company, professional association, limited partnership or nancial institution? |

|

Yes |

|

|

No |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

** If not twelve months, see instructions for annualized revenue |

|

|

|

|

m |

m |

d |

|

d |

|

y |

y |

SIC code |

|

|

|

NAICS code |

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

m m |

d |

d |

y |

|

|

y |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

Accounting year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounting year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

begin date** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

end date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

REVENUE (Whole dollars only) |

|

|

|

|

|

|

|

||

1. |

Gross receipts or sales |

1. |

|

||||||

|

|||||||||

2. |

Dividends |

|

2. |

|

|||||

|

|

||||||||

3. |

Interest |

|

3. |

|

|||||

|

|

||||||||

4. |

Rents (can be negative amount) |

4. |

|

||||||

|

|||||||||

5. |

Royalties |

|

5. |

|

|||||

|

|

||||||||

6. |

Gains/losses (can be negative amount) |

6. |

|

||||||

|

|||||||||

7. |

Other income (can be negative amount) |

7. |

|

||||||

|

|||||||||

8. |

Total gross revenue (Add items 1 thru 7) |

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

9. |

Exclusions from gross revenue (see instructions) |

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

10. |

TOTAL REVENUE |

(item 8 minus item 9 if |

10. |

|

|

|

|

|

|

less than zero, enter 0) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

||||

COST OF GOODS SOLD (Whole dollars only) |

|

|

|

|

|

|

|

||

11. |

Cost of goods sold |

|

11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

12. |

Indirect or administrative overhead costs |

12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

(Limited to 4%) |

|

13. |

|

|

|

|

|

|

13. |

Other (see instructions) |

|

|

|

|

|

|

||

|

|

|

|

|

|

||||

14. |

TOTAL COST OF GOODS SOLD (Add items 11 thru 13)14. |

|

|

|

|||||

|

|

|

|

|

|||||

|

|

||||||||

COMPENSATION (Whole dollars only) |

|

|

|

|

|

|

|

||

15. |

Wages and cash compensation |

15. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

16. |

Employee benefits |

|

16. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||

17. |

Other (see instructions) |

17. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

18. |

TOTAL COMPENSATION (Add items 15 thru 17) |

18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

PROCEED TO NEXT PAGE

VE/DE

PM Date

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

0 0

Page 1 of 2

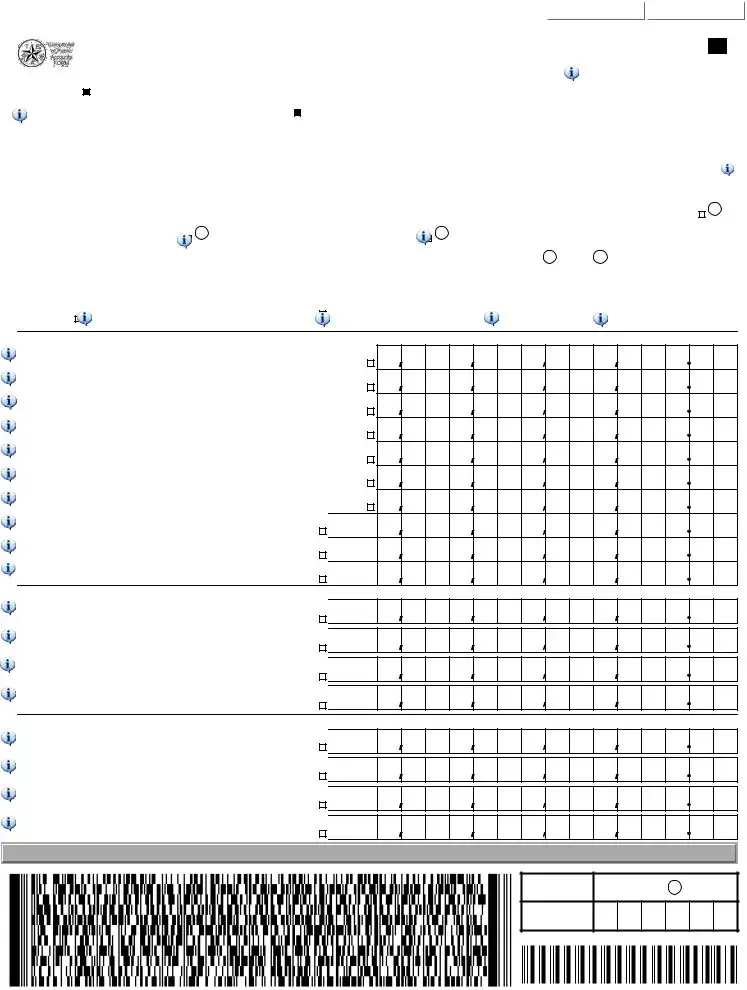

Tcode 13251 Annual

Tcode 13251 Annual

Texas Franchise Tax Report - Page 2

Taxpayer number |

|

Report year |

Due date |

Taxpayer name |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

0 |

|

|

2 |

|

|

1 |

|

|

06/15/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

MARGIN (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

||||||||||||||||||

19. |

70% revenue (item 10 x .70) |

19. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

20. |

Revenue less COGS (item 10 - item 14) |

20. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Revenue less compensation (item 10 - item 18) |

21. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

22. |

Revenue less $1 million (item 10 - $1,000,000) |

22. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

23. |

MARGIN (see instructions) |

23. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPORTIONMENT FACTOR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

24. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||||

24. |

Gross receipts in Texas (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

25. |

Gross receipts everywhere (Whole dollars only) |

25. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

26. |

APPORTIONMENT FACTOR (Divide item 24 by item 25, round to 4 decimal places) |

|

|

|

|

|

|

26. |

|

|

|

. |

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

TAXABLE MARGIN (Whole dollars only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

||||||||||||||||||

27. |

Apportioned margin (Multiply item 23 by item 26) |

27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

28. |

Allowable deductions (see instructions) |

28. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

29. |

TAXABLE MARGIN (item 27 minus item 28) |

29. |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

0 |

0 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

TAX DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

X X |

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||||||||||||

30. |

Tax rate (see instructions for determining the appropriate tax rate) |

|

|

|

|

|

|

|

|

|

30. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31. |

Tax due (Multiply item 29 by the tax rate in item 30) (Dollars and cents) 31. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX ADJUSTMENTS (Dollars and cents) (Do not include prior payments) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||||||||||||

32. |

Tax credits (item 23 from Form |

|

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

33. |

Tax due before discount (item 31 minus item 32) |

|

|

|

|

|

|

|

33. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

34. |

Discount (see instructions, applicable to report years 2008 and 2009) |

34. |

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

TOTAL TAX DUE (Dollars and cents) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

, |

|

|

, |

|

|

|

, |

|

|

. |

|

|

||||||||||||||||||

35. |

TOTAL TAX DUE (item 33 minus item 34) |

|

|

|

|

|

|

|

35. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

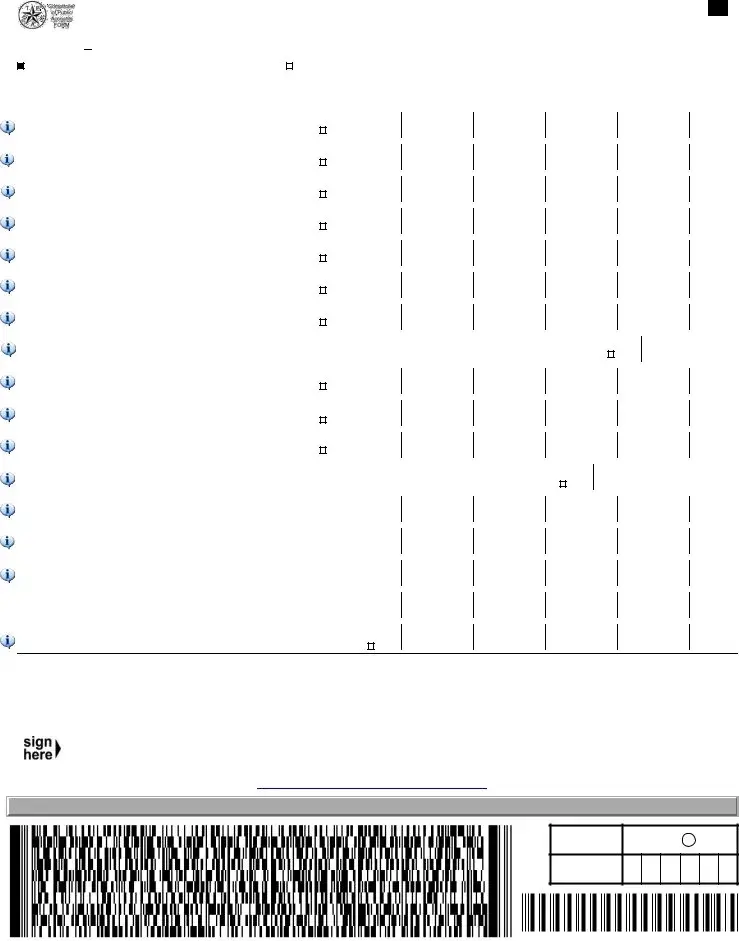

Do not include payment if item 35 is less than $1,000 or if annualized total revenue is less than the no tax due threshold (see instructions). If the entity

makes a tiered partnership election, ANY amount in item 35 is due. Complete Form

Print or type name |

Area code and phone number |

|||

|

|

( |

) |

- |

|

|

|

|

|

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

|

Mail original to: |

|

|

|

|

Texas Comptroller of Public Accounts |

|

|

Date |

|

||

|

|

|

P.O. Box 149348 |

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|

|

Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. If you have any questions, call

