Attorney-Approved Texas Operating Agreement Template

Form Example

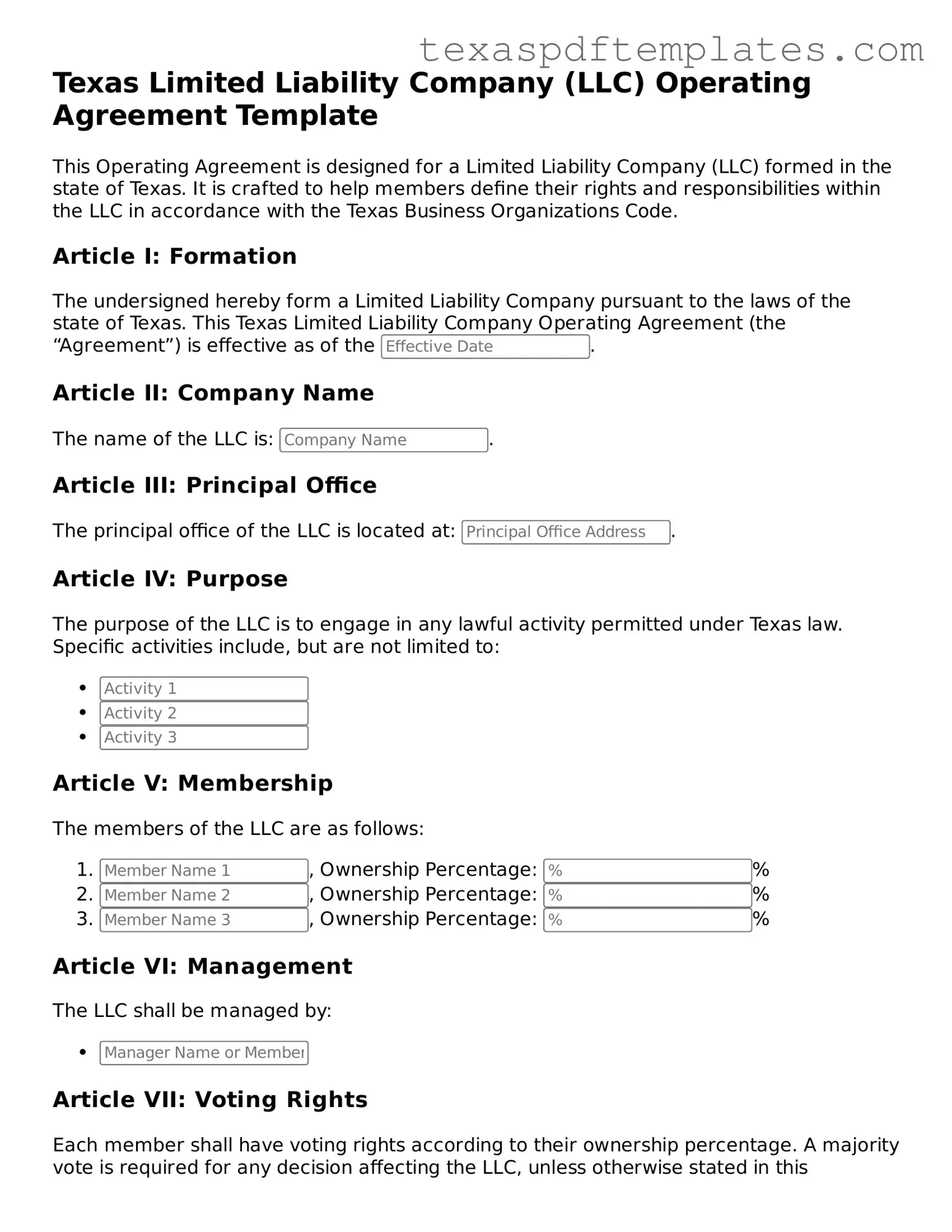

Texas Limited Liability Company (LLC) Operating Agreement Template

This Operating Agreement is designed for a Limited Liability Company (LLC) formed in the state of Texas. It is crafted to help members define their rights and responsibilities within the LLC in accordance with the Texas Business Organizations Code.

Article I: Formation

The undersigned hereby form a Limited Liability Company pursuant to the laws of the state of Texas. This Texas Limited Liability Company Operating Agreement (the “Agreement”) is effective as of the .

Article II: Company Name

The name of the LLC is: .

Article III: Principal Office

The principal office of the LLC is located at: .

