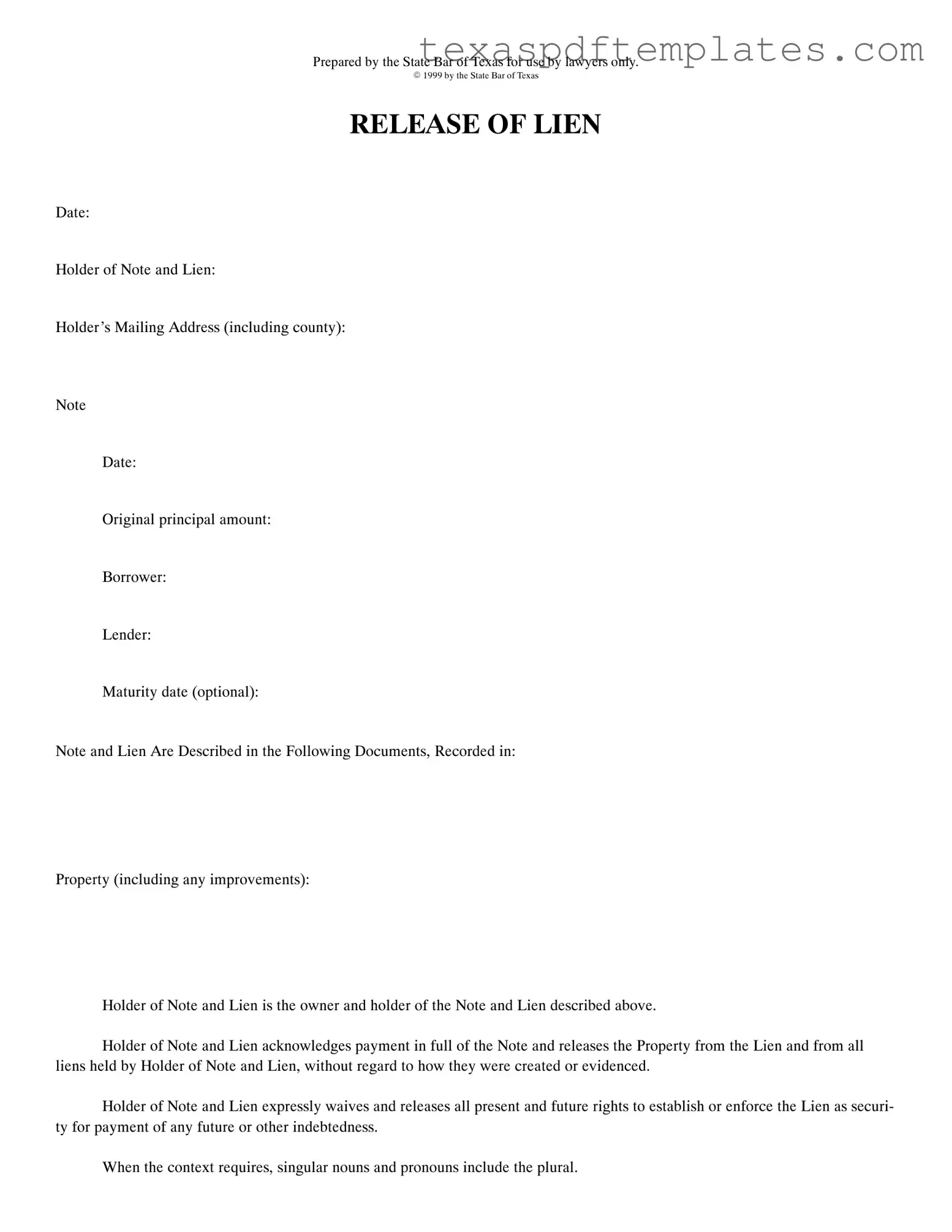

Blank Release Of Lien Texas PDF Template

Form Example

Prepared by the State Bar of Texas for use by lawyers only.

E 1999 by the State Bar of Texas

RELEASE OF LIEN

Date:

Holder of Note and Lien:

Holder’s Mailing Address (including county):

Note

Date:

Original principal amount:

Borrower:

Lender:

Maturity date (optional):

Note and Lien Are Described in the Following Documents, Recorded in:

Property (including any improvements):

Holder of Note and Lien is the owner and holder of the Note and Lien described above.

Holder of Note and Lien acknowledges payment in full of the Note and releases the Property from the Lien and from all liens held by Holder of Note and Lien, without regard to how they were created or evidenced.

