Attorney-Approved Texas Small Estate Affidavit Template

Form Example

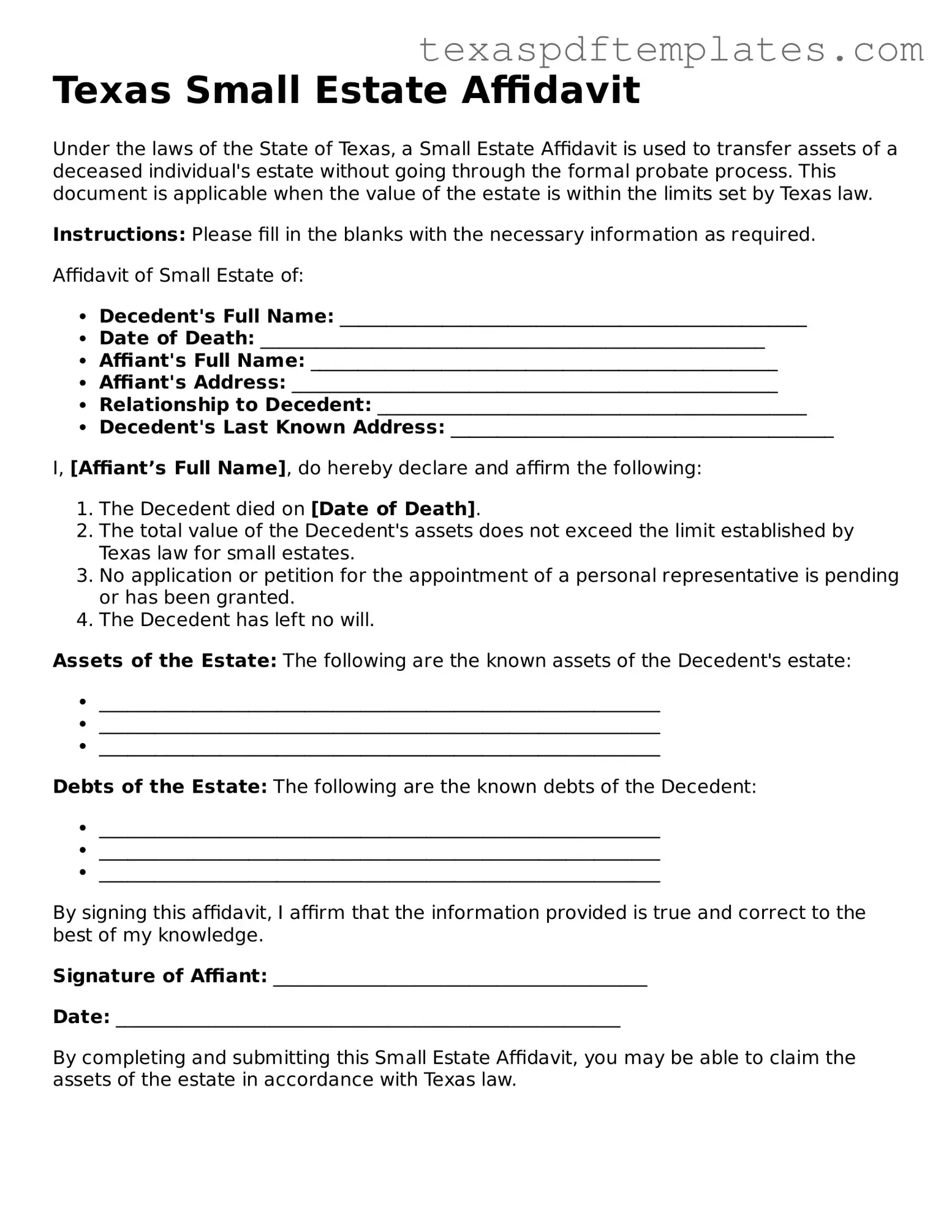

Texas Small Estate Affidavit

Under the laws of the State of Texas, a Small Estate Affidavit is used to transfer assets of a deceased individual's estate without going through the formal probate process. This document is applicable when the value of the estate is within the limits set by Texas law.

Instructions: Please fill in the blanks with the necessary information as required.

Affidavit of Small Estate of:

- Decedent's Full Name: __________________________________________________

- Date of Death: ______________________________________________________

- Affiant's Full Name: __________________________________________________

- Affiant's Address: ____________________________________________________

- Relationship to Decedent: ______________________________________________

- Decedent's Last Known Address: _________________________________________

I, [Affiant’s Full Name], do hereby declare and affirm the following:

- The Decedent died on [Date of Death].

