Blank Mhd 1023 Texas PDF Template

Form Example

More PDF Templates

How Many Acres Do You Need for Ag Exemption in Texas - Retailers are allowed to accept this form as a blanket certificate for qualifying sales within its validity period.

Ifta Texas - Consulting compliance experts can provide additional guidance on the form's requirements.

Common mistakes

-

Incorrect Transaction Type: Selecting the wrong type of transaction can lead to delays. Ensure that you choose either personal property or real property correctly.

-

Missing Required Information: Failing to fill in all required fields can result in the application being returned. Double-check that all necessary information is provided, especially in Blocks 2 and 4.

-

Late Submission: Submitting the application more than 60 days after the sale can incur additional fees. Be mindful of the timeline to avoid unnecessary costs.

-

Improper Address Format: Providing an address that includes a P.O. Box or Route number is not acceptable. Use the physical address for the home instead.

-

Neglecting Signatures: Omitting signatures from sellers or purchasers can invalidate the application. Ensure all required parties sign the form where indicated.

Key takeaways

Filling out the MHD 1023 Texas form is an essential step in the process of transferring ownership of a manufactured home. Here are some key takeaways to keep in mind:

- Timeliness is Crucial: Submit your application for the Statement of Ownership and Location within 60 days of the sale. Late submissions may incur a fee of up to $100.

- Transaction Type Matters: Clearly identify whether the transaction is for personal or real property. Each type has different implications for ownership and title.

- Home Information is Required: Complete details about the home, including model, date of manufacture, and size, must be accurately filled out. This information is vital for processing your application.

- Texas Seal Requirement: If the home lacks HUD labels or Texas seals, you will need to purchase a Texas seal for each section of the home at an additional cost.

- Physical Location is Key: Provide the exact physical address of the home. P.O. boxes or route addresses are not acceptable.

- Ownership Details: Include complete information for both sellers and buyers. This includes names, addresses, and contact numbers to ensure clear communication.

- Right of Survivorship: If there are joint owners, indicate whether they desire the right of survivorship. This decision impacts how ownership is transferred upon death.

- Election of Property Type: Decide whether to treat the home as personal or real property. This choice affects how the home is recorded and taxed.

- Signature Requirements: Ensure that all necessary signatures are obtained. Notarization is optional but recommended for added authenticity.

By keeping these points in mind, you can navigate the process of filling out the MHD 1023 Texas form more effectively, ensuring a smoother transition of ownership for your manufactured home.

