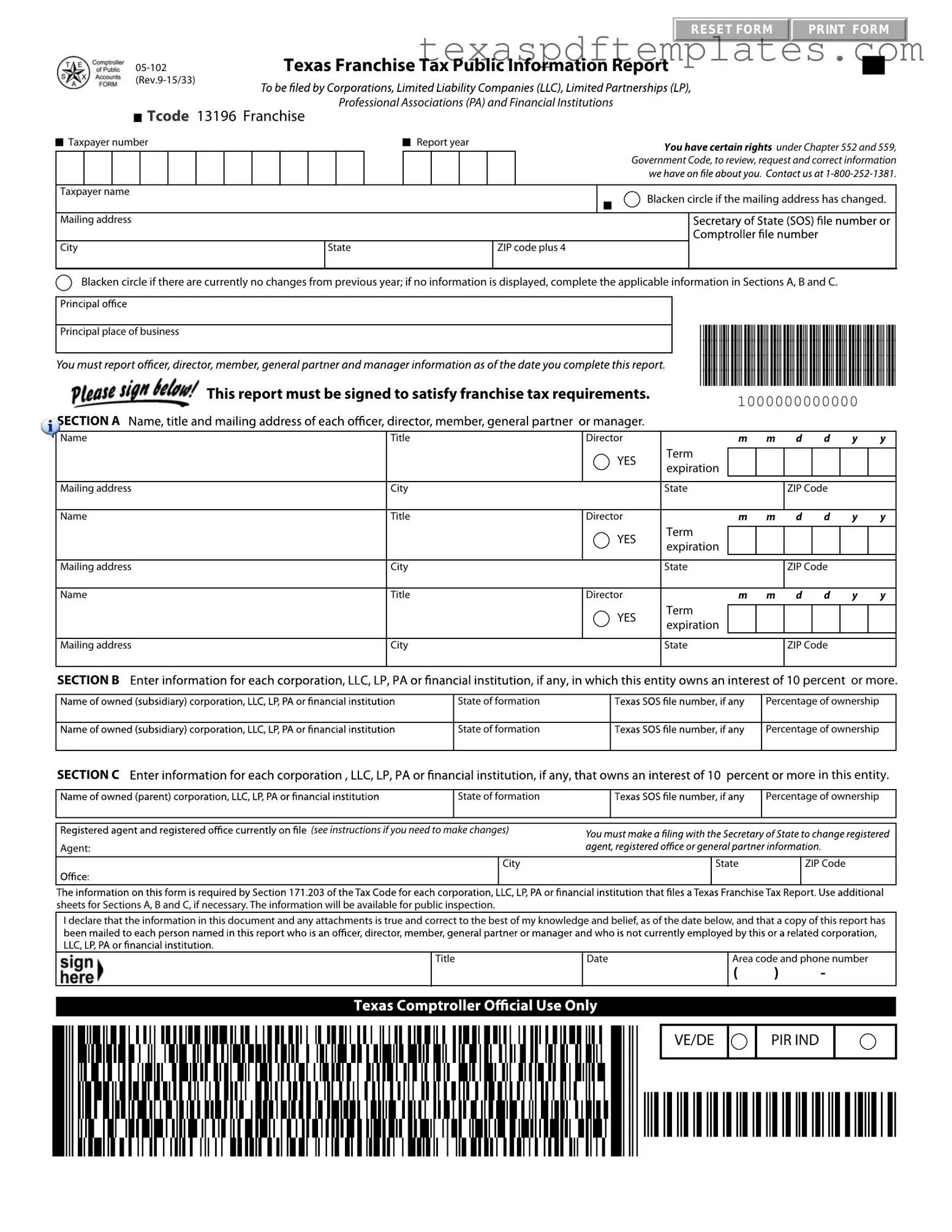

Blank 05 102 Texas PDF Template

Form Example

RESET FORM |

PRINT FORM |

|

|

Texas Franchise Tax Public Information Report

Tcode 13196 Franchise

Tcode 13196 Franchise

Professional Associations (PA) and Financial Institutions

|

Taxpayer number |

|

|

|

|

|

|

|

|

|

|

Report year |

|

|

|

|

|

You have certain rights under Chapter 552 and 559, |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government Code, to review, request and correct information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blacken circle if the mailing address has changed. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City |

|

|

|

|

|

|

State |

|

|

|

|

|

|

ZIP code plus 4 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C.