Article IV: Purpose

The purpose of the LLC is to engage in any lawful activity permitted under Texas law. Specific activities include, but are not limited to:

Article V: Membership

The members of the LLC are as follows:

- , Ownership Percentage: %

- , Ownership Percentage: %

- , Ownership Percentage: %

Article VI: Management

The LLC shall be managed by:

Article VII: Voting Rights

Each member shall have voting rights according to their ownership percentage. A majority vote is required for any decision affecting the LLC, unless otherwise stated in this Agreement.

Article VIII: Distributions

Distributions of profits and losses shall be made to the members in proportion to their ownership percentages as stated in Article V.

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all members. Any modifications shall be recorded and acknowledged by the members.

Article X: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the state of Texas.

Signatures

By signing below, each member agrees to the terms of this Operating Agreement:

- Member Name: , Date:

- Member Name: , Date:

- Member Name: , Date:

Other Popular Texas Templates

Texas Transfer on Death Deed Form - This deed enables smooth and direct transfer of real estate without going through the probate process.

Firearm Bill of Sale Texas - A standard form that can be customized to fit individual transaction needs.

Common mistakes

-

Neglecting to include all members: One common mistake is failing to list every member of the LLC. Each member's name and contribution should be clearly documented to avoid confusion later.

-

Omitting the purpose of the LLC: It's essential to specify the purpose of your LLC in the agreement. Without this, the document may lack clarity and legal standing.

-

Not defining ownership percentages: Members should clearly outline their ownership stakes. This prevents disputes over profit sharing and decision-making authority.

-

Ignoring management structure: The agreement should state whether the LLC will be member-managed or manager-managed. This distinction is crucial for operational clarity.

-

Failing to address voting rights: Voting procedures and rights should be explicitly defined. This helps in resolving disagreements and ensures smooth governance.

-

Not including provisions for adding or removing members: Life circumstances change. It's wise to have clear guidelines on how new members can join or how existing members can exit the LLC.

-

Skipping dispute resolution methods: Including procedures for resolving disputes can save time and money in the future. Without this, conflicts may escalate unnecessarily.

-

Overlooking tax treatment options: Members should discuss and document how the LLC will be taxed. This can have significant financial implications for all involved.

-

Not reviewing the agreement regularly: As the business evolves, so should the operating agreement. Regular reviews ensure that it remains relevant and effective.

-

Failing to sign and date the document: An unsigned agreement lacks legal validity. Every member should sign and date the document to confirm their agreement and commitment.

Key takeaways

When filling out and using the Texas Operating Agreement form, keep these key takeaways in mind:

- Understand the purpose: An Operating Agreement outlines the management structure and operating procedures of your LLC.

- Identify members: Clearly list all members involved in the LLC. This establishes ownership and responsibilities.

- Define roles: Specify the roles and responsibilities of each member. This helps prevent misunderstandings down the line.

- Outline decision-making: Include procedures for making decisions, such as voting rights and how votes are counted.

- Address profit sharing: Clearly state how profits and losses will be distributed among members.

- Include a buy-sell agreement: This can provide a plan for what happens if a member wants to leave the LLC or sell their share.

- Set terms for meetings: Establish how often meetings will occur and the notice required for them.

- Consider amendments: Provide a process for how the Operating Agreement can be amended in the future.

- Consult legal advice: It’s wise to have a lawyer review the agreement to ensure it meets all legal requirements.

- Keep it accessible: Store the completed agreement in a safe but accessible location for all members to reference.

Steps to Using Texas Operating Agreement

Once you have the Texas Operating Agreement form in hand, it’s important to approach the completion of this document with care. This agreement outlines the management and operational structure of your business entity. To ensure that all necessary information is accurately captured, follow the steps outlined below.

- Begin by entering the name of your limited liability company (LLC) at the top of the form. Make sure it matches the name registered with the state.

- Next, provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- Identify the purpose of the LLC. Briefly describe the business activities the company will engage in.

- List the names and addresses of all members involved in the LLC. Include their ownership percentages as well.

- Detail the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Outline the voting rights of members. Specify how decisions will be made and what constitutes a quorum for meetings.

- Include provisions for adding or removing members. Explain the process that will be followed for these changes.

- Address how profits and losses will be distributed among members. This should reflect the ownership percentages established earlier.

- Lastly, review the entire document for accuracy. Ensure all information is complete and correct before signing.

Completing the Texas Operating Agreement form is a crucial step in formalizing your business structure. Once filled out, it should be signed by all members and kept on file as part of your business records.