Holder of Note and Lien expressly waives and releases all present and future rights to establish or enforce the Lien as securi- ty for payment of any future or other indebtedness.

When the context requires, singular nouns and pronouns include the plural.

|

(Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

. |

|

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

|

(Corporate Acknowledgment) |

|

STATE OF TEXAS |

|

|

COUNTY OF |

|

|

This instrument was acknowledged before me on |

, |

|

by |

, |

|

of |

|

|

a |

|

corporation, on behalf of said corporation. |

|

|

|

|

Notary Public, State of Texas |

|

|

Notary’s name (printed): |

|

|

Notary’s commission expires: |

|

AFTER RECORDING RETURN TO: |

PREPARED IN THE LAW OFFICE OF: |

More PDF Templates

Texas Department of Insurance Forms - For questions, you can email or call the Texas Department of Insurance.

Ut Forms - It's important to double-check that your phone numbers are correct.

Rrc Forms - Operators are also accountable for the costs associated with plugging inactive wells based on the Commission's calculations.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. Each section of the form is crucial for its validity. Missing details can lead to delays or even the rejection of the release.

-

Incorrect Names: Using the wrong names for the holder of the note and lien, borrower, or lender can create confusion. It is essential to ensure that all names are spelled correctly and match the official records.

-

Improper Property Description: The property must be accurately described, including any improvements. A vague or incorrect description can result in disputes about the lien's release.

-

Failure to Sign: The form must be signed by the holder of the note and lien. Omitting a signature will render the document ineffective, as it lacks the necessary authorization.

-

Notary Issues: Notarization is a critical step. If the document is not properly acknowledged by a notary public, it may not be legally binding. Ensure that the notary's name is printed clearly and that their commission is valid.

-

Incorrect Dates: Dates play a vital role in the release of lien process. Providing incorrect dates, such as the date of acknowledgment or the note date, can create legal complications.

-

Omitting the Return Address: After recording, the document should be returned to a specified address. Failing to include this information can lead to lost documents and further delays.

-

Ignoring the Acknowledgment Section: The acknowledgment section must be completed accurately. Neglecting this part can invalidate the entire form, as it verifies the authenticity of the signatures.

-

Not Keeping Copies: After submission, it is wise to retain copies of the completed form. Not keeping records can lead to difficulties in proving that the lien was released if future issues arise.

Key takeaways

When filling out and using the Release Of Lien Texas form, keep the following key points in mind:

- The form is designed for use by lawyers, but can be utilized by individuals with proper understanding.

- Ensure that all required fields are completed accurately, including the holder's name and address.

- The date of the release is critical; make sure it reflects the actual date of signing.

- Clearly identify the property involved, including any improvements, to avoid future disputes.

- The holder of the lien must acknowledge payment in full to release the lien effectively.

- Be aware that the holder waives any future rights to enforce the lien once the form is executed.

- Notarization is necessary for the document to be legally binding.

- Check the expiration date of the notary’s commission to ensure validity.

- After recording, return the document to the appropriate law office as specified.

- Keep a copy of the completed form for your records, as proof of lien release.

Steps to Using Release Of Lien Texas

Completing the Release of Lien form in Texas is a straightforward process that requires careful attention to detail. Once you have filled out the form correctly, it should be submitted to the appropriate authority for recording. Following these steps will ensure that all necessary information is included, making the process smoother.

- Date: Write the current date at the top of the form.

- Holder of Note and Lien: Enter the name of the individual or entity that holds the note and lien.

- Holder’s Mailing Address: Provide the complete mailing address of the holder, including the county.

- Note Date: Fill in the date when the note was originally created.

- Original Principal Amount: State the original amount of the loan or obligation.

- Borrower: Include the name of the borrower associated with the note.

- Lender: Specify the name of the lender.

- Maturity Date (optional): If applicable, write the date when the note is due to be paid in full.

- Note and Lien Are Described in the Following Documents: List any documents that describe the note and lien and indicate where they are recorded.

- Property: Describe the property that is subject to the lien, including any improvements.

- Holder of Note and Lien Acknowledgment: Confirm that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: Complete the acknowledgment section, including the state and county, the date of acknowledgment, and the name of the person acknowledging the document.

- Notary Public: Have a notary public sign and stamp the document, including their printed name and commission expiration date.

- Corporate Acknowledgment (if applicable): If the holder is a corporation, complete the corporate acknowledgment section with the necessary details.

- After Recording Return To: Indicate the name and address of the law office or individual to whom the document should be returned after recording.