Attorney-Approved Texas Deed in Lieu of Foreclosure Template

Form Example

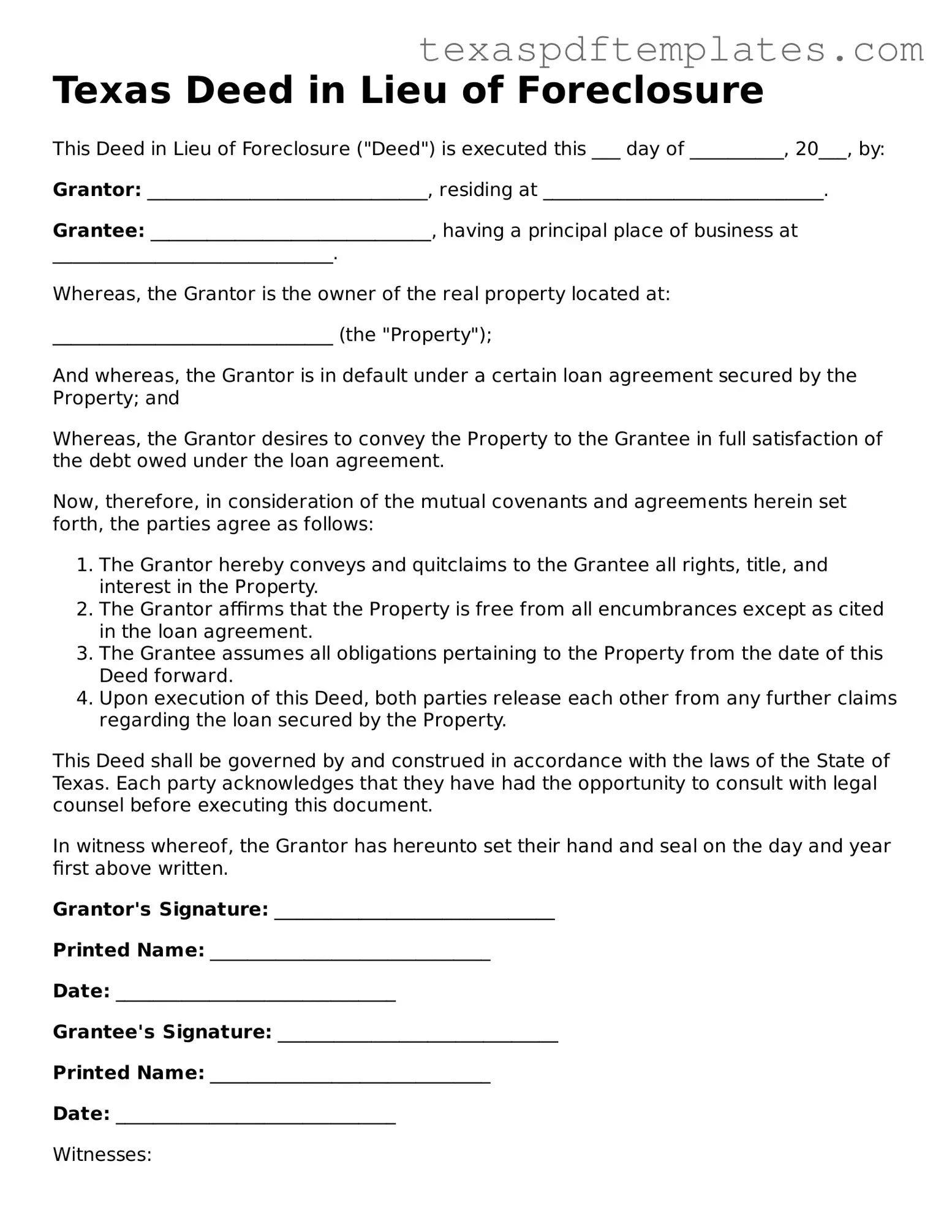

Texas Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure ("Deed") is executed this ___ day of __________, 20___, by:

Grantor: ______________________________, residing at ______________________________.

Grantee: ______________________________, having a principal place of business at ______________________________.

Whereas, the Grantor is the owner of the real property located at:

______________________________ (the "Property");

And whereas, the Grantor is in default under a certain loan agreement secured by the Property; and

Whereas, the Grantor desires to convey the Property to the Grantee in full satisfaction of the debt owed under the loan agreement.