Principal place of business

This report must be signed to satisfy franchise tax requirements.

This report must be signed to satisfy franchise tax requirements.

*1000000000015*

*1000000000015*

*1000000000015*

*1000000000015*

1000000000000

SECTION A

Name

Mailing address

Name

Mailing address

Name

Mailing address

Title |

|

Director |

|

m |

m |

|

d |

d |

y |

y |

|

|

YES |

Term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||

Title |

|

Director |

Term |

m |

m |

|

d |

d |

y |

y |

|

|

|||||||||

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||

Title |

|

Director |

Term |

m |

m |

|

d |

d |

y |

y |

|

|

|||||||||

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B |

|

0 percent or more. |

|

|

|

|

|

|

State of formation |

|

Percentage of ownership |

|

|

|

|

|

State of formation |

|

Percentage of ownership |

|

|

|

|

SECTION C |

|

ore in this entity. |

|

State of formation

Percentage of ownership

(see instructions if you need to make changes)

Agent:

City

State

ZIP Code

sheets for Sections A, B and C, if necessary. The information will be available for public inspection.

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief, as of the date below, and that a copy of this report has

Title

Date

Area code and phone number

( ) -

VE/DE

PIR IND

More PDF Templates

Texas Sales Tax Certificate - The purchaser must provide their name, address, and phone number on the certificate.

How Can I Find Out If I Have a Restraining Order Against Me - The order includes provisions for information disclosed during depositions to be marked as classified.

Common mistakes

-

Incomplete Information: Many people forget to fill out all the required sections. Sections A, B, and C must be completed fully. If you skip any part, your report could be rejected.

-

Incorrect Taxpayer Number: Entering the wrong taxpayer number is a common mistake. Double-check this number to ensure it matches your records. An incorrect number can lead to delays or issues with your filing.

-

Failure to Sign: This report must be signed to meet franchise tax requirements. Some individuals forget to sign, which can invalidate the submission.

-

Ignoring Address Changes: If your mailing address has changed, make sure to blacken the circle indicating this change. Failing to do so can result in important documents being sent to the wrong address.

-

Missing Agent Information: It’s crucial to provide accurate agent information in Section C. Without this, your report may not be processed correctly.

Key takeaways

Here are some key takeaways about filling out and using the 05-102 Texas form:

- Understand the Purpose: This form is used for the Texas Franchise Tax Public Information Report.

- Know Your Taxpayer Number: Ensure you have the correct taxpayer number ready when completing the form.

- Report Year: Clearly indicate the report year for which you are filing.

- Mailing Address: If your mailing address has changed, blacken the appropriate circle on the form.

- Principal Place of Business: Provide the principal place of business accurately to avoid issues.

- Signature Requirement: The form must be signed to meet franchise tax requirements.

- Sections A, B, and C: Complete these sections with the necessary information about directors and ownership percentages.

- Public Inspection: The information provided will be available for public inspection, so ensure accuracy.

- Declaration: You must declare that the information is true and correct as of the date you submit the form.

- Contact Information: Include your area code and phone number for any follow-up questions.

Steps to Using 05 102 Texas

After gathering the necessary information, you can proceed to fill out the 05-102 Texas form. Ensure you have all required details handy, including taxpayer information and ownership percentages. This form must be completed accurately to meet state requirements.

- Start by entering your taxpayer number at the top of the form.

- Fill in the report year in the designated field.

- Provide the taxpayer name in the appropriate section.

- If your mailing address has changed, blacken the circle to indicate this. Otherwise, leave it blank.

- Complete the mailing address, including city, state, and ZIP code plus 4.

- If there are no changes from the previous year, blacken the circle to confirm this. If no information is displayed, fill out Sections A, B, and C as needed.

- In Section A, list the names and mailing addresses of directors. Include their titles and term expiration dates. Make sure to provide the city, state, and ZIP code for each.

- In Section B, indicate the state of formation and percentage of ownership for each entity.

- In Section C, repeat the process for any additional entities, ensuring you specify the state of formation and percentage of ownership.

- If necessary, attach additional sheets for Sections A, B, and C.

- Sign and date the report, affirming that the information is true and correct to the best of your knowledge.

- Lastly, provide your area code and phone number.