Attorney-Approved Texas Promissory Note Template

Form Example

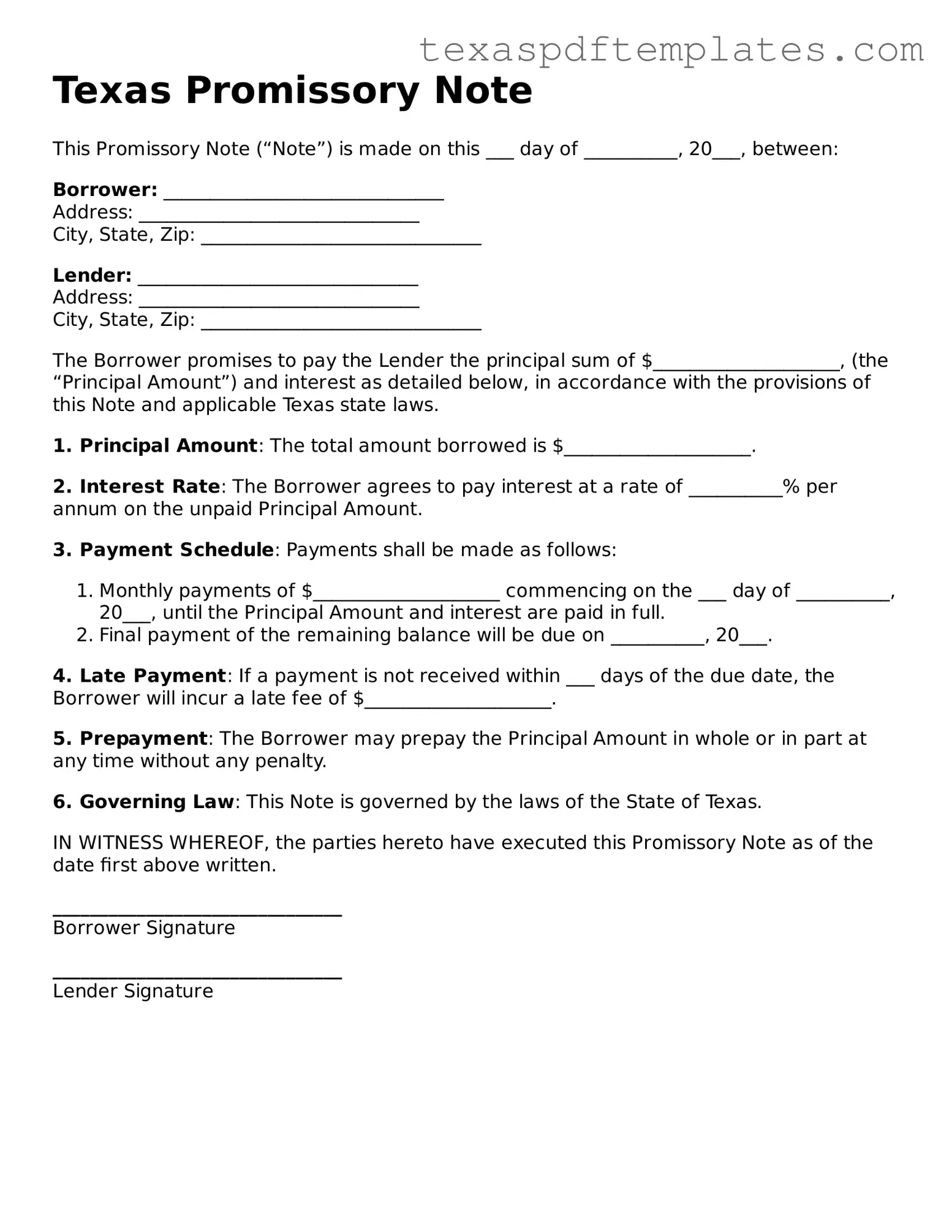

Texas Promissory Note

This Promissory Note (“Note”) is made on this ___ day of __________, 20___, between:

Borrower: ______________________________

Address: ______________________________

City, State, Zip: ______________________________

Lender: ______________________________

Address: ______________________________

City, State, Zip: ______________________________

The Borrower promises to pay the Lender the principal sum of $____________________, (the “Principal Amount”) and interest as detailed below, in accordance with the provisions of this Note and applicable Texas state laws.

1. Principal Amount: The total amount borrowed is $____________________.

2. Interest Rate: The Borrower agrees to pay interest at a rate of __________% per annum on the unpaid Principal Amount.

3. Payment Schedule: Payments shall be made as follows:

- Monthly payments of $____________________ commencing on the ___ day of __________, 20___, until the Principal Amount and interest are paid in full.