Now, therefore, in consideration of the mutual covenants and agreements herein set forth, the parties agree as follows:

- The Grantor hereby conveys and quitclaims to the Grantee all rights, title, and interest in the Property.

- The Grantor affirms that the Property is free from all encumbrances except as cited in the loan agreement.

- The Grantee assumes all obligations pertaining to the Property from the date of this Deed forward.

- Upon execution of this Deed, both parties release each other from any further claims regarding the loan secured by the Property.

This Deed shall be governed by and construed in accordance with the laws of the State of Texas. Each party acknowledges that they have had the opportunity to consult with legal counsel before executing this document.

In witness whereof, the Grantor has hereunto set their hand and seal on the day and year first above written.

Grantor's Signature: ______________________________

Printed Name: ______________________________

Date: ______________________________

Grantee's Signature: ______________________________

Printed Name: ______________________________

Date: ______________________________

Witnesses:

First Witness: ______________________________

Second Witness: ______________________________

Notary Public:

State of Texas

County of ______________________________

Other Popular Texas Templates

Texas Proof of Employment Letter - This verification process builds trust in employer-employee relations.

Buying a Boat Without a Title in Texas - Very useful for personal and commercial transactions.

Statutory Durable Power of Attorney Texas - Facilitates legal formalities for incapacitated individuals through authorization.

Common mistakes

-

Failing to provide accurate property information. It is crucial to include the correct legal description of the property. Inaccuracies can lead to complications.

-

Not signing the form. All parties involved must sign the document. An unsigned deed is not valid.

-

Overlooking the notary requirement. The deed must be notarized to be legally binding. Without notarization, the deed may not be accepted.

-

Ignoring the implications of the deed. Some people do not fully understand that a deed in lieu of foreclosure can affect credit ratings and future homeownership.

-

Not consulting with a legal professional. Many individuals fill out the form without seeking advice, which can lead to mistakes.

-

Failing to communicate with the lender. It is important to keep the lender informed throughout the process to avoid misunderstandings.

-

Not reviewing the deed before submission. Taking the time to double-check all information can prevent errors that may delay the process.

-

Assuming the process is complete after submission. Follow-up is necessary. Ensure that the lender processes the deed and updates their records.

Key takeaways

Filling out and using the Texas Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing foreclosure. Here are some key takeaways to consider:

- The deed in lieu of foreclosure is a legal document that transfers property ownership from the borrower to the lender.

- This option can help avoid the lengthy foreclosure process and minimize damage to the homeowner's credit score.

- Before proceeding, the borrower should ensure that they have exhausted all other alternatives, such as loan modification or short sale.

- Both parties must agree to the terms outlined in the deed in lieu of foreclosure.

- Homeowners should consult with a legal expert or a housing counselor to understand the implications of this decision.

- It is essential to review the mortgage agreement to confirm if a deed in lieu of foreclosure is permitted.

- Homeowners should be aware that they may still be liable for any deficiency balance if the property sells for less than the mortgage amount.

- Properly completing the form is vital; inaccuracies can lead to delays or legal issues.

- The deed must be notarized and recorded with the county clerk’s office to be legally binding.

- After the deed is executed, the homeowner should receive a release of liability from the lender, confirming that they are no longer responsible for the mortgage debt.

Steps to Using Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, it is essential to ensure that all parties involved understand the implications of this document. Once filled out, the form should be signed, dated, and delivered to the appropriate lender. This process can help facilitate a smoother transition for both the homeowner and the lender.

- Obtain the Texas Deed in Lieu of Foreclosure form. This can typically be found online or through your lender.

- Begin by filling in the Grantor's Information. This includes the full name(s) of the homeowner(s) and the address of the property.

- Next, provide the Grantee's Information. This is usually the lender or the financial institution receiving the deed.

- Fill in the Property Description. Include the legal description of the property, which can often be found on your mortgage documents or property tax statements.

- In the section for Consideration, state that the deed is given in lieu of foreclosure. This is often a simple statement affirming the intent of the deed.

- Sign the form where indicated. Ensure all grantors sign, as required.

- Date the document accurately. The date should reflect when the form is signed.

- Have the form notarized. This adds a layer of verification and is often required for legal documents.

- Make copies of the completed form for your records.

- Submit the original signed and notarized form to the lender. Confirm that they have received it.