Steps to Using Mhd 1023 Texas

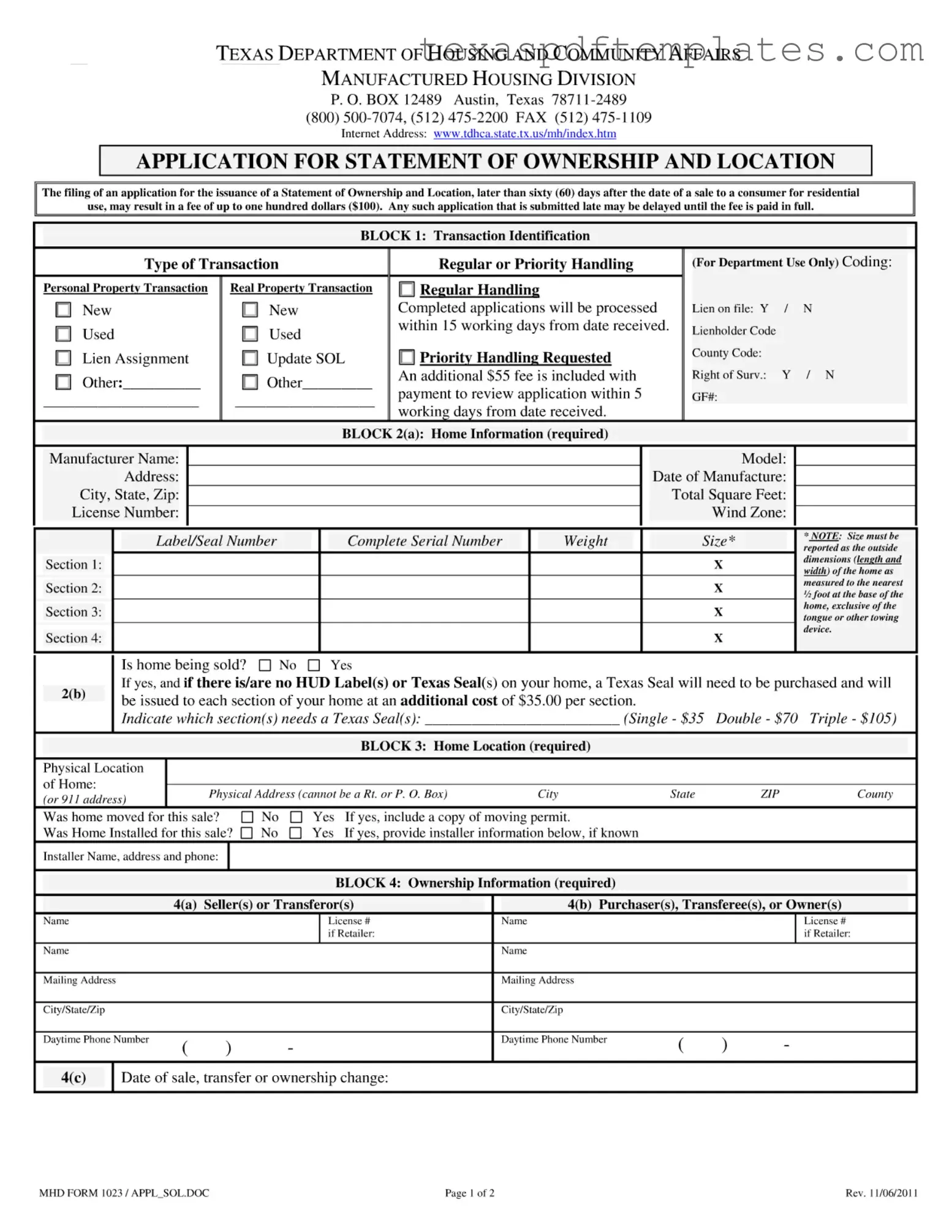

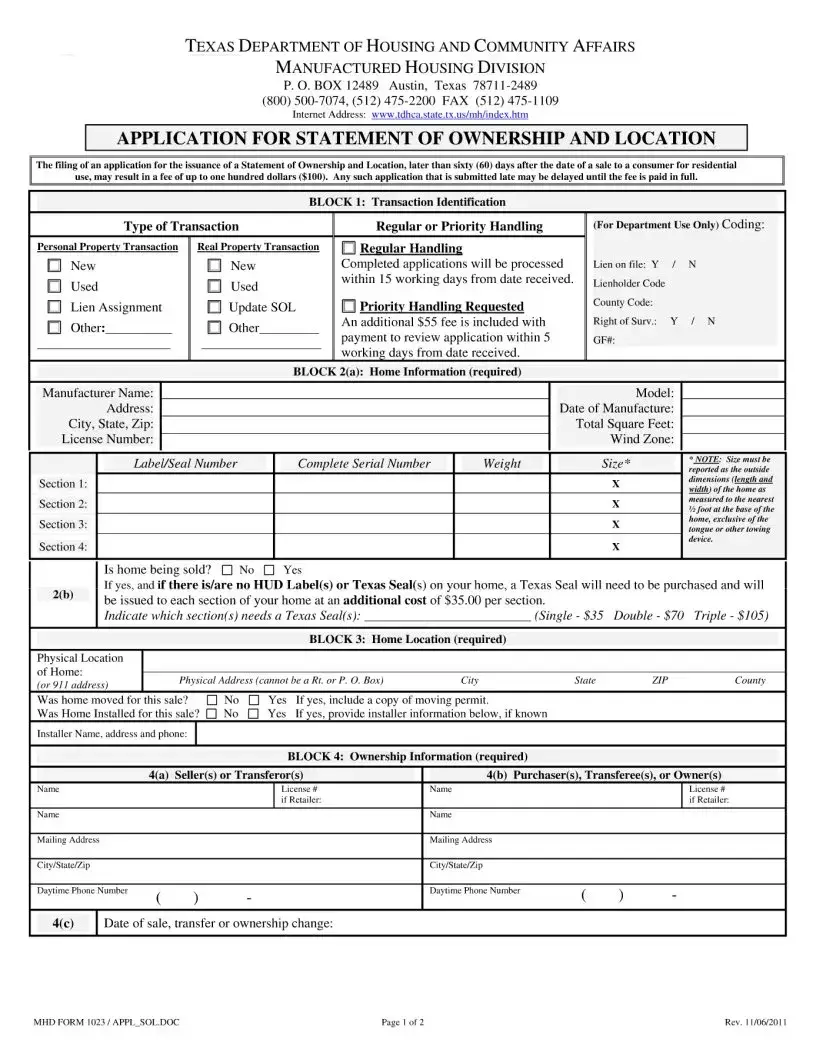

Filling out the Mhd 1023 Texas form is an important step in ensuring the proper ownership and location of a manufactured home is recorded. This process involves gathering specific information about the home, its location, and the parties involved in the transaction. Following the steps outlined below will help streamline your application and ensure that all necessary information is provided.

