Attorney-Approved Texas Lady Bird Deed Template

Form Example

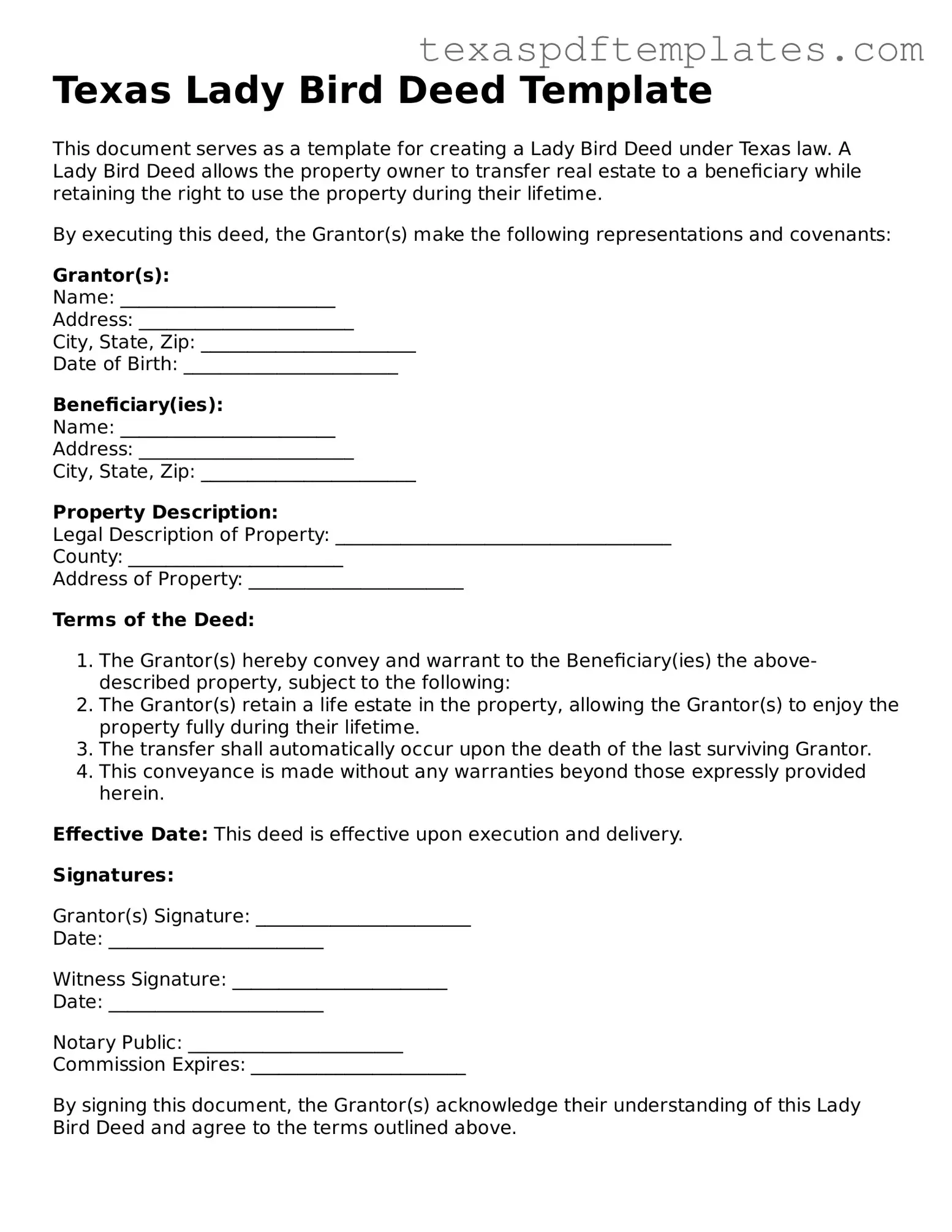

Texas Lady Bird Deed Template

This document serves as a template for creating a Lady Bird Deed under Texas law. A Lady Bird Deed allows the property owner to transfer real estate to a beneficiary while retaining the right to use the property during their lifetime.

