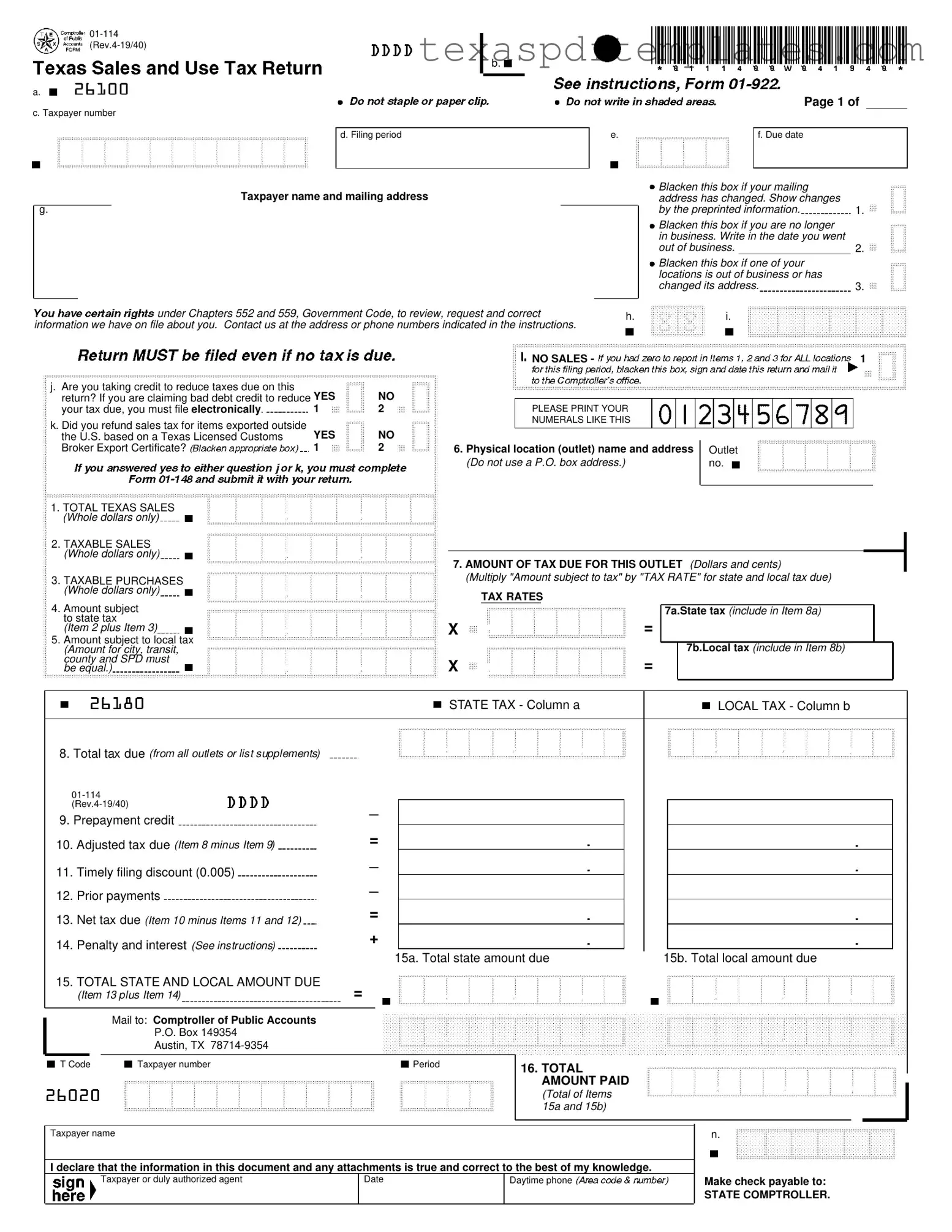

Blank 1 114 Texas PDF Template

Form Example

01- 14

b.

a.

c. Taxp yer number

d. Filing period

Taxpayer name and mailing address

g.