RETURN TO PAGE 1

VE/DE

PM Date

Page 2 of 2

More PDF Templates

Reseller Permit Texas - To successfully obtain the permit, declarations about the accuracy of the information are required from all signers.

How Do I Transfer a Property Title to a Family Member? - The Grantor must fill out their name and the Grantees' names on the Gift Deed.

Texas Neighborhood Nuisance Abatement Act - The statutes encourage collaboration between law enforcement and local authorities.

Common mistakes

-

Incorrect Taxpayer Information: Failing to provide the correct taxpayer number or name can lead to processing delays.

-

Missing Report Year: Not specifying the report year can result in confusion and potential penalties.

-

Improper Revenue Reporting: Reporting gross receipts or sales inaccurately may affect the tax calculation.

-

Ignoring Adjustments: Not blackening the circle for adjusted revenue can lead to incorrect assessments.

-

Omitting Exclusions: Failing to list exclusions from gross revenue can inflate taxable amounts.

-

Errors in Cost of Goods Sold: Miscalculating the cost of goods sold can impact the overall tax margin.

-

Incorrect Compensation Figures: Reporting inaccurate wages or benefits can lead to miscalculations in total compensation.

-

Neglecting to Calculate the Apportionment Factor: This can result in incorrect taxable margins.

-

Failure to Sign and Date: Not signing the form or providing the date can result in rejection of the submission.

Key takeaways

When filling out and using the Texas 05 158 A form, consider the following key takeaways:

- Understand the Purpose: This form is used to report franchise taxes for businesses operating in Texas.

- Know Your Due Date: The form is typically due on June 15th of the reporting year. For example, the 2021 report was due on June 15, 2021.

- Provide Accurate Revenue Information: Report all gross receipts, including sales, dividends, and other income. Ensure that the total revenue is calculated correctly.

- Cost of Goods Sold: Accurately fill out the cost of goods sold section. This includes direct costs and limited administrative overhead costs.

- Calculate the Taxable Margin: Follow the specific calculations for determining your taxable margin, which will affect the amount of tax due.

- Review Instructions Carefully: Each report year has specific instructions available online. These instructions can clarify any uncertainties about filling out the form.

Steps to Using Texas 05 158 A

Filling out the Texas 05 158 A form is an essential step for businesses to comply with state tax requirements. This form collects information regarding your business's financial activities for the reporting year. To ensure accuracy, follow these steps closely.

- Begin by entering your taxpayer number and the report year at the top of the form.

- Fill in the due date for your report, which is typically June 15 of the reporting year.

- Provide your taxpayer name, mailing address, city, state, country, and ZIP code.

- If your address has changed, blacken the corresponding circle.

- If you are filing a combined report, blacken that circle as well.

- If applicable, indicate if total revenue is adjusted for the Tiered Partnership Election.

- Specify if your entity is a corporation, limited liability company, professional association, limited partnership, or financial institution by selecting "Yes" or "No."

- For the accounting year, enter the begin date and end date in the specified format.

- Report your gross receipts or sales in whole dollars.

- Continue to fill out the subsequent lines with dividends, interest, rents, royalties, gains/losses, and other income, ensuring all amounts are in whole dollars.

- Add items 1 through 7 to calculate total gross revenue.

- Report any exclusions from gross revenue as instructed.

- Calculate your total revenue by subtracting exclusions from total gross revenue.

- Fill in the cost of goods sold, including indirect or administrative overhead costs and other costs as specified.

- Calculate your total cost of goods sold by adding the costs together.

- Report wages and cash compensation, employee benefits, and any other compensation.

- Calculate total compensation by adding all compensation amounts.

- Proceed to the next page and complete the margin calculations, including 70% revenue, revenue less COGS, revenue less compensation, and revenue less $1 million.

- Determine your taxable margin and complete the apportionment factor.

- Calculate your tax due based on the taxable margin and applicable tax rate.

- Include any tax adjustments and calculate the total tax due.

- Finally, sign and date the form, and provide your contact information.

- Mail the completed form to the Texas Comptroller of Public Accounts at the specified address.