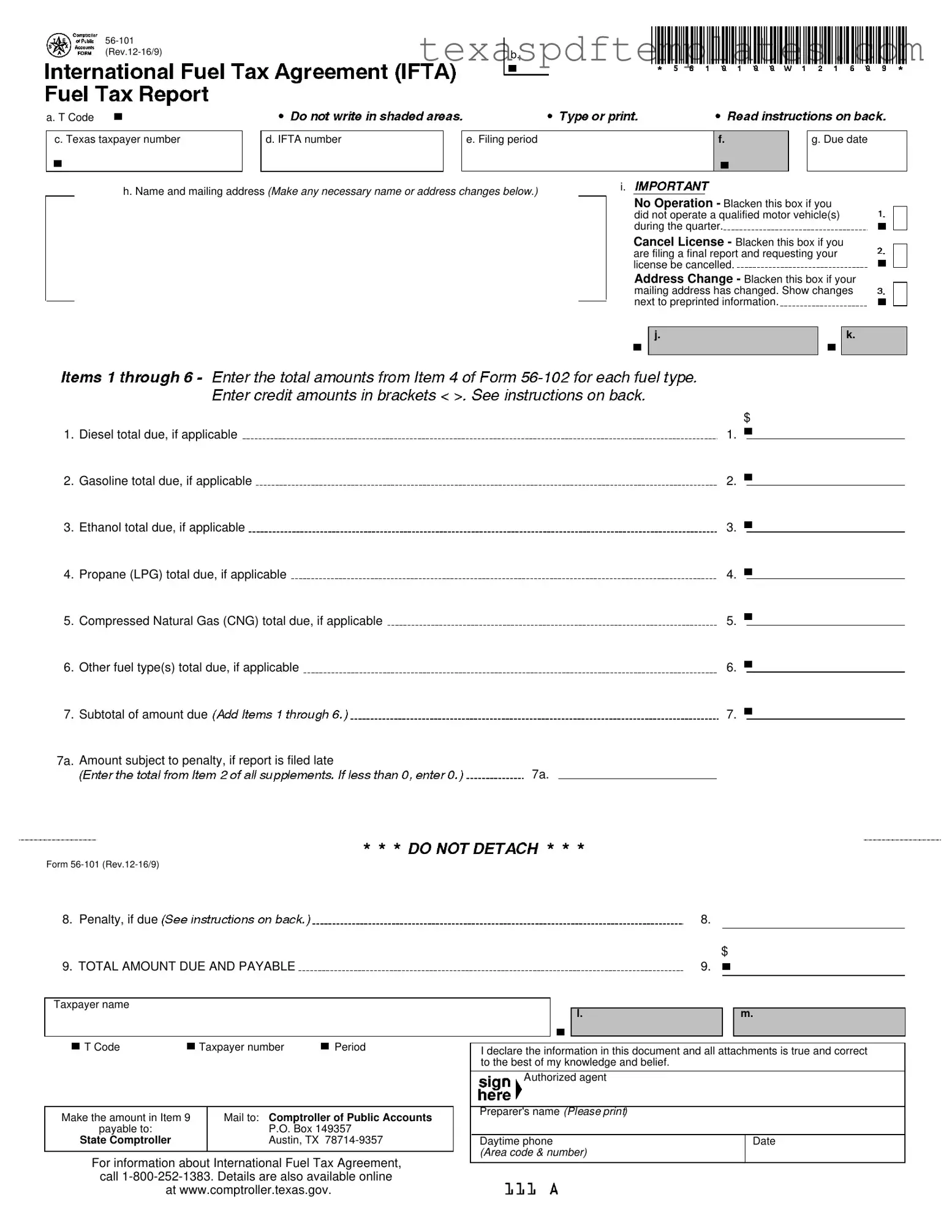

Blank Ifta Texas PDF Template

Form Example

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||

a. T Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. T xas taxpayer n mber |

|

d. IFTA number |

|

e. iling period |

f. |

||

|

|

|

|

|

|

|

|

. Name and mailing add ess (Make ny neces ary name or address changes below.) |

i. |

|

g. Due date

No Operation - Blacken this box if you did not o erate a qualified motor vehicle(s) d ring the quarter.

Cancel License - Blacken this box if you are fi ing a final report and requesting your license be cancelled.

Address Change - Blacken this box if your mailing address has changed. Show changes next to preprinted information.

j.

k.

$

1. |

Dies l otal due, if applicable |

1. |

|||

2. |

Gasoline |

due, if applicable |

2. |

||

3. |

Ethanol total due, if applicable |

3. |

|||

4. |

Propane (LPG) t tal due, if app icable |

4. |

|||

5. |

Compressed Natural Gas (CNG) total due, if applicable |

5. |

|||

6. |

Other fuel |

ype s) total due, if pplicable |

6. |

||

7. |

Subtotal of amount due |

7. |

|||

7a. |

Amount subject to pe alty, if rep rt is filed late |

|

|

|

|

|

|

|

7a. |

|

|

Form

8. Penalty, if due |

8. |

|

|

$ |

|

9. TOTAL AMOUNT DUE AND PAYABLE |

9. |

|

|

|

|

Taxpayer name

l.

m.

T Code |

Taxpayer number |

Period |

|

|

|

|

|

Make the amount in Item 9 |

|

Mail to: Comptroller of Public Accounts |

|

payable to: |

|

P.O. Box 149357 |

|

State Comptroller |

|

Austin, TX |

|

|

|

|

|

For information about International Fuel Tax Agreement, call

I declare the information in this document and all attachments is true and correct to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Daytime phone |

Date |

(Area code & number) |

|

|

|

Form

under Chapt rs 552 and 559, Government Code,

to review, request and correct information we have on file about you. Contact us at the addr ss or phone numbers listed on this form.