under Chapt |

rs 552 and 559, G v rnment Cod , review, request and correct |

information we have n file about you. |

Contact us at the address or phone numbers indicated in the ins ruct ons. |

|

|

|

|

Page 1 of |

||

|

|

|

|

|

|

|

e. |

|

|

f. Due date |

|

|

|

|

|

|

|

|

|

|

|

Blacken this box if your mailing |

|

|

|||

|

address has ch nged. Sh w changes |

|

|

|||

|

by the preprinted information. |

1. |

|

|||

|

Blacken this box if you are no longer |

|

|

|||

|

in |

usiness. Write in the date you went |

|

|

||

|

out of busin ss. |

|

2. |

|

||

|

Blacken this box if one of your |

|

|

|||

|

locations is out of business or has |

|

|

|||

|

changed its ad ress. |

3. |

|

|||

|

|

|

|

|

|

|

. |

|

i. |

|

|

||

j. Are |

t king c |

it to reduce taxes due |

is |

|

|

return? If you are claiming |

d bt cred to reduce YES |

NO |

|||

your tax due, you |

ust file ele tronically. |

1 |

2 |

||

k. Did you refund sales tax f |

r items expor ed outside |

|

|||

the U.S. based |

a T xas Licen ed Cus oms |

YES |

NO |

||

Broker Export Certificate? |

|

1 |

2 |

||

1.TOTAL TEXAS SALES (Whole dollars only)

2.TAXABLE SALES (Whole dollars only)

3.TAXABLE PURCHASES (Whole dollars only)

|

l. NO SALES - |

1 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PLEASE PRINT YOUR |

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMERALS LIKE THIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Physical location (outlet) name and address |

|

Outlet |

|||||||||||

|

|||||||||||||

(Do not use a P.O. box address.) |

|

no. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7.AMOUNT OF TAX DUE FOR THIS OUTLET (Dollars and cents)

(Multiply "Amount subject to tax" by "TAX RATE" for state and local tax due)

TAX RATES

4.Amount subject to state tax

(Item plus Item 3)

5.Amount subject to local tax (Amount for city, transit, county and SPD must

equal.)b

X |

= |

X |

= |

7a.State tax (include in Item 8a)

7b.Local tax (include in Item 8b)

be |

STATE TAX - Column a |

LOCAL TAX - Column b |

8.Total tax due (from all outlets or list supplements)

|

|

|

|

|

|

|

|

|

|

|

||

_ |

|

|

|

|

|

|

|

|

||||

9. Prepayment credit |

|

|

|

|

|

|

|

|

||||

= |

|

|

|

|

|

|

|

|

||||

10. Adjusted tax due (Item 8 minus Item 9) |

|

|

|

|

|

|

|

|

||||

11. Timely filing discount (0.005) |

_ |

|

|

|

|

|

|

|

|

|||

_ |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

12. Prior payments |

|

|

|

|

|

|

|

|

||||

= |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

13. Net tax due (Item 10 minus Items 11 and 12) |

|

|

|

|

|

|

|

|

||||

+ |

|

|

|

|

|

|

|

|

||||

14. Penalty and interest (See instructions) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

15a. Total state amount due |

15b. Total local amount due |

|

|||||||||

|

|

|

|

|

||||||||

15. TOTAL STATE AND LOCAL AMOUNT DUE |

= |

|

|

|

|

|

|

|

|

|

||

(Item 13 plus Item 14) |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to: Comptroller of Public Accounts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 149354 |

|

|

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T Code |

Taxpayer number |

|

|

Period |

16. TOTAL |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

AMOUNT PAID |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(Total of Items |

|

|

|

|

|

|

|

|

|

|

|

|

15a and 15b) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name

I declare that the information in this document and any attachments is true and correct to the best of my kn wledge.

Taxpayer or duly authorized agent |

Date |

Daytime phone |

|

|

|

n.

Make check payable to:

STATE COMPTROLLER.

More PDF Templates

What Is a Order Form - If language is an issue, request an interpreter when filing your paperwork.

Disinterred Body - Handling the document properly reflects the community’s respect for the deceased.

What to Do If an Inmate Is Being Mistreated - Filing this report is part of a larger commitment to offender management.