By executing this deed, the Grantor(s) make the following representations and covenants:

Grantor(s):

Name: _______________________

Address: _______________________

City, State, Zip: _______________________

Date of Birth: _______________________

Beneficiary(ies):

Name: _______________________

Address: _______________________

City, State, Zip: _______________________

Property Description:

Legal Description of Property: ____________________________________

County: _______________________

Address of Property: _______________________

Terms of the Deed:

- The Grantor(s) hereby convey and warrant to the Beneficiary(ies) the above-described property, subject to the following:

- The Grantor(s) retain a life estate in the property, allowing the Grantor(s) to enjoy the property fully during their lifetime.

- The transfer shall automatically occur upon the death of the last surviving Grantor.

- This conveyance is made without any warranties beyond those expressly provided herein.

Effective Date: This deed is effective upon execution and delivery.

Signatures:

Grantor(s) Signature: _______________________

Date: _______________________

Witness Signature: _______________________

Date: _______________________

Notary Public: _______________________

Commission Expires: _______________________

By signing this document, the Grantor(s) acknowledge their understanding of this Lady Bird Deed and agree to the terms outlined above.

Other Popular Texas Templates

Mobile Home Bill of Sale - Establishes a clear chain of ownership for the mobile home.

Texas Dmv Forms - Errors in government records can lead to complications; this form helps mitigate that.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the legal description, which can lead to confusion and potential disputes.

-

Not Identifying All Parties: Individuals often overlook the necessity of clearly identifying all parties involved in the transaction. This includes the grantor, grantee, and any other relevant individuals, which can complicate the deed's validity.

-

Improper Signatures: Signatures must be properly executed. A mistake here can render the deed invalid. All parties must sign in the appropriate places, and witnesses may also be required depending on the situation.

-

Failure to Notarize: Notarization is a critical step that some individuals neglect. Without a notary's acknowledgment, the deed may not be accepted by the county clerk, which can delay or prevent the transfer of property.

-

Ignoring State-Specific Requirements: Each state has its own requirements for deeds. People often make the mistake of not adhering to Texas-specific regulations, which can lead to legal complications.

-

Not Recording the Deed: After completing the deed, it is essential to record it with the appropriate county office. Failing to do so can result in the deed not being recognized in future transactions.

Key takeaways

When considering the Texas Lady Bird Deed, it is essential to understand its unique features and implications. Here are some key takeaways to keep in mind:

- The Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime.

- This type of deed can help avoid probate, which can save time and reduce costs for heirs.

- It is important to specify the beneficiaries clearly to ensure that the property is transferred as intended.

- The deed must be properly executed and recorded with the county clerk to be effective.

- Property owners can change their mind and revoke the deed at any time before their death.

- The Lady Bird Deed can provide tax benefits, as it often allows for a step-up in basis for the beneficiaries.

- Consulting with a legal professional is advisable to ensure that the deed aligns with your estate planning goals.

- Understanding the implications of the deed on Medicaid eligibility is crucial for those considering long-term care options.

Steps to Using Texas Lady Bird Deed

Once you have your Texas Lady Bird Deed form ready, it's time to fill it out carefully. Follow these steps to ensure that you complete the form correctly and efficiently.

- Begin by entering the date at the top of the form. This should be the date you are completing the deed.

- Fill in the names of the grantor(s), which are the individuals transferring the property. Include their full legal names as they appear on official documents.

- Next, provide the names of the grantee(s), the individuals receiving the property. Ensure their names are also complete and accurate.

- Identify the property being transferred. Include the full legal description of the property, which can typically be found on the current deed or property tax statement.

- In the designated section, specify any rights reserved by the grantor. This may include the right to live in or manage the property during their lifetime.

- Sign the deed in the presence of a notary public. Both grantor(s) must sign the document for it to be valid.

- Have the notary public complete their section, which includes their signature and seal, confirming that they witnessed the signing.

- Finally, file the completed deed with the county clerk's office where the property is located. This step is essential for the deed to be legally recognized.

After completing these steps, your Texas Lady Bird Deed will be properly filled out and ready for filing. Make sure to keep a copy for your records.