Attorney-Approved Texas Loan Agreement Template

Form Example

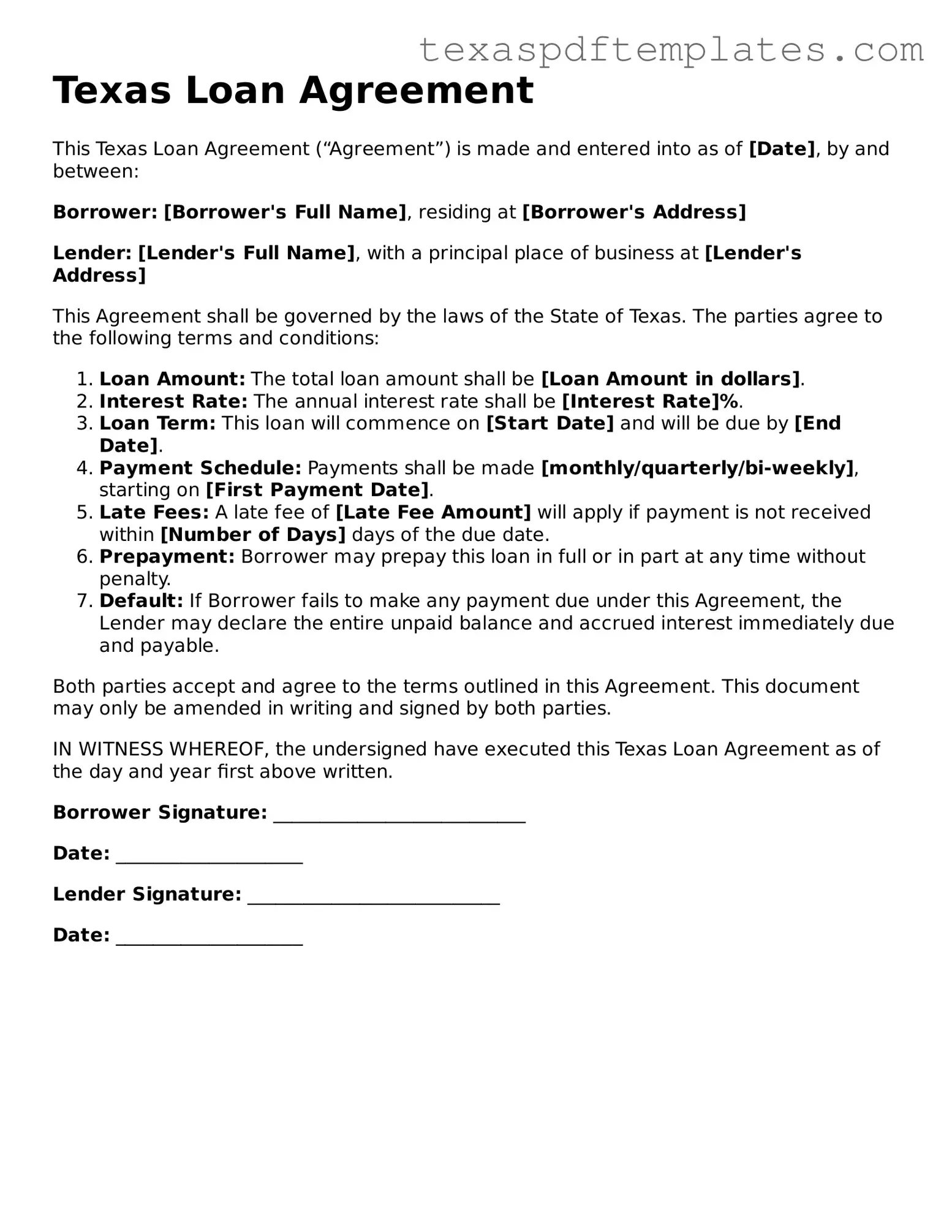

Texas Loan Agreement

This Texas Loan Agreement (“Agreement”) is made and entered into as of [Date], by and between:

Borrower: [Borrower's Full Name], residing at [Borrower's Address]

Lender: [Lender's Full Name], with a principal place of business at [Lender's Address]

This Agreement shall be governed by the laws of the State of Texas. The parties agree to the following terms and conditions:

- Loan Amount: The total loan amount shall be [Loan Amount in dollars].