Common mistakes

-

Failing to include the correct taxpayer number. This number is essential for identifying the business and ensuring proper processing.

-

Not providing the filing period. This information is necessary to determine the timeframe for the reported sales and taxes.

-

Omitting the taxpayer name and mailing address. Accurate identification of the taxpayer is crucial for communication and record-keeping.

-

Neglecting to blacken the box if the mailing address has changed. This can lead to miscommunication and delays in receiving important documents.

-

Failing to indicate if the business is no longer in operation. This information helps the tax authority update their records accordingly.

-

Not filing electronically if claiming a debt credit to reduce taxes due. Electronic filing is required for these claims.

-

Providing incorrect amounts for total Texas sales, taxable sales, and taxable purchases. Whole dollar amounts must be used to avoid discrepancies.

-

Using a P.O. box address for the physical location. The form specifically requires a physical address for accurate identification of the outlet.

-

Failing to calculate the amount of tax due accurately. It is important to multiply the correct amounts to ensure the right tax is reported.

-

Not signing and dating the form. A declaration confirming the accuracy of the information is necessary for the submission to be valid.

Key takeaways

When filling out the 1-114 Texas form, several key points should be kept in mind to ensure accuracy and compliance.

- Accurate Information is Crucial: Provide your taxpayer number, name, and mailing address accurately. Any discrepancies can lead to delays or issues with your filing.

- Understand Your Filing Obligations: Be aware of the due date for submitting the form. Timely filing is essential to avoid penalties and interest.

- Claiming Credits: If you are claiming a credit to reduce your tax due, it is mandatory to file electronically. Ensure you understand the requirements for such claims.

- Review Changes Thoroughly: If your business status has changed—such as going out of business or changing addresses—mark the appropriate boxes and provide the necessary details. This helps maintain accurate records with the state.

By following these guidelines, you can navigate the complexities of the 1-114 Texas form with greater confidence and clarity.

Steps to Using 1 114 Texas

Filling out the 1-114 Texas form requires careful attention to detail. Each section must be completed accurately to ensure compliance with state tax regulations. After completing the form, it should be mailed to the designated address for processing.

- Begin by entering your taxpayer number in the designated field.

- Specify the filing period for which you are reporting.

- Provide your taxpayer name and mailing address clearly.

- Indicate the due date of the form.

- If your mailing address has changed, blacken the corresponding box and show the changes next to the preprinted information.

- If you are no longer in business, blacken that box and write the date you ceased operations.

- For any locations that are out of business or have changed addresses, blacken the appropriate box.

- If you are claiming a credit to reduce taxes due, indicate "YES" or "NO" and remember that electronic filing is required.

- Answer whether you refunded sales tax for items exported outside the U.S. based on a Texas Licensed Customs Broker Export Certificate by marking "YES" or "NO."

- Fill in the TOTAL TEXAS SALES (whole dollars only).

- Complete the TAXABLE SALES (whole dollars only) section.

- Enter the TAXABLE PURCHASES (whole dollars only).

- Print your numerals clearly as instructed.

- Provide the physical location (outlet) name and address, ensuring it is not a P.O. box.

- Calculate the amount of tax due for this outlet by multiplying the "Amount subject to tax" by the "TAX RATE."

- Complete the sections for state tax and local tax.

- Calculate the total tax due from all outlets or list supplements.

- Enter any prepayment credit if applicable.

- Calculate the adjusted tax due by subtracting the prepayment credit from the total tax due.

- Determine the timely filing discount (0.005) if applicable.

- Input any prior payments made.

- Calculate the net tax due by subtracting the timely filing discount and prior payments from the adjusted tax due.

- Include any penalty and interest as specified in the instructions.

- Complete the sections for total state amount due and total local amount due.

- Calculate the total amount due by adding the state and local amounts.

- In the declaration section, affirm that the information is true and correct to the best of your knowledge.

- Provide your daytime phone number and the date of submission.

- Make the check payable to STATE COMPTROLLER if applicable.

- Mail the completed form to the Comptroller of Public Accounts at the specified address.