Attorney-Approved Texas Gift Deed Template

Form Example

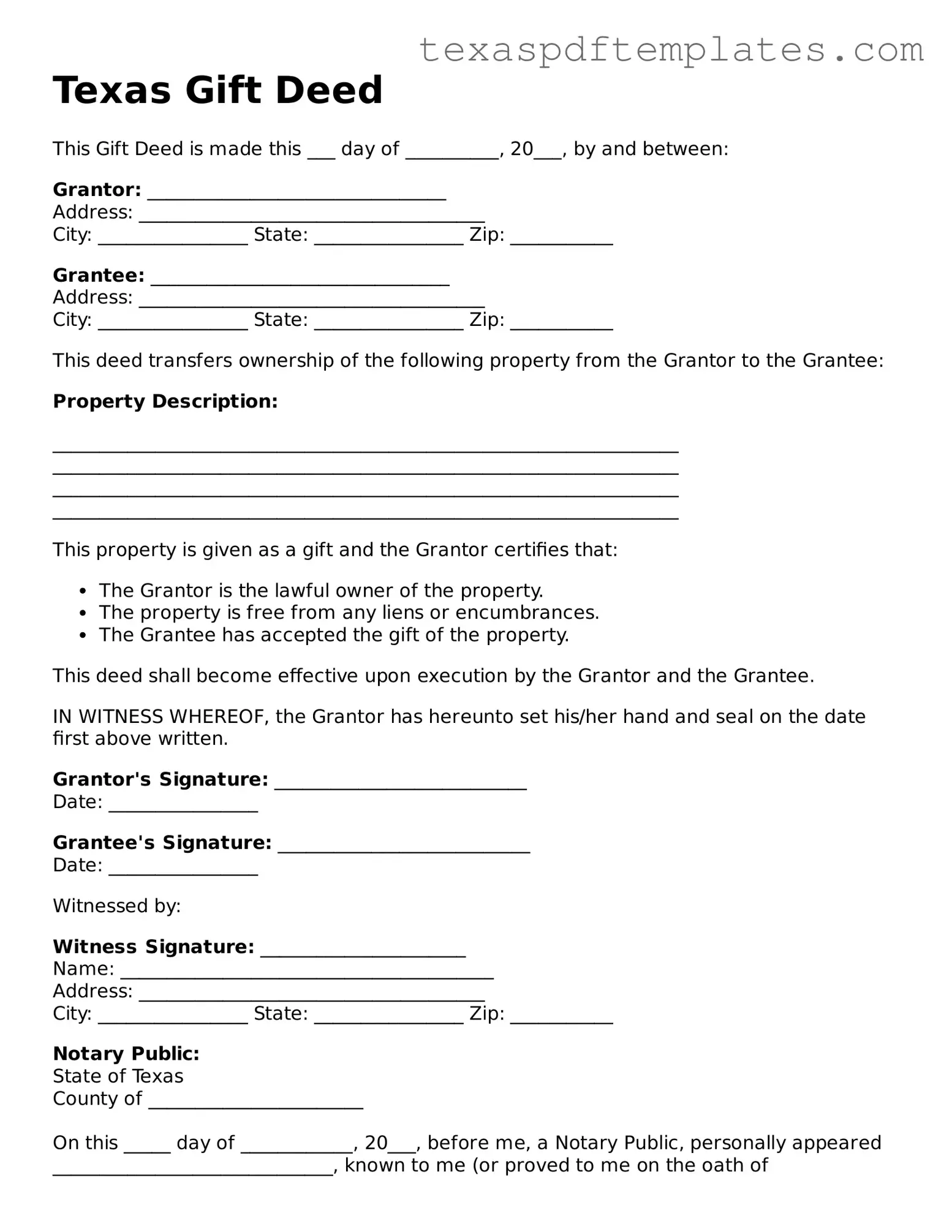

Texas Gift Deed

This Gift Deed is made this ___ day of __________, 20___, by and between:

Grantor: ________________________________

Address: _____________________________________

City: ________________ State: ________________ Zip: ___________

Grantee: ________________________________

Address: _____________________________________

City: ________________ State: ________________ Zip: ___________

This deed transfers ownership of the following property from the Grantor to the Grantee:

Property Description:

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

___________________________________________________________________

This property is given as a gift and the Grantor certifies that:

- The Grantor is the lawful owner of the property.

- The property is free from any liens or encumbrances.

- The Grantee has accepted the gift of the property.

This deed shall become effective upon execution by the Grantor and the Grantee.

IN WITNESS WHEREOF, the Grantor has hereunto set his/her hand and seal on the date first above written.