- The total value of the Decedent's assets does not exceed the limit established by Texas law for small estates.

- No application or petition for the appointment of a personal representative is pending or has been granted.

- The Decedent has left no will.

Assets of the Estate: The following are the known assets of the Decedent's estate:

- ____________________________________________________________

- ____________________________________________________________

- ____________________________________________________________

Debts of the Estate: The following are the known debts of the Decedent:

- ____________________________________________________________

- ____________________________________________________________

- ____________________________________________________________

By signing this affidavit, I affirm that the information provided is true and correct to the best of my knowledge.

Signature of Affiant: ________________________________________

Date: ______________________________________________________

By completing and submitting this Small Estate Affidavit, you may be able to claim the assets of the estate in accordance with Texas law.

Other Popular Texas Templates

Bill of Sale Tractor - Facilitates registration and titling of the tractor in the buyer's name.

Hold Harmless Indemnity Agreement - The agreement is commonly utilized in the context of leases and permits.

Common mistakes

-

Inaccurate Property Valuation: Many individuals underestimate or overestimate the value of the estate's assets. Accurate valuation is crucial, as it determines eligibility for the small estate process. Ensure that all assets are appraised correctly to avoid complications.

-

Omitting Debts: Some people fail to disclose all debts associated with the estate. It is essential to list all liabilities to provide a complete picture of the estate's financial status. This transparency helps prevent disputes among heirs.

-

Incorrect Signatures: The affidavit requires signatures from specific individuals, including heirs and witnesses. Missing or incorrect signatures can lead to delays or rejection of the affidavit. Double-check that all necessary parties have signed.

-

Not Meeting Eligibility Requirements: Individuals sometimes overlook the eligibility criteria for filing a small estate affidavit. Ensure that the estate meets Texas's requirements, such as the total value of assets not exceeding the specified limit.

-

Failure to Include Necessary Documentation: Supporting documents, such as death certificates and asset ownership proofs, are often not included. Ensure all required documentation accompanies the affidavit to facilitate a smoother process.

Key takeaways

Filling out and using the Texas Small Estate Affidavit can simplify the process of settling an estate with limited assets. Here are some key takeaways to keep in mind:

- The Small Estate Affidavit is designed for estates valued at $75,000 or less, excluding certain exempt assets.

- To qualify, the deceased must have been a Texas resident at the time of death.

- Only certain individuals can file the affidavit, typically heirs or beneficiaries of the estate.

- The form must be filed in the county where the deceased lived, and it becomes part of the public record.

- All heirs must agree to the contents of the affidavit and sign it, ensuring that everyone is on the same page.

- Once approved, the affidavit allows heirs to access the deceased’s assets without going through formal probate.

- Be prepared to provide a copy of the death certificate along with the affidavit when filing.

- Consulting with a legal advisor can help clarify any uncertainties and ensure compliance with state laws.

Steps to Using Texas Small Estate Affidavit

After gathering the necessary information, you can proceed to fill out the Texas Small Estate Affidavit form. This document will help streamline the process of settling an estate with minimal assets, allowing heirs to claim property without going through a lengthy probate process.

- Obtain the Form: Download the Texas Small Estate Affidavit form from a reliable source or visit your local courthouse to pick up a physical copy.

- Fill in Personal Information: Enter your name, address, and contact information at the top of the form. This section usually requires the person filing the affidavit to be clearly identified.

- Provide Decedent's Information: Include the full name, date of death, and last known address of the deceased person (decedent).

- List Heirs: Identify all heirs of the estate. Provide their names, addresses, and relationships to the decedent. Make sure to include everyone entitled to inherit.

- Detail Estate Assets: List all assets that are part of the estate. Include descriptions and estimated values for each asset. This may consist of bank accounts, real estate, personal property, etc.

- State Debts and Liabilities: Disclose any known debts or liabilities of the decedent. This helps clarify the net value of the estate.

- Sign the Affidavit: The person filing the affidavit must sign and date the form. Ensure that the signature is done in the presence of a notary public.

- Notarization: Have the affidavit notarized. This step is crucial as it verifies the authenticity of the signatures and the contents of the document.

- File the Affidavit: Submit the completed and notarized affidavit to the appropriate court in the county where the decedent lived. There may be a filing fee, so check in advance.

Once the form is filed, the court will review it. If everything is in order, the estate can be settled according to Texas law, allowing heirs to claim their rightful inheritance efficiently.