Blank Tcdrs 70 Texas PDF Template

Form Example

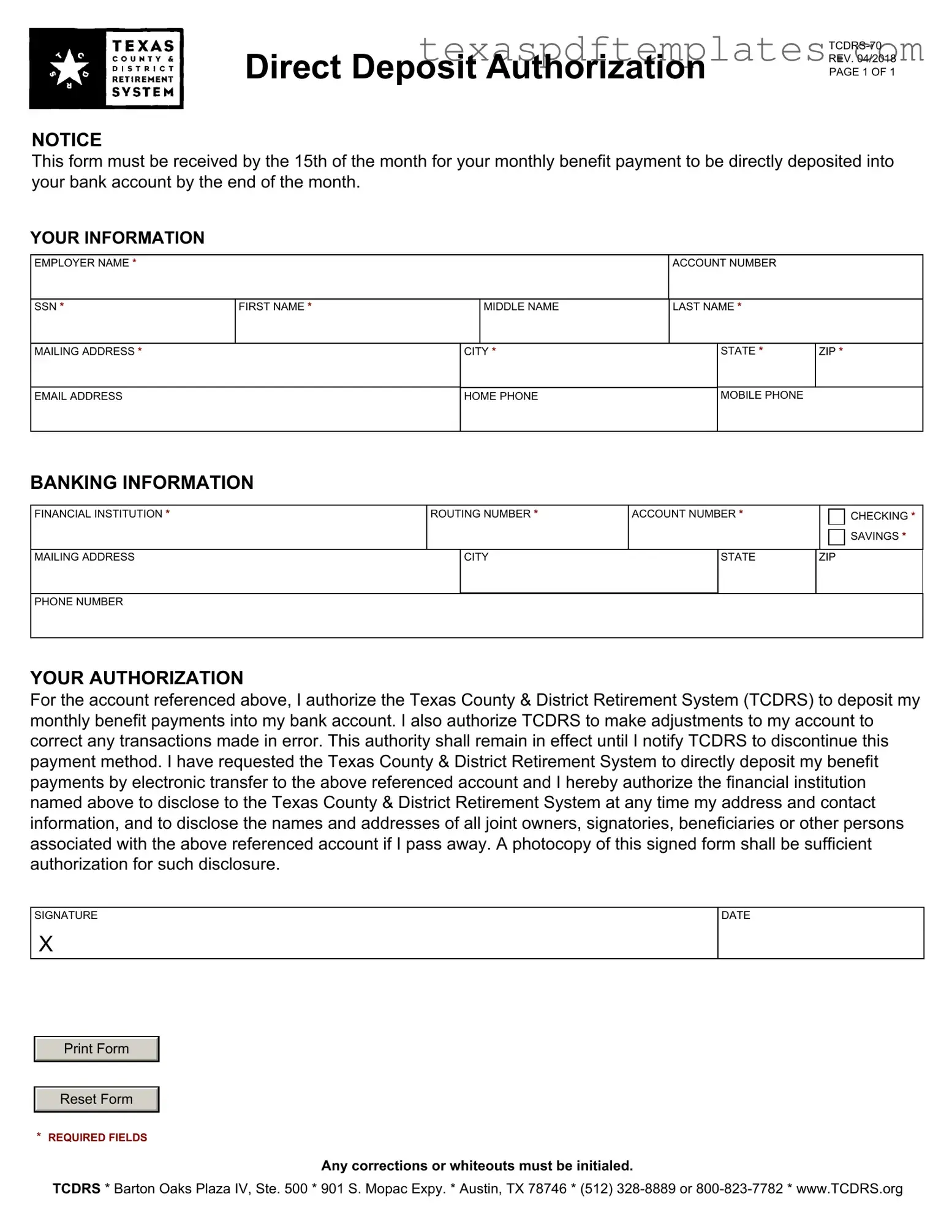

Direct Deposit Authorization

NOTICE

This form must be received by the 15th of the month for your monthly benefit payment to be directly deposited into your bank account by the end of the month.