Grantor's Signature: ___________________________

Date: ________________

Grantee's Signature: ___________________________

Date: ________________

Witnessed by:

Witness Signature: ______________________

Name: ________________________________________

Address: _____________________________________

City: ________________ State: ________________ Zip: ___________

Notary Public:

State of Texas

County of _______________________

On this _____ day of ____________, 20___, before me, a Notary Public, personally appeared ______________________________, known to me (or proved to me on the oath of ____________________________) to be the person whose name is subscribed to this instrument, and acknowledged to me that he/she executed the same for the purposes herein stated.

Given under my hand and seal this ______ day of ____________, 20___.

Notary Public Signature: _______________________________

My Commission Expires: _______________________________

Other Popular Texas Templates

How Much Is an Llc in Texas - Sets forth the voting rights of shareholders.

How to Get a Legal Separation in Texas - It can address the division of household responsibilities during separation.

Common mistakes

-

Failing to include the full legal names of both the donor and the recipient. It is crucial to use the names as they appear on official documents.

-

Not providing a complete and accurate description of the property being gifted. This includes details such as the address, legal description, and any identifying features.

-

Omitting the date of the gift. The date is essential for establishing when the transfer of ownership takes place.

-

Neglecting to sign the form in the presence of a notary public. A signature without notarization may render the deed invalid.

-

Using the wrong type of deed for the transaction. Ensure that a Gift Deed is appropriate for the transfer and that it meets all legal requirements.

-

Forgetting to check for any liens or encumbrances on the property. This can complicate the transfer and may lead to legal issues later.

-

Not consulting with a legal professional. Guidance can help avoid mistakes and ensure compliance with Texas law.

-

Failing to provide the recipient's contact information. This information is often required for record-keeping purposes.

-

Overlooking the need to file the Gift Deed with the appropriate county office. Filing is necessary to officially record the gift.

-

Assuming that a verbal agreement is sufficient. All agreements should be documented to prevent misunderstandings or disputes.

Key takeaways

When considering the Texas Gift Deed form, it is essential to understand its purpose and how to use it effectively. Below are key takeaways that can guide you through the process.

- Purpose of the Gift Deed: This document allows one party to transfer property to another without any exchange of money. It is a legal way to give a gift of real estate.

- Eligibility: Both the giver (grantor) and the receiver (grantee) must be legally competent. Ensure that all parties involved understand the implications of the gift.

- Property Description: Clearly describe the property being gifted. Include details such as the address, legal description, and any identifying information to avoid confusion.

- Signatures Required: The gift deed must be signed by the grantor. In some cases, a notary public may need to witness the signature to validate the document.

- Filing the Deed: After completing the form, it is necessary to file it with the county clerk's office where the property is located. This step is crucial for the transfer to be legally recognized.

- Tax Implications: Be aware that gifting property may have tax consequences. Consult a tax professional to understand any potential gift taxes or implications for both parties.

- Revocation: Once a gift deed is executed and filed, it cannot be revoked without mutual consent. This makes it imperative to be certain about the decision to gift the property.

- Consulting an Attorney: While it is possible to fill out the form without legal assistance, consulting an attorney can help ensure that all legal requirements are met and that the deed is properly executed.

Understanding these key points can help facilitate a smooth transfer of property through a Texas Gift Deed. It is important to act promptly and carefully to avoid any potential issues down the line.

Steps to Using Texas Gift Deed

Filling out the Texas Gift Deed form is an important step in transferring property ownership without the exchange of money. Once you have completed the form, it will need to be signed and notarized before being filed with the appropriate county office. Below are the steps to guide you through the process of filling out the form accurately.

- Begin by downloading the Texas Gift Deed form from a reliable source or obtain a physical copy.

- Fill in the date at the top of the form. This is the date when the gift deed is being executed.

- Identify the grantor (the person giving the gift) by writing their full name and address in the designated section.

- Next, provide the grantee's (the person receiving the gift) full name and address in the appropriate area.

- Describe the property being transferred. Include the legal description, which can usually be found on the property’s current deed or tax records.

- State the consideration, which is typically noted as “love and affection” for a gift deed. This indicates that no money is being exchanged.

- Include any additional terms or conditions if necessary. This could involve stipulations about the property or its use.

- Sign the form in the presence of a notary public. Both the grantor and the grantee should sign the document.

- Have the notary public complete their section, which includes their signature and seal.

- Make copies of the completed and notarized deed for your records.

- Finally, file the original gift deed with the county clerk’s office in the county where the property is located.