- Final payment of the remaining balance will be due on __________, 20___.

4. Late Payment: If a payment is not received within ___ days of the due date, the Borrower will incur a late fee of $____________________.

5. Prepayment: The Borrower may prepay the Principal Amount in whole or in part at any time without any penalty.

6. Governing Law: This Note is governed by the laws of the State of Texas.

IN WITNESS WHEREOF, the parties hereto have executed this Promissory Note as of the date first above written.

_______________________________

Borrower Signature

_______________________________

Lender Signature

Other Popular Texas Templates

Temporary Medical Power of Attorney - This document can be especially important if you travel frequently or move away from home.

Free Will Template Texas - Create a Last Will to express your final wishes regarding your estate and belongings.

Liability Waiver Form Texas - This release facilitates a greater understanding of shared responsibility.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill in all required fields. Each section of the form must be completed to ensure its validity.

-

Incorrect Dates: Entering the wrong date can lead to confusion about the loan's terms. Always double-check the start date and any due dates.

-

Missing Signatures: Both the borrower and the lender must sign the document. Omitting a signature can render the note unenforceable.

-

Improper Loan Amount: Ensure that the loan amount is clearly stated and accurate. Misrepresenting the amount can lead to disputes later.

-

Ambiguous Terms: Vague language regarding repayment terms can create misunderstandings. Be specific about interest rates, payment schedules, and any penalties.

-

Not Initialing Changes: If any part of the form is altered, those changes must be initialed by both parties. Failing to do so can cause issues in enforcement.

-

Ignoring State Laws: Each state has specific requirements for promissory notes. Not adhering to Texas laws can invalidate the document.

-

Failure to Keep Copies: After signing, both parties should retain copies of the note. This ensures that both have access to the agreed-upon terms.

-

Not Consulting a Professional: Skipping the step of having the document reviewed by a legal expert can lead to significant problems. Professional advice can help avoid costly mistakes.

Key takeaways

When dealing with the Texas Promissory Note form, it is essential to understand its components and implications. Here are ten key takeaways to consider:

- Definition: A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a defined future date.

- Parties Involved: The note involves two primary parties: the borrower (the person receiving the funds) and the lender (the person providing the funds).

- Clear Terms: The document should clearly outline the loan amount, interest rate, repayment schedule, and any penalties for late payments.

- Interest Rate: Texas law allows for various interest rates, but it is crucial to ensure that the rate complies with state regulations to avoid any legal issues.

- Signatures: Both parties must sign the promissory note for it to be legally binding. This indicates mutual agreement to the terms outlined in the document.

- Notarization: While notarization is not always required, having the document notarized can provide additional legal protection and help verify the identities of the parties involved.

- Repayment Terms: Clearly state when and how payments will be made. This can include monthly installments or a lump-sum payment at maturity.

- Default Clauses: Include provisions that explain what happens in the event of a default. This might involve late fees or the lender’s right to demand immediate repayment.

- Governing Law: The note should specify that it is governed by Texas law, ensuring that any disputes will be resolved according to state regulations.

- Record Keeping: Both parties should keep a copy of the signed promissory note for their records. This documentation is vital for future reference and potential legal matters.

By understanding these key aspects, individuals can effectively navigate the process of creating and utilizing a Texas Promissory Note.

Steps to Using Texas Promissory Note

After obtaining the Texas Promissory Note form, you will need to carefully fill it out with the necessary information. This document will require details about the loan, the parties involved, and the repayment terms. Ensure that all information is accurate to avoid any potential disputes in the future.

- Identify the Parties: Start by entering the names and addresses of both the borrower and the lender at the top of the form.

- Specify the Loan Amount: Clearly write the total amount of money being borrowed. This should be in both numerical and written form to avoid any confusion.

- State the Interest Rate: Indicate the interest rate that will apply to the loan. Make sure to specify whether it is fixed or variable.

- Outline the Repayment Terms: Describe how and when the borrower will repay the loan. Include the payment schedule, such as monthly or quarterly payments.

- Include Late Fees: If applicable, mention any late fees that will be charged if payments are not made on time.

- Signatures: Ensure that both the borrower and the lender sign and date the form. This signifies that both parties agree to the terms outlined in the note.

- Witness or Notary: Depending on your needs, you may want to have the document witnessed or notarized for added legal protection.