- Interest Rate: The annual interest rate shall be [Interest Rate]%.

- Loan Term: This loan will commence on [Start Date] and will be due by [End Date].

- Payment Schedule: Payments shall be made [monthly/quarterly/bi-weekly], starting on [First Payment Date].

- Late Fees: A late fee of [Late Fee Amount] will apply if payment is not received within [Number of Days] days of the due date.

- Prepayment: Borrower may prepay this loan in full or in part at any time without penalty.

- Default: If Borrower fails to make any payment due under this Agreement, the Lender may declare the entire unpaid balance and accrued interest immediately due and payable.

Both parties accept and agree to the terms outlined in this Agreement. This document may only be amended in writing and signed by both parties.

IN WITNESS WHEREOF, the undersigned have executed this Texas Loan Agreement as of the day and year first above written.

Borrower Signature: ___________________________

Date: ____________________

Lender Signature: ___________________________

Date: ____________________

Other Popular Texas Templates

Texas Operating Agreement - The Operating Agreement can include confidentiality clauses as needed.

Texas Dmv Forms - Proper use of the affidavit can save time and resources in legal matters.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to delays or rejections. Ensure every section is addressed, including names, addresses, and loan amounts.

-

Incorrect Loan Amount: Entering an incorrect loan amount can create confusion. Double-check the figures to ensure they match the agreed terms.

-

Missing Signatures: Not signing the agreement can render it invalid. All parties involved must provide their signatures in the designated areas.

-

Incorrect Dates: Entering the wrong dates can complicate the agreement. Verify that all dates, including the loan start date and repayment schedule, are accurate.

-

Failure to Read Terms: Skipping the review of the loan terms can lead to misunderstandings. Take time to read and understand the obligations and rights outlined in the agreement.

-

Omitting Contact Information: Providing incomplete or incorrect contact information can hinder communication. Ensure that all parties' contact details are accurate and up-to-date.

-

Not Including Collateral Details: If collateral is involved, failing to specify it can cause issues. Clearly outline any collateral being used to secure the loan.

-

Ignoring State-Specific Requirements: Each state may have specific regulations. Familiarize yourself with Texas laws regarding loan agreements to ensure compliance.

Key takeaways

When filling out and using the Texas Loan Agreement form, there are several important points to keep in mind. These takeaways can help ensure that the agreement is clear and legally binding.

- Understand the Parties Involved: Clearly identify the lender and borrower in the agreement. Full names and contact information should be included to avoid confusion.

- Specify Loan Terms: Detail the amount of the loan, interest rates, repayment schedule, and any fees associated with the loan. Clarity in these terms can prevent disputes later on.

- Include Default Provisions: Outline what happens if the borrower fails to repay the loan. This may include late fees, acceleration of the loan, or other consequences.

- Signatures are Essential: Both parties must sign the agreement for it to be valid. Ensure that the date is included, and consider having the document notarized for added protection.

Steps to Using Texas Loan Agreement

Completing the Texas Loan Agreement form is a crucial step in formalizing a loan arrangement. It is essential to ensure that all information is accurate and complete to protect the interests of both the lender and the borrower. Follow these steps carefully to fill out the form correctly.

- Read the Instructions: Begin by thoroughly reviewing any instructions that accompany the form. Understanding the requirements will help you fill it out accurately.

- Provide Borrower Information: Enter the full name, address, and contact information of the borrower. Ensure that this information is current and correct.

- Enter Lender Information: Fill in the lender's name, address, and contact details. This information should also be precise and up to date.

- Specify Loan Amount: Clearly state the total amount of the loan being requested. Double-check this figure to avoid any discrepancies.

- Detail Loan Terms: Outline the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan. Be specific to avoid confusion later.

- Include Signatures: Both the borrower and lender must sign the agreement. Ensure that the signatures are dated and that all parties understand the terms before signing.

- Make Copies: After completing the form, make copies for both the borrower and lender. This ensures that everyone has a record of the agreement.

Once the form is filled out and signed, it becomes a legally binding document. It is advisable to keep it in a safe place and to consult with a legal expert if there are any questions or concerns regarding the agreement.