Attorney-Approved Texas Affidavit of Gift Template

Form Example

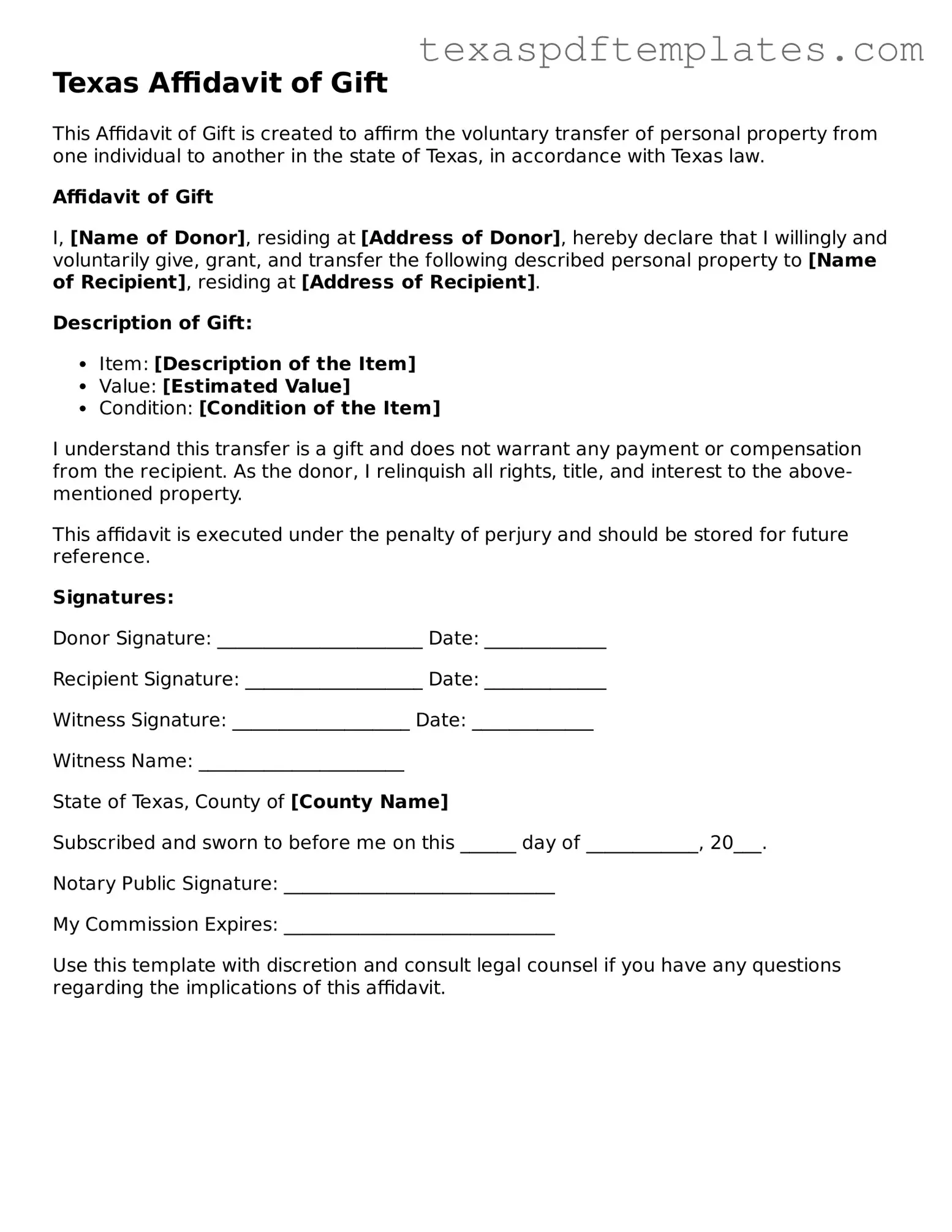

Texas Affidavit of Gift

This Affidavit of Gift is created to affirm the voluntary transfer of personal property from one individual to another in the state of Texas, in accordance with Texas law.

Affidavit of Gift

I, [Name of Donor], residing at [Address of Donor], hereby declare that I willingly and voluntarily give, grant, and transfer the following described personal property to [Name of Recipient], residing at [Address of Recipient].