- Obtain the Form: Download or request the Mhd 1023 Texas form from the Texas Department of Housing and Community Affairs website or office.

- Fill Out Block 1: Identify the type of transaction (Personal Property or Real Property) and provide details such as the manufacturer name, address, and license number.

- Complete Block 2(a): Enter the home information, including model, date of manufacture, total square feet, wind zone, label/seal number, complete serial number, and weight. Specify if the home is being sold.

- Fill Out Block 2(b): If applicable, indicate if a Texas Seal is needed and specify which sections require it.

- Complete Block 3: Provide the physical location of the home, including the complete address and county. Indicate if the home was moved or installed for this sale.

- Fill Out Block 4: Provide ownership information for both the seller(s) and purchaser(s), including names, mailing addresses, and phone numbers.

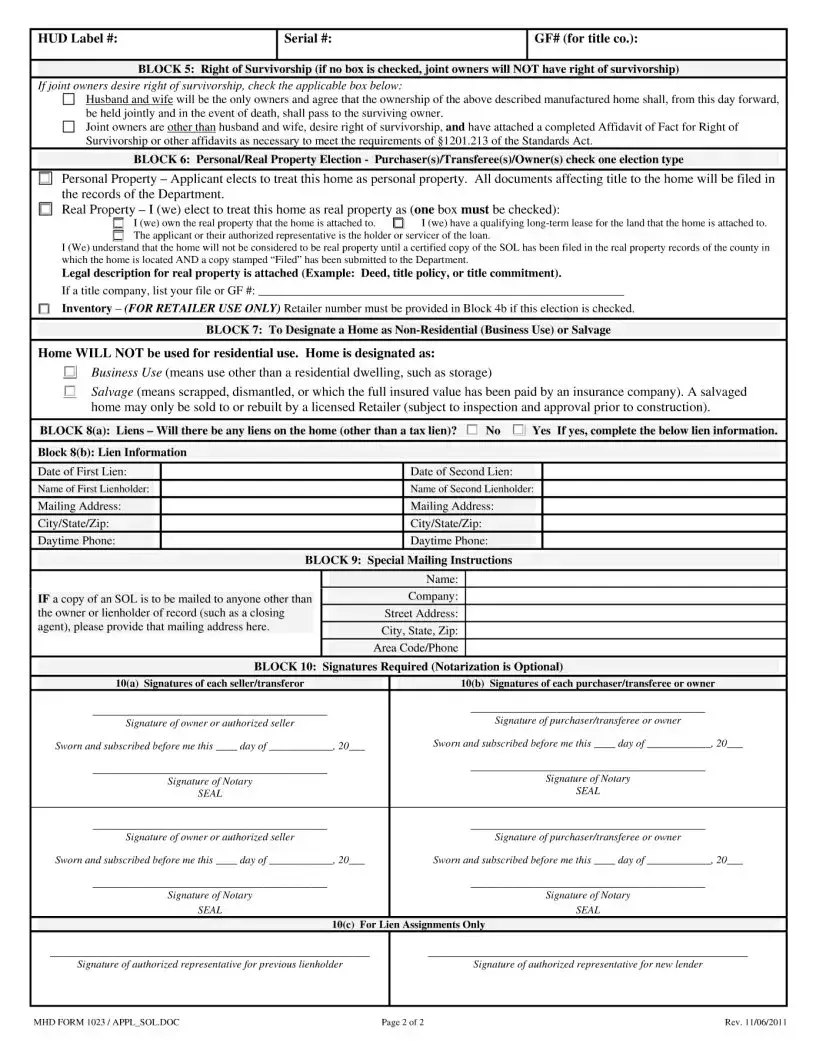

- Complete Block 5: Indicate if joint owners desire the right of survivorship by checking the appropriate box.

- Fill Out Block 6: Choose whether to treat the home as personal or real property and provide the necessary details for your choice.

- Complete Block 7: Designate if the home will be used for business or salvage purposes, if applicable.

- Fill Out Block 8: Indicate if there will be any liens on the home and provide the necessary lien information if applicable.

- Complete Block 9: Provide special mailing instructions if a copy of the Statement of Ownership and Location needs to be sent to someone other than the owner or lienholder.

- Signatures in Block 10: Ensure all required signatures are obtained from sellers, purchasers, and lienholders. Notarization is optional but recommended.