YOUR INFORMATION

EMPLOYER NAME * |

|

|

|

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

SSN * |

FIRST NAME * |

|

MIDDLE NAME |

LAST NAME * |

|

|

|

|

|

|

|

|

|

MAILING ADDRESS * |

|

CITY * |

|

STATE * |

ZIP * |

|

|

|

|

|

|

|

|

EMAIL ADDRESS |

|

HOME PHONE |

|

MOBILE PHONE |

|

|

|

|

|

||||

|

|

|

|

|

|

|

BANKING INFORMATION

FINANCIAL INSTITUTION * |

ROUTING NUMBER * |

ACCOUNT NUMBER * |

|

CHECKING * |

||

|

|

|

|

|

|

SAVINGS * |

|

|

|

|

|

|

|

MAILING ADDRESS |

|

CITY |

|

STATE |

ZIP |

|

|

|

|

|

|

|

|

PHONE NUMBER

YOUR AUTHORIZATION

For the account referenced above, I authorize the Texas County & District Retirement System (TCDRS) to deposit my monthly benefit payments into my bank account. I also authorize TCDRS to make adjustments to my account to correct any transactions made in error. This authority shall remain in effect until I notify TCDRS to discontinue this payment method. I have requested the Texas County & District Retirement System to directly deposit my benefit payments by electronic transfer to the above referenced account and I hereby authorize the financial institution named above to disclose to the Texas County & District Retirement System at any time my address and contact information, and to disclose the names and addresses of all joint owners, signatories, beneficiaries or other persons associated with the above referenced account if I pass away. A photocopy of this signed form shall be sufficient authorization for such disclosure.

SIGNATURE

X

Print Form

Reset Form

*REQUIRED FIELDS

DATE

Any corrections or whiteouts must be initialed.

TCDRS * Barton Oaks Plaza IV, Ste. 500 * 901 S. Mopac Expy. * Austin, TX 78746 * (512)

More PDF Templates

Vaccines for 65 and Older - The form protects both the patient’s and provider's rights regarding immunization.

Texas Tobacco License - For those planning to sell tobacco products online, this application is a necessary step.

Common mistakes

-

Missing Required Fields: Failing to complete all required fields, such as your name, Social Security Number (SSN), or account number, can lead to delays in processing.

-

Incorrect Routing Number: Entering an incorrect routing number can result in your funds being deposited into the wrong account.

-

Wrong Account Type: Selecting the wrong account type (checking or savings) can cause issues with your direct deposit.

-

Inaccurate Contact Information: Providing incorrect phone numbers or email addresses can hinder communication regarding your account.

-

Not Initialing Corrections: Any corrections or whiteouts on the form must be initialed. Failing to do so can lead to the form being rejected.

-

Late Submission: Submitting the form after the 15th of the month means your direct deposit will not occur until the following month.

-

Neglecting to Sign: Forgetting to sign the form is a common mistake that will prevent your request from being processed.

-

Not Keeping a Copy: Failing to keep a copy of the completed form for your records can make it difficult to track your request.

Key takeaways

When filling out the Tcdrs 70 Texas form, several key points should be kept in mind to ensure a smooth process.

- Submission Deadline: The form must be submitted by the 15th of the month to guarantee that your benefit payment is directly deposited by the end of that month.

- Accurate Information: All fields marked with an asterisk (*) are required. Ensure that your personal information, including your name, Social Security Number, and banking details, is accurate to avoid delays.

- Banking Details: Provide the correct financial institution name, routing number, and account number. Specify whether the account is a checking or savings account.

- Authorization: By signing the form, you authorize the Texas County & District Retirement System (TCDRS) to deposit your benefit payments and make necessary adjustments for any errors.

- Continuity of Authorization: This authorization remains in effect until you notify TCDRS to discontinue direct deposit. A photocopy of the signed form is valid for disclosure purposes.

Taking these steps will help ensure that your direct deposit process is efficient and effective.

Steps to Using Tcdrs 70 Texas

Filling out the Tcdrs 70 Texas form requires careful attention to detail, as this information will facilitate the direct deposit of your monthly benefit payments into your bank account. Ensuring accuracy is crucial, as any errors may delay your payments. Below are the steps to complete the form effectively.

- Obtain the form: Make sure you have the Tcdrs 70 Texas form in front of you, either in printed form or as a digital file.

- Fill in your personal information: Start by entering your employer name, account number, Social Security Number (SSN), first name, middle name (if applicable), and last name. Ensure that all fields marked with an asterisk (*) are completed.

- Provide your mailing address: Input your complete mailing address, including city, state, and ZIP code. This information is essential for communication purposes.

- Include your contact information: Enter your email address, home phone number, and mobile phone number. This will help TCDRS reach you if needed.

- Fill in banking information: Specify the name of your financial institution, along with the routing number and account number. Indicate whether the account is a checking or savings account by marking the appropriate box.

- Complete the banking address: If your bank has a different mailing address, provide that information, including city, state, ZIP code, and phone number.

- Review your authorization: Read through the authorization section carefully. This section confirms your consent for TCDRS to deposit your benefits and make any necessary adjustments to correct errors.

- Sign and date the form: At the bottom of the form, sign your name where indicated and write the date. Remember that any corrections or whiteouts must be initialed by you.

- Submit the form: Ensure that the completed form is sent to TCDRS by the 15th of the month to guarantee that your benefits will be deposited by the end of that month.