Description of Gift:

- Item: [Description of the Item]

- Value: [Estimated Value]

- Condition: [Condition of the Item]

I understand this transfer is a gift and does not warrant any payment or compensation from the recipient. As the donor, I relinquish all rights, title, and interest to the above-mentioned property.

This affidavit is executed under the penalty of perjury and should be stored for future reference.

Signatures:

Donor Signature: ______________________ Date: _____________

Recipient Signature: ___________________ Date: _____________

Witness Signature: ___________________ Date: _____________

Witness Name: ______________________

State of Texas, County of [County Name]

Subscribed and sworn to before me on this ______ day of ____________, 20___.

Notary Public Signature: _____________________________

My Commission Expires: _____________________________

Use this template with discretion and consult legal counsel if you have any questions regarding the implications of this affidavit.

Other Popular Texas Templates

How to Get a Legal Separation in Texas - The document can be customized to reflect the unique circumstances of the couple.

Texas Employee Handbook - Details regarding overtime policy and work hours are included here.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to provide all required information. It is essential to fill in every section of the form, as missing details can lead to delays or complications in the gift transfer process.

-

Incorrect Signatures: Signatures must be from both the donor and the recipient. If either party fails to sign the document, it may be deemed invalid. Ensure that both individuals review the form before submitting it.

-

Not Notarizing the Document: The Texas Affidavit of Gift form requires notarization. Neglecting to have the document notarized can result in the form not being accepted. Always verify that a notary has completed this step.

-

Failure to Date the Form: Omitting the date on which the form is completed can create confusion regarding the timing of the gift. Always include the date to establish a clear record of the transaction.

-

Providing Inaccurate Property Descriptions: When describing the property being gifted, it is crucial to be as specific as possible. Vague descriptions can lead to disputes or misunderstandings in the future.

-

Ignoring State-Specific Requirements: Each state may have unique requirements regarding the transfer of property. Failing to adhere to Texas-specific regulations can complicate the process. Research and understand local laws before submitting the form.

-

Not Keeping Copies: After submitting the form, individuals often forget to keep copies for their records. Retaining a copy of the signed and notarized form is vital for future reference.

-

Overlooking Tax Implications: Some may not consider the tax consequences associated with gifting property. It is wise to consult a tax professional to understand any potential implications before proceeding with the gift.

-

Submitting the Form Late: Timeliness is important. If the form is submitted after the deadline, it may not be processed in a timely manner. Always be aware of any deadlines associated with the transfer of the gift.

Key takeaways

When dealing with the Texas Affidavit of Gift form, there are several important points to keep in mind. This form is essential for documenting the transfer of property as a gift. Here are some key takeaways to consider:

- Understanding the Purpose: The Texas Affidavit of Gift is used to legally declare that a property has been given as a gift, rather than sold or exchanged for something of value.

- Completing the Form: It is crucial to fill out the form accurately. All required fields must be completed, including the names of the donor and recipient, a description of the property, and the date of the gift.

- Signature Requirement: The form must be signed by the donor. If the donor is unable to sign, a representative may sign on their behalf, but proper documentation of authority must be provided.

- Notarization: The affidavit must be notarized to be considered valid. This means a notary public must witness the signing of the document and affix their seal.

- Filing the Affidavit: Once completed and notarized, the affidavit should be filed with the appropriate county clerk's office. This step is important for public record and future reference.

- Tax Implications: Be aware that gifting property may have tax consequences. It is advisable to consult with a tax professional to understand any potential gift tax liabilities.

By following these guidelines, individuals can ensure that the Texas Affidavit of Gift form is filled out correctly and used effectively.

Steps to Using Texas Affidavit of Gift

After you have gathered the necessary information, you can begin filling out the Texas Affidavit of Gift form. This form is important for documenting the transfer of a gift. Follow the steps below to complete it accurately.

- Obtain the Texas Affidavit of Gift form. You can find it online or at a local government office.

- Start with the top section. Fill in your name as the donor, along with your address and contact information.

- Next, provide the recipient's name and address. This is the person receiving the gift.

- Describe the gift in detail. Include specifics like the type of item, its value, and any relevant identification numbers.

- Indicate the date when the gift was made. This helps establish the timeline of the transfer.

- Sign the form. Your signature confirms that the information is accurate and that you are giving the gift voluntarily.

- Have the recipient sign the form as well. This shows their acceptance of the gift.

- Finally, make copies of the completed form for both you and the recipient. Keep these copies for your records.