Electronic Tax Filing

You can file yo |

terna ion |

Tax Ag |

t (IFTA) r port using our online webfile syst m. |

your IFTA |

port is fast, easy and |

co veni nt w h we file. Please visit |

|

www.comptroll |

.tex s.gov/t |

||

If you have any webfile questions, pl ase call Elect onic Repor ing at

G neral Information

Who Must File - Each licensee h lding a icense under the International Fuel Tax Agre |

ment (IFTA) is quired to file, on a quarterly basis, an |

||

Int rnational Fuel Tax Agreem |

(IFTA) Fuel Tax Repo t, Form |

||

Failure to file this return and pay the applicab e tax may result in collection action as prescri |

d by Title 2 of the Tax Code. |

||

Form |

nt of the various fuel types computed on each Form |

||

the to al amount due/overpaym |

t, incl |

ding any appropriate penalty. Interest is calculated on Form |

|

Specific Instructions

Item 1 - Enter the total amount from Item 4 of Form

Item 2 - Enter the total amount from Item 4 of Form

Item 3 - Enter the total amount from Item 4 of Form

Item 4 - Enter the total amount from Item 4 of Form

U.S./Metric Conversion Factors

1 liter = 0.2642 gallons |

1 kilometer = 0.62137 miles |

3.785 liters = 1 gallon |

1.6093 kilometers = 1 mile |

Item 5 - Enter the total amount from Item 4 of Form

Item 6 - Other fuel types are:

Methanol.

Item 7a - Amount subject to penalty - Enter the sum of the total Tax Due from Item 2 of all supplements, Form

Item 8 - Penalty - A penalty of $50.00 or 10 percent of delinquent taxes, whichever is greater, is imposed for the failure to file a report, for filing a late report, or for underpayment of taxes due. To determine which is greater, use the worksheet below:

(a) Enter amount from Item 7a of this report. |

. |

(b) Multiply (a) by 10% (.10). |

. |

If Item (b) is greater than $50.00, enter (b) as penalty. If (b) is less than $50.00, enter $50.00 as penalty.

More PDF Templates

Lawsuit Document - Future court actions may depend on the information provided here.

Texas Sales Tax Certificate - This exemption certificate is an important financial tool for institutions like schools.

3071 Form - A section for the hospice representative’s details ensures clear communication channels.

Common mistakes

-

Incorrect Taxpayer Information: Many individuals fail to provide accurate taxpayer names and numbers. This can lead to delays or rejections of the form.

-

Missing Filing Period: Some people forget to specify the correct filing period. This oversight can create confusion and complicate tax calculations.

-

Neglecting to Indicate "No Operation": If a qualified vehicle did not operate during the quarter, it's essential to blacken the "No Operation" box. Failing to do so can result in unnecessary penalties.

-

Ignoring Address Changes: If there are changes to the mailing address, individuals must indicate this on the form. Not doing so may cause important documents to be sent to the wrong location.

-

Incorrect Fuel Totals: Errors in calculating the totals for diesel, gasoline, ethanol, and other fuel types can lead to incorrect tax amounts. Double-checking these figures is crucial.

-

Not Signing the Form: A common mistake is forgetting to sign and date the form. Without a signature, the form may be considered incomplete, resulting in delays or penalties.

Key takeaways

Filling out the IFTA Texas form requires attention to detail. Here are some key takeaways to help you navigate the process:

- Know your deadlines: Ensure you submit your form by the due date to avoid penalties.

- Complete all sections: Fill in your Texas taxpayer number, IFTA number, and the filing period accurately.

- Report accurately: Include total amounts for each fuel type from your Form 56-102 supplements.

- Understand penalties: A penalty may apply for late submissions or underpayment of taxes.

- Check for changes: If your address has changed, indicate this on the form next to the preprinted information.

- Mark no operation: If you did not operate any qualified motor vehicles during the quarter, blacken the appropriate box.

- Cancel license if needed: If filing a final report, remember to request license cancellation on the form.

- Use electronic filing: Consider filing online for convenience. It’s faster and easier.

- Keep records: Maintain copies of your completed forms and any supporting documents for your records.

- Contact for help: If you have questions, reach out to the Comptroller's office or check their website for additional resources.

Following these guidelines will help ensure a smooth filing experience with the IFTA Texas form.

Steps to Using Ifta Texas

Filling out the IFTA Texas form requires careful attention to detail. This form is essential for reporting fuel taxes, and accuracy is key to avoid penalties. Below are the steps to complete the form efficiently.

- Obtain the IFTA Texas form (56-101) from the Texas Comptroller's website or your local office.

- Fill in your Texas taxpayer number in section c.

- Enter your IFTA number in section d.

- Specify the filing period in section e.

- Provide your name and mailing address in section f. Make any necessary changes below this section.

- Check the appropriate box if you did not operate a qualified motor vehicle during the quarter, if you are filing a final report, or if your mailing address has changed.

- Complete the amounts due for various fuel types in sections 1 through 6. Use the totals from your Form 56-102 supplements:

- Diesel fuel total due in section 1.

- Gasoline total due in section 2.

- Ethanol total due in section 3.

- Propane (LPG) total due in section 4.

- Compressed Natural Gas (CNG) total due in section 5.

- Other fuel types total due in section 6.

- Calculate the subtotal of amounts due and enter it in section 7.

- If applicable, enter the amount subject to penalty in section 7a.

- Calculate and enter the penalty in section 8 based on the guidelines provided.

- Finally, calculate the total amount due and payable in section 9.

- Sign and date the form, and provide the name of the authorized agent and daytime phone number.

- Mail the completed form and payment to the address provided on the form.

After completing these steps, ensure that all information is accurate before mailing the form. Filing on time can help avoid penalties and keep your IFTA license in good standing.